How to Set Up the Magento 2 Skrill Payments Extension?

Is your store missing a smooth payment processing system? The Magento 2 Skrill extension is a world-leading payment gateway in 200 countries.

In this tutorial, we explain the configuration and the benefits of the Skrill module.

Key Takeaways

- Skrill offers a secure payment solution across 200 countries.

- Merchants gain robust protection with advanced anti-fraud technologies.

- The extension provides smooth integration with Magento 2 stores.

- Many payment methods support global and local transactions.

- Transparent pricing structure with competitive transaction fee rates.

What is Magento Skrill Payment Gateway Integration?

The Skrill Payment Gateway is a digital payment solution. It enables merchants to accept various payment methods. It uses a secure hosted payment form.

It allows to process payments via credit cards, debit cards, and wallets across 80 banks. It also supports bank transfers through Rapid Transfer and Manual Bank Transfer systems. The system can be set up. It allows merchants to begin accepting payments within hours of installation.

The integration requires only four essential credentials:

- Merchant ID

- Merchant Account email

- Secret word

- API Password.

It provides a secure hosted payment form that removes PCI compliance from merchants.

Benefits of Magento 2 Skrill Extension Integration

| Benefit Category | Features |

|---|---|

| Payment Options | - Credit/debit card processing - 100+ local payment solutions - Integration with 80+ global banks |

| Setup & Integration | - Free and quick setup - Single integration process - Instant payment activation |

| Security | - PCI DSS Merchant Level 1 compliance - Secure hosted payment form - Advanced anti-fraud technology |

| Currency Management | - Support for 40+ currencies - Multicurrency account access - Instant settlement capabilities |

| User Experience | - Mobile-responsive design - No sign-up for customers - Seamless checkout process |

| Administrative Features | - Enhanced reporting tools - Transaction status monitoring - Built-in Magento refund order management |

Security Features of Skrill Payment Module for Magento 2

1. Security Compliance

- Skrill maintains the highest level of PCI DSS compliance. It is through its Merchant Level 1 QSA certification. It ensures that all payment processing adheres to strict international security standards. The payment gateway uses a complete redirect system. It transfers customers to Skrill's secure environment for transaction processing.

- The API/MQI password adds an extra layer of security for merchant accounts. Every transaction undergoes IP address verification to prevent unauthorized access.

- Communications between stores and servers need TLS 1.1 or later encryption protocols. The system mandates valid security certificates for all connections.

2. Anti Fraud Capabilities

- Skrill integrates Fraud Detection Suite technology to provide an extra layer of security. FDS examines many data points during each transaction. It includes IP address, geographical location, and device fingerprinting.

- The Transaction Monitoring System (TMS) tracks payment flows and flags unusual activities. TMS uses machine learning algorithms to establish standard transaction patterns for each merchant. Any deviation from these patterns triggers immediate alerts for investigation.

- Velocity-checking tools check the frequency and volume of transactions from individual accounts. This feature helps prevent rapid-fire fraud attempts and identifies card testing activities.

- Skrill's fraud prevention system includes a chargeback management tool. This tool helps merchants track and respond to chargebacks.

3. Authentication Measures

- Skrill uses a complex API authentication system through MQI (Merchant Query Interface) passwords. These passwords enable secure communication between the Magento store and Skrill's payment servers. The API authentication process validates each request using many security checkpoints.

- Skrill maintains a whitelist of authorized IP addresses for each merchant account. Only requests originating from these approved IP addresses can process transactions. The system blocks any transaction attempts from unauthorized IP addresses.

- Every transaction undergoes a multi-step validation process. The system verifies the merchant ID, secret word, and IP address. This triple-verification approach ensures most security for payment processing. Failed authentication attempts to trigger alerts to the merchant and security team.

- Skrill provides secure tools for managing authentication credentials. Merchants can update their secret words and API passwords through a safe interface. The system enforces strong password policies to maintain security standards. Automated tools support regular credential rotation.

