Magento 2 US Tax Configuration: 8 Steps to Configure Magento 2 Tax

Want to avoid fines and legal issues for your e-stores in the US? Properly configuring your Magento 2 US tax settings is important. It helps maintain your reputation and avoids potential problems. This article covers the steps to configure Magento 2 US tax. It also discusses the importance of staying compliant.

Key takeaways

-

Learn to configure Magento 2 tax settings in US.

-

Understand the importance of US tax law compliance.

-

Discover best practices for financial record-keeping and tax processes.

-

Explore the consequences of non-compliance and the benefits of proper tax configuration.

-

Gain insights on contributing to the US economy through tax compliance.

Importance of Staying Compliant to US Tax Laws

| Reasons | Explanations |

|---|---|

| Avoid Penalties and Fines | Failing to comply with US tax laws can result in significant penalties and fines. The IRS imposes steep fines for late or inaccurate filings, as well as interest on unpaid taxes. Staying compliant helps your business avoid these costly consequences and maintain financial stability. |

| Protect Your Business Reputation | Compliance with tax laws can protect your business's reputation. If customers, partners, or investors discover that your company has violated tax regulations, it can erode trust and credibility. Maintaining compliance demonstrates your commitment to ethical practices and enhances your professional image. |

| Prevent Legal Consequences | Serious tax violations can lead to criminal charges and legal action. Tax evasion and fraud are felony offenses that can result in jail time and substantial fines. By staying compliant, you protect yourself and your business from legal repercussions that could jeopardize your future. |

| Ensure Accurate Financial Reporting | Complying with tax laws helps ensure that your financial reporting is accurate and transparent. This is crucial for making informed business decisions, securing funding, and maintaining investor confidence. Accurate financial reporting also simplifies the auditing process and reduces the risk of discrepancies. |

| Contribute to the Economy | Paying your fair share of taxes contributes to the overall functioning and growth of the US economy. Tax revenue funds essential public services, infrastructure projects, and social programs. By staying compliant, your business supports the economic well-being of the country and demonstrates good corporate citizenship. |

