Magento International Payment Limit: Top 6 Payment Methods

Are you unsure about how much you can charge customers from other countries? Magento International Payment Limit shows how payment systems set limits for international sales.

This tutorial will explain how to integrate payment gateways in Magento and understand payment limits.

Key Takeaway

-

PayPal and Stripe support international payments, but they have fees for transactions.

-

Banks can impose restrictions on international payments.

-

Processing fees can vary from 1% to 3.5%, depending on the gateway.

-

Magento configuration can restrict international transactions if not set up correctly.

-

Local regulations can limit Magento payment processing for international orders.

-

Fraud prevention measures can increase payment declines for international customers.

-

What Are The Best Payment Gateways For Magento For Cross-Border Transactions?

-

Tabular Comparison Of Top Payment Gateways For Magento For Cross-Border Transactions

-

How Does Magento 2 Handle Payment Methods For Cross-Border Transactions?

-

How To Integrate Magento 2 Payment Gateway With Magento Store?

-

How To Restrict Magento 2 Payment Methods By Customer Groups?

-

How To Restrict Payment Methods Based On Shipping Address In Magento 2?

What Is Magento Payment Gateway?

A Magento payment gateway is an integrated system that enables online payments for ecommerce stores. It securely processes transactions by connecting your ecommerce store with banks or payment processors.

The Magento payment gateway integration follows payment card industry data security (PCI DSS) standards. It ensures the safety of your customers' payment information. Magento offers customers payment options such as credit cards and third-party payment gateways.

What Are The Magento International Payment Limits?

Magento international payment limits refer to the maximum transaction amounts set by gateways. These limits can affect how much you can charge customers from different countries.

Magento doesn't set specific limits on international payments. Instead, the payment providers you choose determine those limits. Payment gateways may have different rules based on the country of the buyer or seller.

You can adjust settings for international payments directly in Magento. But it's essential to check the payment platform you use to understand their limits.

What Factors Impact Magento's International Payment Limits?

1. Payment Gateway Limitations

Each payment gateway sets its limits on international transactions:

-

PayPal: For businesses in the US, PayPal allows up to $60,000 per transaction. PayPal may cap it at $10,000 for regulatory reasons. Additional verification steps are required to lift withdrawal limits.

-

Stripe: Stripe has no fixed limits for international payments. But, its fraud protection system might block payments if a transaction is flagged as suspicious. Stripe also charges for currency conversions: 1% for US accounts and 2% for non-US accounts.

-

AuthorizeNet: This gateway has specific limits based on your merchant account settings. If you're a new account holder, international transaction limits may be restricted. It will lift when you complete additional verification.

2. Bank Account and Merchant Account Limitations

Your bank or payment processor also imposes its transaction limits. For example:

-

Bank Transfer Limits: Domestic ACH payments in the US are capped at $25,000 per transaction, but international ACH transfers can have different limits.

-

Merchant Account Fees: Banks or processors charge fees for international transactions, and the fees can vary widely. For example, American Express charges 3.5% for international card payments. Visa and Mastercard charge about 2.5% as an interchange fee.