Skrill Payments vs. SagePay: Features Comparison

| Feature | Skrill | SagePay |

|---|---|---|

| Primary Focus | Digital wallet and online payments | Payment gateway for various transaction types |

| Payment Methods Supported | Credit/Debit cards, over 100 local methods | Credit/Debit cards, PayPal, digital wallets, local methods |

| Transaction Fees | 1.9% + £0.29 for cards; 1% + £0.29 for bank transfers | 1.99% for cards; varies by payment type |

| Multi-Currency Support | Yes, supports 40+ currencies | Yes, supports over 25 currencies |

| Security Features | PCI DSS compliance, anti-fraud technology | PCI DSS compliance, fraud prevention tools |

| Integration with Magento | Integrated with Magento 2 | Smooth integration with Magento 2 |

| Customer Experience | No sign-up for payments | Customizable payment pages for branding |

| Settlement Speed | Instant settlement | Varies by transaction type |

| Support Options | 24/7 customer support | Phone and online support |

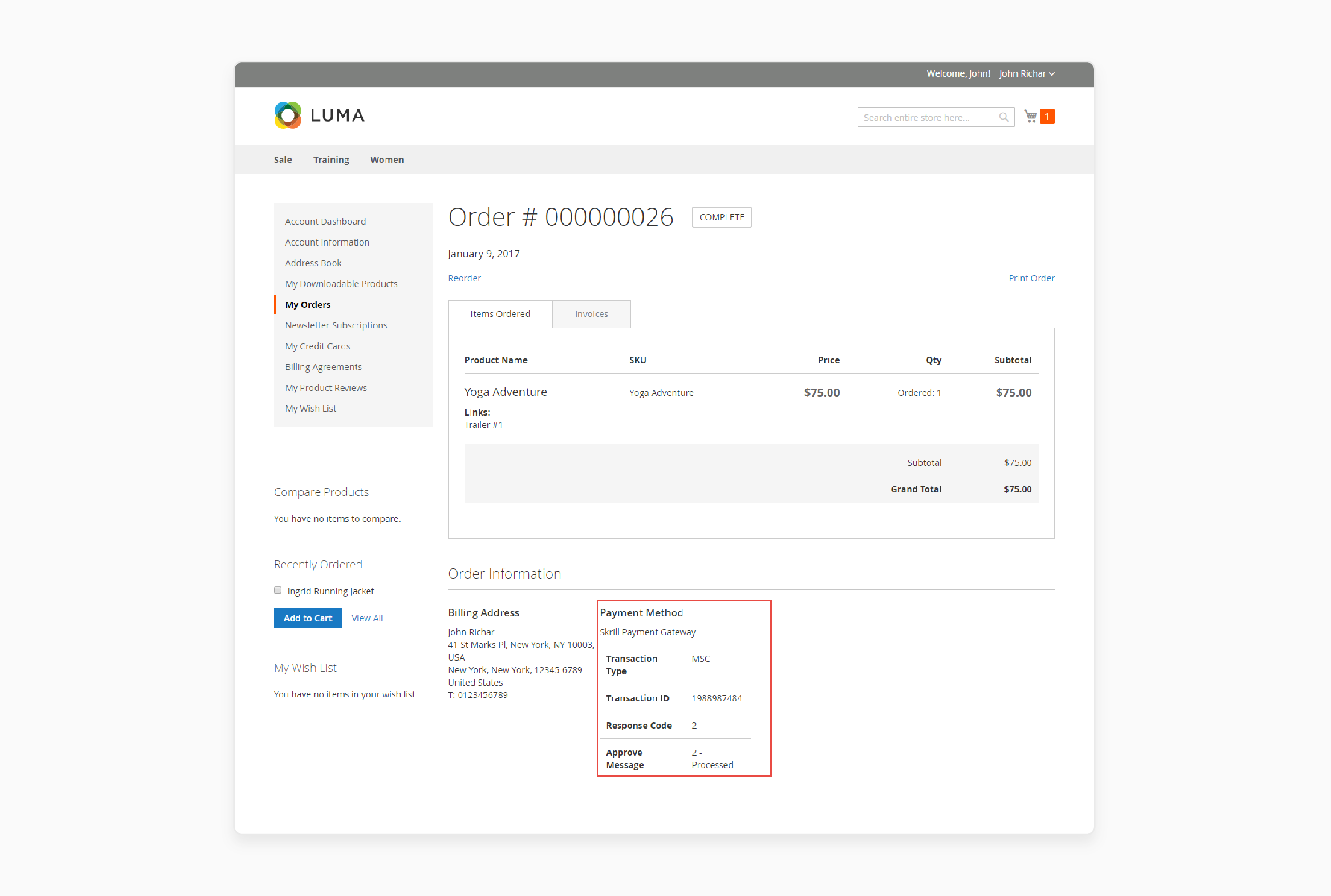

Steps to Configure the Magento 2 Skrill Extension

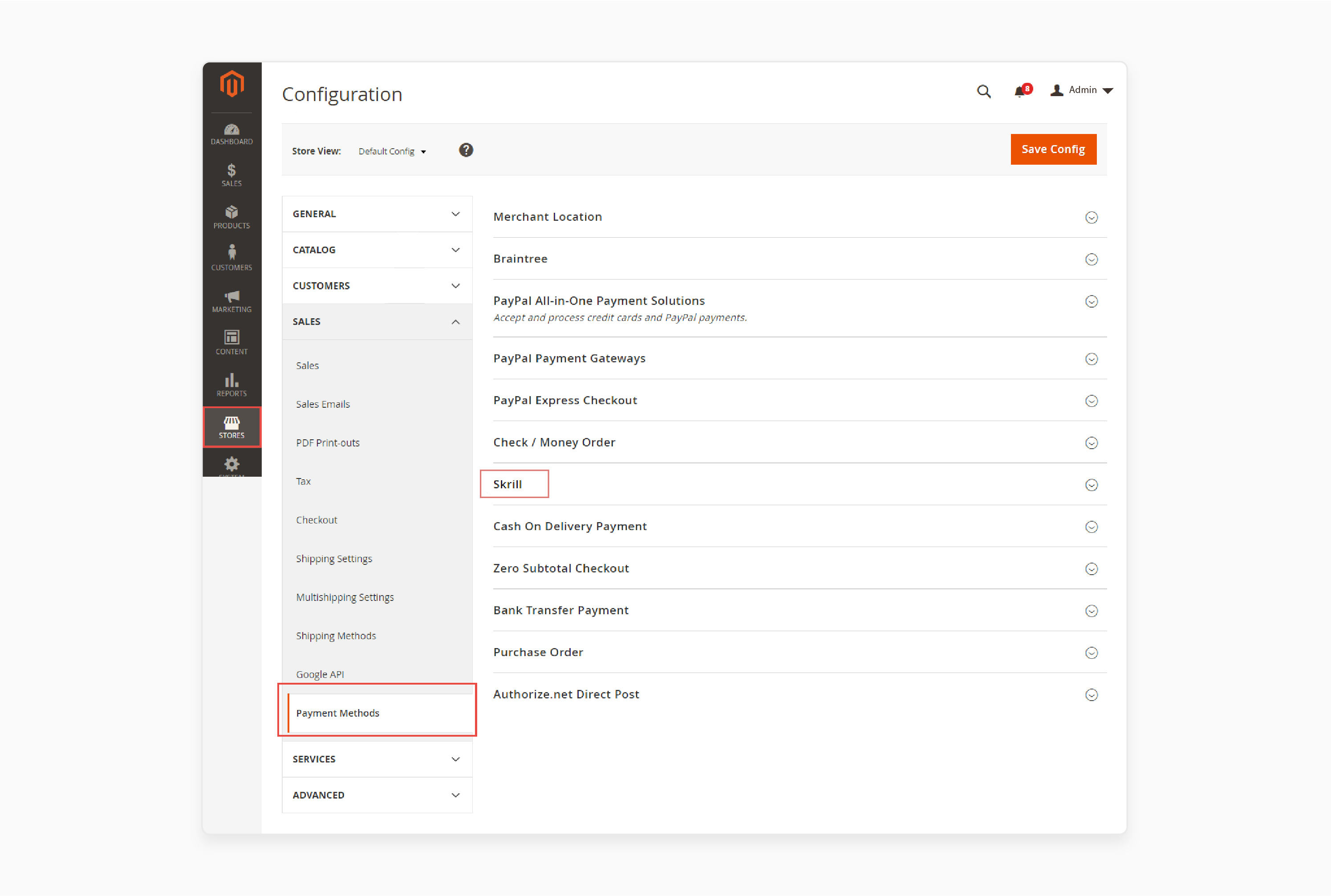

-

Log in to the Magento Admin panel after installing the extension.