Steps to Configure US Tax in Magento 2

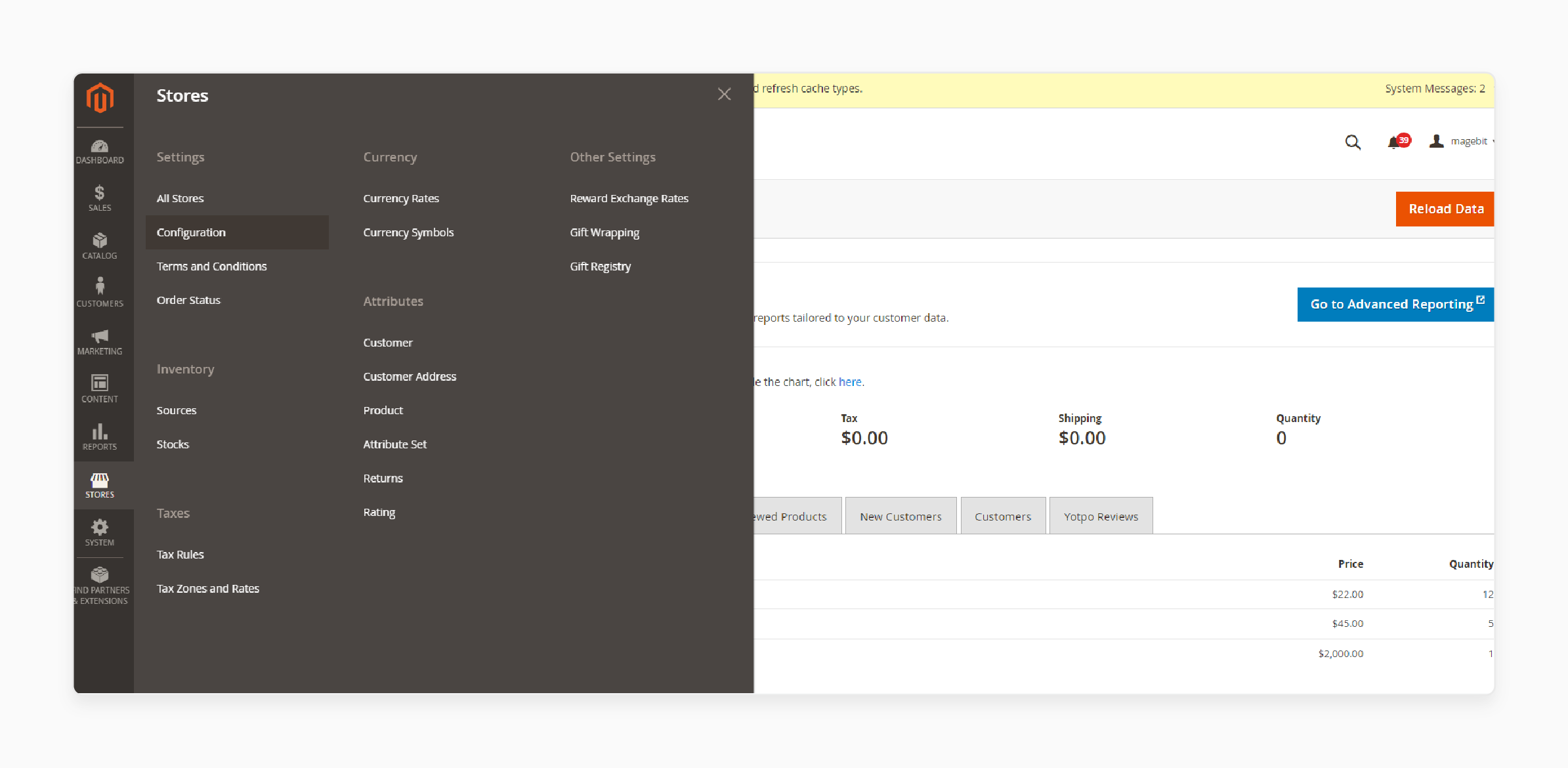

1. Navigate to tax configuration

In the Admin Panel, go to Stores > Settings > Configuration. Select Tax under the Sales section on the left panel.

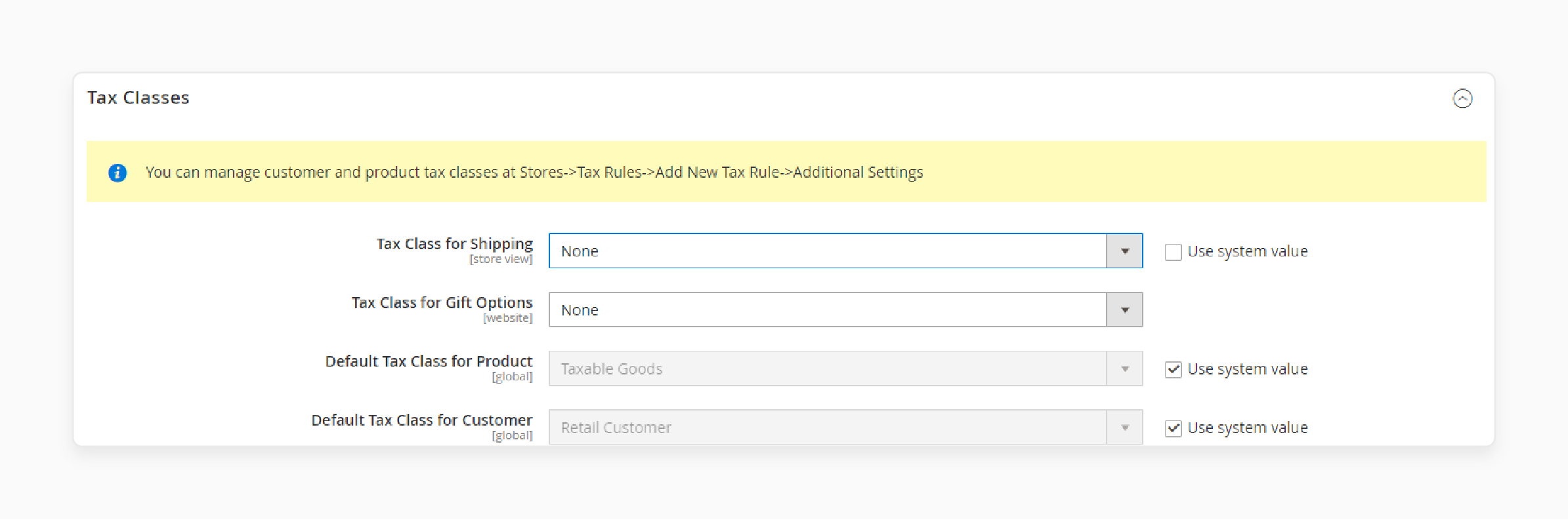

2. Set tax class for shipping

Expand the Tax Classes section. Set Tax Class for Shipping to "None."

