Magento 2 Fixed Product Taxes: Setup Fixed Product Tax in Magento 2

Want to streamline tax management in your Magento 2 store? Magento 2 fixed product taxes allow you to apply specific tax amounts to products. FPT makes it easier to comply with regional tax regulations. This tutorial covers steps to set up Magento 2 Fixed Product Taxes along with some of the best FPT practices.

Key Takeaways

-

Simplify tax management with Magento 2 Fixed Product Taxes (FPT).

-

Discover FPT benefits: accurate pricing, streamlined management, and customer trust.

-

Learn step-by-step FPT setup and configuration.

-

Explore FPT best practices for various business scenarios.

-

Troubleshoot common FPT issues and tax configuration problems.

-

Troubleshooting Common Issues with Magento Fixed Product Taxes

-

Best Practices of Using Fixed Product Taxes in Different Business Scenarios

What are Magento Fixed Product Taxes?

Magento Fixed Product Taxes (FPT) are additional charges applied to products. These taxes are fixed amounts, not percentages.

They are useful for products requiring specific taxes like electronic recycling fees. FPT ensures compliance with regional tax regulations.

FPTs are easy to configure in Magento. You can apply them to specific products or categories. This flexibility helps manage different tax rules efficiently. With FPT you streamline tax management, ensuring accurate pricing for customers.

Why Use Magento Fixed Product Taxes?

1. Simplifies Tax Management

Using Magento Fixed Product Taxes (FPT) simplifies tax management. Unlike percentage-based taxes, FPT is a fixed amount. It eliminates the need for complex calculations. You set a specific amount for each product. FPT makes it easier to ensure compliance with regional tax regulations. FPT is straightforward and reduces errors in tax applications.

2. Ensures Accurate Pricing

FPT helps in ensuring accurate pricing for your products. By setting a fixed tax amount, you avoid fluctuating tax charges. It is particularly useful for products with specific tax requirements like eco-taxes. Customers see the exact tax amount added to their order. This transparency builds trust and enhances the shopping experience.

3. Complies with Specific Tax Regulations

Certain regions have tax regulations requiring fixed charges, such as the WEEE tax. FPT allows you to comply with these specific tax laws easily. You can configure FPT for products needing a fixed tax amount. It ensures your store meets all legal tax requirements. It also prevents potential legal issues from incorrect tax applications.

4. Easy Configuration in Magento

Configuring FPT in Magento is simple. You can set simple tax rates or tax rules. Instead, you set the conditions of the product attributes. Magento automatically adds the FPT to the payment process. This ease of configuration saves time and effort in tax management.

5. Enhances Customer Trust

Using FPT enhances customer trust by providing clear and transparent pricing. Customers see the exact tax amount added to their order, eliminating surprises at checkout. This clarity helps build a positive shopping experience. Customers appreciate knowing the total cost upfront. Transparent pricing fosters trust and encourages repeat business.

