How Do You Configure the Magento Rapyd Payment Plugin?

Want to expand your ecommerce reach globally? The Magento Rapyd integration accepts 900 payment methods worldwide through a single platform.

In this tutorial, we will explain how to configure the Rapyd payments plugin for Magento.

Key Takeaways

- Rapyd's plugin handles 900+ payment methods in 100+ countries worldwide

- Installation requires only your API keys and basic Magento admin setup

- Built-in security protects against fraud through AI and machine learning

- Pricing varies by region, with lower fees for local transactions

- The system tracks suspicious activities and monitors endpoints 24/7

What is the Rapyd Payment Plugin for Magento 2?

“The Rapyd plugin supports 900 payment methods across 100+ countries and 65+ currencies.”

It allows merchants to accept credit cards, bank transfers, e-wallets, and cash payments. The global payment plugin:

- Supports B2B transactions with bank transfer capabilities

- Includes fraud monitoring features

- Enables marketplace payments and split payments when needed

- Offers digital invoicing capabilities

The plugin also offers two main integration approaches:

- Hosted Checkout Page: A pre-built, secure payment page that can be made to match brands.

- Checkout Toolkit: An embedded solution that allows deeper customization within the merchant's website.

Key Security Features of Rapyd Magento Payment Gateway

1. Security Infrastructure

-

The system performs daily vulnerability scans across all infrastructure components, applications, and APIs. It identifies and addresses potential security weaknesses before they can be exploited. The platform employs an advanced endpoint protection system. It safeguards all access points and monitors for suspicious activities.

-

Rapyd's infrastructure is designed with redundancy in mind. The multi-region approach means data and services are distributed across multiple geographic locations. The distribution ensures optimal performance.

-

The protection platform operates 24/7. It uses sophisticated algorithms to detect and prevent unauthorized access attempts. Each endpoint in the system undergoes rigorous security checks and continuous monitoring.

2. Data Protection Measures

-

Rapyd utilizes SSL and TLS certificates from trusted providers. These certificates establish secure connections between clients and servers. It protects data during transmission.

-

Hardware security modules (HSM) add another layer of protection. These physical devices manage digital keys and provide cryptographic processing. They ensure that key generation and encryption occur in a secure environment.

-

Rapyd employs tokenization methods to protect sensitive data. Tokenization replaces credit card numbers with unique identification tokens. These tokens are used to process transactions without exposing the actual sensitive data.

3. Fraud Prevention

-

One of the key components is the use of AI-powered machine learning models. These models analyze transaction data to detect patterns indicative of fraud. By continuously learning from new data, they improve their accuracy over time.

-

Rapyd uses a proprietary rules engine for transaction monitoring. This engine applies specific rules to evaluate each transaction in real-time. It assesses transaction amount and user behavior to determine the likelihood of fraud.

-

Rapyd provides a transaction reporting system. It enables merchants to track and analyze their transactions. This system helps identify trends and anomalies that may show fraudulent behavior. The system also actively monitors purchase frequency. It helps detect any irregularities in customer purchasing patterns.

4. Access Management

-

The platform uses a Single Sign-On (SSO) mechanism that optimizes the authentication process. It allows users to access many related systems with a single set of credentials. The SSO reduces the risk of password fatigue and improves overall security.

-

Rapyd strictly follows the need-to-know principle. It is when access is granted to different parts of the system. Users receive access to the specific functions and data necessary for their role.

-

The access management system maintains logs of all authentication attempts and user activities. These logs are regularly analyzed to detect any potential security threats. The system also sends immediate alerts when suspicious login attempts are detected.

5. Proactive Security Maintenance

-

Periodic penetration testing plays an essential role in maintaining system security. Professional security experts simulate real-world attacks to test the system's defenses. These tests identify weaknesses that might not be apparent during routine security scans. The findings from these tests drive improvements to security measures.

-

The bug bounty program encourages security researchers worldwide to report potential vulnerabilities. This crowdsourced approach to security testing provides another layer of protection. Researchers who discover legitimate security issues receive rewards.

