How to Set Up the Magento 2 Mastercard Payment Gateway?

Looking for a widely used and compatible payment gateway for your store? The Magento 2 Mastercard payment gateway provides advanced features for a smooth checkout.

In this tutorial, we explain how to configure the module and its benefits.

Key Takeaways

-

Configure the Mastercard Payment Gateway for secure transactions.

-

Compare Mastercard with Stripe for payment features.

-

Optimize checkout with Hosted and API models.

-

Ensure compliance with PCI standards effortlessly.

-

Improve business efficiency with an advanced reconciliation tool.

What is the Magento 2 Mastercard Payment Gateway?

The gateway is a bridge between your store and Mastercard's payment processing infrastructure. It handles payment validation, encryption, and real-time transaction processing.

This payment solution operates in over 210 countries and territories. Some accepted payment methods include:

1. Credit and Debit Cards: Mastercard, Visa, American Express, Discover, UnionPay, JCB, and Diners.

2. Digital Wallets: Google Pay, Apple Pay, and Samsung Pay.

3. Alternative Methods: Buy-now-pay-later services, ACH transfers, and phone-based payment

Key Features of Mastercard Payment Gateway for Magento

1. Integration Models

-

The Hosted Checkout model provides a straightforward integration approach. It redirects customers to a secure, Mastercard-hosted payment page. This page handles all sensitive payment data collection. Mastercard fully maintains and secures the interface. Merchants don't need to worry about PCI compliance for payment data.

-

This model offers greater flexibility and control over the payment experience. Merchants can maintain their store's look and feel throughout the checkout process. The payment form appears seamlessly within your website's interface. All sensitive data is still processed through Mastercard's secure servers.

-

ACH (Automated Clearing House) integration enables direct bank-to-bank transfers. This model is designed for US-based transactions. It provides a cost-effective alternative to card payments. Merchants can accept direct debit payments from customer bank accounts. The integration supports both one-time and recurring payments. It includes verification processes to reduce payment risks. ACH transactions typically have lower processing fees compared to credit cards.

2. Security Features

-

The Mastercard Payment Gateway service provides API integration options. These APIs are built on RESTful architecture. They support both JSON and XML formats. Developers can easily access detailed API documentation. The integration supports multiple authentication methods. Real-time transaction processing is available through API calls.

-

Multiple integration models cater to different business needs. The Hosted Checkout model offers a complete payment interface. Direct API integration allows for custom implementations. The hosted payment session provides flexibility. Each model comes with detailed user guides. Merchants can switch between models as needed.

-

An SDK is available for multiple programming languages. Debug tools help identify integration issues quickly. The platform includes detailed error-logging capabilities. Testing environments mirror production features. Code samples are provided for common implementation scenarios.

3. Business Benefits

-

Daily reconciliation becomes effortless with automated tools. The system matches transactions with bank deposits automatically. Discrepancies are flagged for immediate attention. Batch processing simplifies large transaction volumes. Settlement reports are generated automatically.

-

The gateway provides robust chargeback management tools. Merchants receive instant notifications of chargebacks. Evidence can be submitted directly through the portal. The system tracks chargeback deadlines automatically. Previous chargeback data helps identify patterns. Prevention tools help reduce chargeback frequency.

-

The system generates detailed financial summaries automatically. Transaction histories are stored securely for future reference. Multiple report formats are available for download. The reporting interface is user-friendly and intuitive. Analytics tools help identify sales patterns and trends.

4. Omnichannel Capabilities

-

Mobile payment processing is fully supported across all devices. The gateway integrates with both iOS and Android applications. Mobile SDK provides native payment functionality. Responsive design ensures a consistent user experience. Biometric authentication enhances security. Push notifications keep customers informed.

-

Agents can process payments through a dedicated interface. Virtual terminal capabilities enable phone-based transactions. Customer profiles can be accessed instantly. Payment verification is quick and efficient. Transaction histories are readily available.

-

The gateway connects smoothly with physical POS systems. It supports various POS hardware configurations. Real-time transaction processing is guaranteed. Offline mode ensures continuous operation. Receipt printing is customizable. Cash drawer integration is supported. Inventory management systems can be connected.

