5 Steps to Integrate the Right Magento Supported Payment Gateways

Are you providing the best payment options for smooth checkouts? Magento supported payment gateways are important for handling purchase transactions. A Magento payment portal supports many payment methods, ensuring an easy checkout.

This tutorial will cover how the right payment gateways can boost your e-commerce.

Key Takeaways

-

Features of payment platforms handle global transactions.

-

Steps to connect payment gateway with ecommerce platform stores.

-

Key security features protect billing and data.

-

Compare fees and pricing to find the most cost-effective gateway.

-

Adobe Commerce payment portals improve the checkout process.

-

Benefits of using payment platforms in ecommerce.

-

5 Features of Magento 2 Payment Gateways for Global Transactions

-

5 Steps to Integrate Supported Payment Gateway to Your Website Store

-

Security Features of Supported Payment Gateways for your Magento

-

Magento Supported Payment Gateways: Fees and Pricing Comparison

-

How Adobe Commerce Supported Payment Gateways Improve Checkout Experience?

-

Top 7 Benefits of Using Supported Payment Gateways on Your E-Commerce Site

How Magento 2 Supports Multiple Payment Gateways?

1. Native Integration

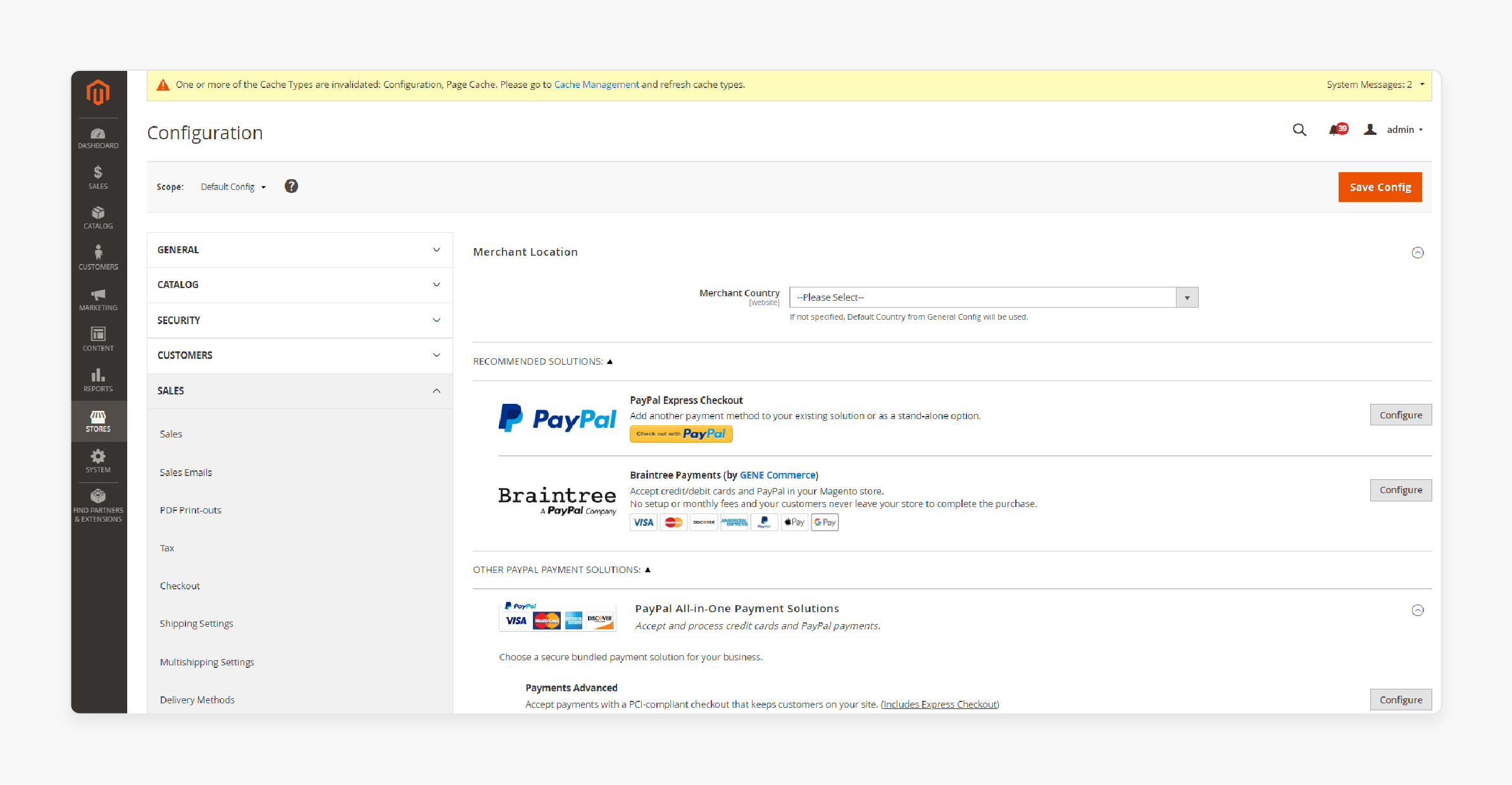

Magento supports payment services like PayPal payments and Braintree. This built-in support lets merchants accept credit cards and other payment methods. For example, a small store can use Braintree to process credit card payments and PayPal. This native support ensures secure and simple Magento payment processing. It provides support for both businesses and customers.