-

The use of OWASP's top 10 risk mitigations ensures protection against security risks. These address common vulnerabilities such as:

-

Injection attacks

-

Broken authentication

-

Data Exposure

-

Steps to Configure the Rapyd Payment Gateway for Magento 2

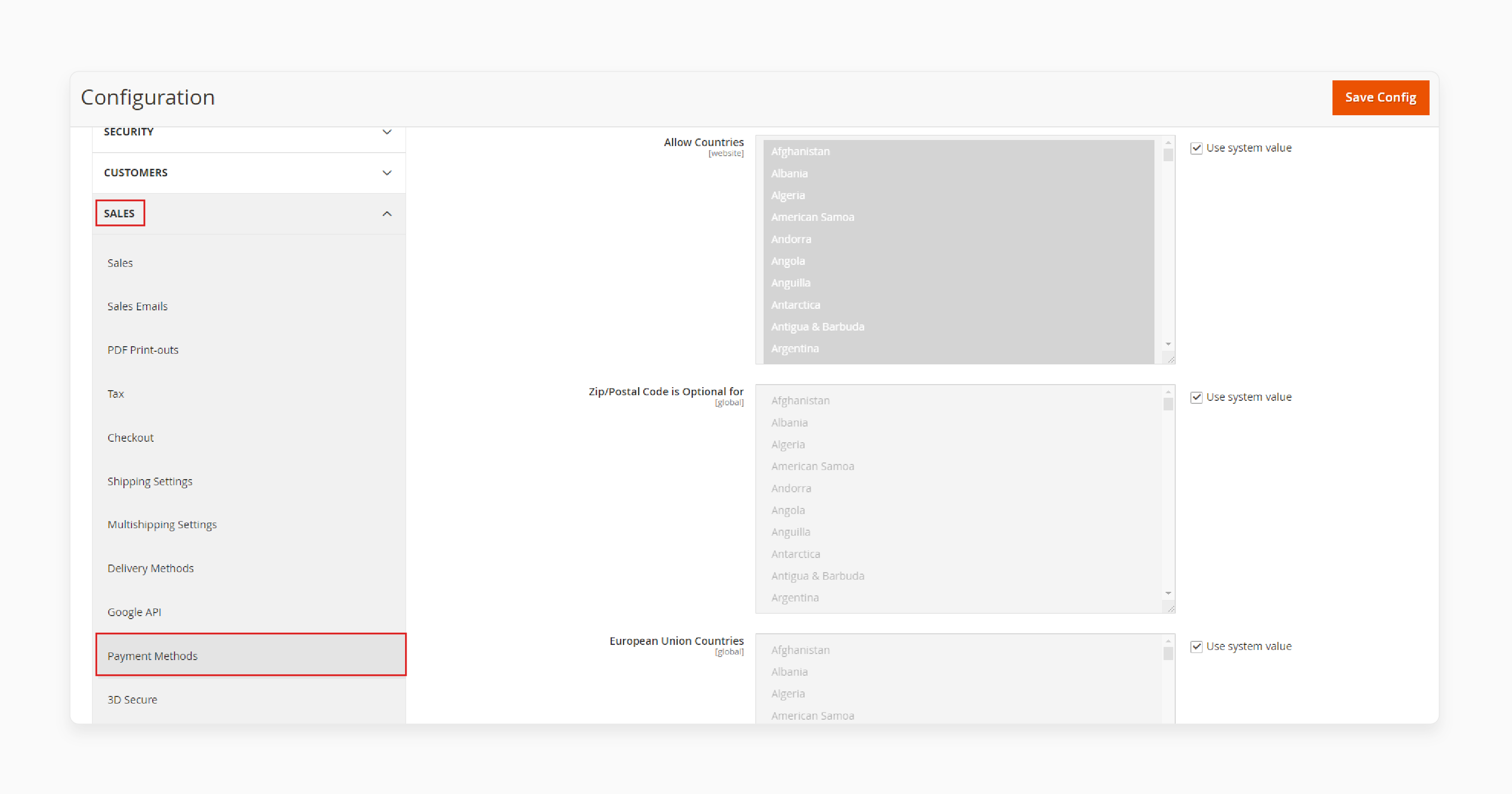

- Log in to the Magento admin panel after installing the Rapyd extension.