-

Navigate to Stores > Configuration > Payment Methods > Skrill.

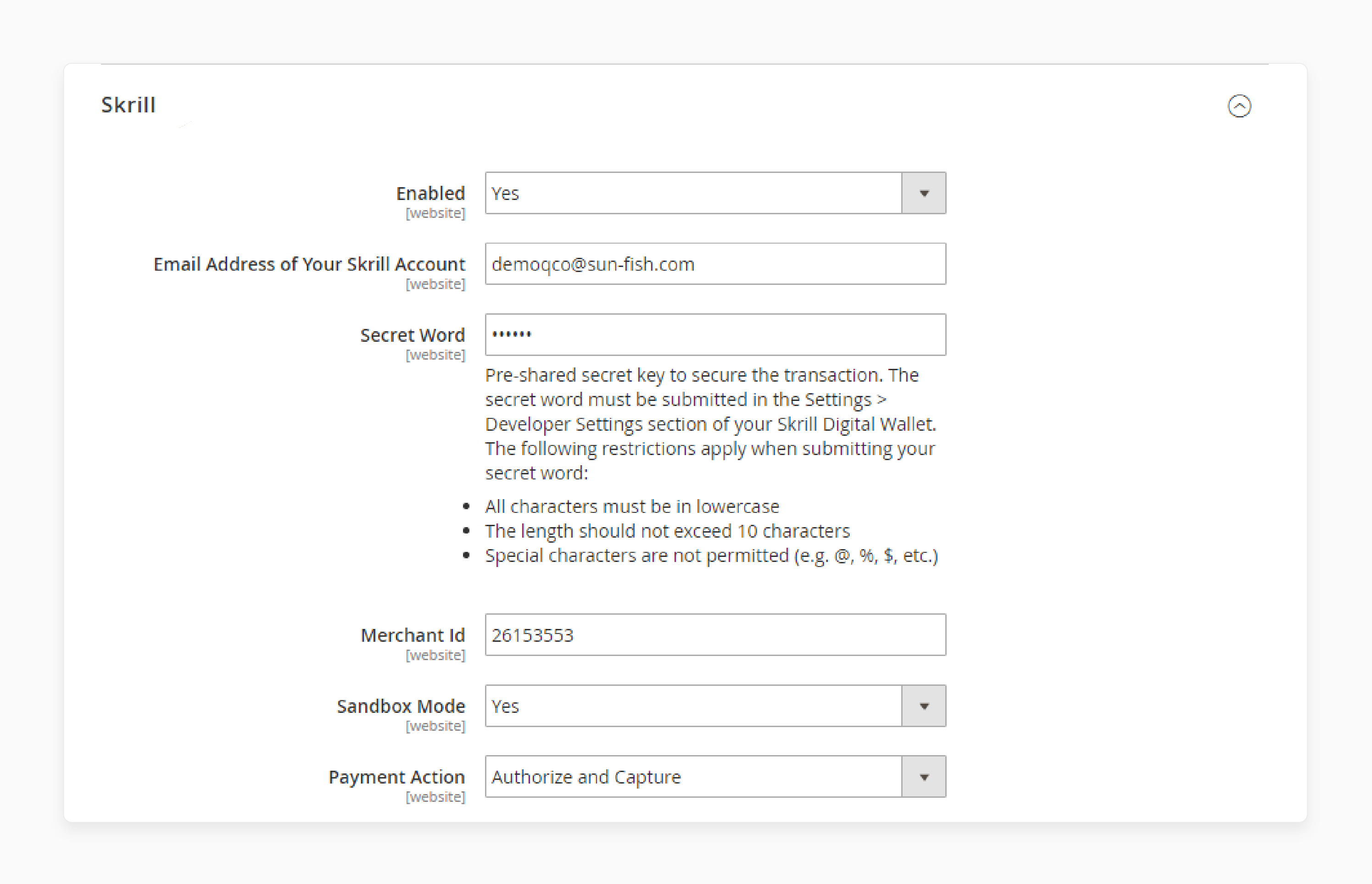

-

Enable the extension and enter your Skrill account email address.