3. Magento Store Configuration

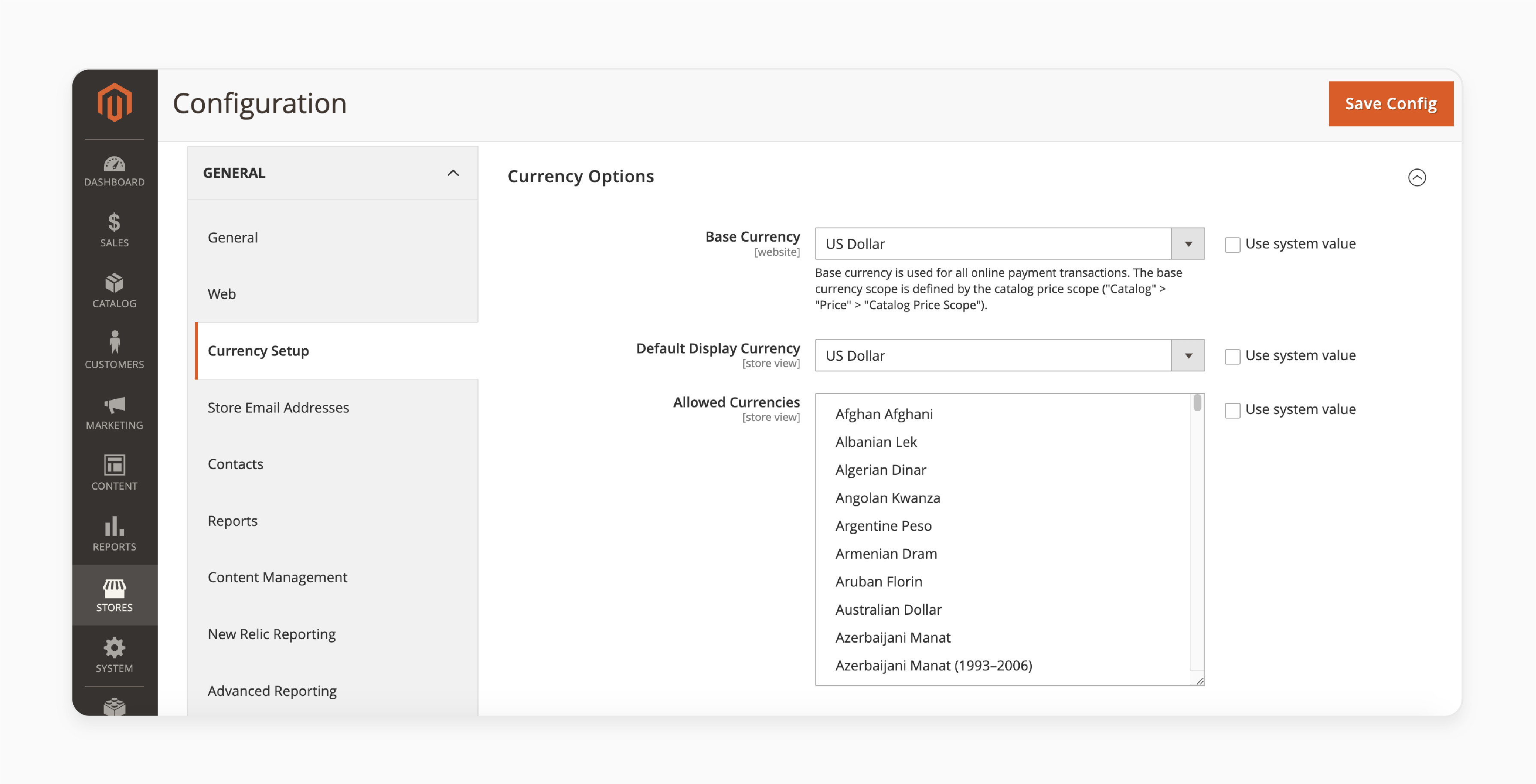

Although Magento doesn't directly set limits, specific configurations can impact international transactions:

-

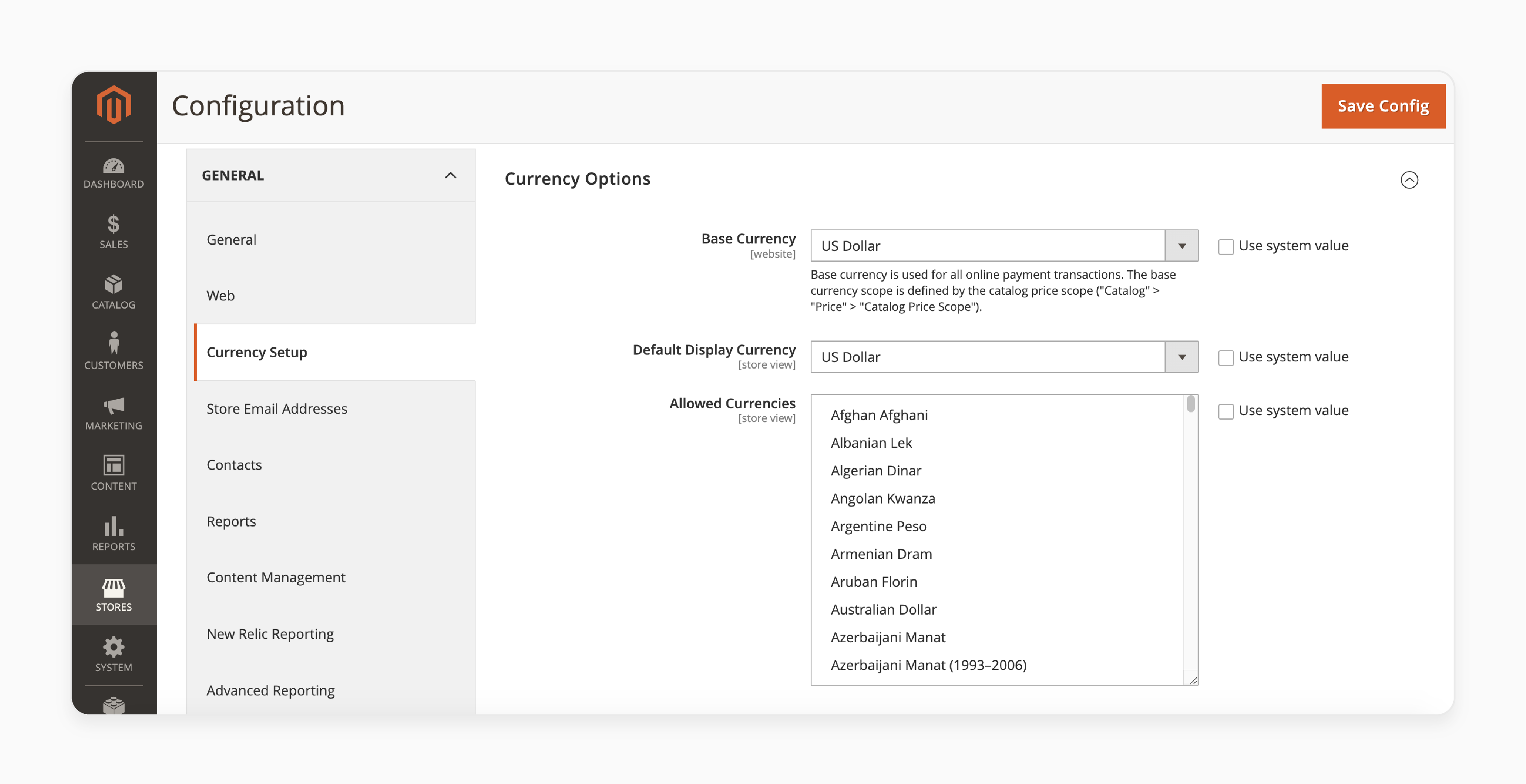

Currency Configuration: Magento allows you to set multiple currencies under Stores > Configuration > General > Currency Setup. But, if your payment gateway doesn't support a particular currency or region, the transaction will not be processed.

-

Shipping and Tax Configuration: Make sure your shipping and tax setup is correct for international customers. If it is not configured correctly, it could prevent customers from making a purchase.

4. Local Regulations

Some countries enforce restrictions that directly impact payment transactions:

-

India: The Reserve Bank of India mandates that payments for goods and services can only be processed via RBI-approved payment gateways. It also caps international payments. Businesses must comply with local data protection and reporting laws.