-

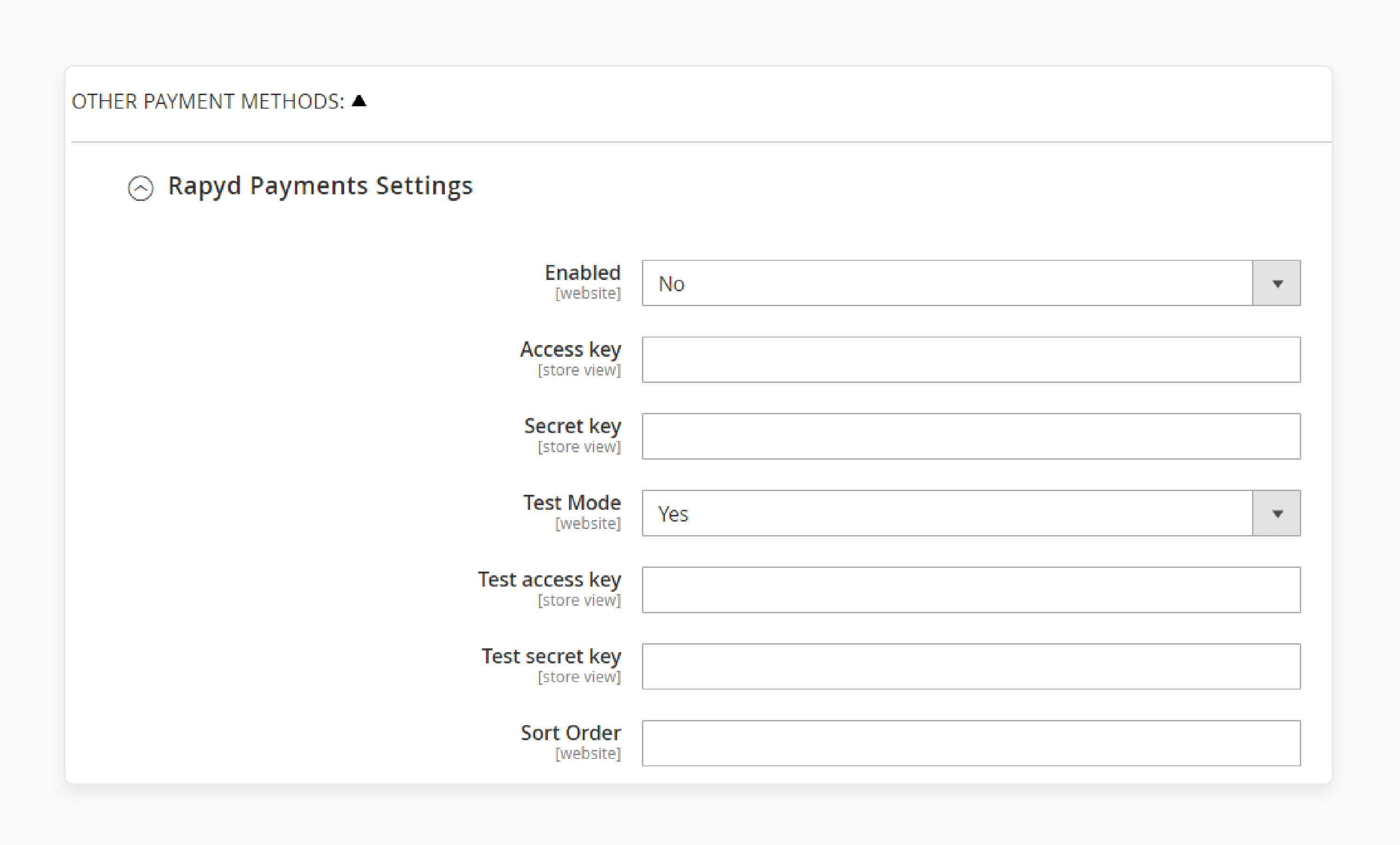

Navigate to Stores > Configuration > Sales > Payment Methods > Rapyd.

-

Enable the Sandbox mode for initial testing.

-

Enter the Test Secret key and Access Key from the Rapyd Dashboard.

-

Assign 1 to the Sort Number field.

-

Click on Save Config to save changes.