-

Enter the Secret Word and Merchant ID from your Skrill dashboard.

-

Enable Sandbox mode and choose Allow and Capture as Payment Action.

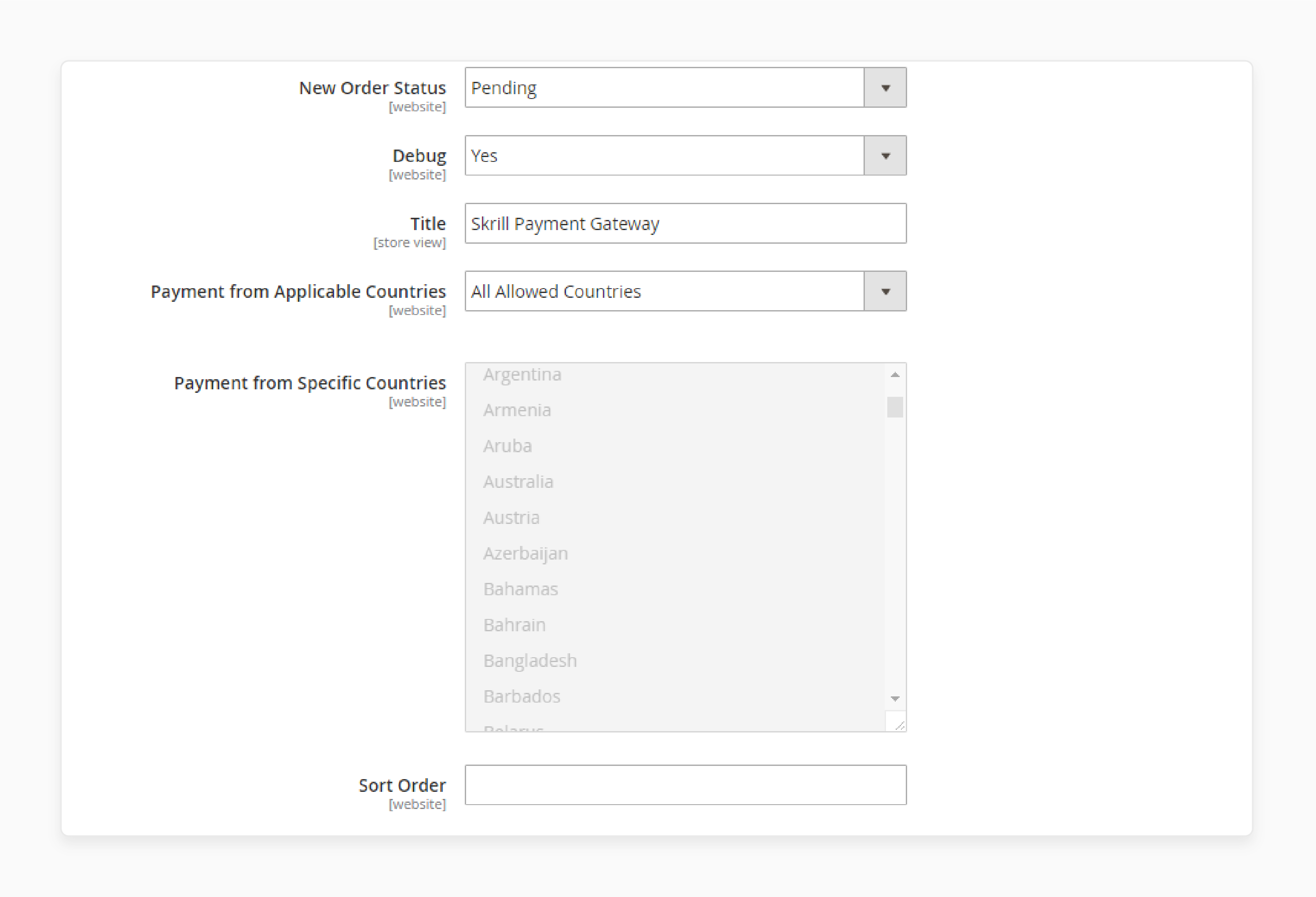

-

Select Yes to enable Debug mode for your Magento 2 store.