-

China: China heavily regulates cross-border transactions. The Chinese government limits the amount an individual can pay internationally to $50,000 per year. Payment gateways must comply with these rules to avoid penalties.

-

EU: The EU enforces strict rules under PSD2 (Payment Services Directive 2). For example, payments over set limits will require Strong Customer Authentication (SCA). If the payment system doesn't comply, these regulations can delay or limit international payments.

5. Fraud Prevention

International transactions are subject to stricter fraud prevention checks. Payment gateways like Stripe and PayPal use Magento 2 3D Secure 2.0 for high-risk international transactions. If the transaction fails this check, the payment will be rejected.

What Are The Best Payment Gateways For Magento For Cross-Border Transactions?

1. PayPal

PayPal is one of the most widely used payment options worldwide. It allows businesses and customers to make and receive payments securely over the Internet. PayPal supports transactions in multiple currencies. It is an excellent choice for international payments.

-

Uses advanced encryption technology to protect users' financial information during transactions.

-

It can be integrated into ecommerce platforms like Magento, Shopify, and WooCommerce.

-

Offers mobile applications for both iOS and Android users.

-

Supports credit card payment, bank transfers, and alternative payment methods like PayPal Credit.

2. Stripe

Stripe is a financial services platform that enables businesses to accept payments, manage revenue, and facilitate online transactions. It supports international credit and debit cards. Stripe offers built-in support for alternative Magento 2 payment methods like Alipay, Klarna, and more. Thus, it's an excellent solution for countries with non-traditional payment methods.

-

Known for easy integration services and payment processing in multiple currencies.

-

Businesses can process in-person transactions using physical card readers that integrate smoothly with their existing systems.

-

Supports credit and debit cards, Apple Pay, Google Pay, and local methods like Alipay and SEPA.

-

Transparent pricing with no setup fees and competitive rates.

3. Amazon Pay

Amazon Pay is a payment processing service offered by Amazon. It allows merchants and businesses to use the payment methods stored in their customers' Amazon accounts. It makes the checkout process faster and more convenient.

-

Trusted by customers worldwide, allowing payments via their Amazon account.

-

Global acceptance with transactions in multiple currencies, including USD, EUR, and GBP.

-

Offers A-to-Z Guarantee Protection, ensuring the buyer receives the item they ordered or their money back.

-

Easy checkout experience for customers with saved payment information.

4. Braintree

Braintree is a full-stack payment platform that allows businesses to accept, process, and disburse payments. It provides a robust solution for merchants who want to accept various forms of payment. The Braintree Magento 2 platform is ideal for stores that offer flexible payment solutions to international customers.

-

Accepts credit card payment, PayPal, Venmo (US), and local payment options like SEPA.

-

Offers SDKs (Software Development Kits) for both iOS and Android.

-

Supports recurring payments for subscriptions and invoicing.

-

Excellent for stores targeting global markets with local payment options.

5. Worldpay

Worldpay is a global payment platform that allows businesses a comprehensive suite of payment solutions to accept payments from customers worldwide. These solutions include credit/debit cards, local payments, and mobile wallets. Worldpay Magento 2 also provides strong fraud protection for secure international payments.

-

Merchants can accept payments in person, including contactless payments, EMV chip cards, and mobile wallets.

-

Offers point-of-sale (POS) solutions for brick-and-mortar businesses.

-

Multi-currency support and currency conversion tools.

-

Offers fraud protection and PCI DSS compliance for secure payments.

6. Authorize.Net

Authorize.Net is a popular payment gateway with comprehensive solutions. It supports credit cards, e-check payments, and recurring billing. Authorize.Net provides fraud prevention and chargeback management tools for secure transactions.

-

Supports credit card and e-check payments globally.

-

Provides advanced fraud detection suite (AFDS) and chargeback management tools.

-

Offers mobile payment solutions. It allows businesses to process payments via mobile devices using its Mobile POS app.

-

Flexible integration options for Magento 2.

Tabular Comparison Of Top Payment Gateways For Magento For Cross-Border Transactions

| Feature | PayPal | Stripe | Braintree | Amazon Pay | Worldpay | Authorize.Net |

|---|---|---|---|---|---|---|

| Supported Countries | 200+ countries | 40+ countries | 45+ countries | 20+ countries | 40+ countries | 30+ countries |

| Supported Currencies | 25+ currencies (USD, EUR, GBP, AUD, etc.) | 135+ currencies | 130+ currencies | 20+ currencies (USD, EUR, GBP, etc.) | 100+ currencies | 30+ currencies (USD, EUR, GBP, etc.) |

| Payment Methods | Credit cards, Debit cards, PayPal balance | Credit cards, Debit cards, Digital wallets (Apple Pay, Google Pay) | Credit cards, Debit cards, PayPal, Venmo, SEPA | Amazon account payments (credit/debit cards, bank transfer) | Credit cards, Debit cards, Digital wallets, Local methods | Credit cards, Debit cards, e-checks, Recurring payments |

| Transaction Fees | 2.9% + $0.30 (domestic); 4.4% + fixed fee (international) | 2.9% + 30¢ per transaction (domestic); 3.9% + 30¢ (international) | 2.9% + $0.30 (domestic); 3.9% + $0.30 (international) | 2.9% + $0.30 (domestic); varies in every country or region for international transactions | 2.75% per transaction (US); 3.5% (international) | 2.9% + $0.30 (domestic); 3.5% for international transactions |

| Monthly Fees | No monthly fees | No monthly fees | No monthly fees | No monthly fees | Monthly fees apply based on the plan | $25 monthly fee (Pro version) |