-

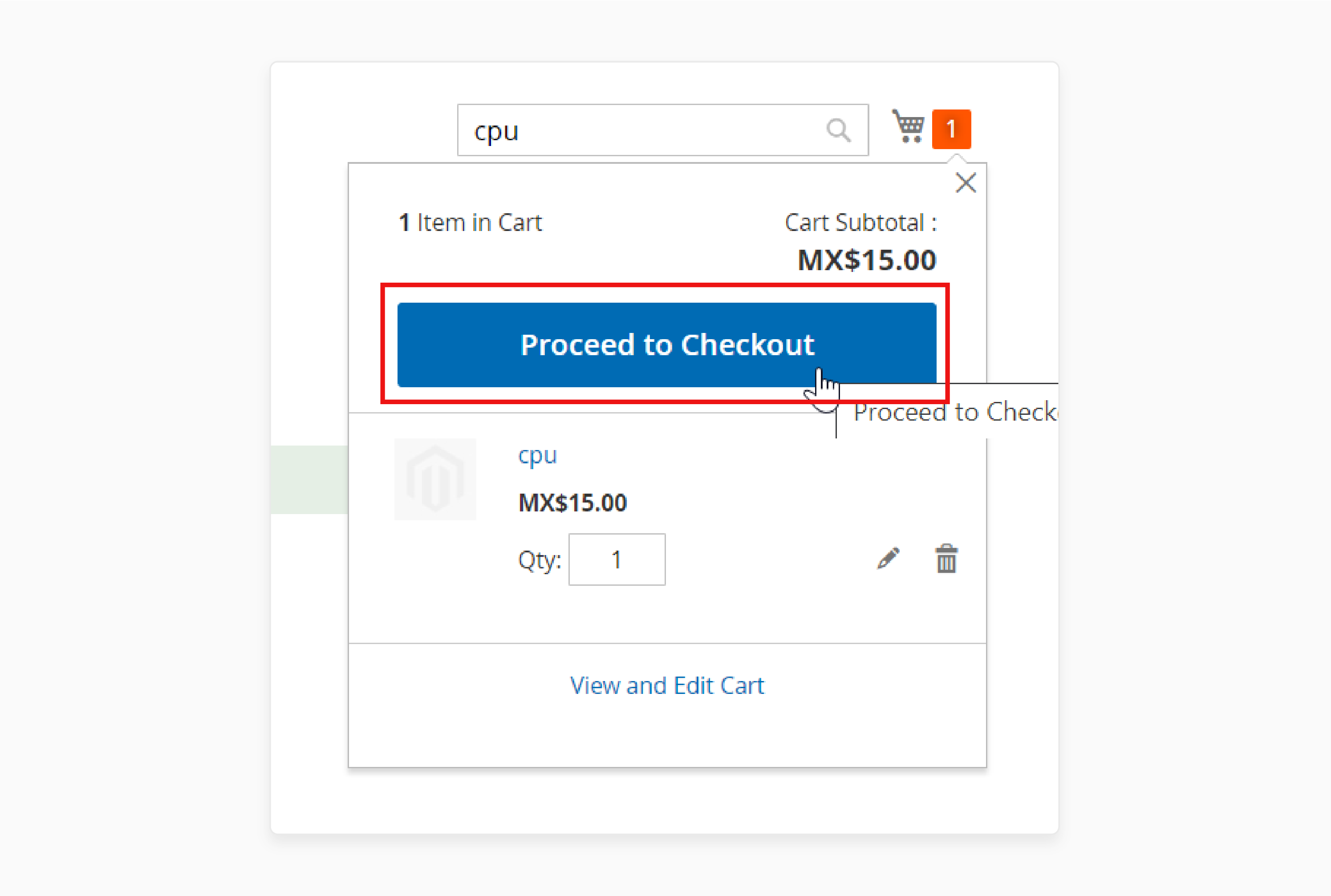

Test the payment method with a transaction.

Pricing Structure of Rapyd Ecommerce Payment Gateway

1. Transaction Fees

-

Transaction fees show base pricing for card types across regions (EU, UK, Iceland). It highlights how fees vary between domestic and international transactions.

-

It includes both percentage rates and fixed fees per transaction. It also demonstrates lower rates for local/European cards compared to international ones.

| Payment Method | Region | Currency | Rate | Fixed Fee |

|---|---|---|---|---|

| European Cards | EU | EUR | 1.20% | 0.25 EUR |

| All Cards (inc. non-European) | EU | EUR | 2.90% | 0.30 EUR |

| Domestic Cards | UK | GBP | 2.80% | 0.10 GBP |

| European Cards | UK | GBP | 2.00% | 0.10 GBP |

| European Cards | Iceland | ISK | 1.40% | 15 ISK |

| International Cards | Iceland | ISK | 2.90% | 15 ISK |

2. Interchange++ Structure

The interchange++ structure breaks down the three main components of card processing costs:

-

Interchange Fee: Amount paid to the card-issuing bank

2. Scheme Fee: Amount paid to card networks (Visa, Mastercard, etc.)

3. Acquirer Fee: Rapyd's service charge for processing

| Fee Component | Rate Range | Description |

|---|---|---|

| Interchange Fee | 0.20% - 1.80% | Issuer fee |

| Scheme Fee | 0.02% - 0.65% | Card network fee |

| Acquirer Fee | Variable | Rapyd's processing fee |

3. Additional Fees

-

The additional fees list non-transaction-related costs merchants should expect. It covers operational expenses like platform access and special handling.