Mastercard vs Stripe: Magento Payment Gateway Comparison

| Feature | Mastercard Payment Gateway | Stripe |

|---|---|---|

| Global Presence | Available in 210+ countries and territories | Available in 46 countries with support for 195+ countries for cross-border payments |

| Currency Support | Multiple currencies supported | 135+ currencies supported |

| Payment Methods | - Credit & Debit cards - Google Pay - ACH payments - Digital wallets |

- All major credit/debit cards - Digital wallets - ACH transfers - Buy now, pay later options |

| Key Security Features | - PCI Level 1 certified - 3D Secure v1 & v2 - Address Verification Service (AVS) - Tokenization |

- PCI compliant - Fraud prevention tools - Strong Customer Authentication (SCA) - Advanced encryption |

| Integration Options | - Hosted Checkout - Hosted Payment Session - REST & GraphQL API |

- Stripe Elements - Stripe Checkout - Payment Links - Custom API integration |

| Additional Features | - Full/Partial refunds - Void transactions - Real-time monitoring - Transaction management |

- One-click checkout - Subscription billing - Automated reconciliation - Detailed reporting |

| Pricing Structure | Varies based on transaction volume and processing fees | 2.9% + $0.30 per successful transaction (US rates) Additional fees for international cards |

| Checkout Experience | - Customizable checkout - Hosted payment page - Smooth integration |