-

Test the payment methods via a transaction.

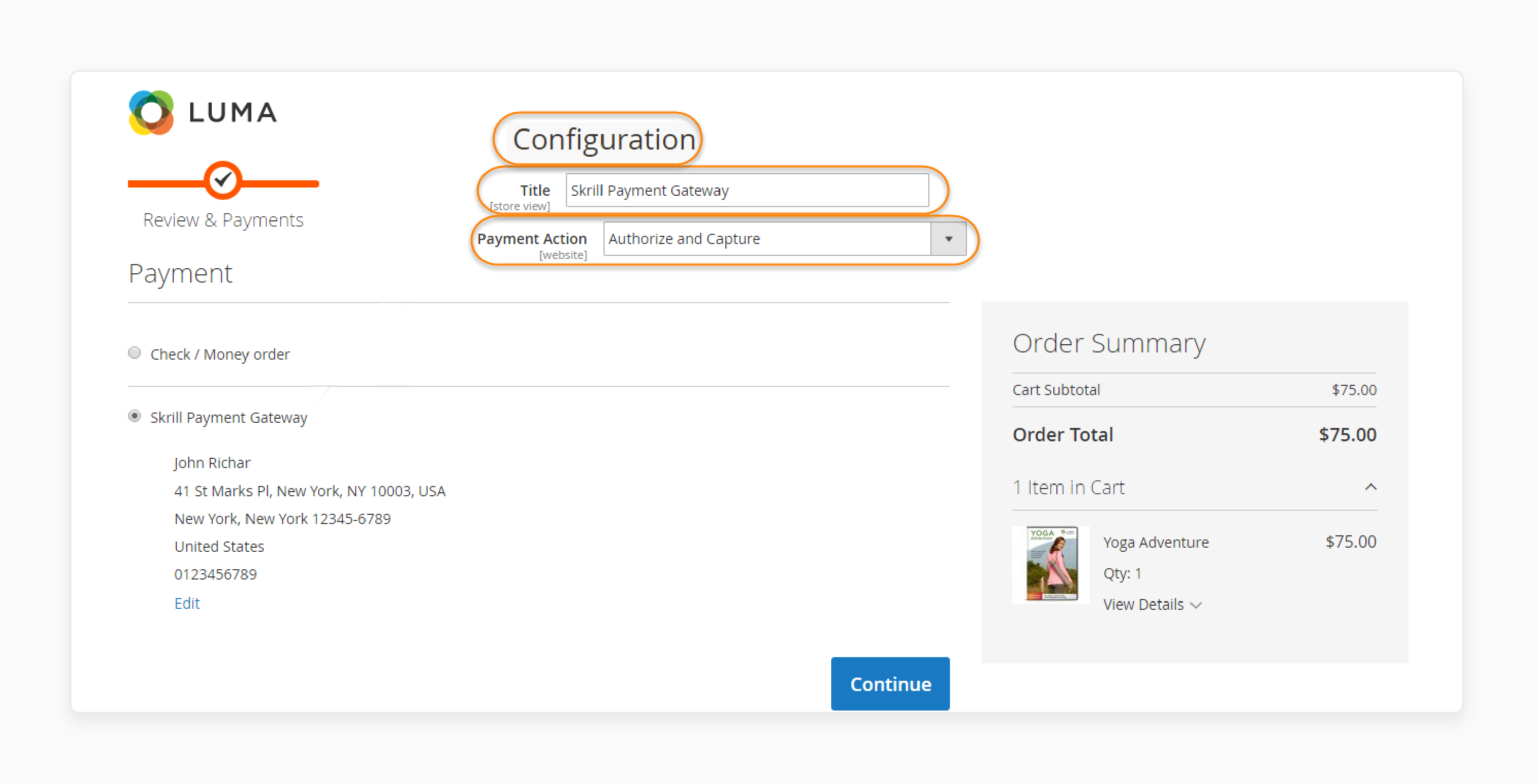

-

Choose Skrill payment gateway on the checkout page.