Configuration Steps to Setup Magento 2 Fixed Product Taxes

Step 1: Enable FPT

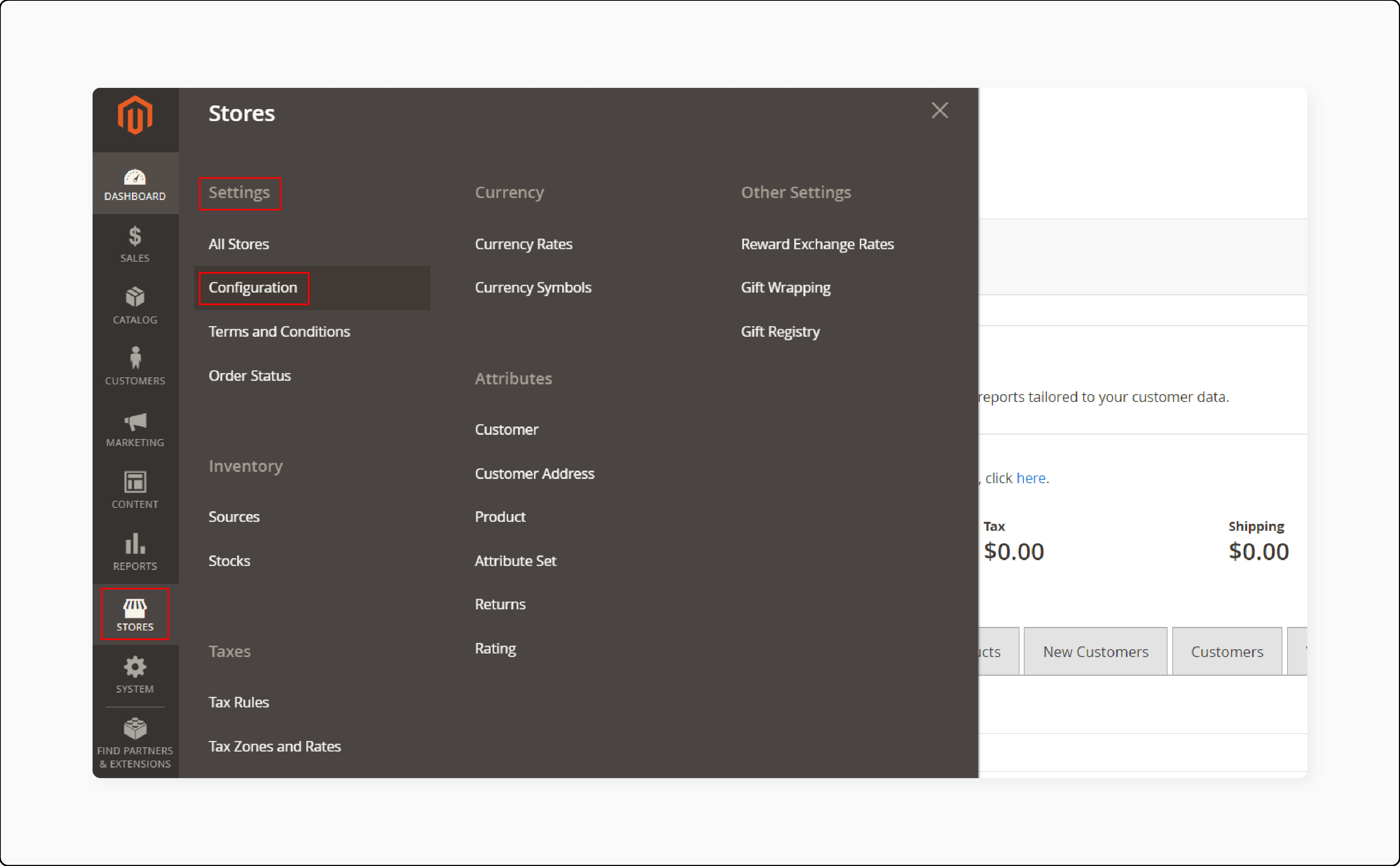

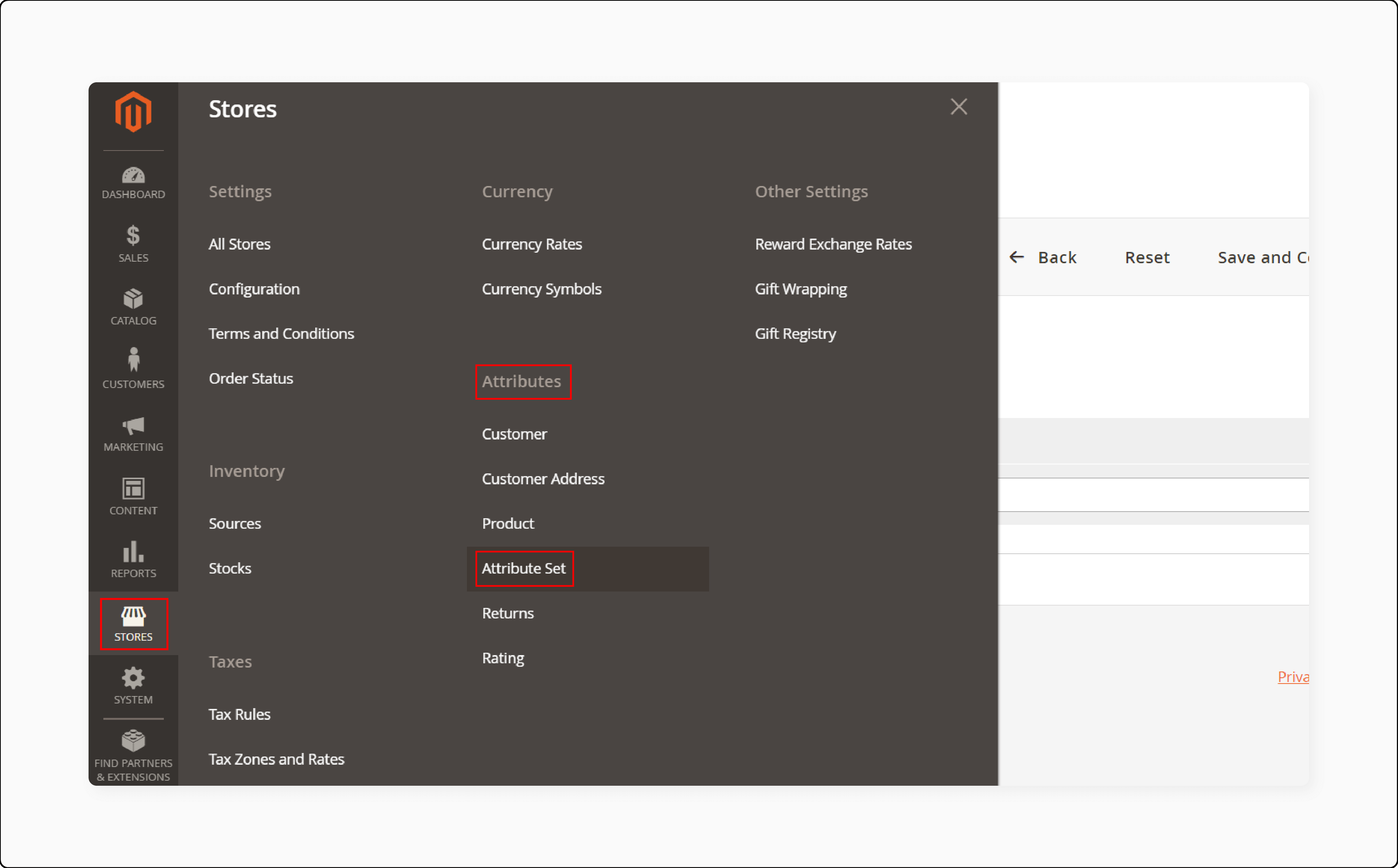

- Go to Stores > Settings > Configurations in the Admin Panel.