| Setup Fees | None | None | None | None | None | $49 Setup fee (for Advanced Integration) |

| Security | PCI DSS Level 1 compliance, fraud detection tools | PCI DSS Level 1, encryption, 3D Secure | PCI DSS Level 1, fraud prevention tools | PCI DSS Level 1, Amazon security infrastructure | PCI DSS Level 1, fraud protection tools | PCI DSS Level 1, fraud prevention, tokenization |

| Fraud Protection | Advanced fraud detection (transaction monitoring) | Radar for fraud prevention (machine learning) | Advanced fraud protection tools, 3D Secure | Fraud detection with Amazon's security system | Strong fraud protection tools, 3D Secure | Advanced fraud prevention, chargeback protection |

| Recurring Payments | Yes, through PayPal Billing Agreements | Yes, via Subscription API | Yes, supports subscriptions | No built-in recurring payments | Yes, supports recurring billing | Yes, via Automated Recurring Billing (ARB) |

| Chargeback Management | Yes, via the PayPal Resolution Center | Yes, via Stripe's Chargeback Protection | Yes, via Chargeback Management | No (Amazon handles disputes) | Yes, via Chargeback Management | Yes, via Chargeback Management |

| Mobile Payments | Yes, via the PayPal app and mobile-responsive checkout | Yes, via Stripe Elements (mobile-optimized) | Yes, via mobile SDK for Android/iOS | Yes, via Amazon Pay mobile integration | Yes, via mobile checkout, mobile wallet support | Yes, via mobile-optimized checkout |

| Integration | Easy integration with plugins and APIs | Easy integration via Stripe API and SDKs | Easy integration with Magento, also offers SDKs | Easy integration with Amazon Pay API | Magento extension, API, and SDK | Simple integration via API and Magento extension |

| Refunds | Easy to process within the Admin Panel | Easily processed through Stripe Dashboard | Easy to process within the Admin Panel | Managed through Amazon interface | Processed through Worldpay Admin Panel | Processed via Admin Panel |

| Customer Support | 24/7 via phone, chat, email | 24/7 via phone, chat, email | 24/7 support via email, phone, chat | 24/7 support via phone, email | 24/7 support via phone, email, chat | 24/7 support via phone, email, chat |

| Currencies Conversion | Automatic conversion for international payments | Automatic conversion for multi-currency support | Supports automatic conversion for multi-currency | Automatic currency conversion based on the buyer's Amazon account | Multi-currency support with conversion | Supports multiple currencies with auto-conversion |

| Local Payment Methods | Yes, for specific regions (e.g., SEPA, iDEAL) | Yes, supports Alipay, Klarna, SEPA, Giropay, etc. | Yes, supports local methods like SEPA, Alipay | Limited to Amazon's supported methods | Yes, supports local methods (e.g., SEPA, Giropay) | Yes, supports local methods like SEPA, e-checks |

| Custom Payment Flow | Standard checkout flow | Customizable checkout flow via API and SDK | Customizable checkout flow | Standard Amazon checkout flow | Customizable checkout flow, API available | Customizable checkout flow via API and SDK |

| Multilingual Support | Available in multiple languages | Available in multiple languages | Available in multiple languages | Available in multiple languages | Available in multiple languages | Available in multiple languages |

How Does Magento 2 Handle Payment Methods For Cross-Border Transactions?

1. Automatic Tax Calculations and Compliance

Magento 2 can automatically calculate taxes based on the customer's shipping address and the set tax rules. The platform allows stores to set up tax rates specific to each region or country.

2. Multi-currency handling and Exchange Rates

Magento 2 supports multi-currency transactions. It allows you to set up different currencies for your store. Exchange rates are updated regularly, either manually or automatically, for real-time values. It ensures prices match customers' correct conversion rates.

3. Localized Payment Options

Magento 2 provides the ability to configure payment methods specific to regions. Customers in Europe may prefer SEPA or Giropay. North American customers may use PayPal or credit cards. Magento integrates payment gateways that support local payment methods. It ensures a localized shopping experience for international buyers.

4. Customizable Payment Method Restrictions

Magento 2 allows store owners to restrict payment methods based on the shipping address. It also helps merchants limit payment options due to regional regulations or availability.

5. Transaction Fee Management

Magento 2 handles transaction fees for cross-border payments based on location and gateway. Payment processors often charge these fees for international transactions. They can be added to the total order amount or displayed separately during checkout.

6. Security Compliance (PCI DSS)

Magento 2 ensures that all payments are PCI DSS compliant for security. It protects credit card information and sensitive payment data during transactions.

How To Integrate Magento 2 Payment Gateway With Magento Store?

1. Choose a Payment Gateway

Select a payment gateway you want to integrate (e.g., PayPal, Stripe, etc.). Make sure it supports the countries and shipping methods relevant to your business.

2. Install the Payment Gateway Plugin

-

Go to the Magento Marketplace and find the payment gateway extension that you want to install.

-

Download and install the extension. You can do this either using Composer (a command-line interface) or manually uploading it via the Magento Admin Panel.

-

Via Composer

composer require vendor/extension-package php bin/magento setup:upgrade php bin/magento setup:di:compile php bin/magento cache:flush

-

Via Admin Panel

-

Go to the Magento Admin Panel.

-

Navigate to System > Web Setup Wizard > Extension Manager.

-

Search for the payment gateway plugin you want to install and click "Install."

-

3. Configure the Payment Gateway

-

After installation, go to Stores > Configuration > Sales > Payment Methods.

-

Find the newly installed payment gateway and click "Configure."

-

Enter required information such as API keys, merchant ID, payment action, or other credentials provided by the payment provider.