2. Extension Installation

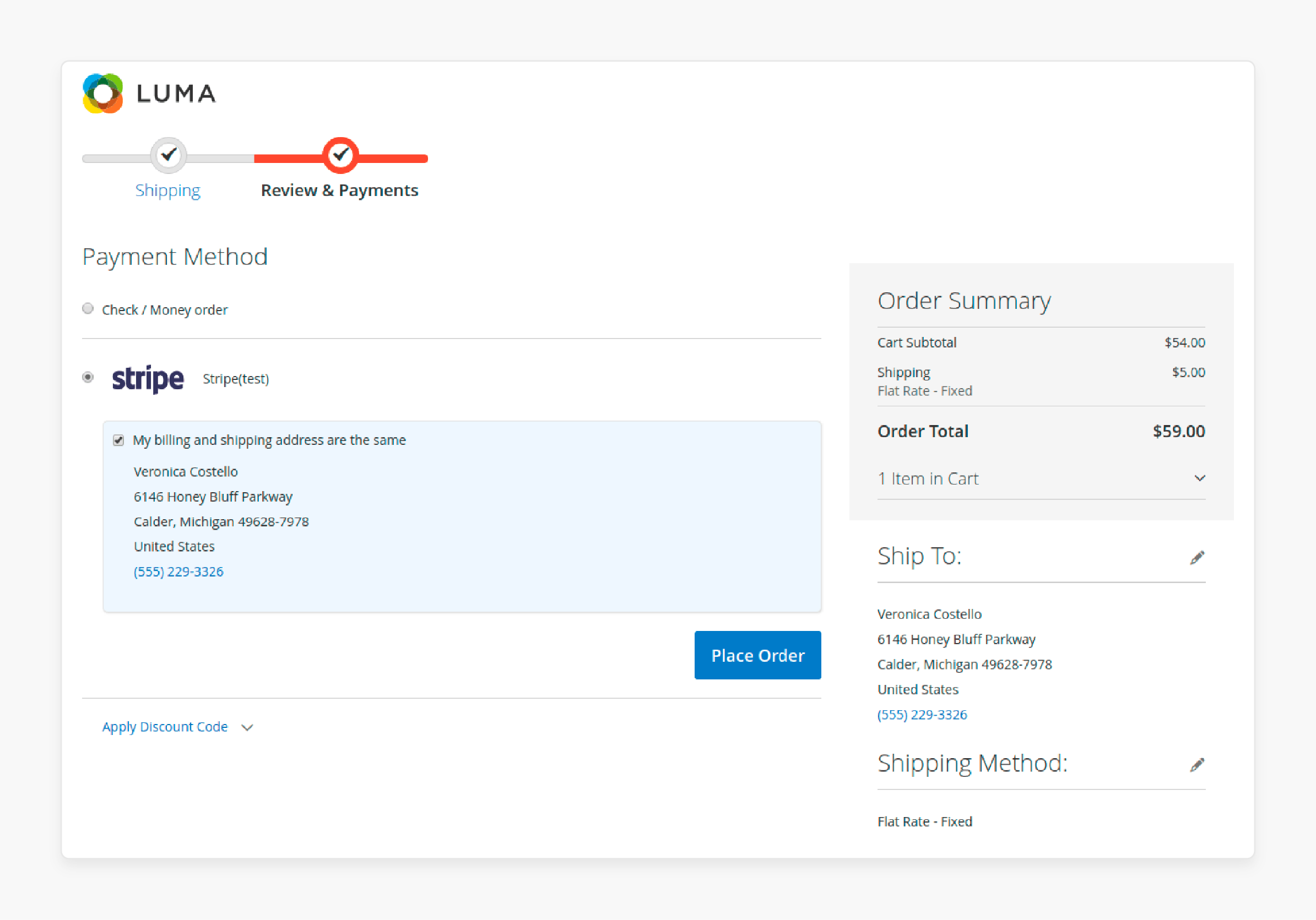

Merchants can install extra payment gateway extensions from the Magento Marketplace. For example, a business can easily add Stripe or 2Checkout through the Marketplace. They can also install the supported billing portals from third-party payment gateway providers.

An international store may use Amazon payment to reach more customers. The flexibility allows businesses to support various payment methods and meet customer preferences.

3. Configuration

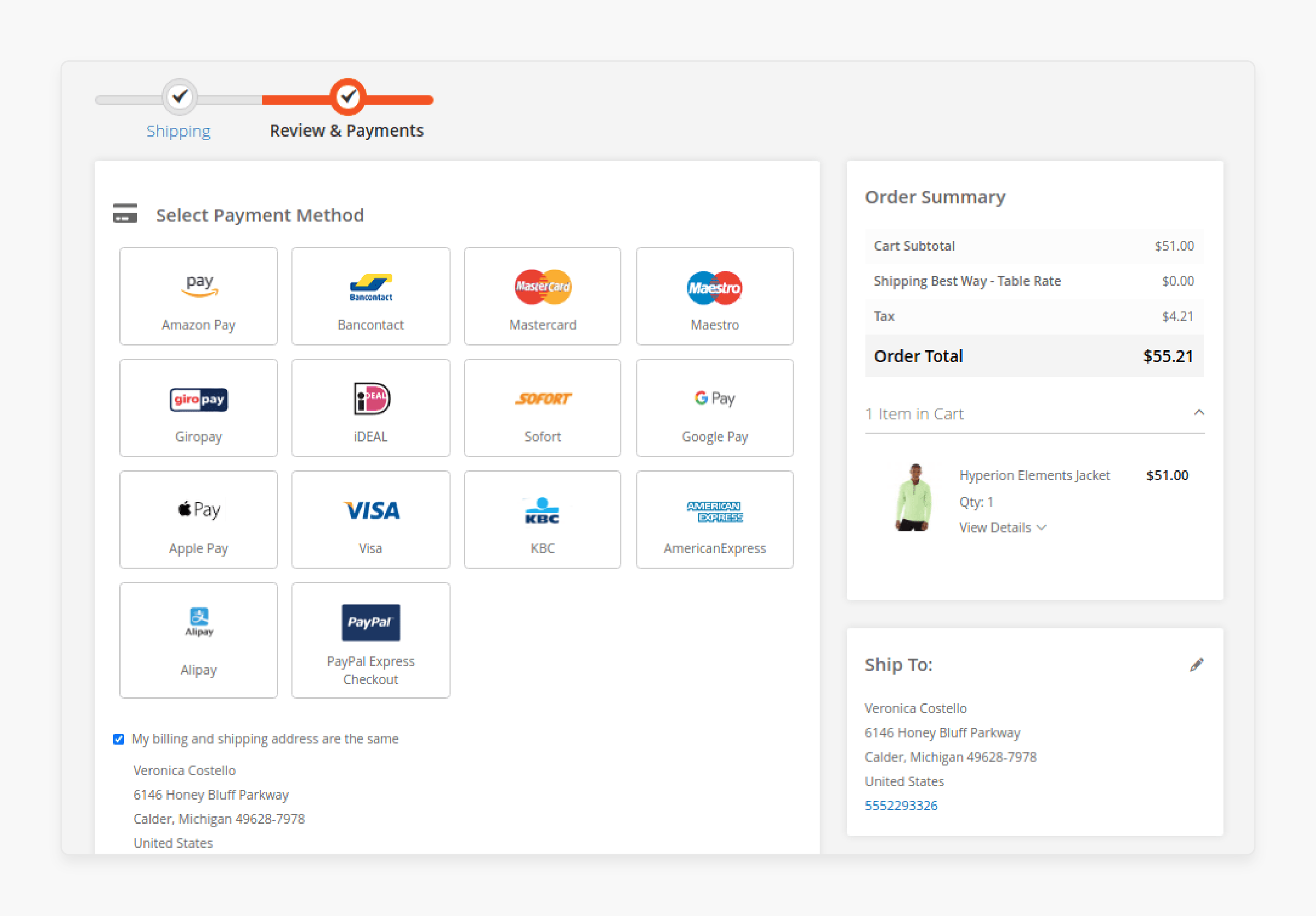

Magento 2’s admin panel makes it easy to configure multi-payment types. Merchants can go to configuration > sales > payment to set up their chosen payment gateway. For example, a fashion store can configure credit and debit cards. They can offer Amazon payment and PayPal. The simple setup allows businesses to configure their payment system quickly.