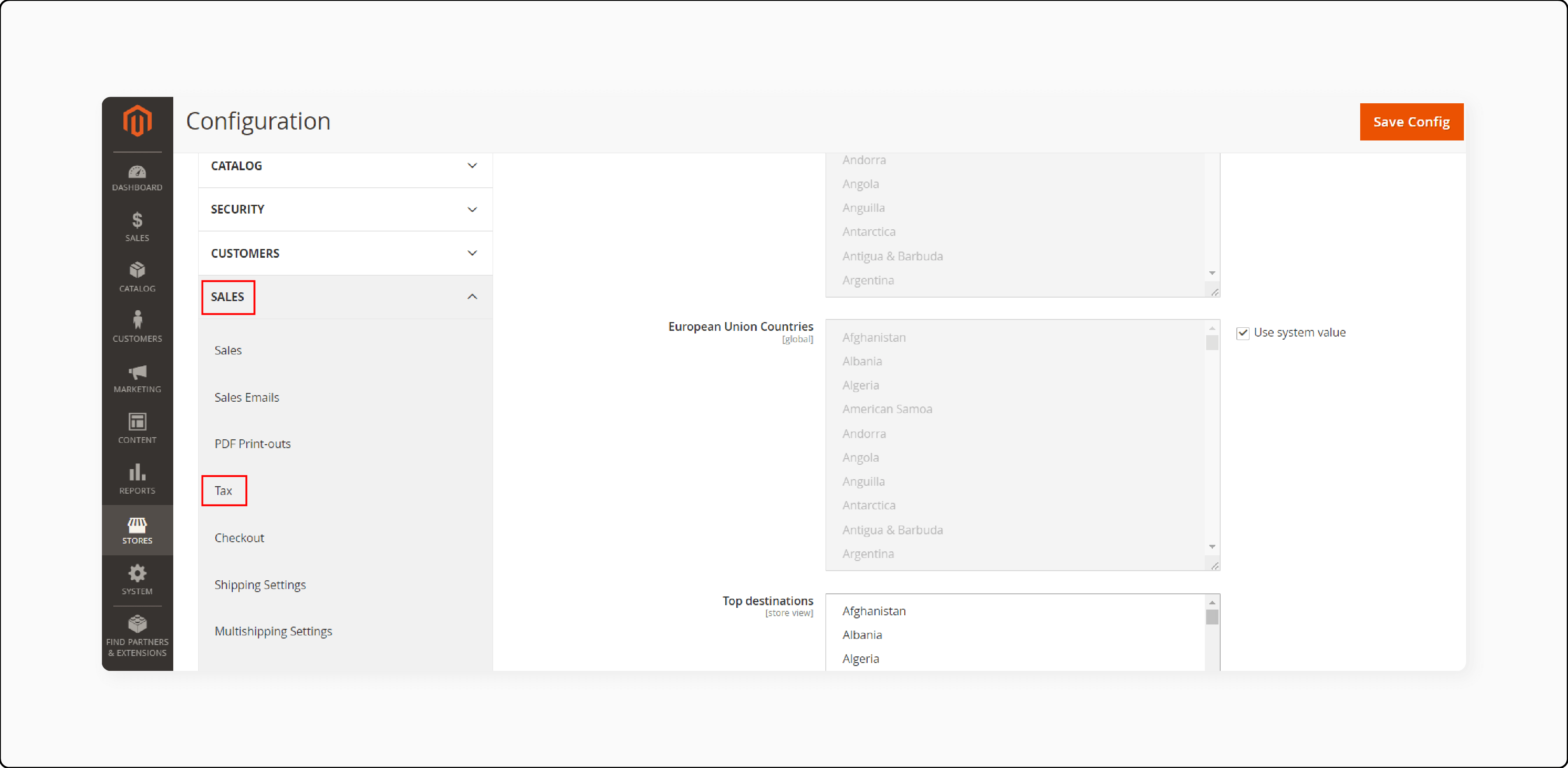

- Under Sales, click the Tax tab.

-

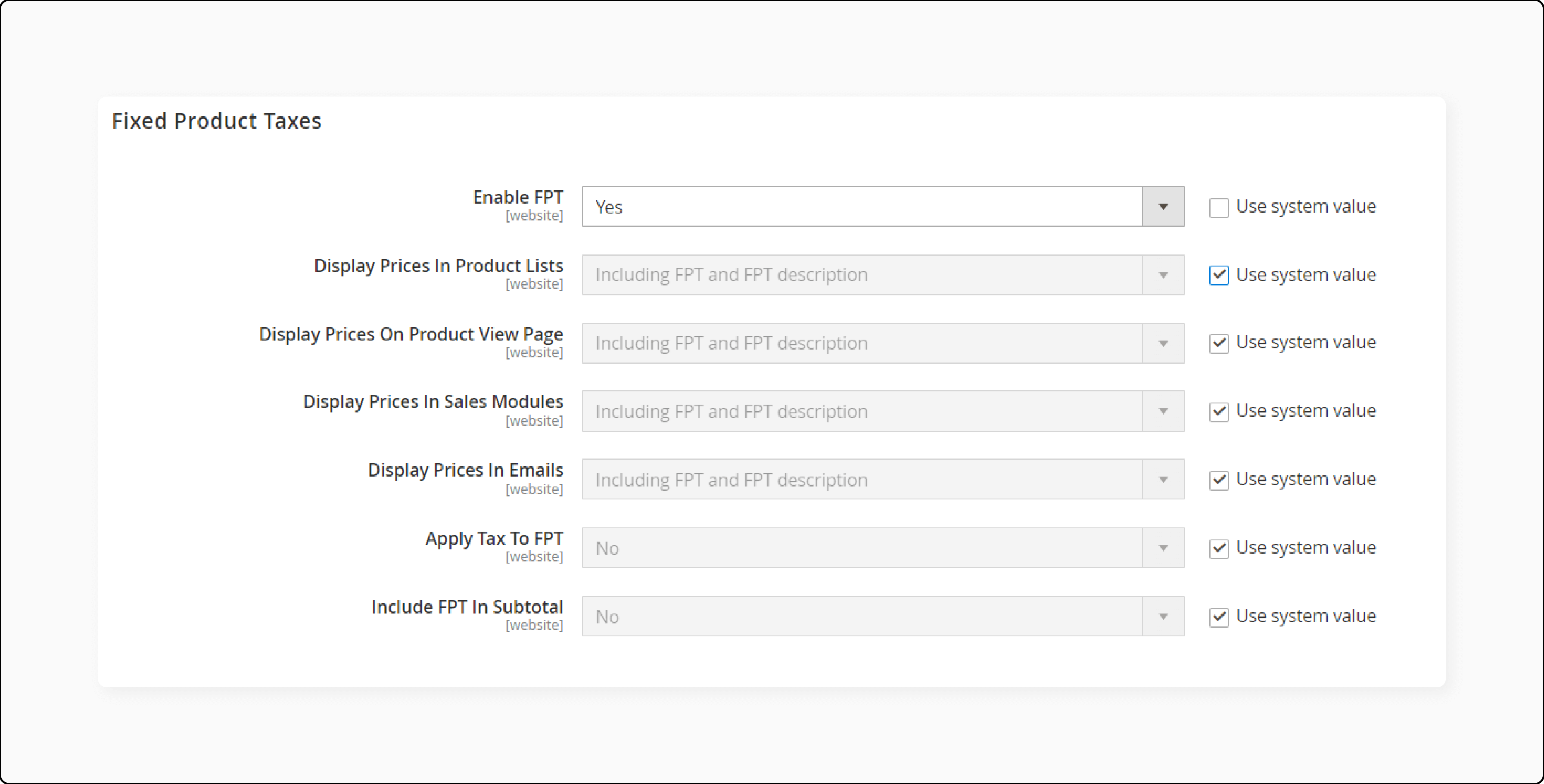

Open the Fixed Product Taxes section.

