How to Set Up Magento 2 CardSave Payments for Your Store?

Is your Magento 2 store losing sales due to payment issues? Magento 2 CardSave payments ensure fast and secure transactions. The payment gateway integrates easily and supports multiple cards.

This tutorial covers CardSave integration, setup, and testing. You will also learn to configure, troubleshoot, and optimize your store's payments.

Key Takeaway

-

Magento 2 CardSave ensures secure and seamless online payment processing.

-

CardSave offers two types of payment: hosted and direct transactions.

-

Businesses control transactions while customers securely enter card details.

-

PCI-compliant encryption protects credit card information on the CardSave server.

-

Easy integration with Magento 2 boosts conversion rates and efficiency.

-

What are the Features of Magento 2 CardSave Direct Payments?

-

What are the Benefits of Using CardSave Payment Extension with Magento 2?

What is Magento 2 CardSave?

Magento 2 CardSave is a secure payment gateway for Magento 2 stores. It is a UK-based payment solution owned by Worldpay that integrates seamlessly with Adobe Commerce. CardSave ensures PCI-compliant transactions and protects customer card data.

It offers businesses two types of payment gateways for processing online transactions: Hosted and Direct Payment. Hosted payments use CardSave's secure payment page, while direct payments process card data on the server. Both methods ensure data security and encryption.

With encryption and fraud protection, Magento 2 CardSave provides a spam-free online payment facility. Businesses also get complete control over transactions. It reduces risks while improving customer experience and conversion rates.

What are the Features of Magento 2 CardSave Direct Payments?

1. Direct On-Site Payment Processing

The Magento 2 CardSave direct payments method processes transactions directly on your store. Customers enter card details without being redirected. It uses CardSave's secure platform to ensure real-time processing without third-party delays.

2. Real-Time Payment Authorization

CardSave Direct payments are approved instantly. The system checks card validity, funds, and fraud risks in seconds. This process speeds up order completion. It also offers immediate feedback that reduces cart abandonment. Customers enjoy quick confirmations, enhancing their shopping experience.

3. PCI Compliance Assurance

CardSave direct payments adhere to strict PCI-DSS standards. Your store doesn't store card data; all sensitive information is encrypted. It protects both your business and customers from data breaches.

4. Customizable Checkout Experience

CardSave direct payments allow you to tailor the payment page to match your store's branding. You can adjust colors, logos, and fields without coding. A consistent look builds customer confidence. Personalized checkouts also feel professional and encourage repeat purchases.

5. Support for Multiple Card Types

Accept Visa, Mastercard, Maestro, and other major cards. Broad card support caters to diverse customer preferences. This flexibility increases conversion rates. It also ensures no customer is turned away due to payment method limitations.

What are the Benefits of Using CardSave Payment Extension with Magento 2?

1. Enhanced Customer Experience

The CardSave payment extension simplifies the checkout process. Customers can quickly enter card details on a hosted payment page, reducing cart abandonment. The extension also ensures a seamless payment experience and supports multiple payment options. It makes it a convenient option for users.

2. Improved Security

CardSave extension ensures secure online payments by using advanced encryption. Card data is stored on CardSave's server, not your site. It reduces fraud risks. The Magento 2 CardSave hosted payments use a hash method for added safety so that customers can trust the platform for safe transactions.

3. Business Efficiency

The integration of Magento 2 with CardSave streamlines operations. It automates payment processing, saving time. The extension integrates Magento 2 with the UK's popular CardSave payment gateway. It eliminates manual errors, and businesses can gain better control over transactions.

4. Increased Conversion Rates

The Magento 2 CardSave payments extension offers a smooth payment process. Customers don't need to leave your site to pay. The hosted payment page is user-friendly. It ensures quick transactions that lead to higher conversion rates and better sales.

How to Integrate CardSave Payments with Magento 2?

