Magento Sales Tax Guide Setup Rules Compliance & Automation

Did you know that 60% of eCommerce businesses face tax compliance issues? Magento sales tax ensures that online stores apply the correct tax rates and avoid costly penalties.

In this tutorial, we will explore the key aspects, configuration steps, and troubleshooting of Magento sales tax.

Key Takeaways

-

Follow a step-by-step guide to configure tax settings correctly.

-

Ensure your store meets local and international tax regulations.

-

Set tax rules based on location and customer group.

-

Configure tax settings for a transparent checkout experience.

-

Set up VAT rules and exemptions for B2B and B2C transactions.

What is Magento Sales Tax?

Magento sales tax is a built-in feature in the Magento eCommerce platform that enables merchants to calculate and manage sales tax. It is based on customer location and tax regulations.

Sales tax allows store owners to set and apply tax rules at checkout dynamically. Magento supports different tax classes for products and customers, as well as shipping tax configurations.

The tax integrates with tax automation services like Avalara and TaxJar to ensure compliance with regional tax laws. Proper sales tax configuration in Magento is essential for accuracy and legal compliance.

7 Key Aspects of Magento Sales Tax

1. Tax Rules & Rates

-

Magento allows store owners to set up tax rules based on different locations and conditions. Merchants can create tax rates for specific:

1. Countries

2. States

3. Regions

4. Zip codes

-

It helps businesses selling across multiple jurisdictions with different tax rates.

-

If your business operates in areas with different tax rates, you can configure Magento to apply the appropriate rate. It depends on where the customer is located.

-

You can define tax rules based on factors such as customer group, product category, and shipping destination to ensure accurate taxation.

2. Product & Customer Tax Classes

-

Store owners can assign different tax classes for products, including:

1. The standard rate for taxable goods

2. Reduced rate for specific products

3. Non-taxable items

-

Customer groups can have special tax exemptions, including:

1. Regular customers

2. Wholesale customers

3. Non-profit organizations

-

By categorizing products and customers, Magento ensures that the right tax rules apply at checkout.

3. Automatic Tax Calculation

-

Magento dynamically calculates sales tax during checkout based on the customer's billing or shipping address.

-

Store owners can configure Magento to apply tax based on:

1. The customer’s shipping address

2. The store’s origin

-

Merchants can decide whether prices should be displayed with tax included or excluded. It depends on their business model.

-

Magento allows taxes to be calculated before or after discounts. It helps businesses run promotions.

4. Tax Display Options

-

Magento offers flexibility in how tax display settings can be applied to store views or customer groups.

-

Store owners can display product prices with or without tax on product pages, carts, and invoices.

-

Customers can see a breakdown of tax amounts in the shopping cart before finalizing a purchase.

-

Businesses can choose whether tax details appear on invoices and order confirmation emails.

-

The customization enhances transparency and helps meet local tax compliance requirements.

5. Shipping & Tax Handling

-

Magento allows merchants to configure how shipping charges are taxed.

-

Shipping fees may be taxable depending on the region. Magento enables store owners to apply tax to shipping costs if required by law.

-

Taxes can be applied to shipping costs based on the shipping address or the store’s origin.

-

It ensures compliance with laws in different regions where shipping may or may not be subject to taxation.

6. EU VAT & International Tax Support

-

Magento supports international tax rules, including VAT (Value-Added Tax) for businesses operating in the European Union.

-

Customers with a valid VAT ID can be exempt from tax when purchasing from another EU country.

-

Magento can also be configured to handle tax systems like:

1. GST (Goods and Services Tax) in Canada, Australia, India

2. HST (Harmonized Sales Tax) in certain Canadian provinces

-

The flexibility makes Magento a global-ready platform for eCommerce taxation.

7. Tax Reporting & Compliance

-

Magento offers built-in tax reporting tools to help businesses correctly track and file their taxes.

-

Magento provides detailed tax reports showing tax collected by region and product type. It ensures accurate record-keeping and compliance.

-

Properly configured tax settings ensure that records are accurate. It helps easily prepare tax audits.

-

Businesses can generate Magento’s tax reports for tax filing and audits. It ensures compliance with tax authorities.