-

Set Enable FPT to "Yes".

-

Choose FPT settings for price display locations.

-

Set Apply Tax to FPT and Include FPT in Subtotal if needed.

Step 2: Create an FPT attribute

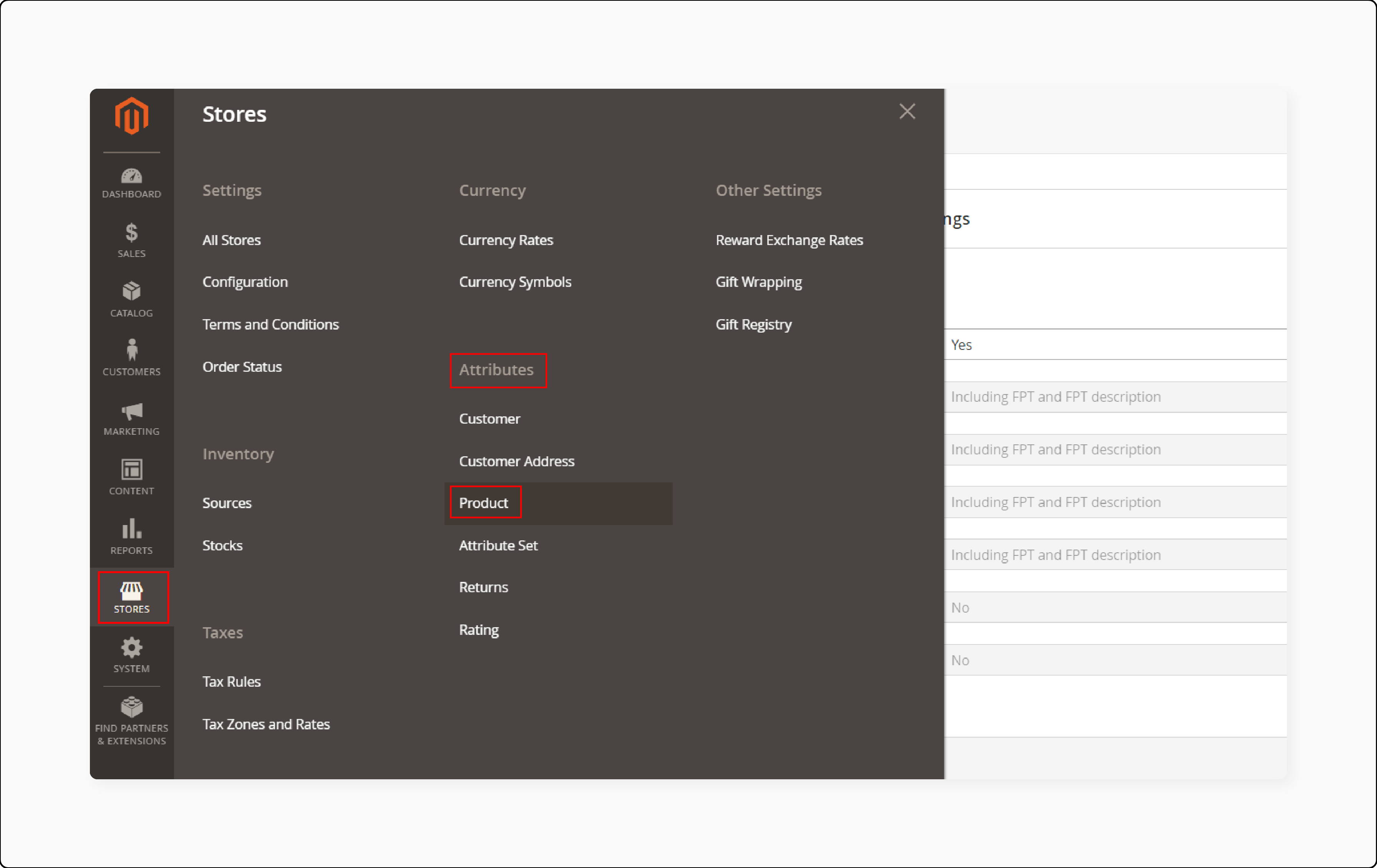