4. Set Up Payment Methods

-

Configure payment options and set up regions or customer groups.

-

Enable or disable specific payment methods based on customer preferences or geographical location.

5. Test the Third-party Payment Gateway

-

Set the gateway to Test Mode (most gateways offer a sandbox or test mode).

-

Perform a test transaction on your store's front end to verify the integration.

-

Check if transactions are correctly logged and the appropriate order statuses are updated.

-

Ensure the payment gateway processes payments correctly and follows PCI DSS standards.

6. Switch to Live Mode

Once testing is successful, switch the gateway to Live Mode:

-

Go back to Stores > Configuration > Sales > Payment Methods.

-

Change the payment gateway mode to Live and save your configuration.

7. Activate the Payment Gateway

- Once you're satisfied with the configuration, enable the payment gateway in the Admin Panel.

8. Monitor and Troubleshoot

After the integration is complete, monitor the transactions and troubleshoot any issues. Common problems include payment errors, incorrect configurations, or failed transactions.

How To Restrict Magento 2 Payment Methods By Customer Groups?

Step 1: Configuration

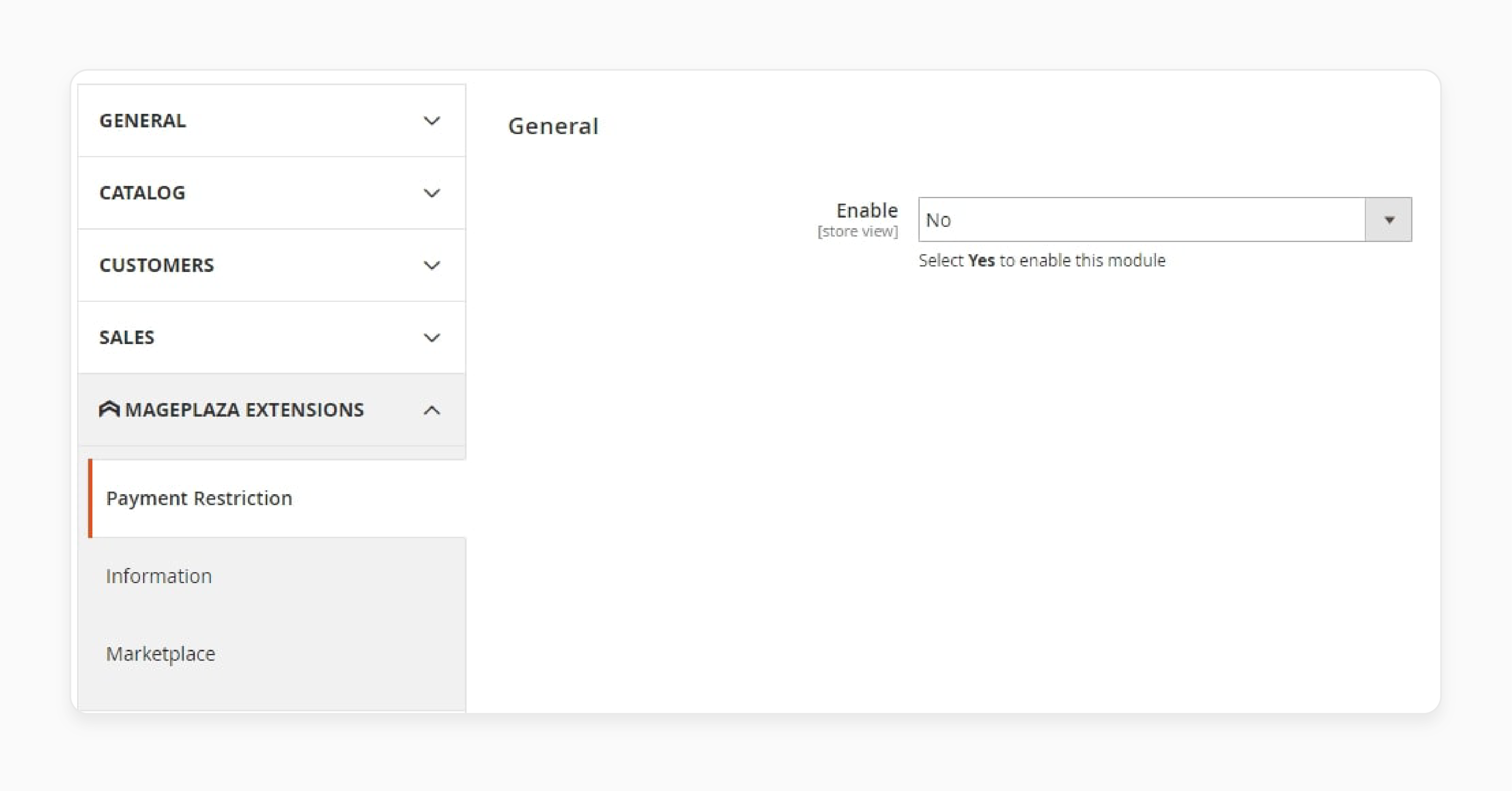

In the Admin Panel, go to Sales > Payment Restriction > Configuration > General Configuration > Yes.