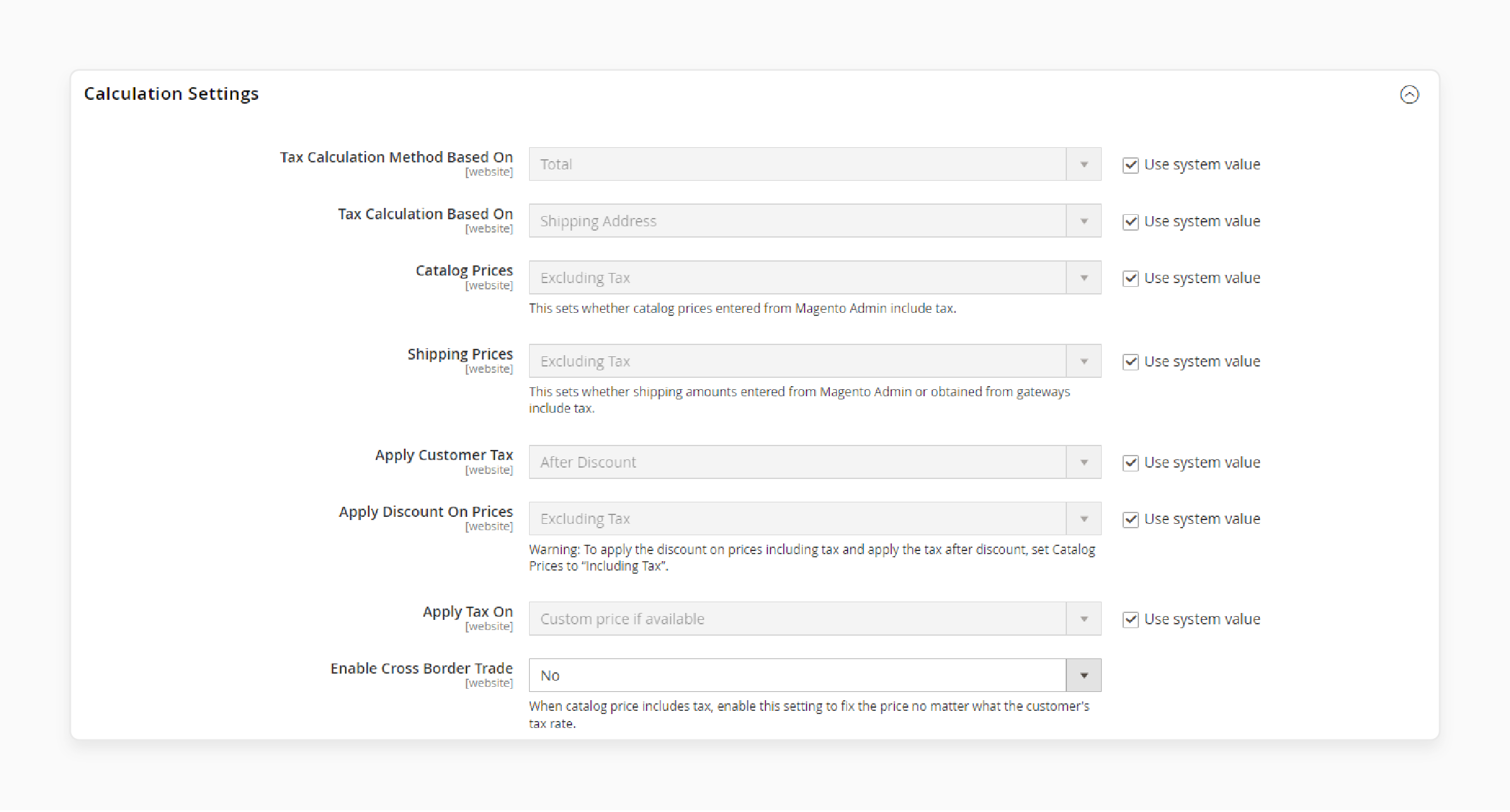

3. Configure tax calculation settings

In the Calculation Settings section:

-

Set the tax calculation method based on the "Total."