4. Gateway Selection

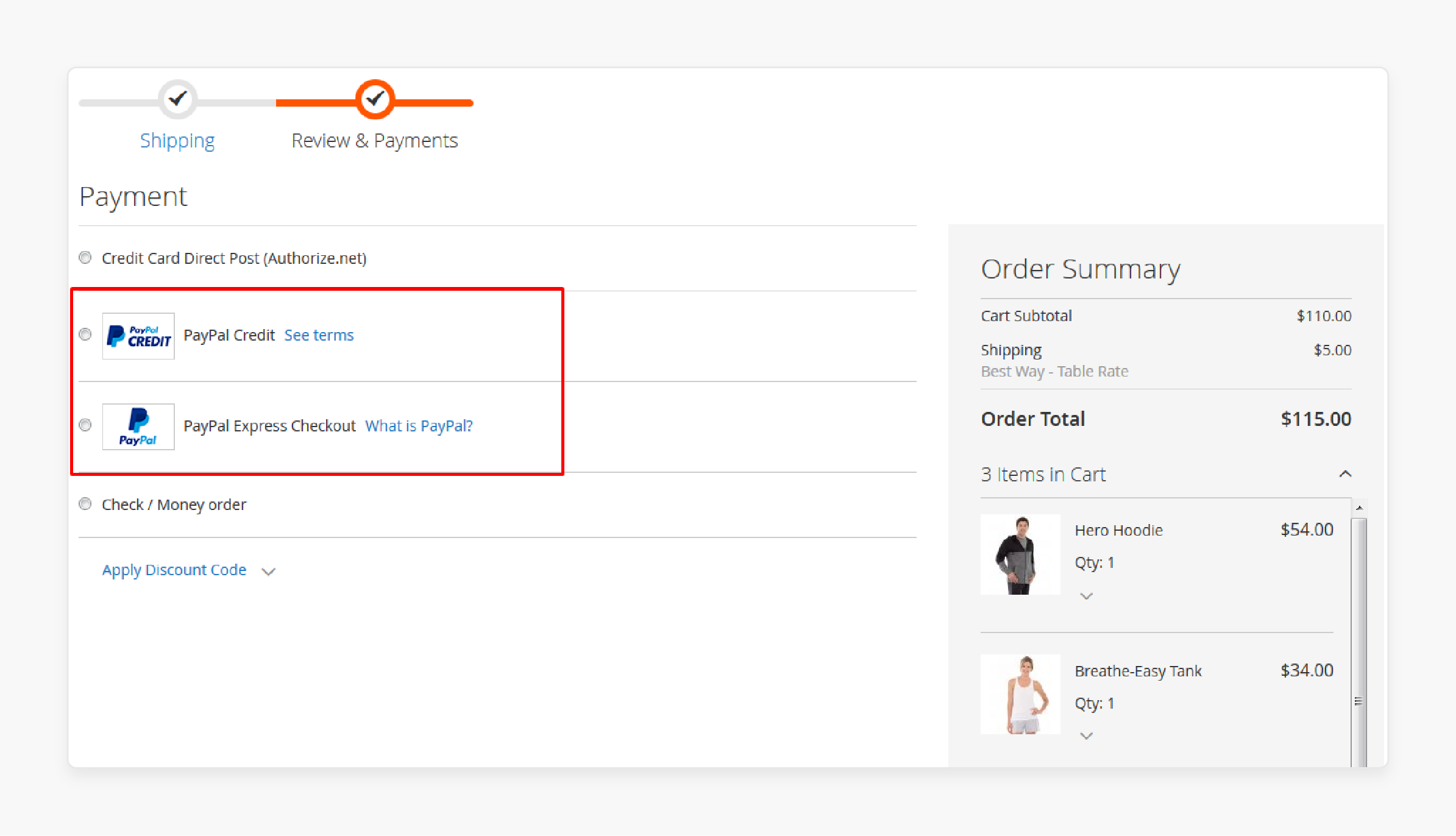

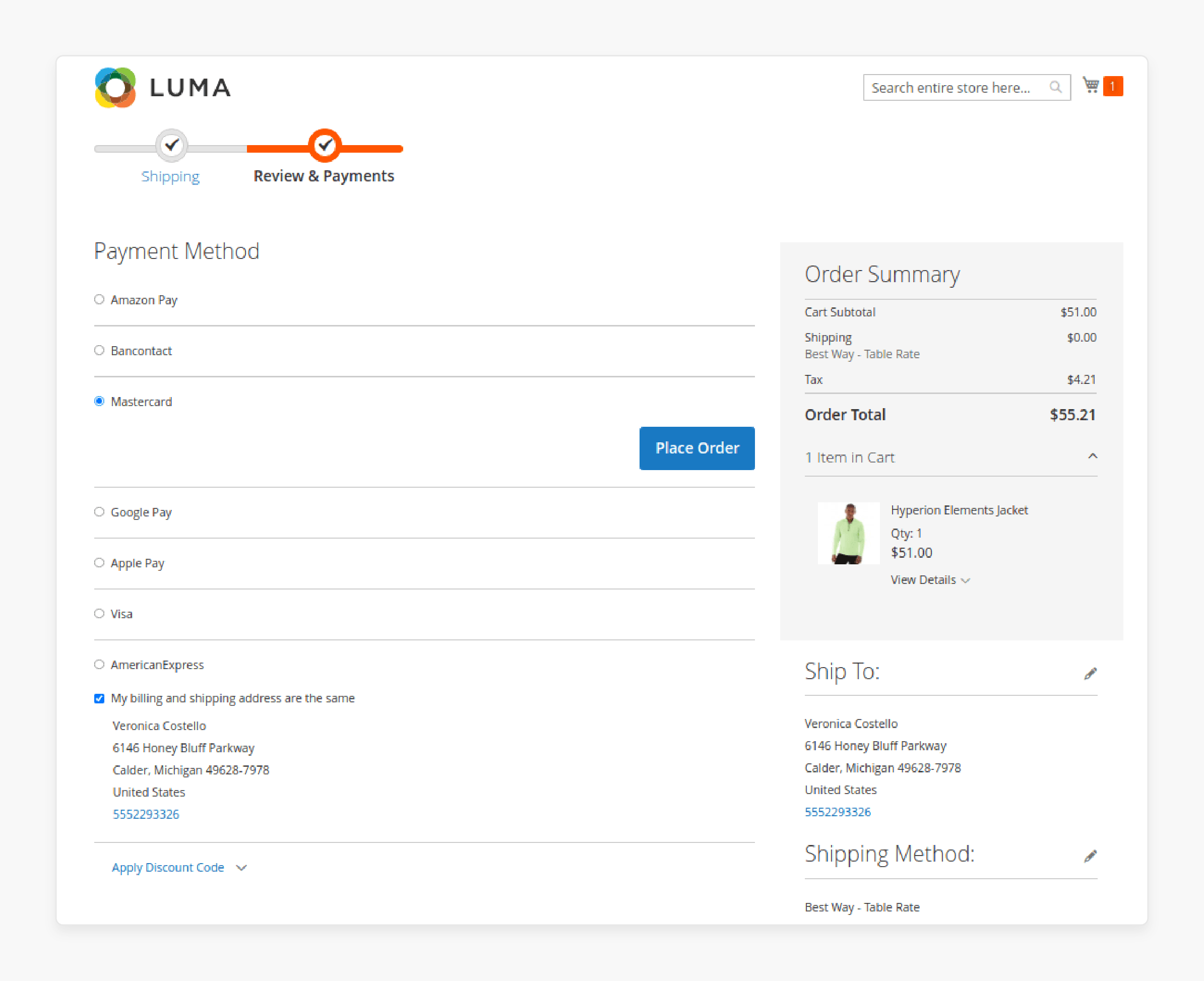

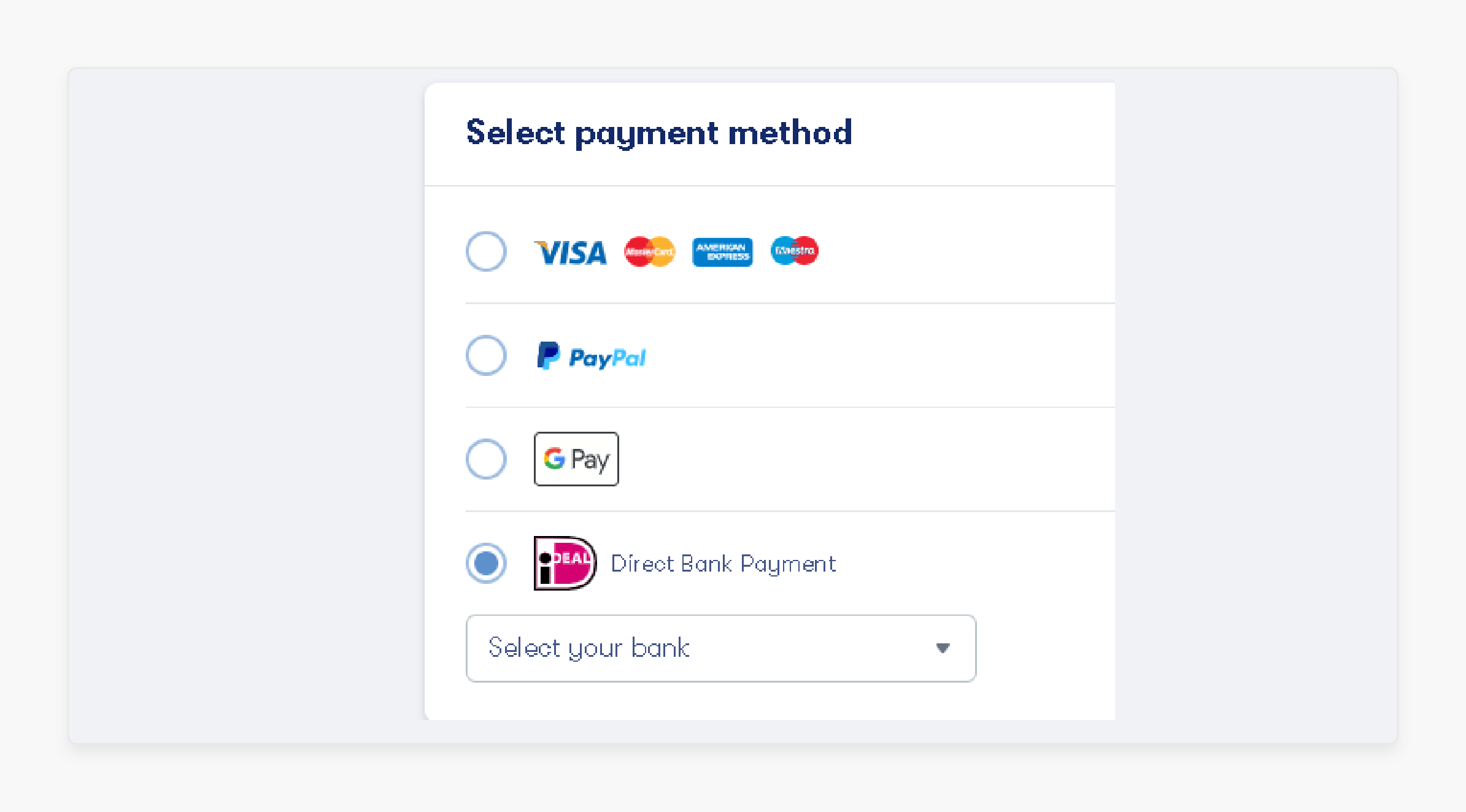

Magento lets merchants offer different payment gateway options. Customers can choose their preferred method at checkout. For example, an electronics store might offer credit cards and Amazon Pay. It gives customers more ways to pay. The flexibility increases conversions and improves the overall payment experience.

5. Flexibility and Backup

Using multi-payment portal providers adds flexibility and backup if one gateway fails. For example, if the credit card payment provider goes down. Having another eCommerce payment gateway ensures transactions continue. It is important during peak times like Black Friday. Having various payment systems keeps the business running smoothly.

6. Security

Magento ensures secure performance optimization payment processing. It encrypts data and follows payment card industry standards (PCI DSS). For example, a jewelry store was processing large