1. Prerequisites

Ensure Magento 2 Version Compatibility

- Check Your Magento Version

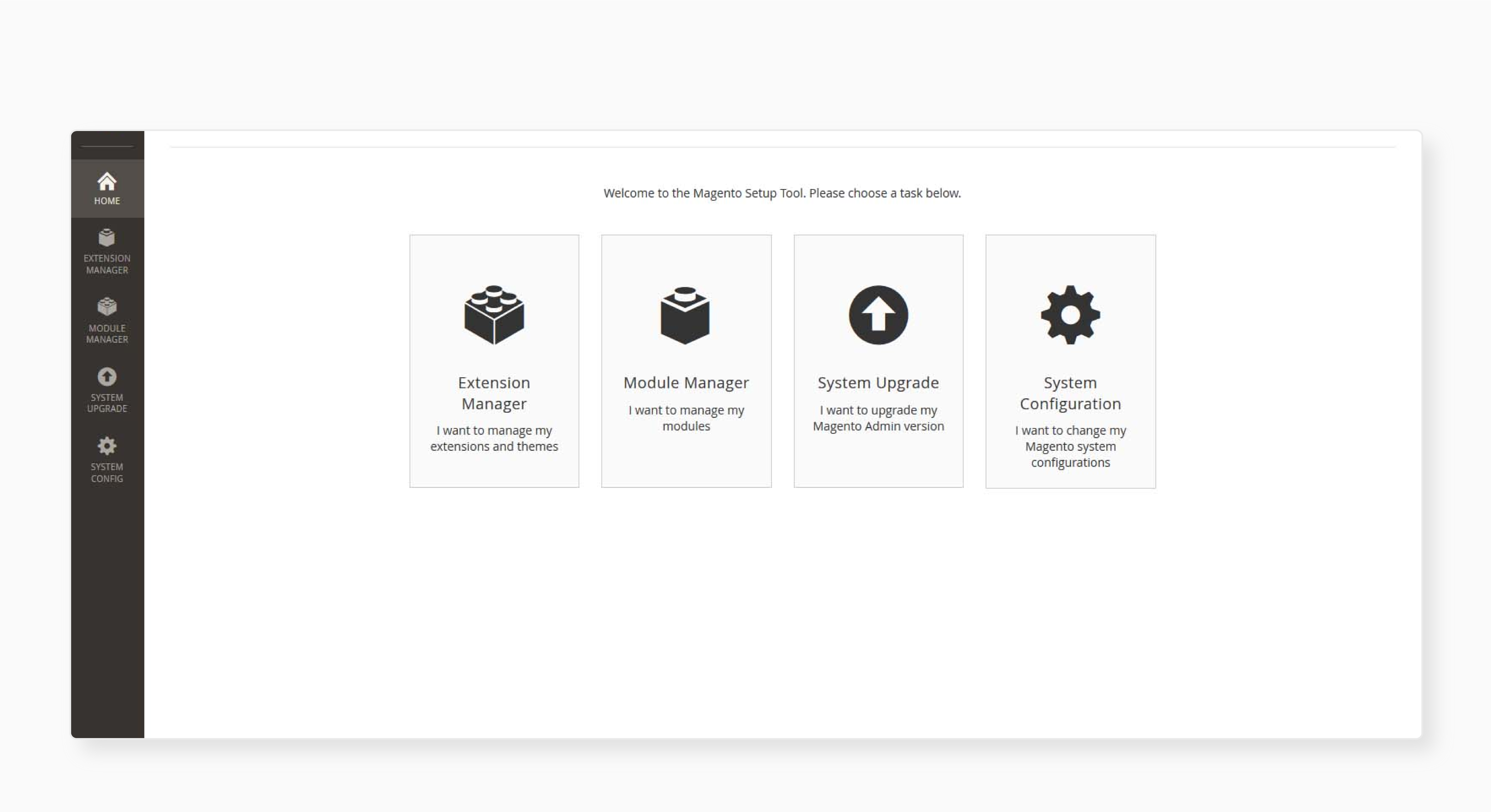

Log in to your Magento admin panel. Go to System > Tools > Web Setup Wizard.

Click on System Configuration to view your current Magento version.

-

Verify Compatibility

Visit the extension provider's website. Check the documentation for the Magento 2 CardSave payments extension. Ensure your Magento version is supported.

Set Up a CardSave Account

-

Visit CardSave's Website

Go to CardSave's official website. Sign up for a merchant account if you don't have one.

-

Complete the Application Process

Provide the required business details. Submit the necessary documents for verification.

Obtain API Credentials

-

Log in to Your CardSave Account

After your account is approved, log in to the CardSave merchant portal using your merchant ID.

-

Navigate to API Settings

Go to Settings > API Credentials in your CardSave dashboard.

-

Generate API Credentials

Request a pre-shared key and other API details. Save these credentials securely.

2. Step-by-Step Integration

Install the CardSave Payment Extension for Magento 2

-

Download the Extension

Visit the Magento 2 Marketplace or the developer's website. Download the Magento 2 CardSave payments extension.