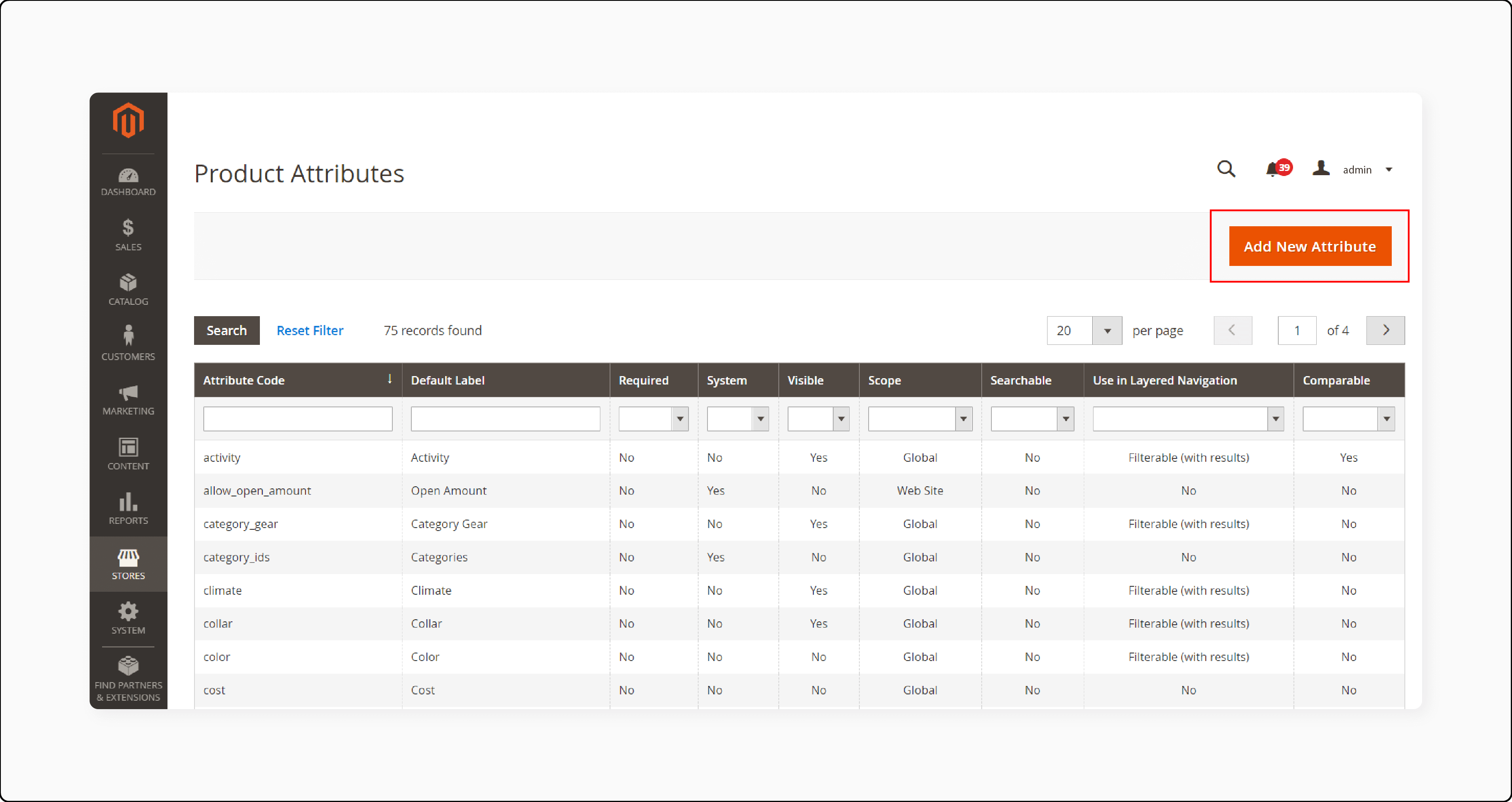

- Navigate to Stores > Attributes > Products.

- Click Add New Attribute.

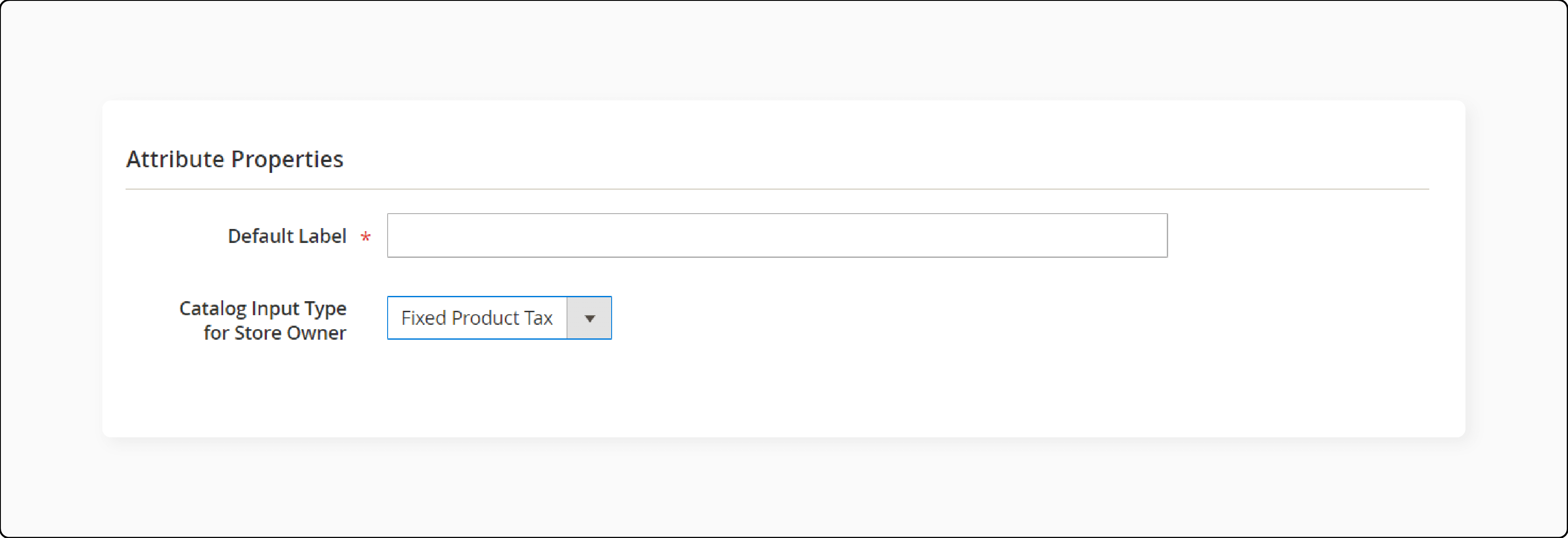

- Enter Default Label and select Fixed Product Tax as input type.