Step 2: Managing Rules

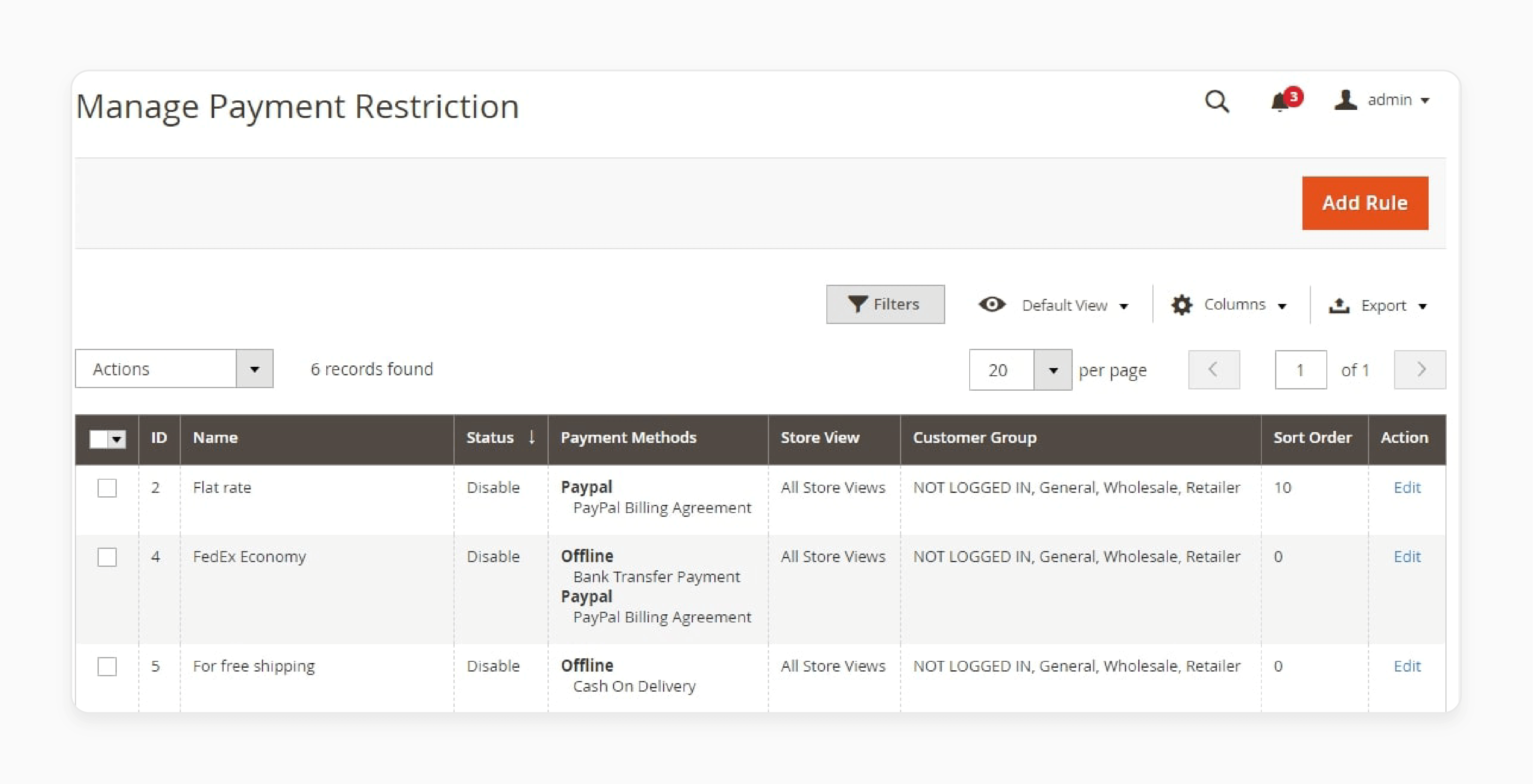

Navigate to Sales > Payment Restriction > Manage Rules in the Admin Panel. Here, you'll see all the rules created. It will display basic details such as Name, Method, Status, Customer Groups, and Store View.

The store admin has several options to manage these rules:

-

Delete: Remove the selected rule.

-

Change Status: Select a rule and update its status to Running to activate it.

-

Edit: Modify the rule's details as needed.

Admins can do the following:

-

Filter rules;

-

Adjust store views;

-

Hide or display the grid;

-

Add new rules by clicking the Add Rule button.

Step 3: Restrict Payment Methods by Customer Groups

In the Admin Panel, go to Sales > Payment Restriction > Configuration and click the Add New button. Then, configure the rule by entering the following:

-

Name: Choose a name for the rule.

-

Description: Write a description of the rule.

-

Status: Set it to Enable for the rule to be applied.

-

Store Views: Select store views where the rule will apply.

-

Customer Groups: Choose one or more customer groups that will use this rule.

-

From and To: Set start and end dates for rule application.

-

Select Days: Choose the days of the week when the rule is active.

-

Time from: Set the time when the rule starts.

-

Time to: Set the time when the rule ends.

-

Priority: Assign a priority to the rule (lower number = higher priority).