-

Choose Shipping Origin for Tax Calculation Based On.

-

Select Excluding Tax for Catalog Prices and Shipping Prices.

-

Set Apply Customer Tax to "After Discount."

-

Choose Excluding Tax to Apply Discount on Prices.

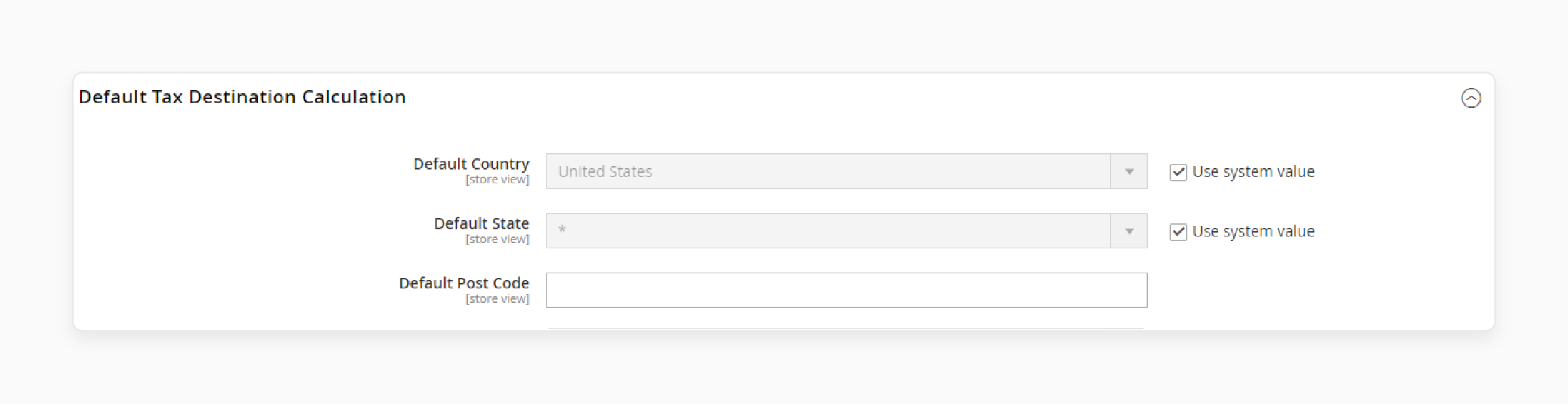

4. Set default tax destination

In the Default Tax Destination Calculation section:

-

Set Default Country to "United States."

-

Choose the state where your business is located for Default State.

-

Enter the corresponding ZIP code range for the Default Post Code.

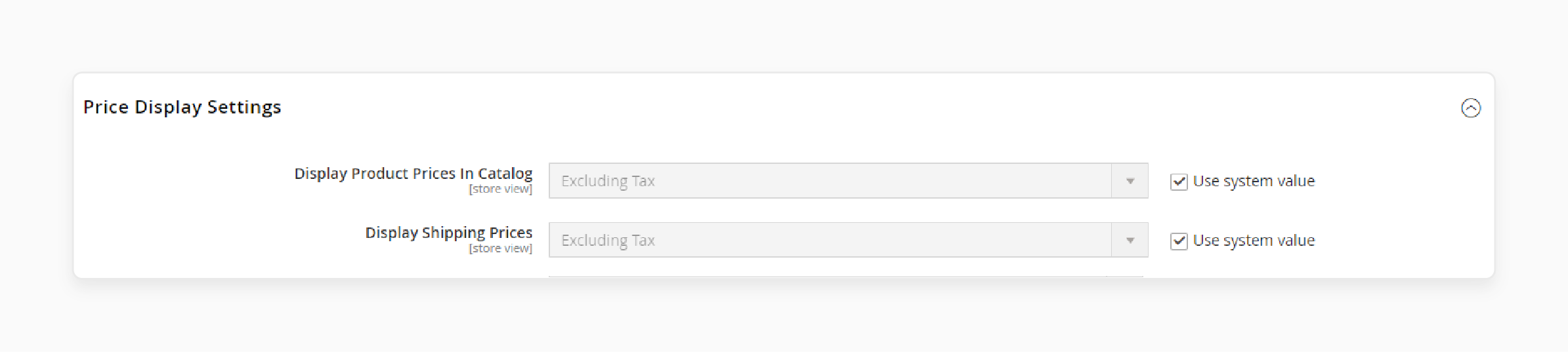

5. Configure price display settings

In the Price Display Settings section, select Excluding Tax for both Display Product Prices in Catalog and Display Shipping Prices.