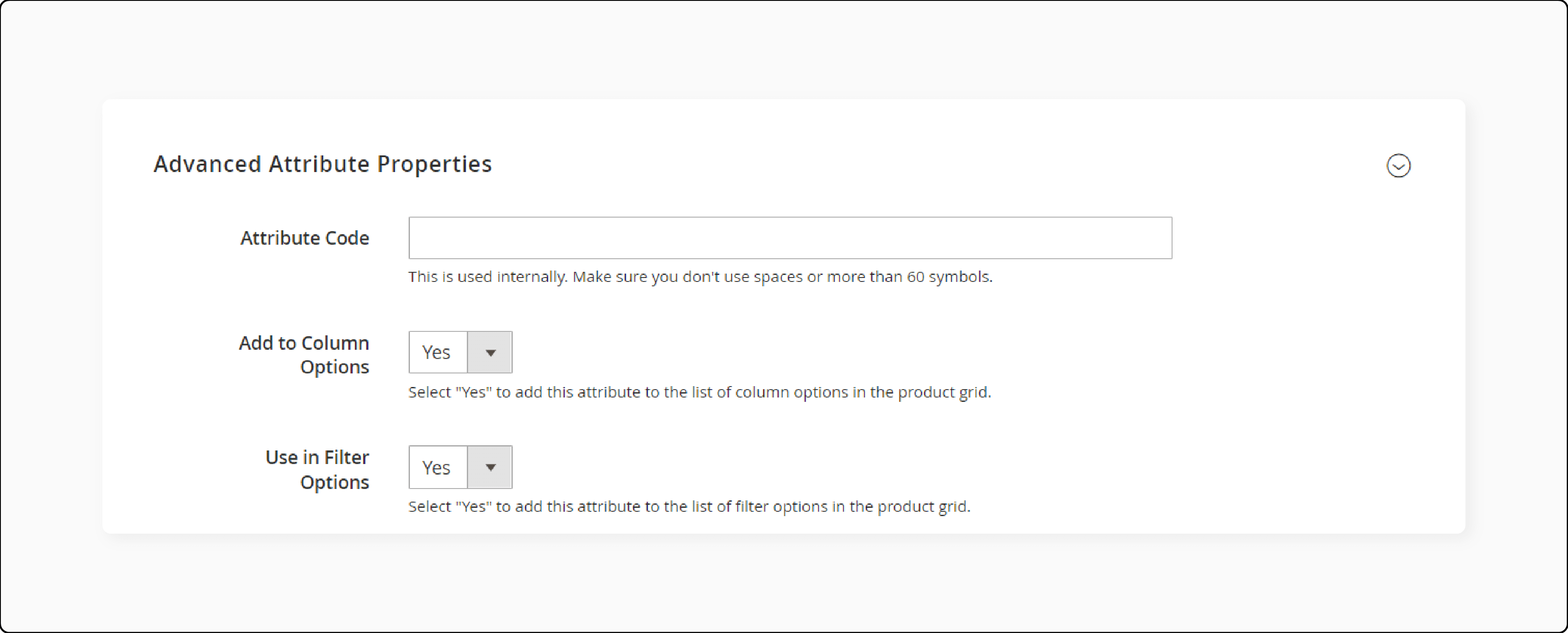

- Fill out the Attribute Code and set Add to Column Options and Use in Filter Options.

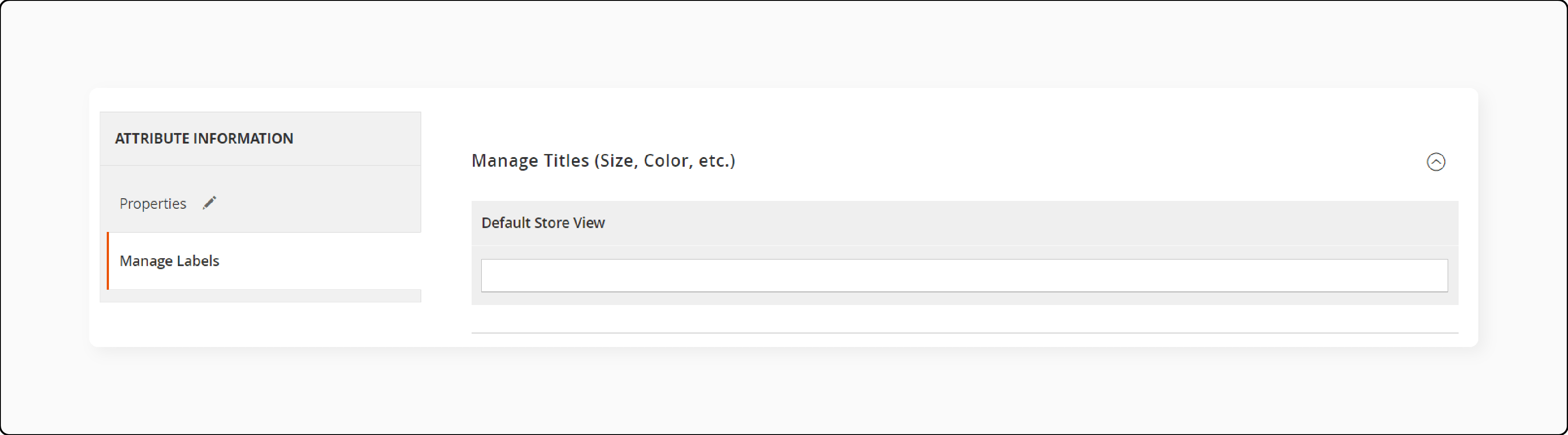

- Add store view-specific labels if desired.

- Save the attribute and flush the cache.