- Customizable UI - On-site checkout - Saved payment methods |

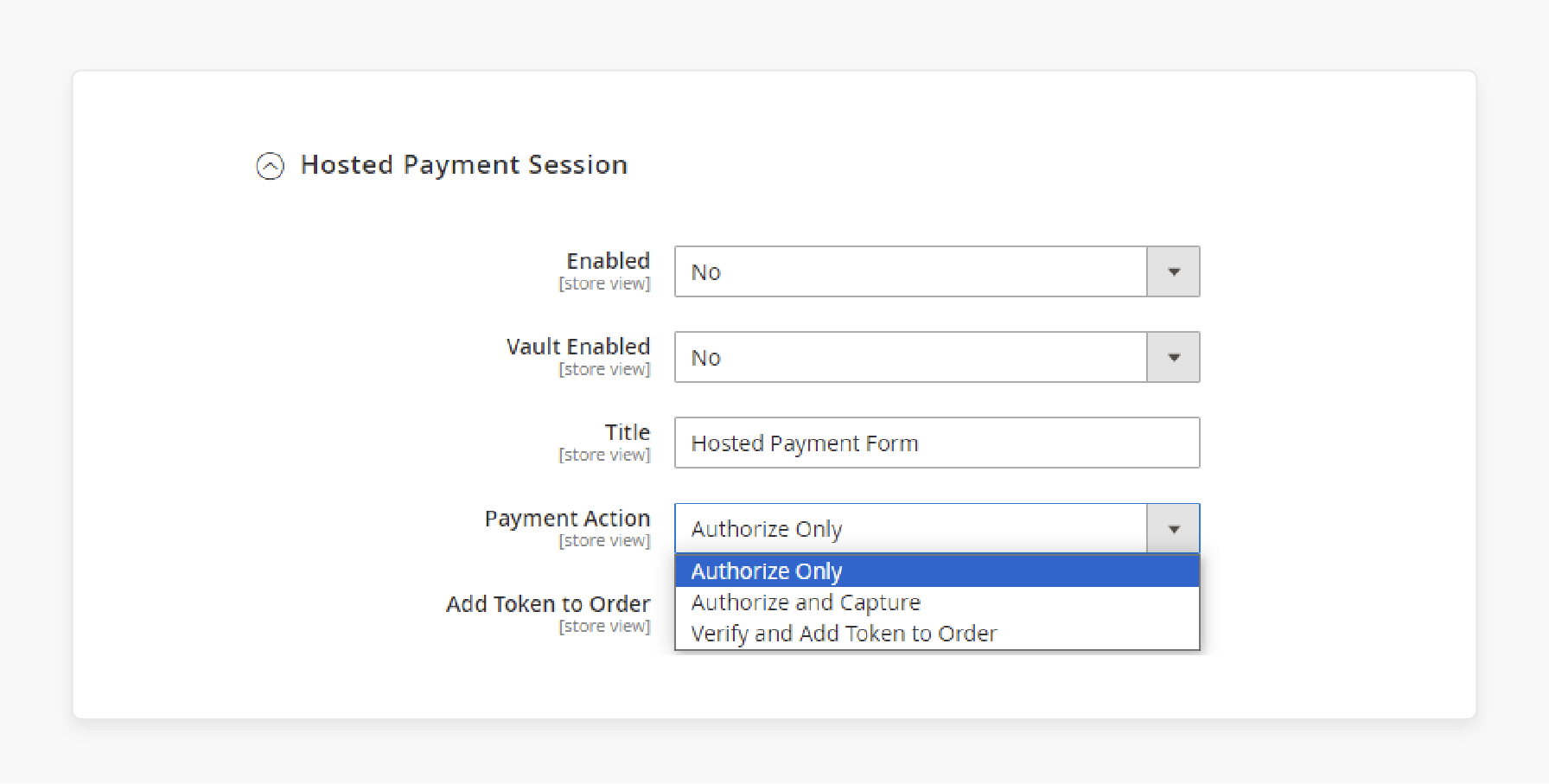

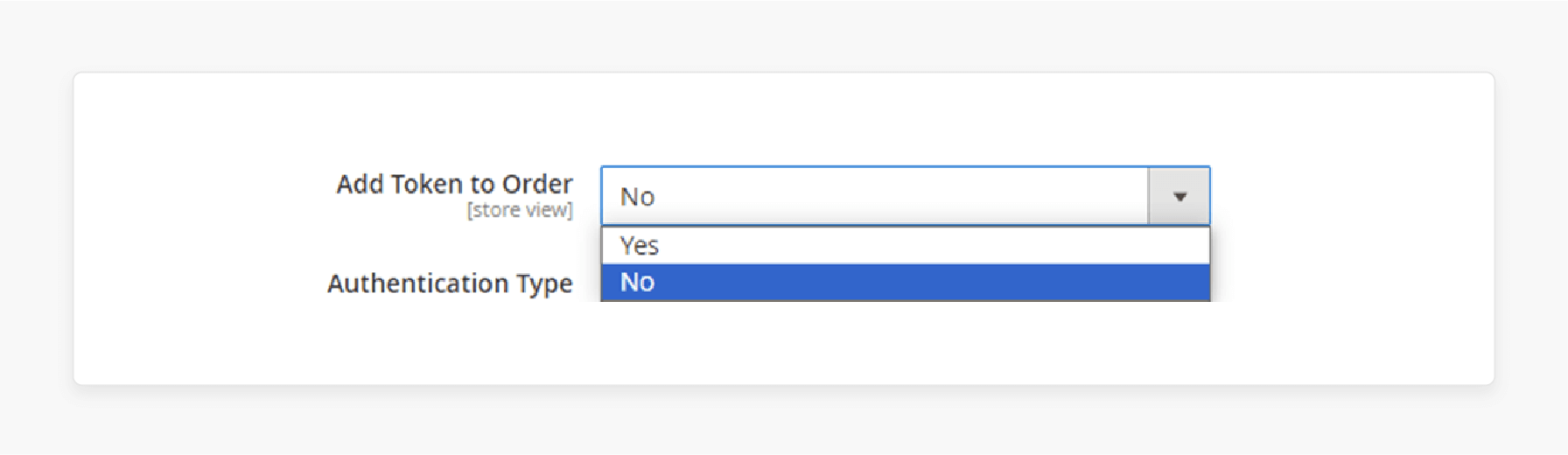

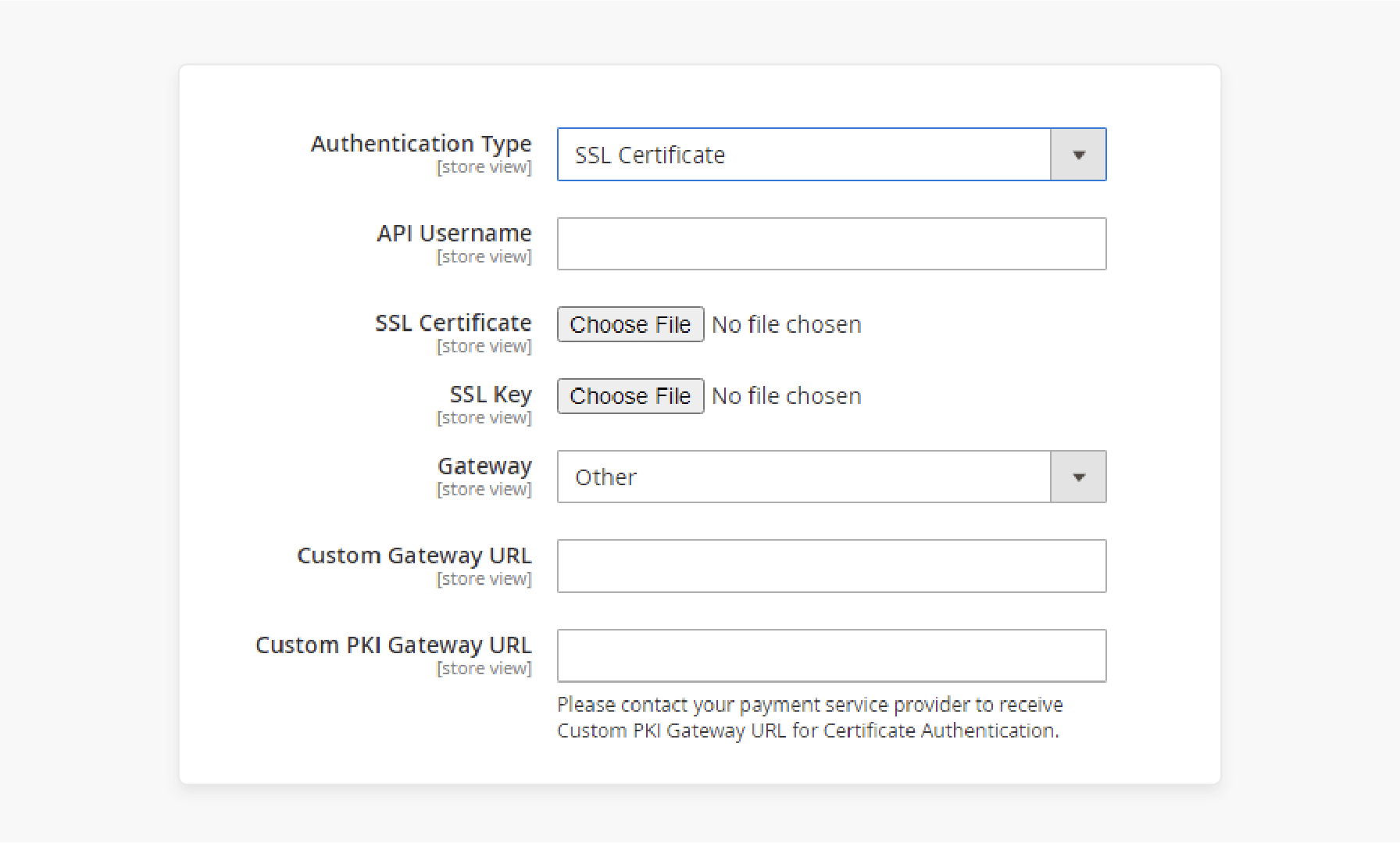