credit card payments. They can rely on Braintree to handle transaction information and encode details safely. It keeps both businesses and customers protected from fraud.

5 Features of Magento 2 Payment Gateways for Global Transactions

1. Multiple Currency Support

Magento allows businesses to accept purchases in multiple currencies. It makes global transactions smooth. If your store is based in the US but sells to Europe or Asia. Magento payment gateways can convert money into local currencies.

For example, like Euros or Yen. This removes the need for manual currency conversion. Magento payment gateway integration helps manage multiple currencies easily. It lets retailers reach customers worldwide.

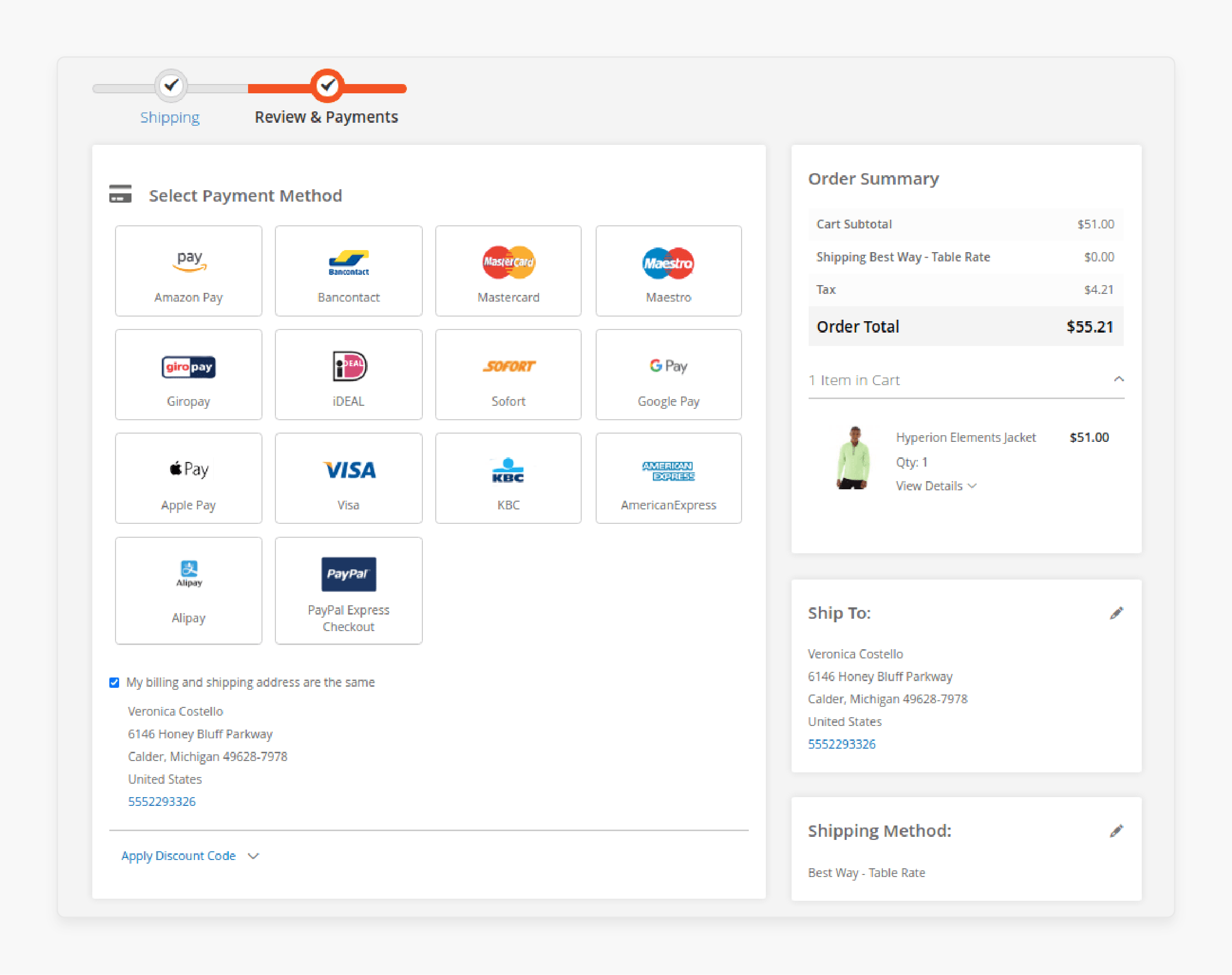

2. Support for Local Payment Methods

Different regions prefer different payment methods. Magento 2 works with gateways that support local options. In Europe, for example, iDEAL is popular in the Netherlands. Offering these portal options builds trust and reduces cart abandonment.