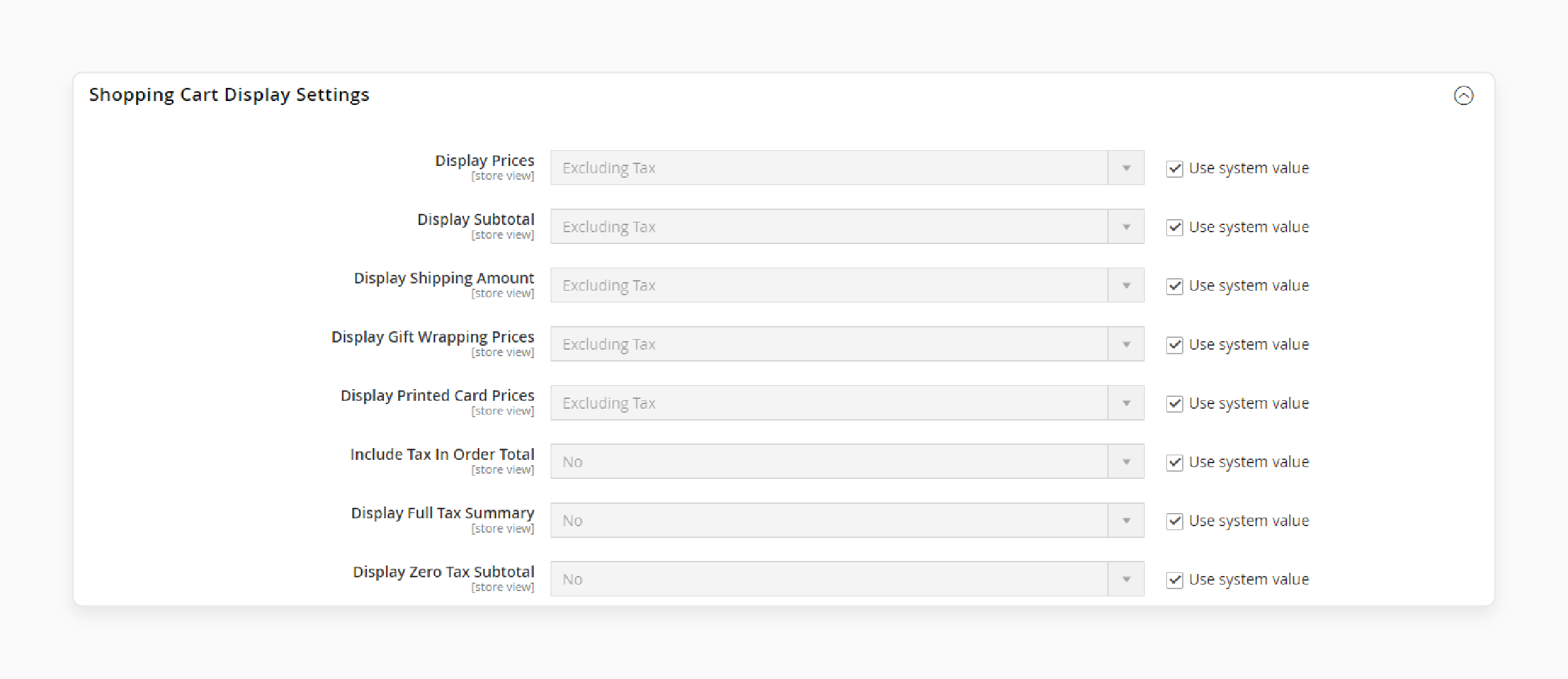

6. Set shopping cart display settings

Expand the Shopping Cart Display Settings section:

-

Choose Excluding Tax for Prices, Subtotal, Shipping Amount, Gift Wrapping Prices, and Printed Card Prices.

-

Set Include Tax in Grand Total, Display Full Tax Summary, and Display Zero Tax Subtotal to "Yes."