14 Steps to Set Up Sales Tax in Magento 2

1. Log in to the Magento 2 Admin Panel.

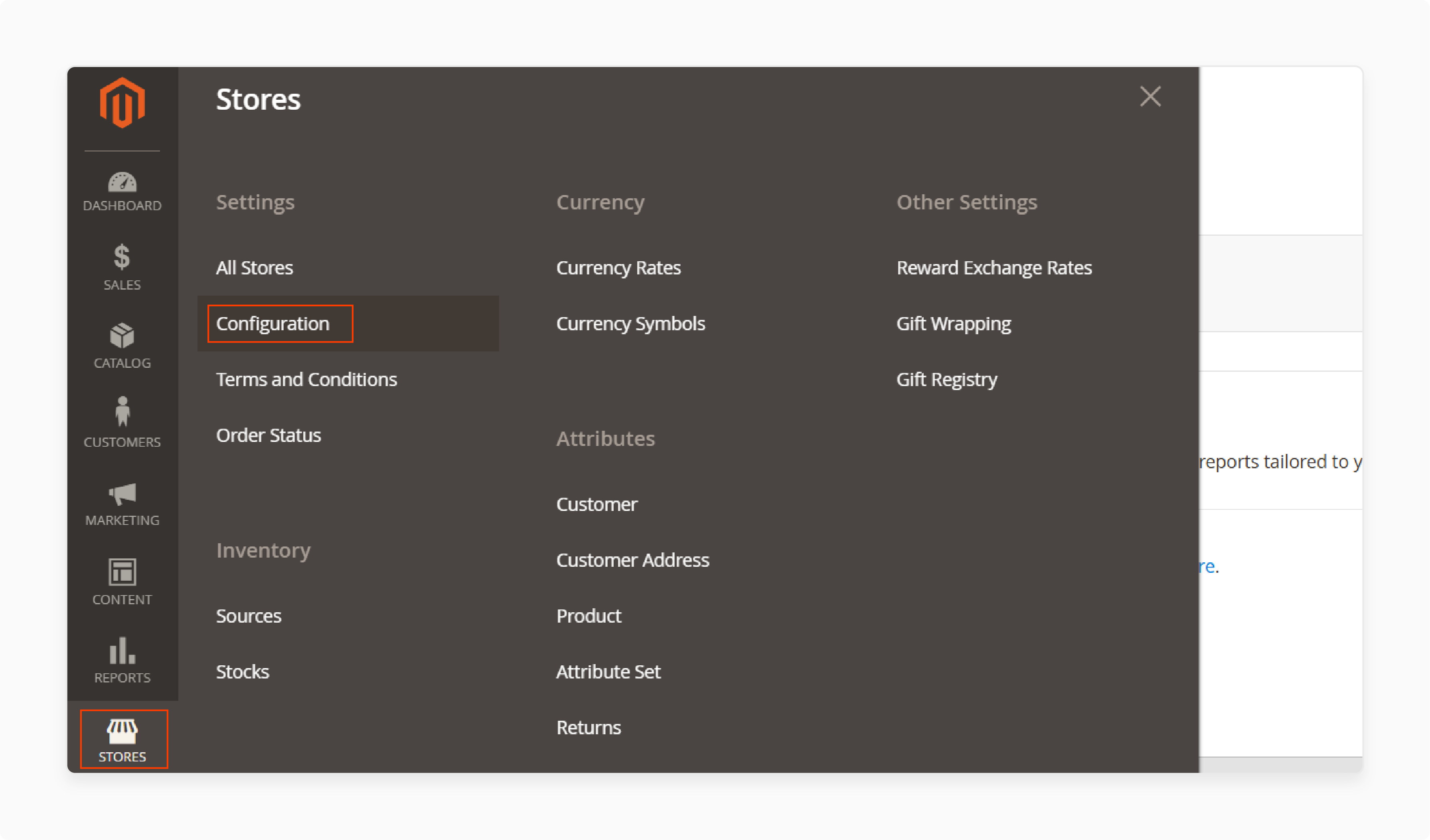

2. Go to Stores > Settings > Configuration.