Magento supports payment processors, offering multiple local methods in one integration. This helps you integrate billing portals for your global customers.

3. Popular Global Payment Gateways

Magento integrates with some of the best Magento payment gateways for global use. It includes PayPal, Stripe, and Braintree. These gateways accept payment methods like:

-

Credit cards

-

Debit cards

-

Mobile payments in many countries.

These popular payment portals help businesses reach international customers. They reach without worrying about local compatibility.

4. Gateway Flexibility for Global Markets

Magento 2 lets merchants choose the gateway that offers the best fit for each region. For example, a US-based store that sells in Asia might use Adyen or Alipay for Asia. The flexibility allows customers to use payment methods like the ones they trust.

Choosing the right payment gateway requires comparing both international and domestic fees. They can become familiar to global buyers.

5. Payment Gateway Providers with Multi-Language Support

Many payment gateway providers that work with Magento offer multi-language support. It is the key for non-English-speaking customers. They make it easier for global customers to understand the payment page. By understanding the language, customers can complete transactions confidently. This seamless integration with Magento helps you serve customers worldwide. It also provides a better experience for all users.

5 Steps to Integrate Supported Payment Gateway to Your Website Store

Always test the integration on a test server before setting it up on your live store. If you use a Magento version below 2.4.0. Check the gateway provider's documentation for extra steps to set up webhooks.

Step 1: Install the Official Payment Gateway Extension for Magento 2

-

Purchase the payment extension for Magento 2 from the Magento Marketplace.

-

Log into your Magento 2 server.

-

Run the command from the project root to install-

$ composer require vendor/extension-name. -

Once the command finishes, run the following commands:

-

$ php bin/magento setup:upgrade -

$ php bin/magento cache:flush -

$ php bin/magento cache:clean.

-

-

If your Magento is in Production mode, also run:

-

$ php bin/magento setup:di:compile -

$ php bin/magento setup:static-content:deploy.

-

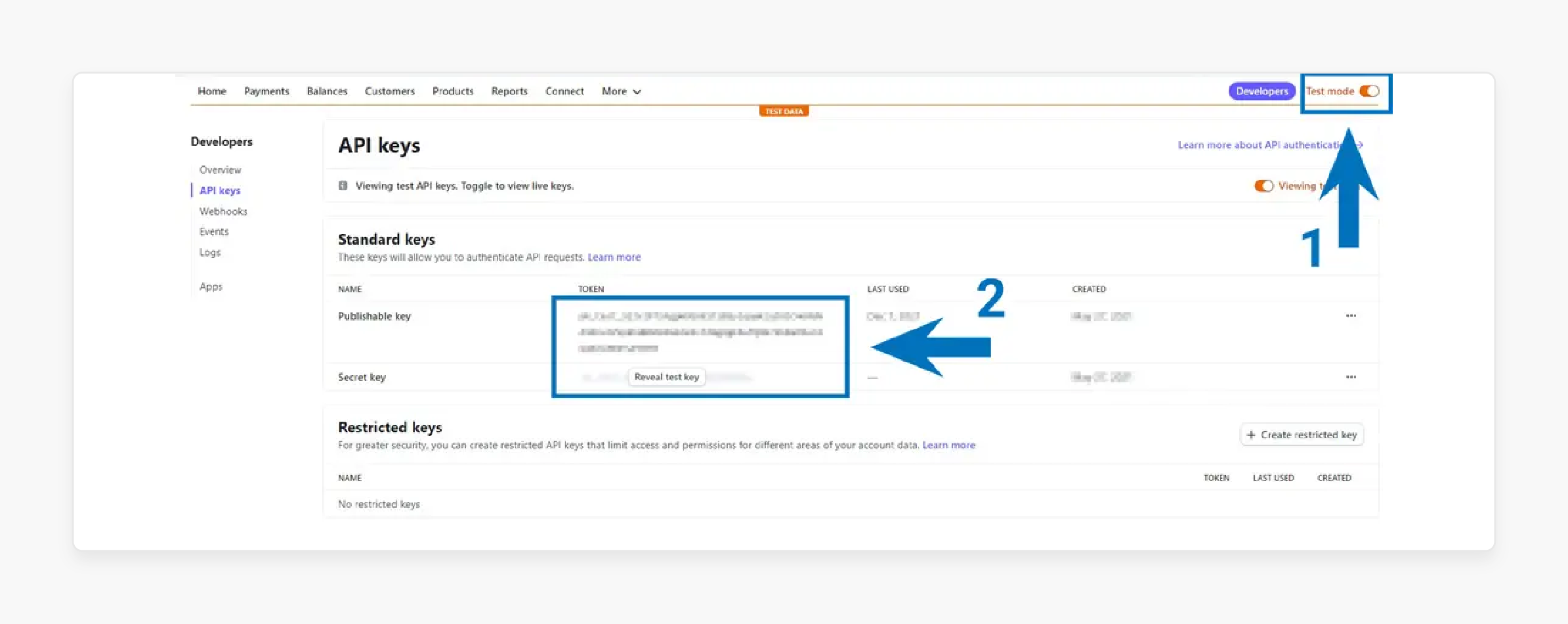

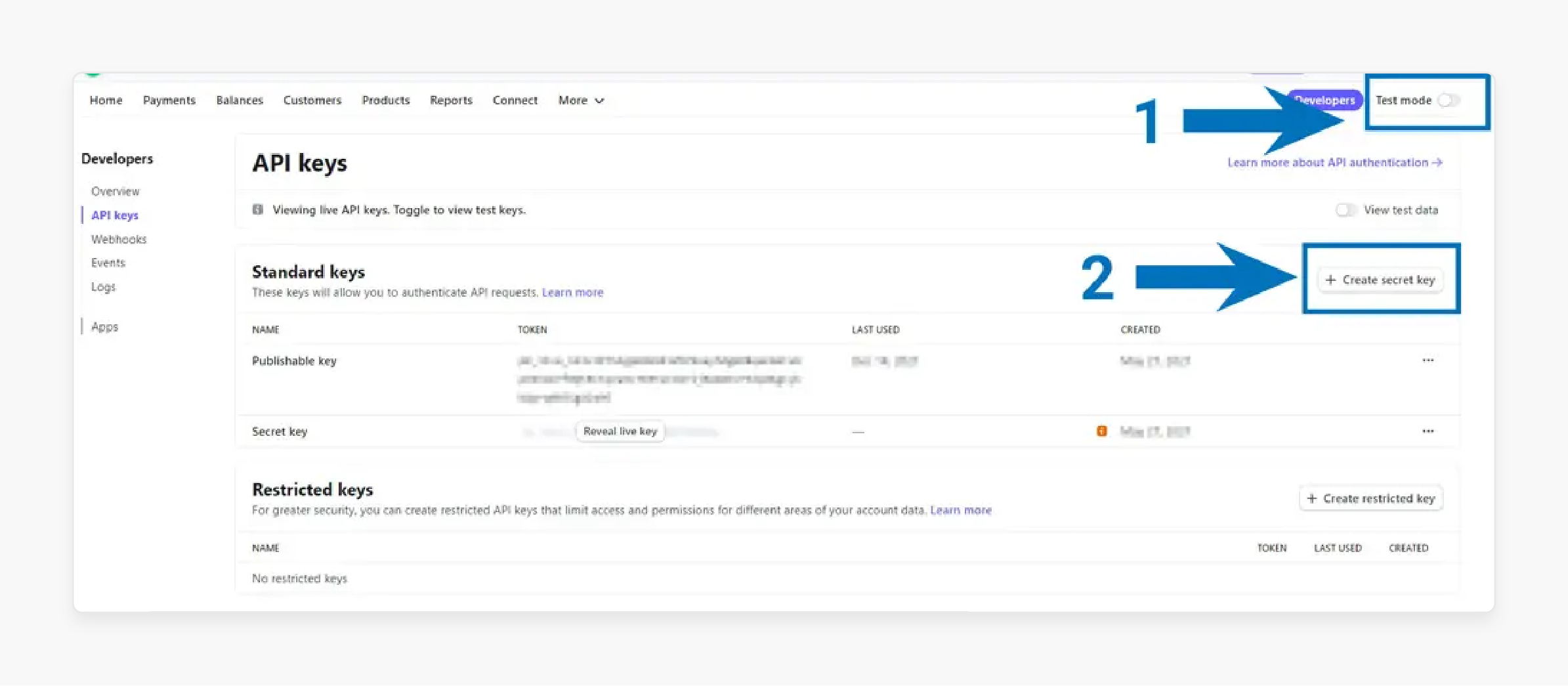

Step 2: Create New Test API Keys in Your Payment Gateway Account

-

Log into your payment platform.