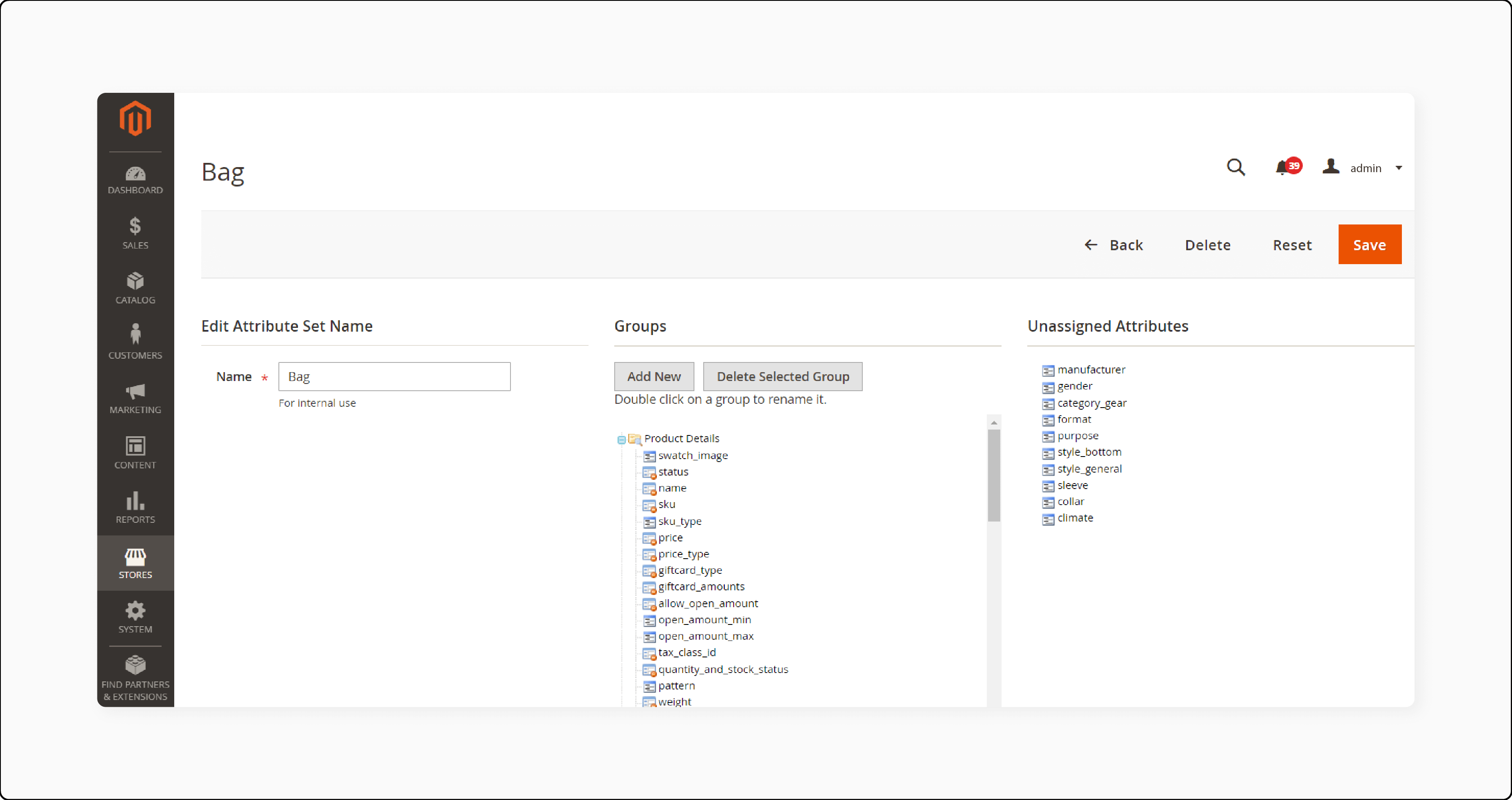

Step 3: Add FPT attribute to attribute set

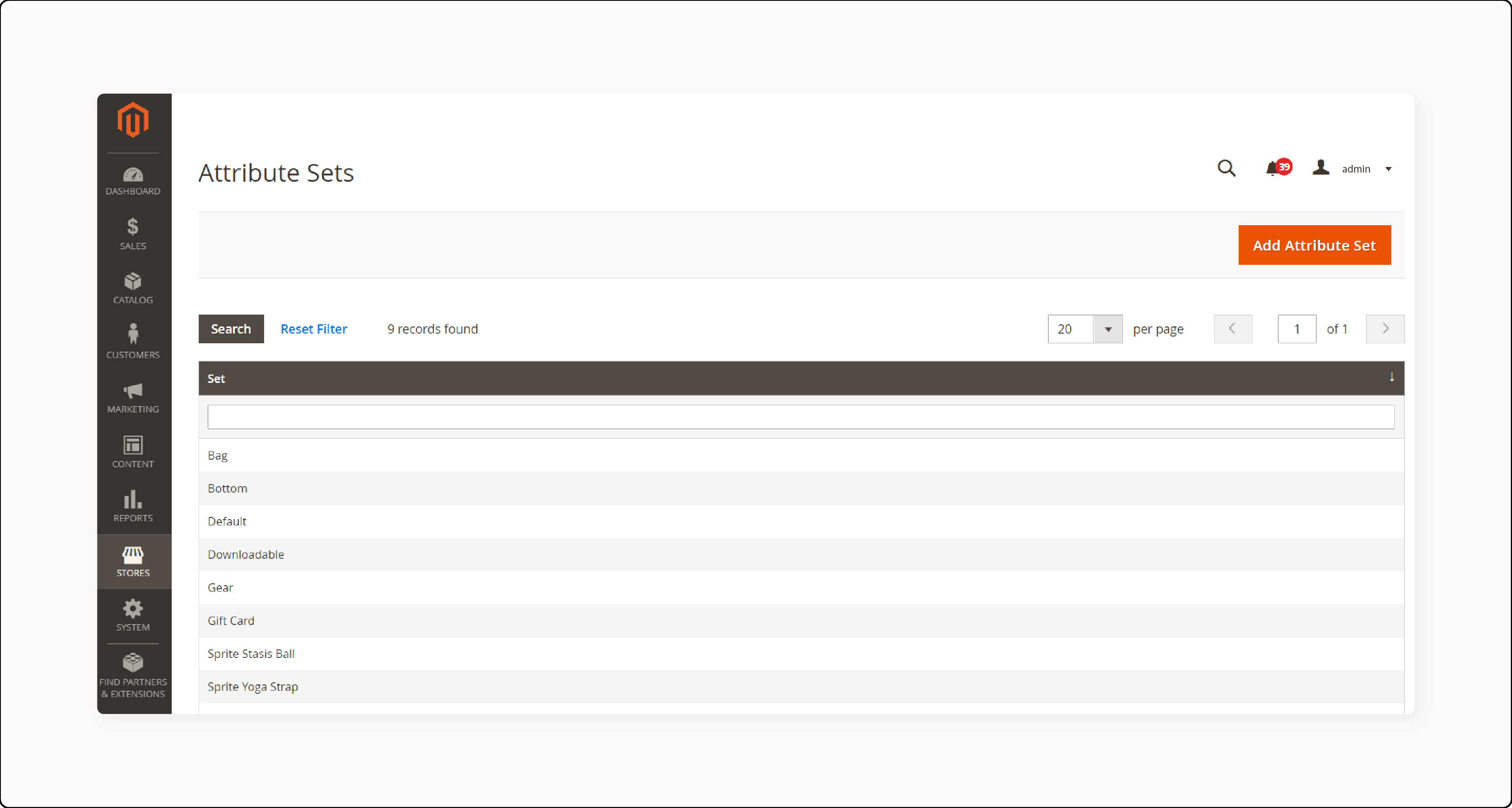

- Go to Stores > Attributes > Attribute Set.