-

Upload to Your Magento Store

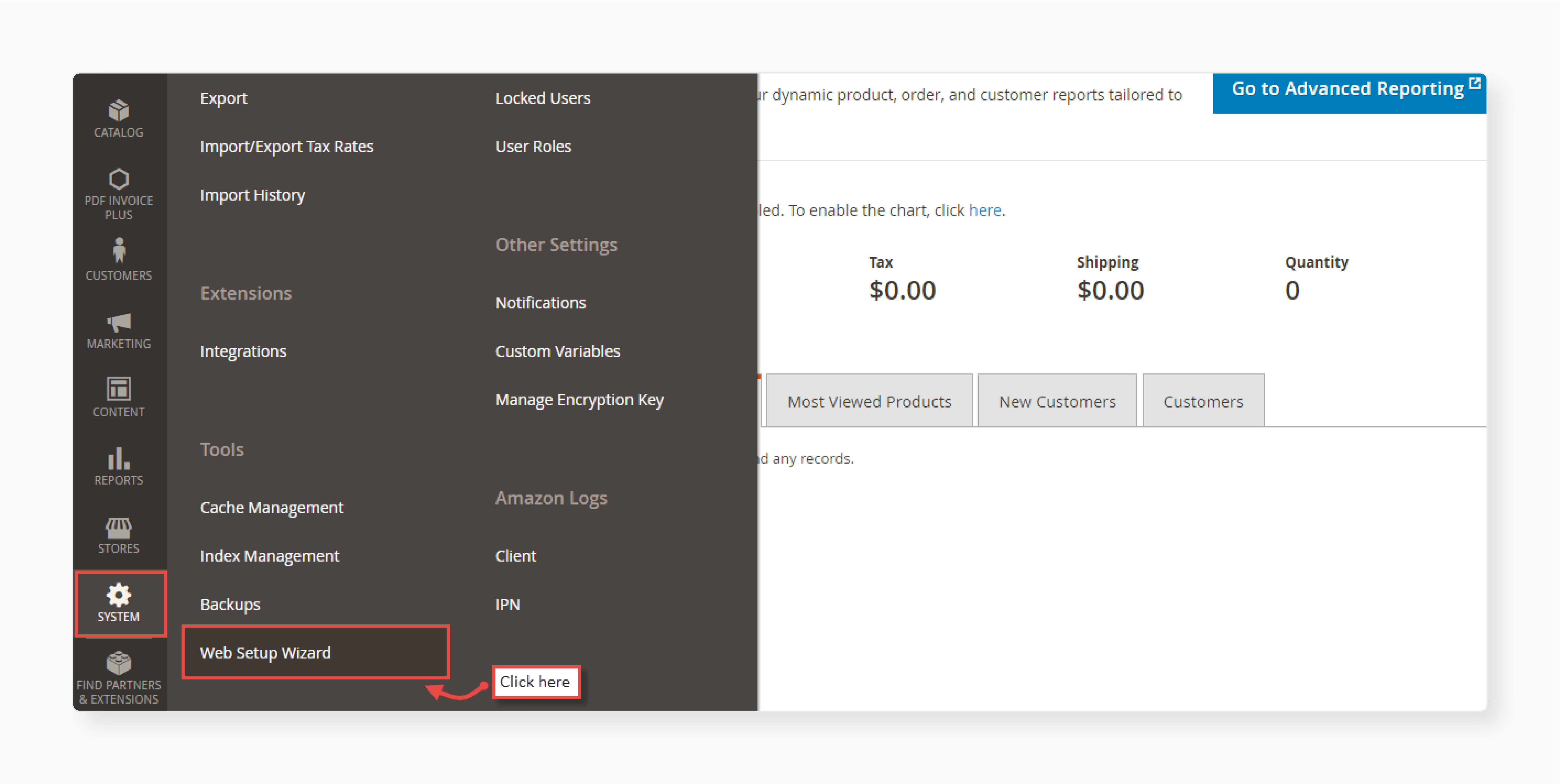

Go to your Magento admin panel. Click on System > Web Setup Wizard > Component Manager. Then, upload the extension file here.

-

Run Installation Commands

Access your server via SSH. Run the following commands:

php bin/magento setup:upgradephp bin/magento setup:di:compilephp bin/magento cache:flushIt installs the module and integrates Magento 2 with CardSave's payment system.

Configure CardSave API Keys in the Magento Backend

-

Log in to the Magento Admin Panel

Enter your admin credentials to access the backend.