-

Go to Developers > API keys.

-

Turn on the Test mode.

-

Copy the test API keys for your store.

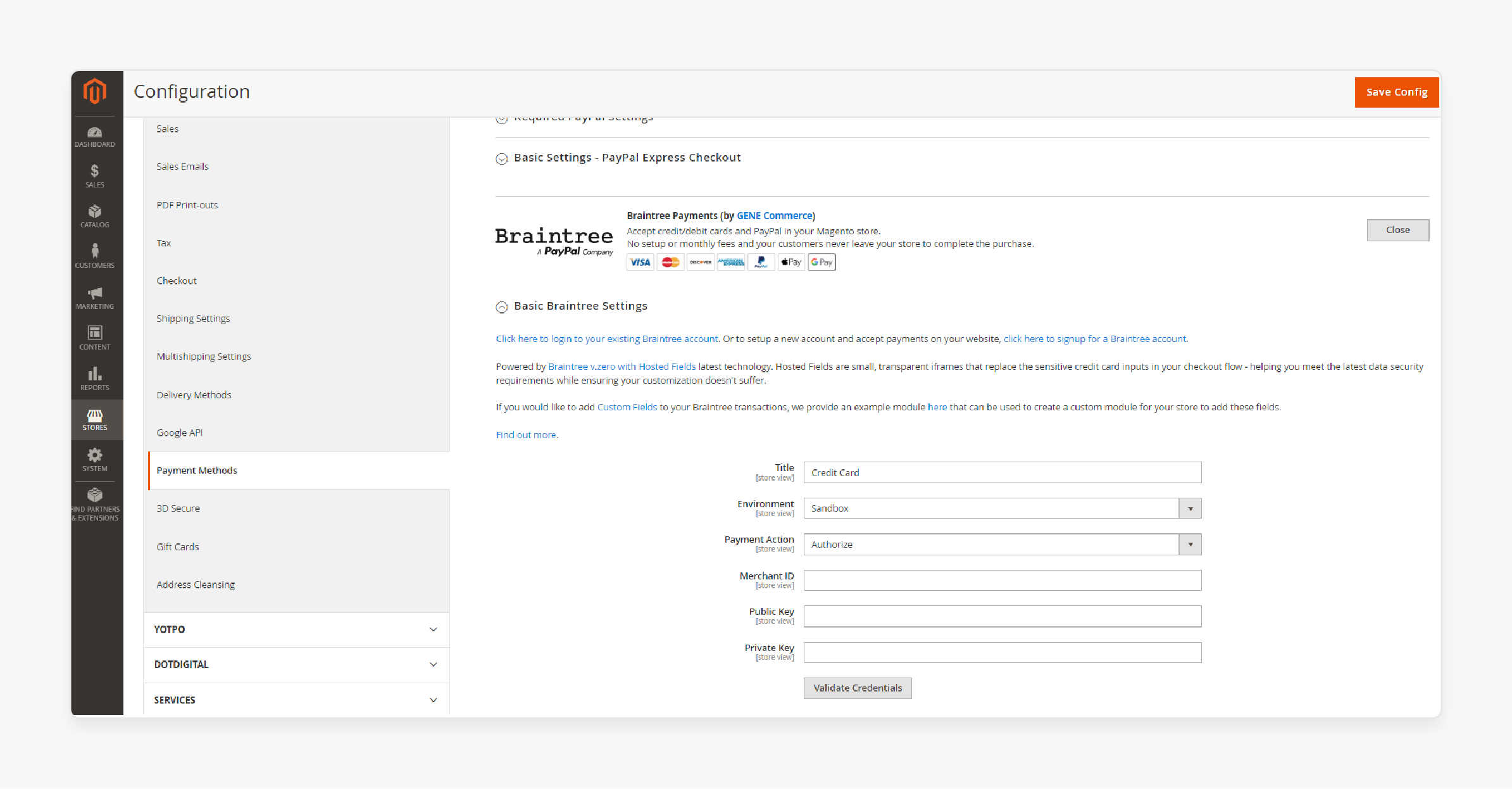

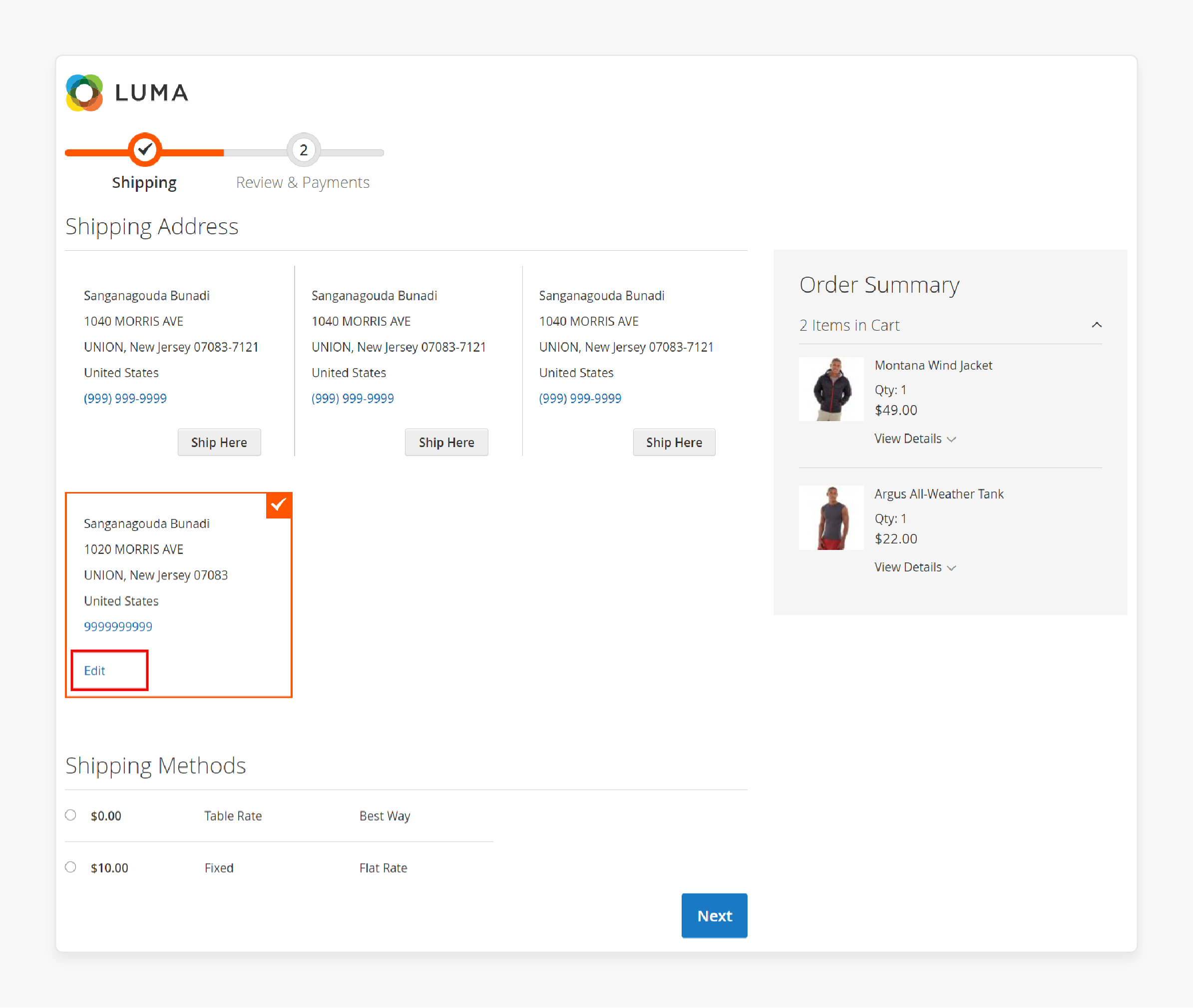

Step 3: Configure the Payment Gateway in the Magento 2 Admin

-

Log into your Magento 2 admin panel.

-

Navigate Stores > Configuration > Sales > Payment Methods > RECOMMENDED SOLUTIONS > [Gateway Name]

-

Click Configure.

-

Expand the General settings and set Mode to Test.

-

Paste your test keys into the Test publishable API key and Test secret API key fields.

-

Expand the Payments section and set Enabled to Yes.

-

Choose your Payment flow:

-

Either embed the customizable payment form.

-

Redirect customers to an external checkout.

-

-

Add a Title that will show on the payment page.

[Optional Step]: You can set up other payment methods by clicking the Configure link. It takes you to the payment platform's dashboard.

-

Set the Payment Action to Authorize and Capture.

-

Enable Save customer payment method. If you want customers to save their billing details for future orders.

-

Use the Card CVC code setting to choose when to ask for CVC codes.

-

You can also add a Statement descriptor and set the Sort order for the checkout page.

-