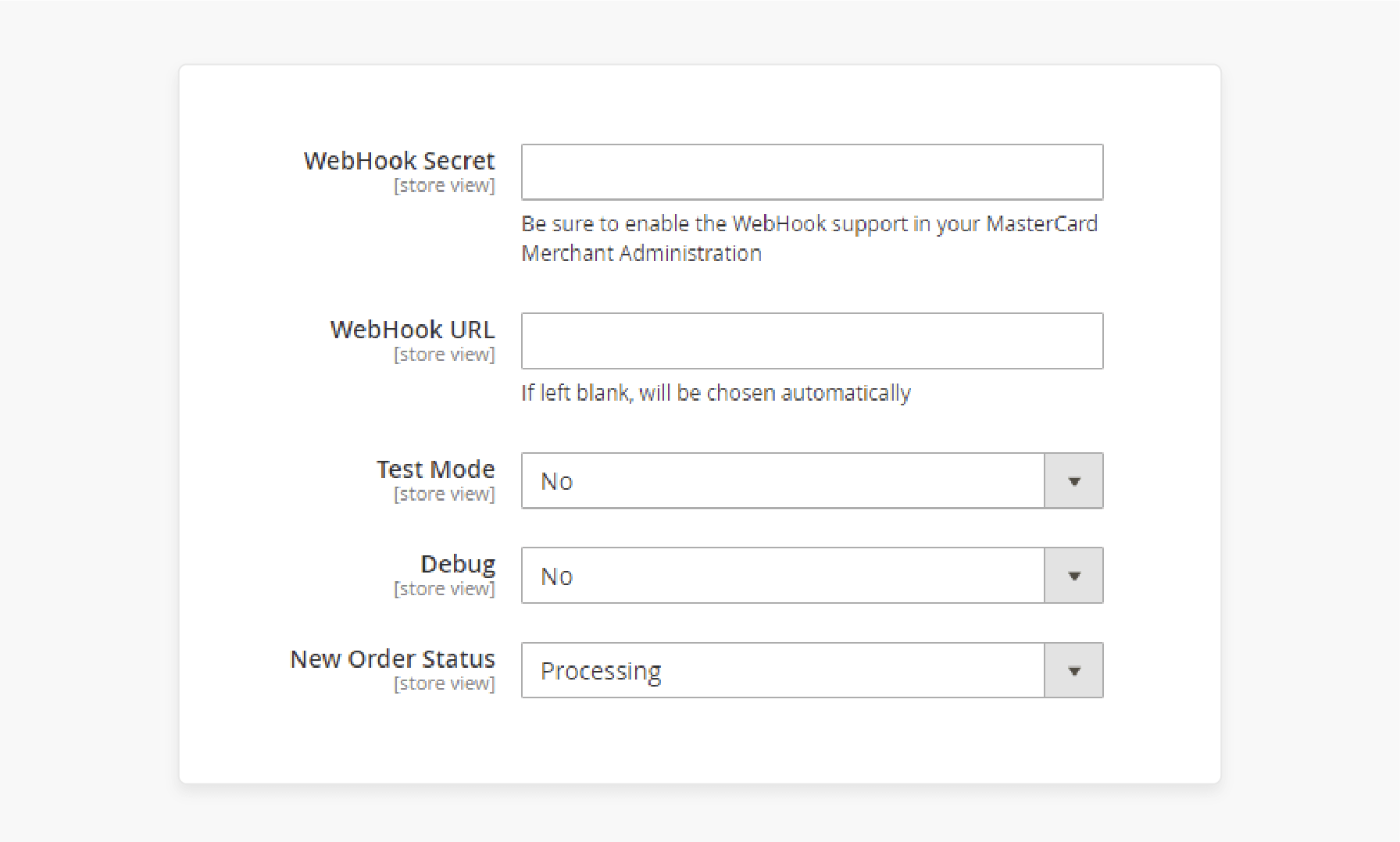

Steps to Configure the Mastercard Payment Extension

- Log in to the Magento admin panel after installing the extension.

- Enable the extension and the vault.

-

Choose a Payment Action and Tokens.

-

Select User and Password as the Authentication Type.

- Upload the SSL Certificate and Key.

- Enter your Webhook Secret key from your merchant account.