3. If managing multiple sites, switch to the appropriate Store View.

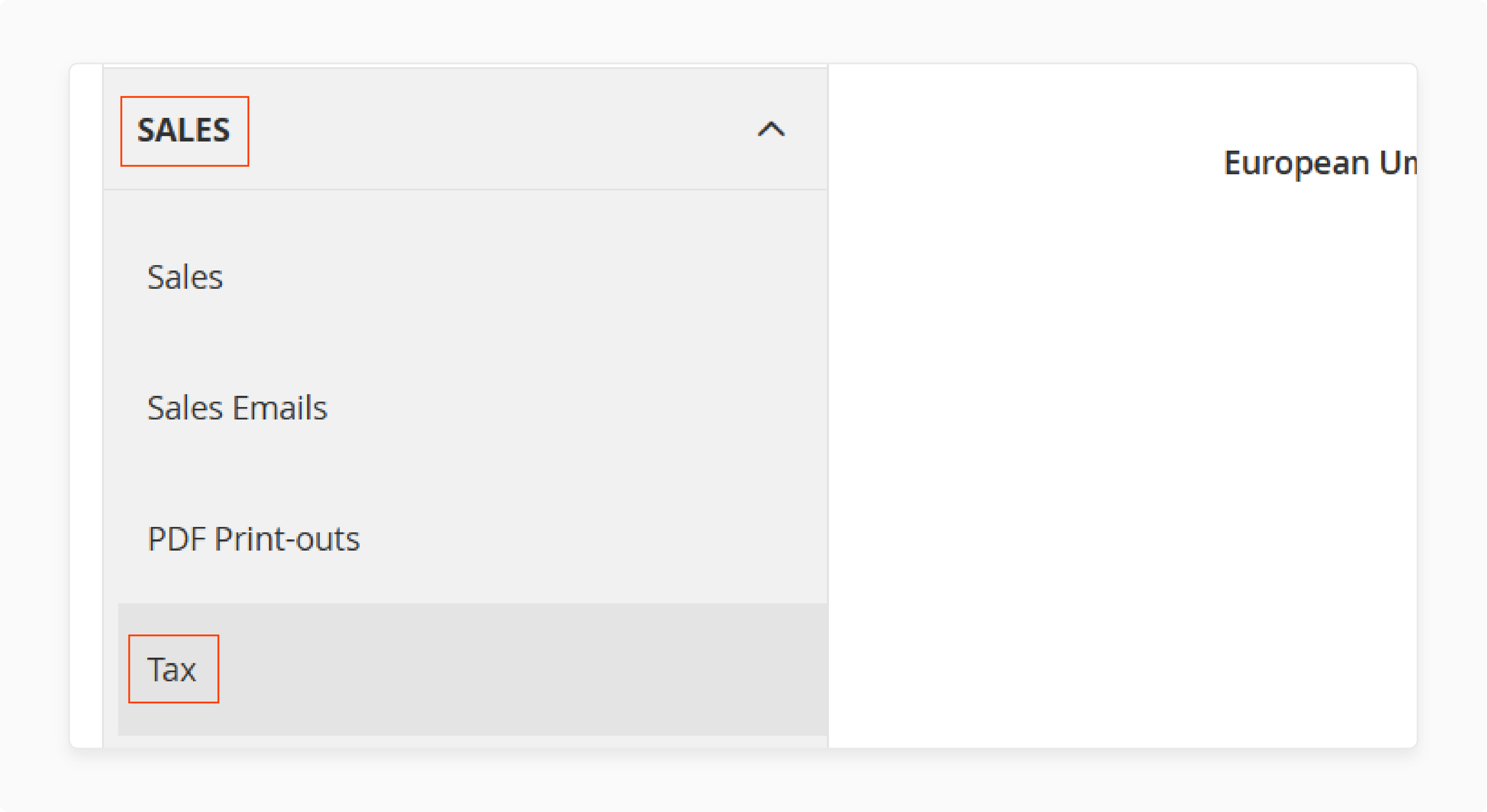

4. Open the Sales tab and click Tax.

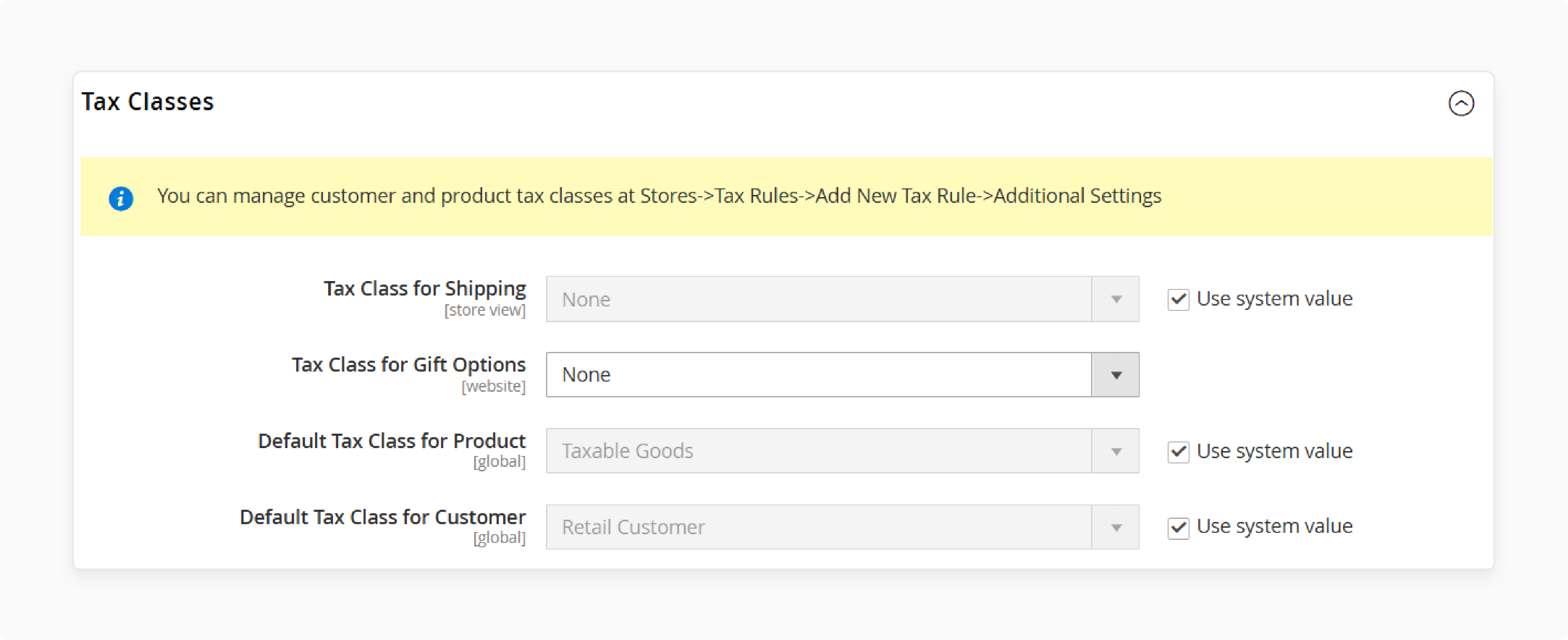