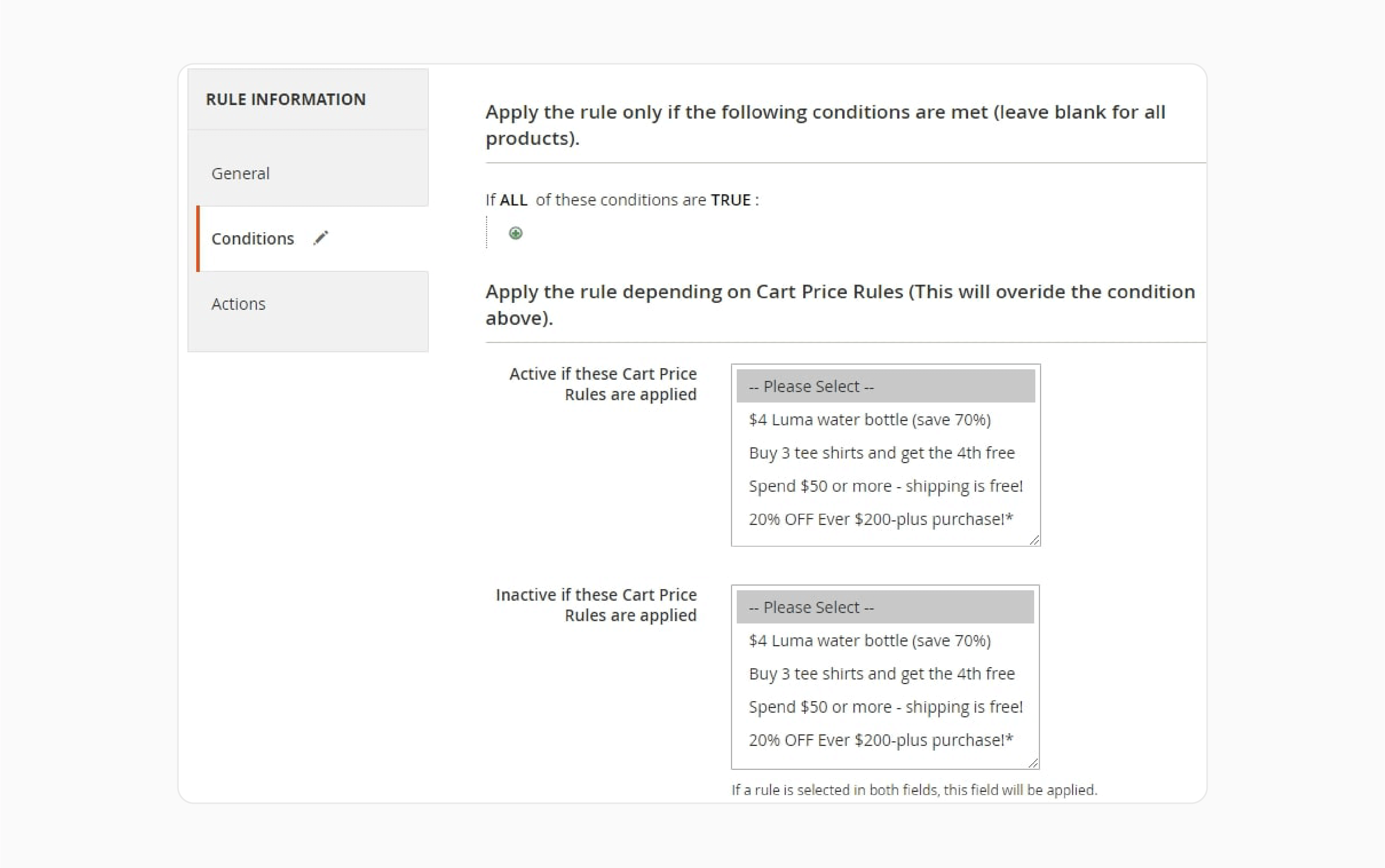

Step 4: Conditions

Set conditions for when the rule should apply. You can also link the rule to the Cart Price Rules. These conditions determine which items or scenarios the rule applies to, such as when discounts or promotions are used.

-

Active if these Cart Price Rules are applied: Select rules to enable the payment method restriction when those conditions are met.

-

Inactive if these Cart Price Rules are applied: Select rules to prevent the payment method restriction from being used.

You can apply multiple rules simultaneously. The Inactive if field will override the Active if field if both are selected.