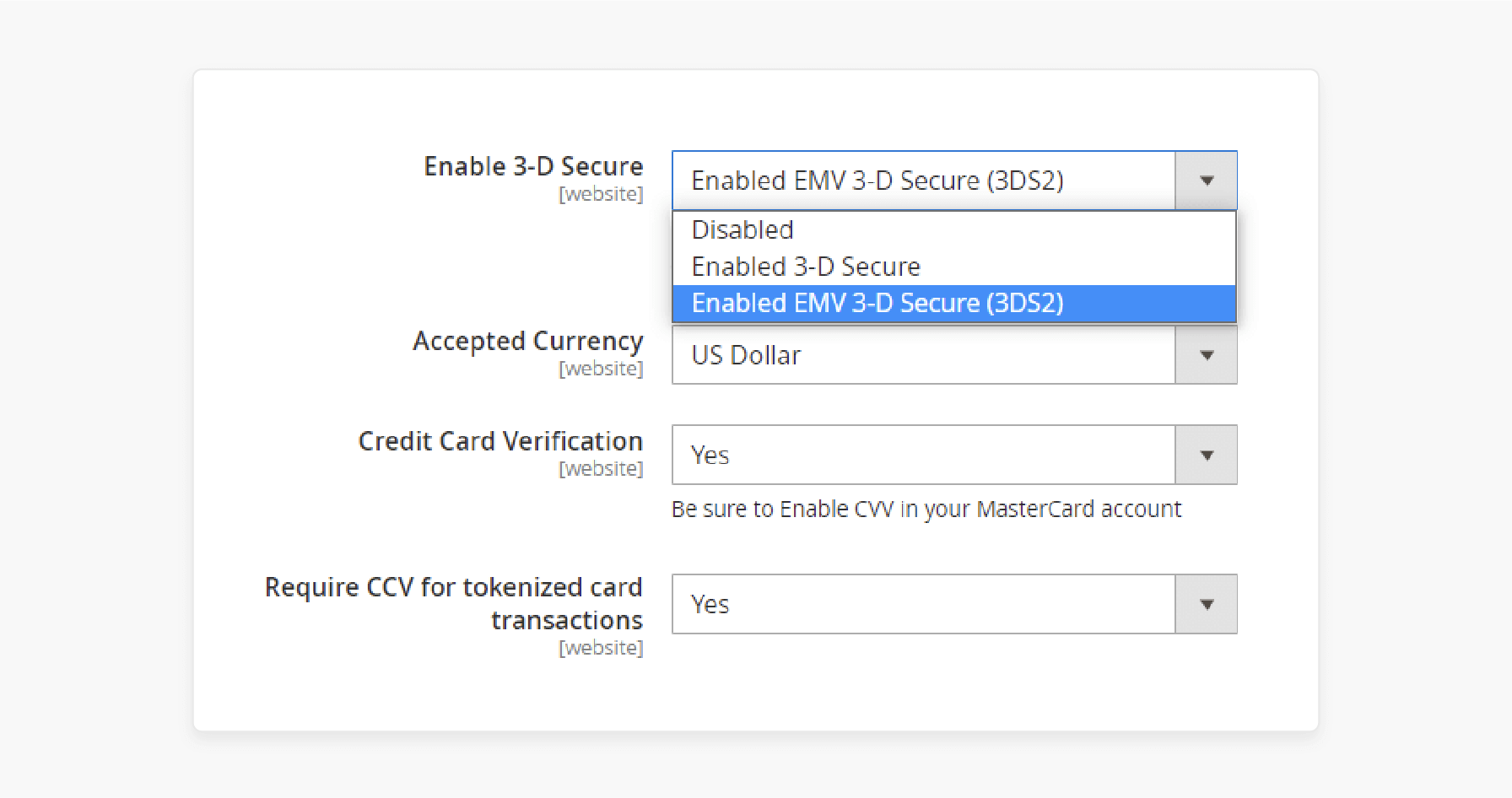

- Enable the 3D Secure feature for security.

- Choose an Accepted Currency and Credit Card verification.

- Click on Save Config to save changes.

Best Practices for Using Mastercard Payment Gateway

1. Refund Management

-

Every refund must have clear documentation. Create detailed notes for each refund request. Record specific customer complaints or issues. Include product condition details if applicable. Take photos when necessary for product returns. Maintain a standardized documentation process. It helps track refund patterns. Documentation protects both merchant and customer interests.