5. Under the Tax Classes section, specify the Tax Class for Shipping, Product, and Customer.

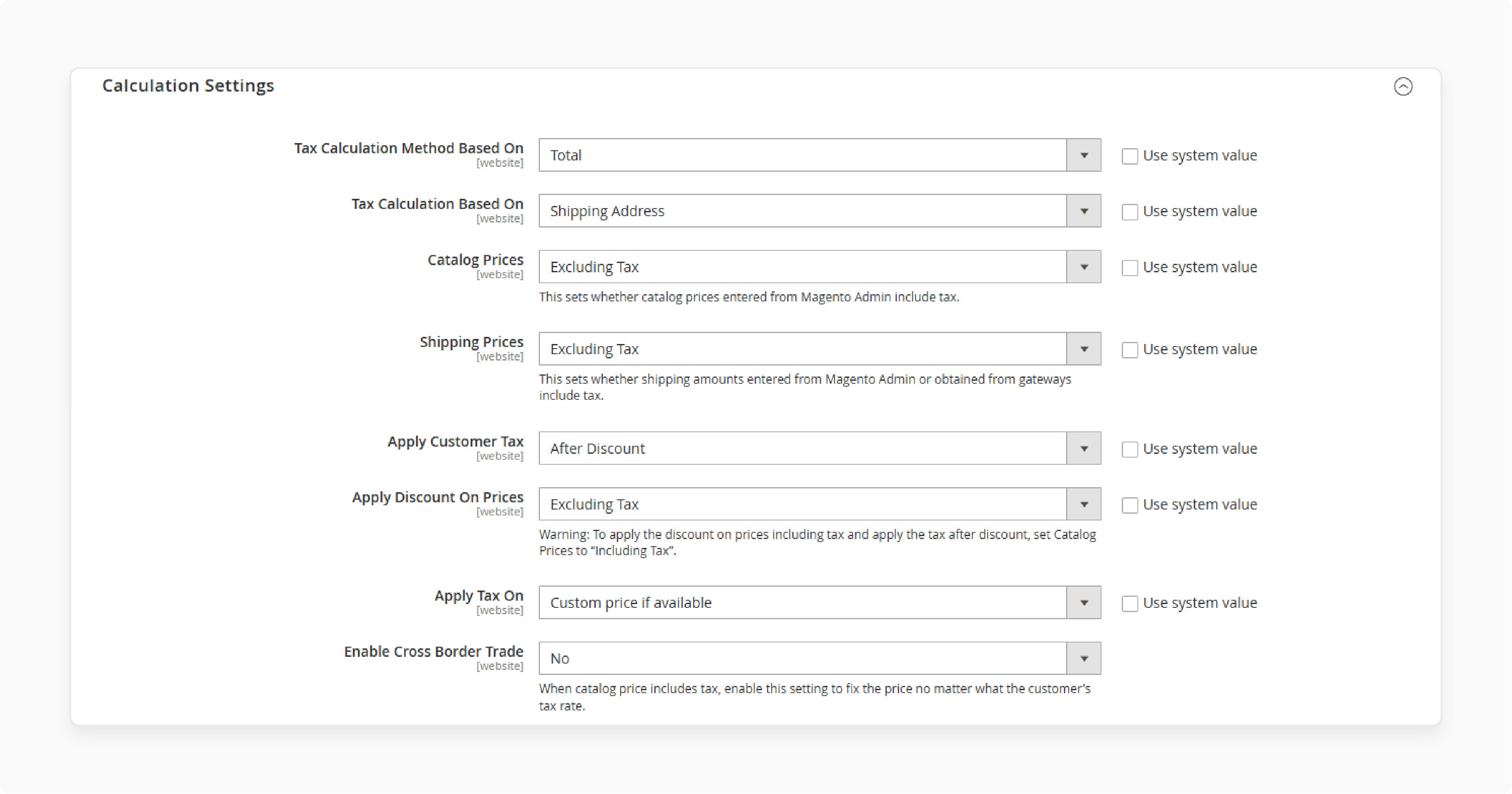

6. Go to the Calculation Settings section. Choose the base price for tax calculation:

-

Unit Price is the price of each separate product in the catalog.

-

Row Total is the sum of all products in the cart minus the discount.

-

Total is the order total.