Other settings like Wallet Button, Fraud detection, and Subscriptions can be adjusted. When ready, click Save Config.

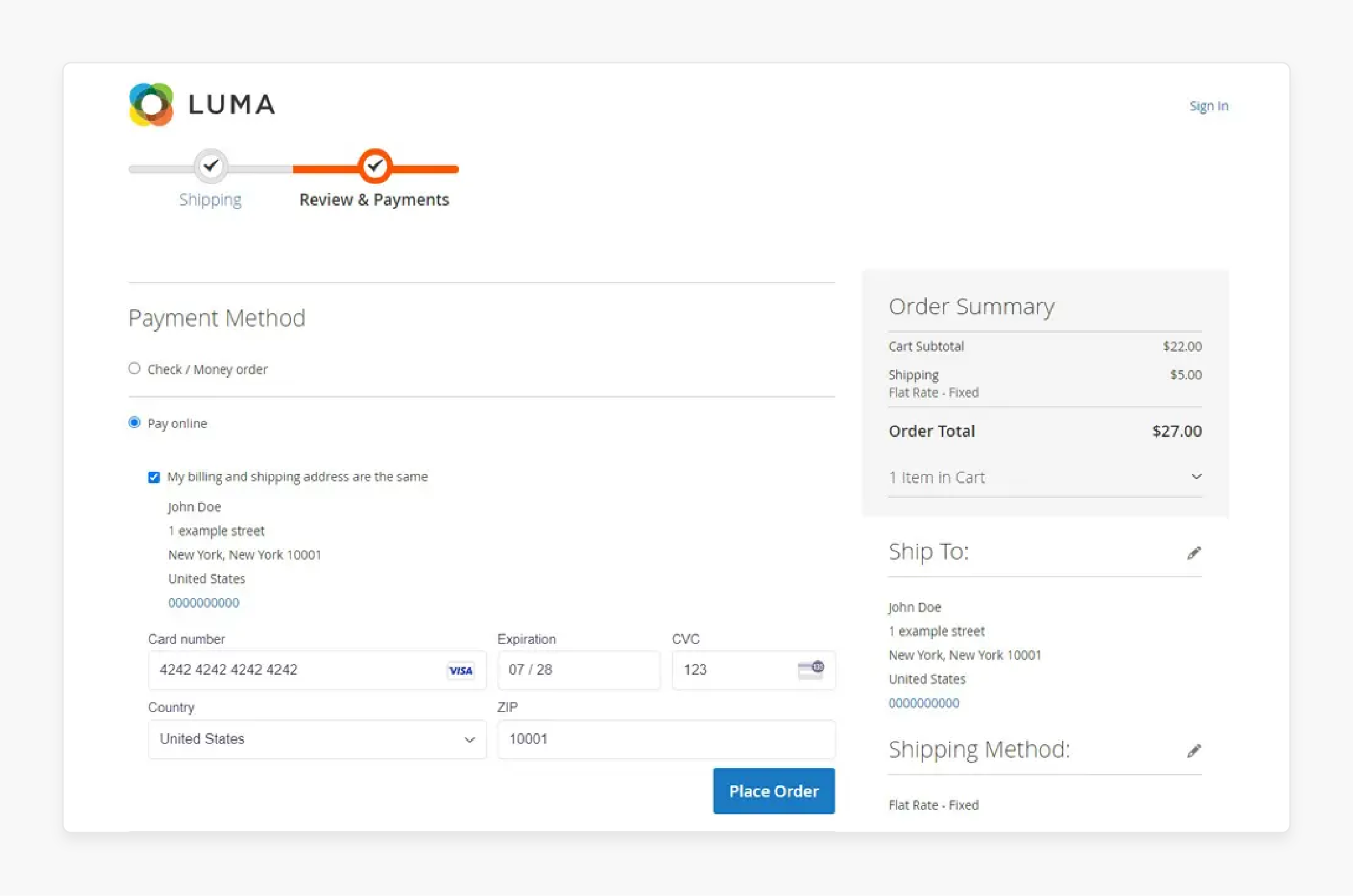

Step 4: Verify the Magento Payment Gateway Integration

-

Go to the front end.

-

Add items to your cart and proceed to checkout.

-

Use the test card numbers given by the payment portal to make a test payment.

-

Once the payment goes through, check the order status.

-

Go to the Magento admin panel under the order management section to check the status. Make sure the order status shows as Processing.

-

Log into the payment portal's dashboard.

-

Check that the transaction is shown in the test environment. If the transaction appears, your integration is successful.

Step 5: Switch to Live Mode

-

Go to the payment portal's dashboard.

-

Navigate to Developers > API keys.

-

Turn off Test mode and create live API keys in the Standard keys section.

-

Copy the live keys and return them to the Magento admin.

-

Navigate to Stores > Configuration > Sales > Payment Methods > RECOMMENDED SOLUTIONS > [Gateway Name].

-

Expand the General settings.

-

Set Mode to Live, and paste your live keys into the Live publishable API key and Live secret API key fields.

-

Turn off Test Mode, add the live keys, and click Save Config.