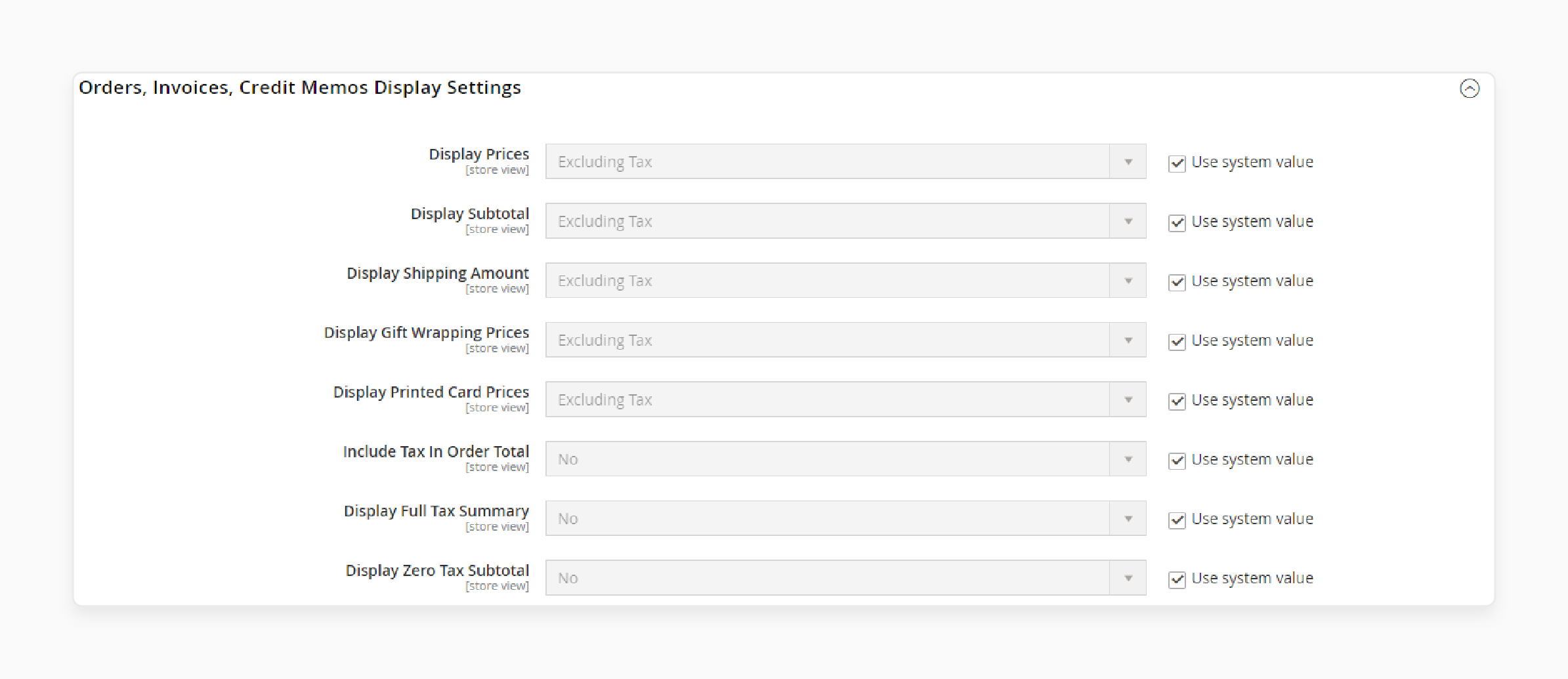

7. Configure order invoiceand credit memo display settings

In the Orders, Invoices, Credit Memos Display Settings section:

-

Select Excluding Tax for Prices, Subtotal, and Shipping Amount.

-

Set Include Tax in Grand Total, Display Full Tax Summary, and Display Zero Tax Subtotal to "Yes."