7. In the Tax Calculation Based On field, select the base address for tax calculation:

1. Sipping

2. Billing

3. Shipping origin

8. Choose whether to include or exclude Tax from the catalog and shipping prices.

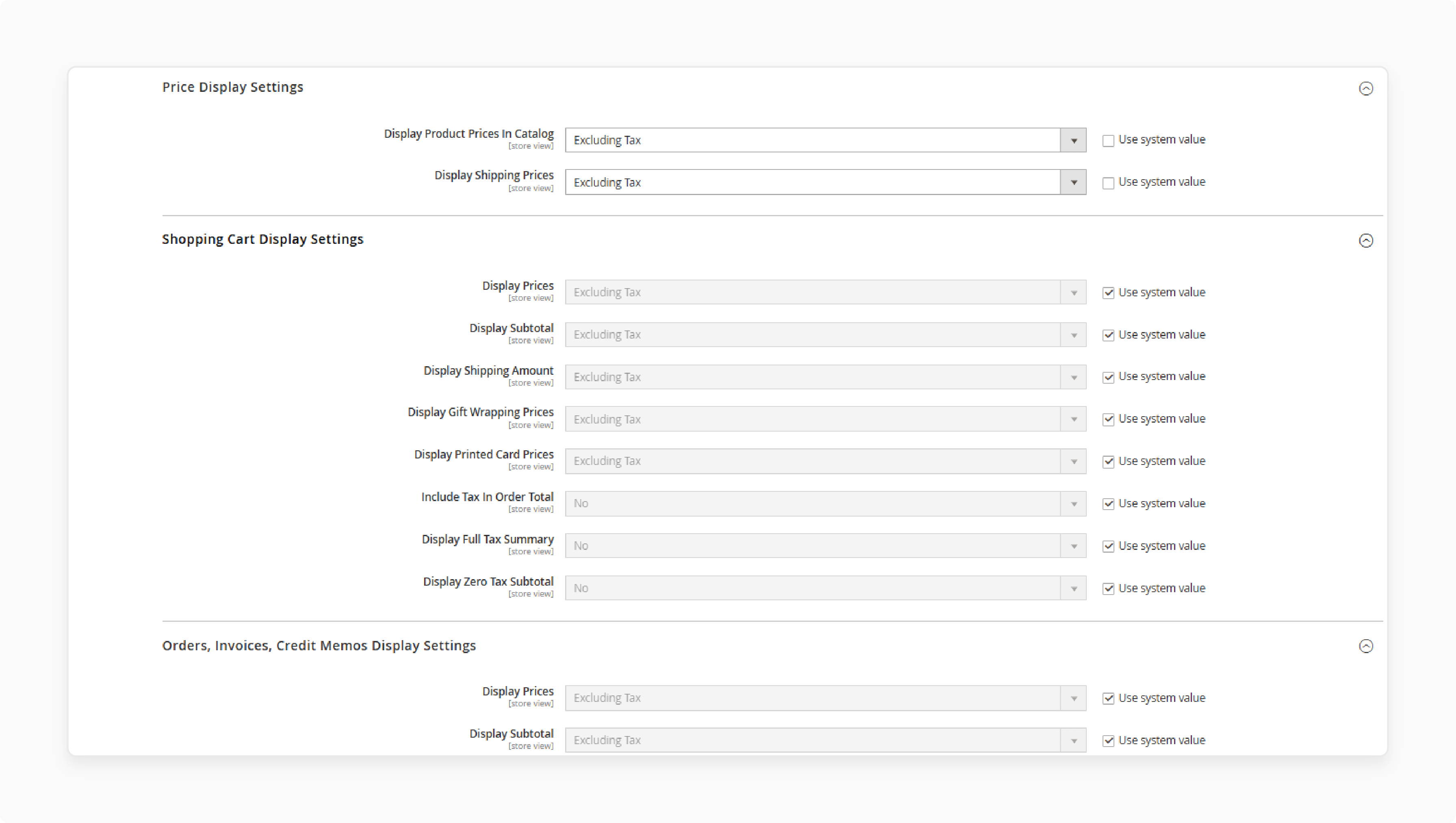

9. In the Apply Customer Tax field, decide whether tax should be applied before or after discounts.

10. In Apply Discount on Prices, specify if discounts should include or exclude tax.

11. Select whether to apply tax on Original or Custom Price in the Apply Tax On Custom Price field.

12. If selling internationally, enable Cross-Border Trade to ensure consistent tax-inclusive pricing across regions.

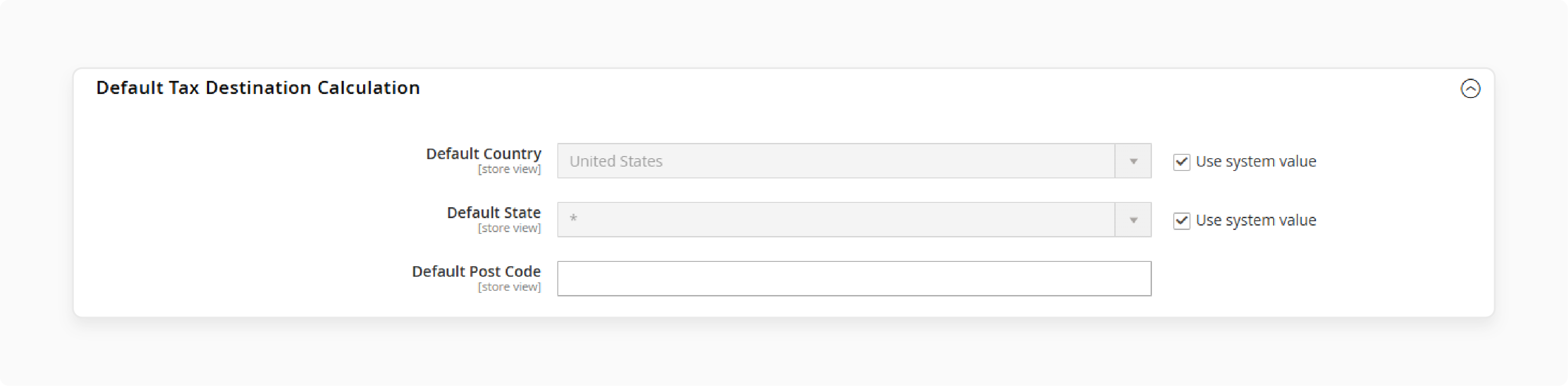

13. Configure the default country and state for tax calculations under Default Tax Destination Calculation.

14. Modify price display settings on product pages, shopping carts, and invoices.

15. Refer to the official Magento documentation for detailed display settings.

16. When ready, Click Save Config to apply the tax settings.

Why Is Magento Sales Tax Important?

1. Ensures Legal Compliance

-

Different regions and countries have specific tax laws that businesses must follow. Failure to collect and remit taxes properly can lead to penalties and legal issues.

-

Magento allows store owners to configure taxes based on local or international laws.

Example: A store selling in multiple US states must comply with economic nexus laws. These require collecting tax even without a physical presence.

2. Provides Accurate and Transparent Pricing

-

Customers want to see clear and accurate tax amounts before completing their purchase.

-

Magento allows businesses to display prices with or without tax. It ensures a consistent and transparent checkout experience.

-

Showing taxes prevents confusion and reduces cart abandonment.