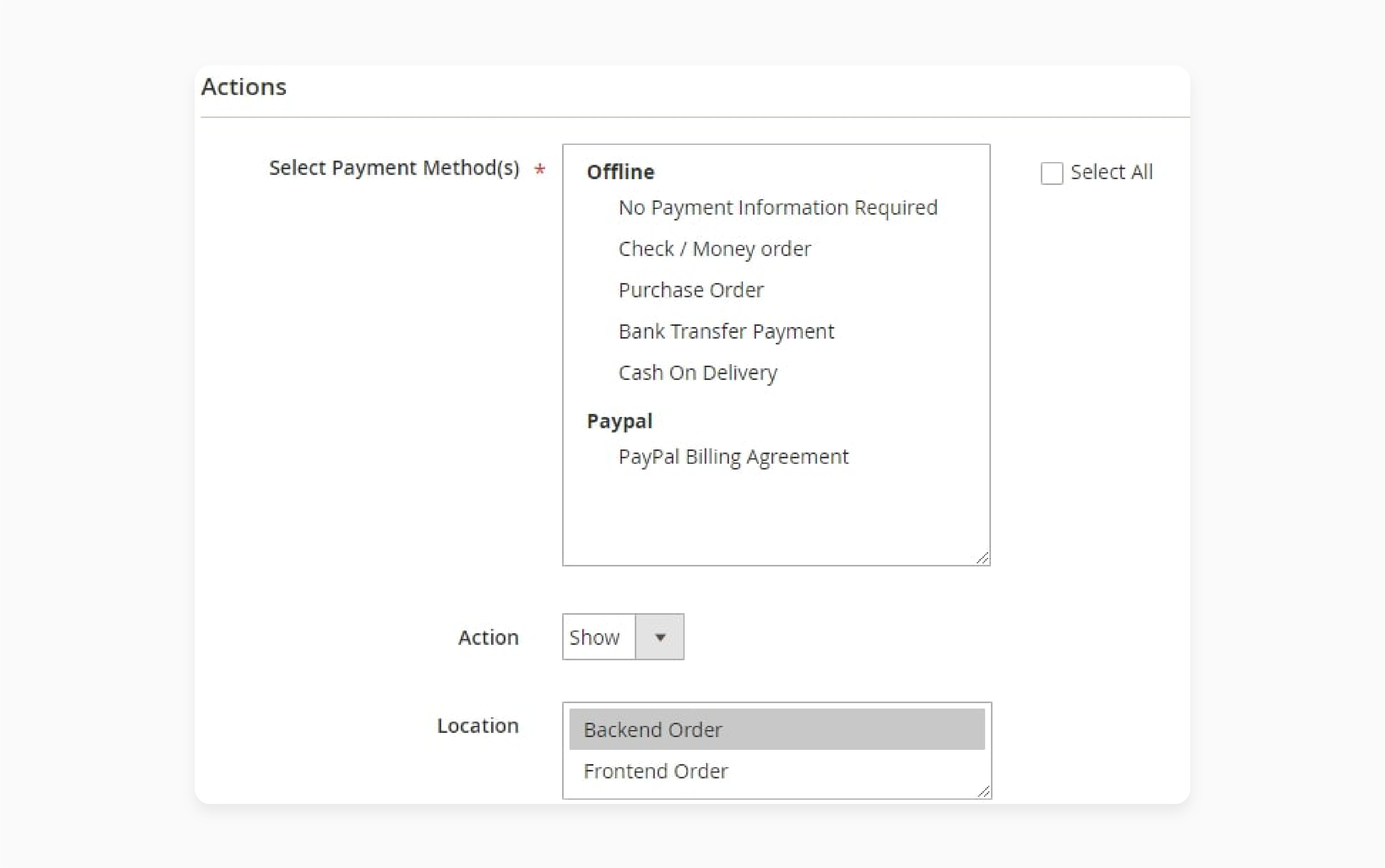

Step 5: Actions

In the Actions section, choose the payment methods to which the rule will apply. You can select one or all available payment methods.

-

Select Payment Methods: Choose the payment methods you want to restrict for specific customer groups or conditions.

-

Action: Select Show to display the chosen payment methods.

-

Apply for: Choose where to apply the rule — either for Frontend Order or Backend Order.

How To Restrict Payment Methods Based On Shipping Address In Magento 2?

-

Log in to your Magento Admin Panel.

-

In the Admin Panel, click on Stores in the left sidebar.

-

Under Settings, click on Configuration.

-

In the Configuration menu, scroll down to Sales.

-

Click on Payment Methods. Here, you will see a list of all available payment options.

-

Find the payment method you want to restrict (e.g., PayPal, Credit Card, etc.).

-

Look for the option: Magent 2 Payment Restrictions or Available for Shipping Address.

-

Set the conditions for the payment method. You can restrict it based on the shipping country, region, or even postal code.

-

Click the Save Config button at the top-right of the page to apply your changes.

Why Is Restricting Payment Methods Important In Magento 2?

1. Compliance with Regional Regulations

Payment gateways have location-specific rules. Some payment methods, like credit cards or PayPal, can only be used in certain places. Magento 2 shows the relevant payment methods based on the customer's shipping address. It helps the store follow local rules and avoid problems with payments.

2. Fraud Prevention

Some payment methods are more prone to fraud in certain countries. Local options in this situation are safer. Magento 2 protects stores from fraud by blocking risky methods. It also uses tools like address checks and security codes to ensure safe payments.

Many Magento 2 payment gateways have built-in fraud protection features, including address verification systems (AVS), card security code (CSC) checks, and IP geolocation-based fraud detection.

3. Enhanced Customer Experience

Customers prefer using familiar payment methods, and showing the wrong options can confuse them. For example, Europeans prefer SEPA, while Americans like PayPal or credit cards. Magento 2 displays the right payment options based on the shipping address, making it easier for customers to pay.

4. Optimizing Payment Processing

Different payment methods have varying fees, with international ones often being more expensive. Restricting specific methods can save money on fees. Local payment options usually cost less than international ones. The right Magento setup ensures smoother transactions and fewer delays.

5. Targeting Market Preferences

Payment preferences vary by region. In Brazil, Boleto Bancário is standard, while US customers prefer PayPal. Magento 2 lets you restrict shipping and payment methods for each region. It ensures your store offers a range of payment options. By integrating a payment gateway, you meet both local and international preferences.

FAQs

1. How can Magento payment gateway integration affect store performance?

Magento ecommerce payment gateway integration is important for your store's performance. A well-integrated gateway speeds up order processing, improves checkout times, and ensures a smooth payment page experience.

2. Can Magento handle payment gateway restrictions for specific regions?

Yes, Magento can handle payment gateway restrictions based on customer location. You can configure Magento to accept payment methods that are available in every country or set regional preferences.

3. What are magento payment gateway extensions?

Magento payment gateway extensions are plugins that expand your store's payment capabilities. They allow you to integrate various payment services into your store. Using a plugin for Magento ensures that the chosen payment gateway works smoothly with your system.

4. How do I choose the right payment gateway for my Magento store?

When choosing the right payment gateway for your online store, consider factors like payment methods, security, and fees. Make sure it supports your store's needs and region.

5. Can I restrict payment methods in Magento 2?

Yes, Magento 2 lets you restrict payment methods for specific customers or regions, ensuring you only offer the most relevant payment options.

6. How does payment gateway integration affect my order processing?

With payment gateway integration, your order processing becomes smoother. Payments are automatically processed when customers complete their checkout.

7. Where can I get help with Magento payment gateway issues?

You can find answers to your Magento payment gateway questions on Magento Stack Exchange. It's a great place to get help from experts and other users.

Summary

Magento International Payment Limit can impact how much you can charge for international orders.

-

Magento 2 restricts payment methods for international orders.

-

Payment gateways process payments using methods like currency conversion and fraud protection.

-

Select a top Magento payment gateway that accepts international payments.

-

Magento lets you offer many payment methods, with options depending on the country.

-

Using Magento 2, you can integrate one of many payment types for global sales.

Explore our managed Magento Hosting services for smooth payment processing for your Magento store.