-

It also includes compliance-related fees such as identity verification. The table details penalty fees for chargebacks and manual processing requirements as well.

| Fee Type | Amount |

|---|---|

| Monthly Platform Fee | $99/month |

| Manual Refund | $25.00 |

| Chargeback | $15.00 |

| Identity Verification | $3.00 per new user |

Rapyd vs. Sagepay: Features Comparison for Magento 2 Sites

| Feature Category | Rapyd | SagePay (Opayo) |

|---|---|---|

| Global Coverage | Over 100 countries, 70+ currencies | Mainly Europe-centered |

| Payment Methods | Cards, bank transfers, eWallets, cash | Cards, direct debits, eChecks |

| Security | - PCI DSS Level 1 compliance - AI-powered fraud detection - Real-time risk assessment |

- PCI DSS compliance - 3D Secure authentication - SSL encryption |

| Integration | - API-based integration - Multiple plugin support - White-label solution |

- Server integration - Form integration - Direct integration |

| Fraud Prevention | - AI-powered machine learning - Proprietary rules engine - Automated velocity checks |

- Built-in fraud prevention tools - 3D Secure - AVS/CVC checks |

| Wallet Features | - Digital wallet functionality - Multi-currency support - Internal transfers |

Wallet features are not available |

| Transaction Management | - Real-time monitoring - Detailed reporting - Split payments |

- Transaction logging - Manual review capability - Refund management |

| Pricing Structure | - Percentage + fixed fee per transaction - Varies by region - Additional services fees |

- Monthly subscription plans - Transaction fees vary by plan - Volume-based pricing |

| Customer Support | 24/7 support with dedicated account managers | 24/7 UK-based support |

| Additional Features | - Virtual accounts - Card issuing - FX capabilities |

- Virtual terminal - Customizable payment pages - Integration with Sage Accounting |

FAQs

1. How does Rapyd help you make cross-border commerce easier for magento users?

Rapyd is a single platform that accepts payments in over 100 countries and 65+ currencies. The solution supports various payment types. These include credit cards, bank transfers, and wallets. It makes it easier for merchants to expand their reach globally. They can do this while providing a smooth checkout experience for customers.

2. What technical support and compliance measures are included in Rapyd?

Rapyd offers PCI-DSS compliance, 24/7 security monitoring, and API support. The platform includes fraud prevention, dedicated third-party developer assistance, and enterprise-level security. Configuration for testing is also available through sandbox mode for proper execution.

3. How can Rapyd's payment plugins help increase cart conversions?

Merchants see improved conversion rates by offering preferred payment methods across the globe. Rapyd's checkout process supports hundreds of local payment methods. It allows customers to pay using their preferred local payment methods. It typically leads to higher completion rates and reduced cart abandonment.

4. What installation steps are required to implement Rapyd's payment solution?

Using Composer, the installation process is straightforward. After installation, merchants can access everything through the Magento admin panel. They can configure their API keys, enable sandbox mode, and customize their settings.

5. What makes Rapyd one of the best e-commerce payment solutions for Magento?

Rapyd provides Magento users with tools for card acceptance and local payment methods. It also offers advanced features like marketplace capabilities, digital invoicing, and fraud monitoring. The platform's checkout toolkit and hosted checkout page options ensure a smooth integration.

Summary

The Magento Rapyd plugin allows customers to check out comfortably using local payment methods. In this tutorial, we explain how to configure and use the Rapyd payment gateway. Here is a quick recap:

- Install and integrate the Rapyd plugin through the Magento panel.

- Configure sandbox mode with Rapyd test API keys.

- The platform supports multiple currencies and payment processing methods.

- Security features include SSL encryption and fraud monitoring.

- Transaction fees vary based on region and cards.

Choose managed Magento hosting with Rapyd payments to create swift shopping experiences.