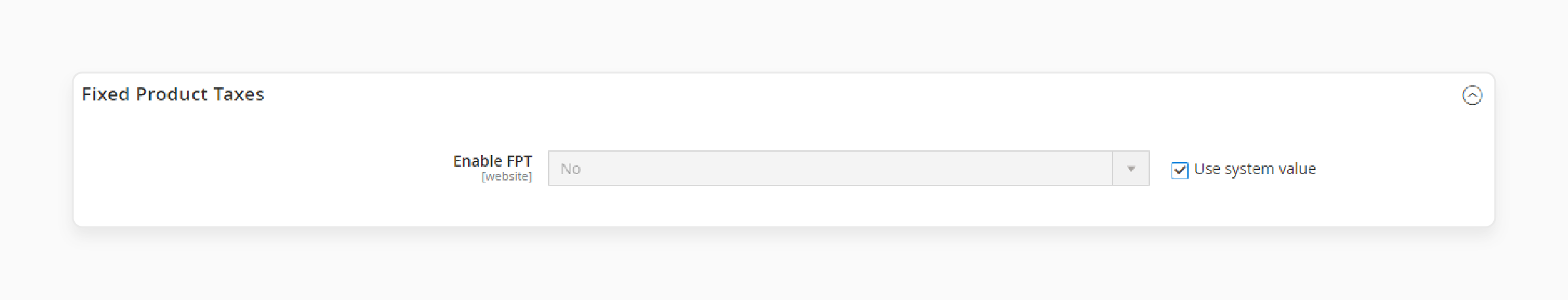

8. Disable fixed product taxes

In the Fixed Product Taxes section, set Enable FPT to "No" to approve US tax.

Best Practices for Adhering to US Magento 2 Tax Rule

| Best Practices | Explanations |

|---|---|

| Stay informed about tax law updates | Regularly monitor changes in US tax laws and regulations. Subscribe to IRS newsletters, attend webinars, and consult with tax professionals to stay current. Adapt your business practices to ensure ongoing compliance with the latest requirements. Failing to stay informed can lead to unintentional non-compliance and potential penalties. |

| Maintain accurate financial records | Keep detailed and organized financial records, including income, expenses, and deductions. Use accounting software to streamline record-keeping and ensure accuracy. Retain records for the required period, typically 3-7 years, to support your tax filings. Accurate records are essential for preparing tax returns, responding to audits, and making informed business decisions. |

| Classify workers correctly | Understand the difference between employees and independent contractors. Correctly classify workers to ensure compliance with payroll taxes, benefits, and labor laws. Misclassifying workers can result in significant fines and legal issues. Regularly review worker classifications and maintain documentation to support your decisions. |

| File and pay taxes on time | Know the deadlines for filing and paying various federal, state, and local taxes. Set reminders and establish internal processes to ensure timely compliance. Use electronic filing and payment methods to streamline the process and avoid delays. Late filings and payments can result in penalties, interest charges, and increased scrutiny from tax authorities. |

| Seek professional assistance | Consult with tax professionals, such as CPAs or tax attorneys, to ensure compliance. Leverage their expertise for complex tax situations, strategic planning, and representation during audits. Establish a relationship with a trusted tax advisor who understands your business and industry. Professional guidance can help you navigate tax laws, minimize liabilities, and make informed decisions. |

FAQs

1. How do I add a new tax rate in a Magento 2 store?

To add a tax rate, navigate to Stores > Taxes > Tax Zones and Rates. Click on Add New Tax Rate. Fill in the necessary details like tax rate, tax zone, and rate, and save.

2. What is the process to set up a customer tax class in Magento?

In your Magento store, go to Stores > Taxes > Tax Rules. Select Add New Tax Rule and choose the appropriate customer sales tax class. Dedicated Magento hosting ensures that different types of customers are taxed correctly.

3. How do I configure product tax classes for different products?

For Magento 2 tax configuration, go to Stores > Taxes > Tax Rules. Click on Add New Tax Rule and select the product tax class. It helps in assigning different tax rates to various products in your Magento 2 store.

4. How do I calculate the tax based on the shipping address?

In the tax settings, navigate to Stores > Configuration > Sales > Tax. Set Tax Calculation Based On Shipping Address. It allows Magento 2 to calculate the tax according to the customer's shipping location.

5. What are the steps to configure Magento 2 tax rules for different regions?

Go to Stores > Taxes > Tax Rules and click on Add New Tax Rule. Select the tax zone and rate, customer tax class, and product tax class. It ensures you apply the correct tax rules in Magento for various regions.

Summary

Configuring Magento 2 US tax is important for running a compliant store. Here are the key advantages:

-

Avoid penalties and legal issues: Ensure your store complies with tax laws to prevent fines and legal problems.

-

Maintain accurate financial records: Keep precise financial records for better financial management.

-

Protect your business's reputation: Compliance helps in maintaining trust and credibility with customers.

-

Contribute to the US economy: Paying taxes supports national economic development.

-

Streamline tax processes: Simplify and automate tax calculations to save time and reduce errors.

Consider managed Magento hosting to keep your store updated for US tax laws.