Example: In Europe, VAT-inclusive pricing is common, whereas in the US, prices are typically displayed before tax.

3. Supports International Sales & Tax Compliance

-

Magento is built for global eCommerce, supporting tax structures like:

1. EU VAT (Value-Added Tax)

2. Canadian GST/HST

3. Australia’s Goods and Services Tax (GST)

-

It also allows VAT-exempt transactions for B2B businesses and customers with valid VAT IDs.

Example: A business selling to different EU countries must apply the correct VAT rate or offer VAT exemption for B2B sales.

4. Automates Tax Calculation & Reduces Errors

-

Managing sales tax is complex due to constantly changing tax rates and rules. Magento automates tax calculations. It ensures precise and up-to-date rates based on the customer’s location.

-

Tax automation services like Avalara and Vertex integrate with Magento to effortlessly handle:

1. Tax calculations

2. Reporting

3. Compliance

Example: A store selling in multiple US states can use TaxJar. It helps automatically determine whether tax should be collected based on economic nexus laws.

5. Simplifies Tax Reporting & Filing

-

Magento provides detailed tax reports to help businesses track tax collected by region and customer type.

-

These reports make tax filing and audits easier. It ensures businesses stay compliant with tax authorities. Automated tax reports save time and reduce accounting errors.

Example: A store selling in California and Texas can generate reports. It shows how much sales tax was collected for each state.

6. Helps Avoid Tax Penalties & Audits

-

Incorrect tax collection or failure to remit taxes on time can result in audits or legal actions.

-

Using Magento’s tax system ensures businesses collect and report the correct tax amounts. It reduces the risk of penalties.

-

Tax compliance also builds trust with tax authorities and simplifies the audit process.