- Edit the relevant attribute set.

- Drag the FPT attribute from Unassigned Attributes to the appropriate group.

-

Save changes.

-

Repeat this for each attribute set which should include FPT.

Step 4: Apply FPT to specific products

-

Open the product edit page from Products > Inventory > Catalog.

-

In the FPT section, click Add Tax.

-

Select Website and currency if multiple stores.

-

Choose the Country/State for the tax.

-

Enter the FPT amount.

-

Add more taxes with the Add Tax button if needed.

-

Save the product.

The fixed product tax setup is now complete. FPT will display on the storefront and apply during checkout based on your configuration choices.

Troubleshooting Common Issues with Magento Fixed Product Taxes

| Issues | Solutions |

|---|---|

| FPT not applying to products | Ensure the FPT attribute is correctly configured in the product settings. Check if the attribute is assigned to the appropriate product types. Verify the tax class settings in Magento. Reindex and clear the cache to apply changes. Ensure the FPT module is enabled in your Magento configuration. |

| Incorrect FPT amount displayed | Check the FPT value set in the product's attribute. Ensure there are no conflicting tax rules affecting the FPT calculation. Verify the currency settings are correctly configured. Reindex and clear the cache to reflect the correct FPT amount. Test on a clean Magento instance if issues persist. |

| FPT not showing on checkout | Verify that the FPT attribute is enabled and correctly configured. Check the store view and website settings to ensure FPT is enabled. Ensure there are no conflicting tax settings. Test the checkout process to identify the issue. |

| FPT calculation errors | Ensure the FPT amount is correctly entered in the product attribute. Verify that there are no overlapping tax rules affecting FPT calculation. Check the currency and locale settings. Reindex and clear the cache to correct any errors. Test with different products to identify patterns. |

| FPT not updating after changes | Reindex and clear the cache to apply changes. Verify that the FPT attribute has been correctly updated. Check if any system overrides are affecting the FPT. Ensure all product types are updated with the new FPT settings. Test in a clean Magento instance if issues persist. |

Best Practices of Using Fixed Product Taxes in Different Business Scenarios

| Practices | Explanations |

|---|---|

| Configuring FPT for Electronics | - Identify and apply WEEE tax for applicable products. - Set a fixed tax amount per product. - Ensure product attributes reflect FPT settings. - Reindex and clear the cache after configuration. - Regularly review tax compliance requirements. - Monitor FPT accuracy on checkout. |

| Implementing FPT for Environmentally Friendly Products | - Apply eco-tax to relevant products. - Ensure transparency in tax display on product pages. - Configure FPT to reflect legal mandates. - Reindex and clear cache to update changes. - Regularly audit tax settings for compliance. - Educate customers about the eco-tax benefits. |

| Using FPT for Recyclable Materials | - Identify products subject to recycling fees. - Set fixed tax amounts in product attributes. - Ensure clear labeling of tax on product pages. - Reindex and clear cache to apply changes. - Maintain records of FPT applications. - Ensure ecommerce compliance with recycling fee regulations. |

| Applying FPT in International Markets | - Understand regional tax regulations. - Configure FPT for each market separately. - Use currency conversion to set accurate FPT. - Reindex and clear cache for each market's configuration. - Regularly update FPT to reflect currency fluctuations. - Ensure legal compliance in each market. |

| Managing FPT for Seasonal Products | - Identify seasonal products requiring special taxes. - Set fixed tax amounts for these specific periods. - Ensure FPT is reflected in product attributes. - Reindex and clear cache after applying changes. - Monitor sales to ensure FPT accuracy. - Adjust FPT settings post-season as needed |

FAQs

1. How does Magento 2 tax calculation work?

Magento 2 tax calculation works by applying configured tax rules to the product price. You can choose to include tax in the displayed price or show it without tax. The system uses default tax settings unless specified otherwise. Proper tax configuration ensures accurate calculations.

2. Can I display product prices without tax in Magento 2?

Yes, you can display product prices without tax in Magento 2. Adjust the tax configuration in the admin panel to exclude tax from the displayed prices. It is useful if you want to show the base price and add tax later. Ensure your settings match your business needs.

3. How do I set up a fixed product tax (FPT) in Magento 2?

To set up an FPT tax in Magento 2, enable the FPT option in the tax configuration. Create an FPT attribute and assign it to the relevant products. Configure the fixed tax amount per product. It allows you to apply specific tax charges as needed.

4. Why is my FPT not included in the product price?

Your FPT tax might not be included in the product price due to incorrect tax configuration. Ensure that the FPT attribute is properly assigned to the product. Check if the setting to include tax in the price is enabled. Reindex and clear the cache to apply changes.

5. How can I troubleshoot issues with Magento 2 tax configuration?

To troubleshoot Magento 2 tax configuration issues, verify all tax settings and rules. Ensure the default tax rates are correct. Check if the FPT tax attribute is properly configured and assigned. Reindex and clear the cache. Test with different products to identify any patterns. Using dedicated Magento hosting also resolves different tax management issues.

Summary

Implementing Magento 2 Fixed Product Taxes simplifies tax management of your online store. By properly configuring FPT you can:

-

Ensure compliance with regional tax regulations.

-

Provide accurate pricing for products with specific tax requirements.

-

Streamline tax management and reduce errors.

-

Enhance customer trust through transparent pricing.

-

Easily apply fixed tax amounts to specific products or categories.

Consider a managed Magento hosting solution to manage Magento store taxes easily.