-

Establish clear authorization levels for refunds. Set specific approval thresholds. Implement multi-level verification for large refunds. Create an authorization chain of command. Document who approved each refund. Maintain logs of authorization decisions. Review authorization processes regularly.

-

Store all refund-related documents securely. Keep digital copies of all communications. Record transaction IDs and reference numbers. Document payment gateway responses. Store customer interaction history. Maintain audit trails for each refund. Create backup systems for record storage.

2. Gateway Settings

-

API credentials require careful maintenance and regular updates. Change API keys periodically for security. Store credentials in secure locations. Implement encryption for credential storage. Monitor API access logs regularly. Update expired credentials immediately. Maintain backup access credentials.

-

Proper error handling ensures a smooth customer experience. Configure clear error messages. Set up automatic error notifications. Create custom error pages. Implement logging for all errors. Monitor error frequency patterns. Address common errors proactively. Set up error escalation procedures.

-

Test all new features in the sandbox first. Regularly update sandbox configurations. Maintain test card numbers and scenarios. Create various testing scenarios. Document all test results.

3. Technical Maintainance

-

Database maintenance ensures smooth transaction processing. Optimize MySQL queries regularly. Monitor database performance metrics. Schedule regular database backups. Clean up unnecessary tables. Maintain proper indexing.

-

Development environments require constant attention and updates. Install security patches immediately upon release. Keep all development tools current. Update IDE configurations regularly. Maintain version control systems.

-

PHP settings directly impact gateway performance. Optimize PHP memory limits for optimal processing. Configure PHP timeout settings appropriately. Update PHP versions when required. Monitor PHP error logs daily. Adjust PHP-FPM settings for better performance.

4. Payment Testing

-

Thorough refund testing maintains customer satisfaction. Test full refund functionality weekly. Verify partial refund processing. Check refund notification systems. Monitor refund processing times. Test multiple currency refunds. Verify refund documentation procedures.

-

Regular payment flow testing ensures smooth checkout experiences. Test complete checkout processes. Verify all payment steps work correctly. Check error message displays. Test payment form validation. Verify address verification systems. Monitor 3D Secure functionality. Test payment confirmation emails.

-

Test international transactions. Verify multi-currency processing. Check high-value transaction limits. Test minimum amount restrictions. Verify declined transaction handling. Test expired card scenarios. Check invalid card number handling. Test CVV validation processes. Verify billing address validation of your online store.

FAQs

1. What is the best payment gateway for Magento?

The best payment gateways for Magento depend on your store's specific needs. Popular options include the Mastercard Payment Gateway Module, Stripe, and PayPal. They offer smooth integration and advanced features.

2. How does the hosted checkout method improve security?

The hosted checkout method redirects users to a secure page for payment. It ensures sensitive card data is processed without compromising your store’s safety.

3. Can I configure a payment gateway module without technical expertise?

Yes, most payment gateway modules, including the Mastercard Payment Gateway Module. It provides user-friendly interfaces and detailed documentation to guide you through the setup.

4. What payment options are supported for Magento 2 checkout?

Magento 2 supports various payment options. It includes credit cards, digital wallets, and payment through ACH transfers. It offers a versatile and convenient checkout page experience.

5. Why choose the Mastercard Payment Gateway Module for your ecommerce website?

This module is a payment gateway solution. It offers advanced features like fraud prevention and many currencies. It also provides integration with different Magento versions. It is to improve your store's checkout process.

Summary

The Magento 2 Mastercard payment gateway integration helps secure transactions and customer data. In this tutorial, we explain how to configure the extension and its features in detail. Here is a recap:

- Secure payments with Mastercard Payment Gateway Module integration.

- Supports various payment methods for global transactions.

- Offers Hosted Checkout and API integration models.

- Advanced security features ensure PCI compliance effortlessly.

- Optimized configuration steps enhance Magento 2 checkout.

Pick a managed Magento hosting plan with the Mastercard gateway to secure and scale your store.