Example: Magento’s detailed tax reports help verify transactions and prove compliance. It is true if a business is flagged for a tax audit.

7 Common Magento Sales Tax Issues and Solutions

1. Taxes Not Applying at Checkout

Even though tax rules are configured, sales tax is not calculated or applied at checkout.

Solution:

-

Go to Tax Zones and Rates and verify if the correct tax rate is assigned to the location.

-

Navigate to Catalog, select a product, and verify that the correct Product Tax Class is assigned.

-

In Customer Groups, ensure customers are assigned to the appropriate tax class.

2. Wrong Tax Rate Being Applied

The checkout displays a tax rate that does not match the expected tax rate for a customer’s location.

Solution:

-

Magento applies tax rules from highest to lowest priority. Check the priority of tax rules order.

-

Set Tax Calculation Based On either Shipping, Billing, or Store addresses.

-

If certain customers are tax-exempt but are being charged tax, check their tax class under Customer Groups.

3. Tax Not Showing in Cart or Checkout

Taxes are configured correctly but are not visible in the cart or checkout.

Solution:

-

Set Display Tax in Cart to "Including and Excluding Tax."

-

Ensure the Apply Tax After Discount is properly set based on your business rules.

4. Tax Included in Price but Still Adding Tax at Checkout

Product prices already include tax, but Magento adds tax again at checkout.

Solution:

-

Set Apply Tax On to Original Price Only under Calculation Settings.

-

Under Shopping Cart Display Settings, select Including and Excluding Tax for clear customer transparency.

5. Economic Nexus Laws Not Being Considered (U.S. Sales Tax)

Some states require tax collection due to economic nexus laws. Magento does not automatically apply tax for new locations.

Solution:

-

Integrate TaxJar or Vertex to handle tax updates for nexus compliance automatically.

-

Add tax rates for states where economic nexus applies. It is based on your business’s sales volume in each state.

6. VAT (Value-Added Tax) Issues for EU Businesses

VAT is not applying correctly for B2B or B2C transactions.

Solution:

-

Go to Tax and enable Enable VAT Calculation.

-

Enable VAT ID Validation under Customer Configuration.

-

Assign B2B customers with a valid VAT ID to the VAT Exempt tax class.

7. Tax Reports Not Matching Expected Values

The Magento tax reports show incorrect or unexpected tax amounts.

Solution:

-

Ensure taxes are calculated consistently using the same method for reports and checkout.

-

Magento only includes completed orders in tax reports. Check the order status before running reports.

-

If reporting discrepancies persist, consider integrating TaxJar, Avalara, or Vertex for accurate tax reports.

FAQs

1. What are the tax requirements for a Magento store?

Tax requirements for a Magento store depend on the store’s location and customer regions. Magento allows merchants to configure tax rules based on countries and zip codes. It ensures compliance with local and international tax laws.

2. How do I collect sales tax in my Magento store?

To collect sales tax in a Magento store, configure tax rules under Stores > Settings > Tax in the admin panel. Magento automatically applies sales tax based on customer location and tax class. Integrating tax automation services like Avalara ensures accurate collection.

3. When should I charge sales tax on customer orders?

You should charge sales tax when selling in states or countries where your business has a nexus. Magento allows tax calculation based on shipping or billing addresses. Ensure your store's tax settings match your jurisdiction’s tax laws.

4. Do I need a sales tax permit to collect sales tax in Magento?

Businesses in most regions must obtain a sales tax permit before collecting tax. Magento enables store owners to apply the correct tax rates. Compliance depends on registering with local tax authorities. Check state regulations for specific requirements.

Summary

Magento sales tax is a built-in feature that helps eCommerce businesses calculate and manage taxes based on customer location and tax regulations. The tutorial explores the key aspects of the tax, including:

-

Merchants can define tax rates based on location and customer group.

-

Magento dynamically applies tax based on shipping or billing addresses.

-

Supports EU VAT, GST, and HST, ensuring global compliance.

-

Built-in tax reports & compliance assist in accurate record-keeping and audits.

Ensure accurate tax compliance and seamless eCommerce operations with managed Magento hosting.