Fees & Pricing Structure of Skrill Payment Options for Magento 2

1. Transaction fees

Skrill charges Magento transaction fees based on the payment methods. The fees can range from 0% to 5% for local payments. For global payment methods, the fee is up to 1.25%. These fees apply when customers make payments using credit or debit cards.

2. Withdrawal Fees

Different fees apply to withdrawing funds based on the method used. For local payment methods, the fee can be as low as 0% but may go up to 3.49%. It depends on the withdrawal method selected. For global payment methods, a fee of 1.75% applies. It comes with a least fee of €3.50 for each transaction.

3. Skrill Money Transfer Fees

Sending money via bank transfer incurs zero fees. Sending by debit card may attract a fee of up to 1%. If money moves via credit card, the fee can be as high as 2.99%. If the transfer involves currency conversion, an exchange rate mark-up of 4.99% may apply.

4. Currency Conversion Fees

Skrill applies a foreign exchange fee of 3.99%. This is for transactions that need currency conversion. If your account is not denominated in euros, this fee may be at 1.5% for cryptocurrency transfers. Skrill sets the exchange rate used, which fluctuates throughout the day.

5. Account Maintenance Fees

Skrill does not charge a service fee. This is as long as users make a transaction at least once every six months. If an account remains inactive for 6 months, a monthly service fee of €5.00 applies.

6. Prepaid Card Fees

For those using the Skrill Prepaid Mastercard, there are fees associated with its use. A new card application incurs a one-time fee of €10. It also has a maintenance fee of €10. There is a foreign exchange fee of 3.99% for transactions with foreign currencies. A fee of 1.75% at ATMs is also applied.

7. Chargeback and Other Fees

Skrill also imposes fees for chargebacks at €25 per occurrence. Other fees include €150 for providing inaccurate information or lack of cooperation. €10 goes for attempted cash uploads that are not successful.

FAQs

1. What security requirements does the Skrill payment gateway meet?

The Skrill payment gateway meets the highest data security standards. It is through its Merchant Level 1 QSA certification. It ensures PCI compliance and uses TLS 1.1 encryption protocols and anti-fraud. It includes a Fraud Detection Suite (FDS) to protect sensitive transaction data.

2. How can businesses review the payment methods supported by Skrill?

Skrill offers a complete payment solution supporting over 20 local payment methods. It also has integration with 80+ global banks. Merchants can accept payments via credit and debit cards.

3. How much do Skrill's transaction fees cost?

Skrill's transaction fees vary based on payment methods. Local payment method fees range from 0% to 5%. Global payment methods charge up to 1.25%. The pricing structure includes currency conversion fees of 3.99%. It also has fees for different transaction types. It makes it essential for merchants to understand the complete fee breakdown.

4. Can merchants trust the Skrill payment integration for their Magento 2 marketplace?

Yes, merchants can trust the Skrill payment gateway. It provides an integrated payment solution with instant settlement functionality. It has built-in refund management and advanced security features. The system includes multi-step authentication, IP address verification, and a Transaction Monitoring System. It uses machine learning to detect and prevent fraud.

5. What makes Skrill stand out from other gateways like SagePay?

Skrill stands out with its features, including support for 40 currencies and settlement. Skrill offers no sign-up requirements for customers. It supports over 100 local payment methods and provides 24/7 customer support. The comparison with SagePay shows Skrill's competitive edge in fees and multi-currency support. It has a more flexible payment processing approach for Magento 2 merchants.

Summary

The Magento 2 Skrill extension manages payments across different currencies and countries. In this tutorial, we explain how to configure the extension and its benefits. Here is a quick recap:

- Skrill is a global payment gateway supporting 200 countries.

- Improved security with PCI DSS compliance measures.

- Advanced anti-fraud technology protects merchant transactions.

- Many payment methods across 80+ global banks.

- Easy configuration through Magento 2 admin panel.

Choose managed Magento hosting with Skrill for swift payments, growth, and optimized performance.