Security Features of Supported Payment Gateways for your Magento

| Security Feature | Details |

|---|---|

| PCI DSS Compliance | Ensures the store follows security solutions. It includes Payment Card Industry Data Security Standards (PCI DSS), help to protect sensitive data. |

| 3D Secure Authentication | Adds two-factor authentication. It requires customers to verify their identity during purchase, reducing unauthorized transactions. |

| Tokenization | Replaces sensitive purchasing data with a token. Secure the real data within the payment platforms and protect it from attackers. |

| Secure Payment Vaults | Stores customer billing information securely for future transactions. Ensures sensitive details are encrypted and protected. |

| Encryption | Encrypts billing data during transfer between the Magento store and the payment platforms. It helps to prevent unauthorized access. |

| Address Verification System (AVS) | Verifies that the billing address matches the one on file with the card issuer. It adds an extra layer of fraud protection. |

| Fraud Detection and Prevention | Real-time monitoring of transactions to flag and block suspicious activities. It protects the store from fraudulent purchases. |

Magento Supported Payment Gateways: Fees and Pricing Comparison

| Gateway | Domestic Transaction Fees | International Transaction Fees | Additional Costs |

|---|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | 4.4% + a fixed fee (varies by country) | No refund fees, but sales fees are non-refundable. |

| 2Checkout | 3.5% + $0.35 per transaction | Additional 2% + $0.35 per transaction | No setup fees or extra costs are mentioned. |

| Stripe | 2.9% + $0.30 per transaction | 1% + $0.30 per transaction | $15 fee for chargebacks. |

| Square | 2.6% + $0.10 per transaction | 3.9% + $0.30 per transaction | No hidden fees, only processing fees and no setup fees. |

| Authorize.net | 10 cents per transaction + $0.10 daily batch fee | 1.5% additional for international transactions | Chargeback fee: $25; IVRS authorization: $1.20 per transaction. |

| Amazon Payment | 2.9% + $0.30 per transaction | 3.9% + $0.30 per transaction | No setup fees or hidden charges; $20 charge for chargeback disputes. |

| WorldPay | 2.75% + $0.20 per transaction | 3.5% + $0.20 per transaction | No additional costs are mentioned. |

| Razorpay | 2% per transaction (fees vary based on specific fee amount) | Additional 1% per transaction (fees vary by charge amount) | 18% GST on fees (Indian tax); no other costs stated. |

| Braintree | 2.59% + $0.49 per transaction | Additional 1% + $0.49 per international transaction | $15 fee for chargebacks. Refunds do not incur transaction fees for accounts set up before a specific date. |

How Adobe Commerce Supported Payment Gateways Improve Checkout Experience?

1. Streamlined Checkout

-

One-Click Checkout: Adobe Payment providers offer one-click checkout and stored fee options. This makes it quicker and easier for repeat customers to complete purchases. The Magento payment platform will automatically save billing details for future use. It also speeds up the process.

-

Card Vaulting: Card vaulting allows customers to save purchase details for instant purchases. This reduces checkout steps and improves the customer experience. It securely redirects the processed payment to the merchant.

2. Various Payment Options

-

Wide Range of Payment Methods: Adobe supports a wide range of payment methods. It includes credit/debit cards, Apple Pay, and Google Pay. Offering various options caters to customer preferences and helps increase conversions.

-

Global Currency Support: Adobe supports multiple currencies. This allows businesses to sell globally without concerns about currency conversions.

3. Integrated Payment Experience

-

Unified Solution: Adobe Services provides an integrated payment solution. It allows merchants to manage purchases, orders, and reports from one dashboard. This setup makes managing charges easier and more efficient.

-

Simplified Integration: Adobe services integrate smoothly with Magento ecommerce payment portals. Merchants can handle everything through the configuration > sales > payment section in the backend. It simplifies the purchase process.

4. Security and Fraud Protection

-

Enterprise-Level Security: Adobe uses enterprise-grade security. It includes PCI DSS compliance, 3D Secure, and encryption. This ensures that every payment portal work is secure, protecting merchants and customers.

-

Fraud Prevention Tools: These include fraud detection and AI tools. They help keep your online store safe from fraud. This reduces chargebacks and protects revenue.

5. Real-Time Transaction Insights

-

Comprehensive Reporting: Adobe offers real-time insights into payments. It includes refunds, sales performance, and transaction monitoring. Merchants can track every processed payment to the merchant account instantly.

-

Transparent Pricing: Adobe Services provides clear pricing. Merchants can monitor transaction volume, purchase balances, and payouts. This ensures transparency in how the top payment platforms operate.

Top 7 Benefits of Using Supported Payment Gateways on Your E-Commerce Site

-

Convenience: Using more than one gateway for your e-commerce store is convenient for customers. Many customers prefer diverse purchasing options. They do not just prefer convenience for availability but because of personal preferences. Offering multi-payment portals reduces cart abandonment and boosts sales.

-

Good Economics: Using the best payment gateways for Magento is a smart move. Even if you are not expanding globally. The fees and terms depending on the specific payment portals, can improve your conversions.

-

Professionalism: Adding several payment platforms makes your site look more professional and reliable. This creates a sense of security for your customers. Most successful businesses use more than one gateway.

-

Providing Backup: Having more than one gateway for your Magento 2 serves as a backup. For example, using Magento 2 Amazon Pay ensures transactions. It continues if the main gateway has issues. It keeps your your sales steady.

-

Helps You Connect Internationally: Different regions and currencies often prefer certain gateways. Using the top payment portals helps you reach a global audience. They can handle different currencies, which is important for expanding your business internationally.

-

Independence: Most payment platforms have limits. Each payment portal is a third-party service. By using more than one gateway, you give customers more flexibility. It ensures a smoother shopping experience, whether online or in-store.

-

Customer Retention: Multiple gateways and how to integrate them reduce failed transactions. They frustrate merchants and customers. Offering more than one option helps users complete purchases without problems. It also boosts retention and conversion rates. This is key when selecting a Magento purchase solution.

FAQs

1. How does a payment gateway work in a Magento store?

A payment gateway in a Magento store handles online payment transactions. It securely sends billing information between the customer, merchant, and bank. It ensures the payment portal will automatically receive and send the money. It approves purchases and sends money to the merchant's account.

2. What should I consider when choosing a Magento payment platform?

When selecting a payment platform, look at fees, security features, and how well it works. Consider whether a gateway supports global payments and multiple currencies while choosing.

3. What limits should I be aware of in the Magento community?

The Magento community offers limited direct support for third-party payment gateway integrations. However, many of the best Magento payment portals provide guides. They help store owners set up payment systems.

4. What happens after a payment is processed through a Magento gateway?

After a payment is processed, the payment platform will automatically receive the payment. It helps in transferring the funds to the merchant. The gateway for your online store ensures secure transactions between customers and banks.

5. Why should I integrate a payment gateway in my Magento store?

Integrating a payment platform in your online store helps streamline payments. It can secure transactions and improve the shopping experience. Using the top Magento payment portals ensures an easy checkout process for global payments.

6. How did Adobe Commerce help in Supported Payment Gateways?

Adobe Commerce works with many supported payment platforms. It allows businesses to offer secure and flexible payment options. Adobe ensures smooth transactions, supports multiple currencies, and includes fraud protection. It improves the checkout experience.

Summary

Magento Supported Payment Gateways provide secure and flexible payment options. They integrate directly with Magento. It supports various currencies and domestic payment methods. Consider the following features:

-

Multiple Currency Support enables businesses to accept payments in various currencies.

-

Supports Local Payment Methods tailored to different regions.

-

Integrates with popular global payment gateways like PayPal, Stripe, and Braintree.

-

Offers Gateway Flexibility for Global Markets to select the best gateway.

-

Payment platform providers offer Multi-Language Support to cater to global customers.

Considering Managed Magento Hosting ensures seamless integration of supported payment gateways.