-

Navigate to Payment Settings

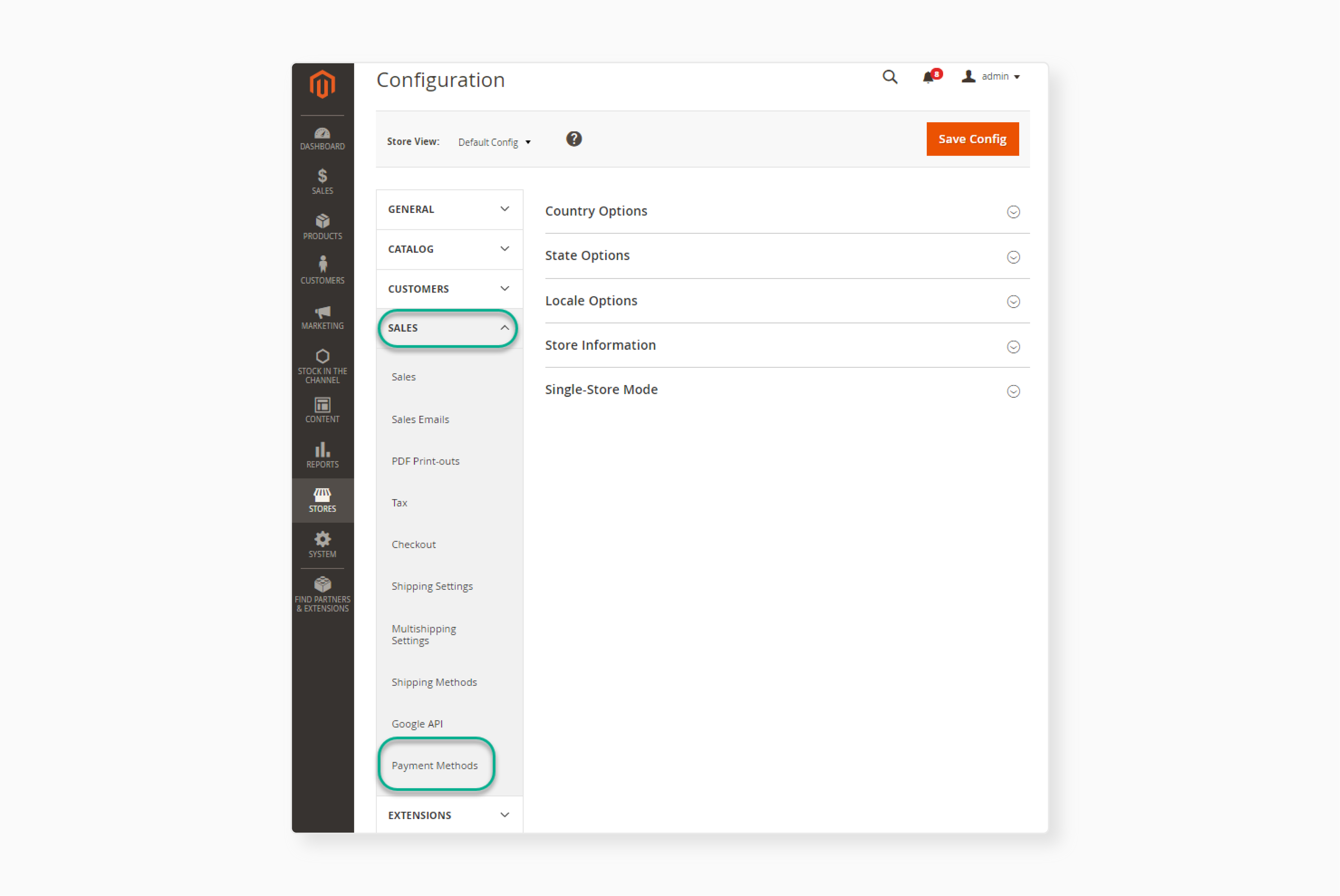

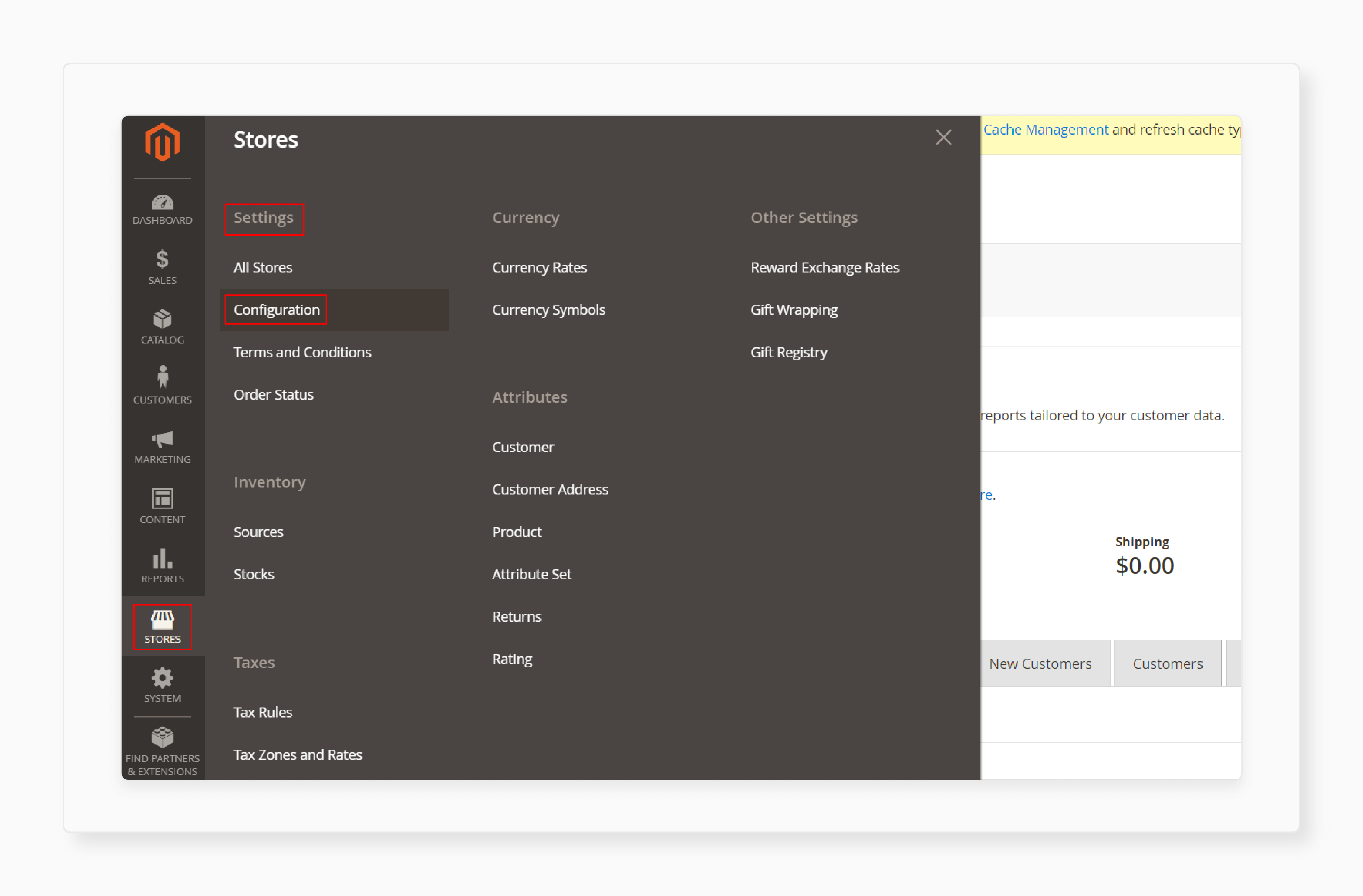

Go to Stores > Configuration > Sales > Payment Methods.

-

Enter API Credentials

Scroll to the CardSave payment gateway section. Input the API credentials (pre-shared key) obtained from CardSave, then save the configuration.

Customize Payment Options

-

Set Up Supported Card Types

Enable card types like Visa and MasterCard in the same Payment Methods section.

-

Customize Hosted Payment Page

-

Go to Stores > Configuration > CardSave Settings. Adjust the design to match your store's theme.

-

Enable Stored Payment for Returning Customers

In the CardSave settings, toggle the option for stored payment. It allows customers to save card details securely.

-

Align Payment Process with Your Brand

Ensure the hosted payment page reflects your brand's colors and logo. Test the flow to confirm consistency.

3. Testing and Verification

Test in a Sandbox Environment

-

Enable Sandbox Mode

-

Go to your Magento admin panel. Navigate to Stores > Configuration > Sales > Payment Methods.

-

Find the CardSave payment gateway section. Enable the Sandbox Mode option. Save the configuration.

-

-

Mimic Transactions

-

Visit your Magento store as a customer. Add products to the cart and proceed to checkout.

-

On the hosted payment page, enter the test card details provided by CardSave. Complete the transaction.

-

-

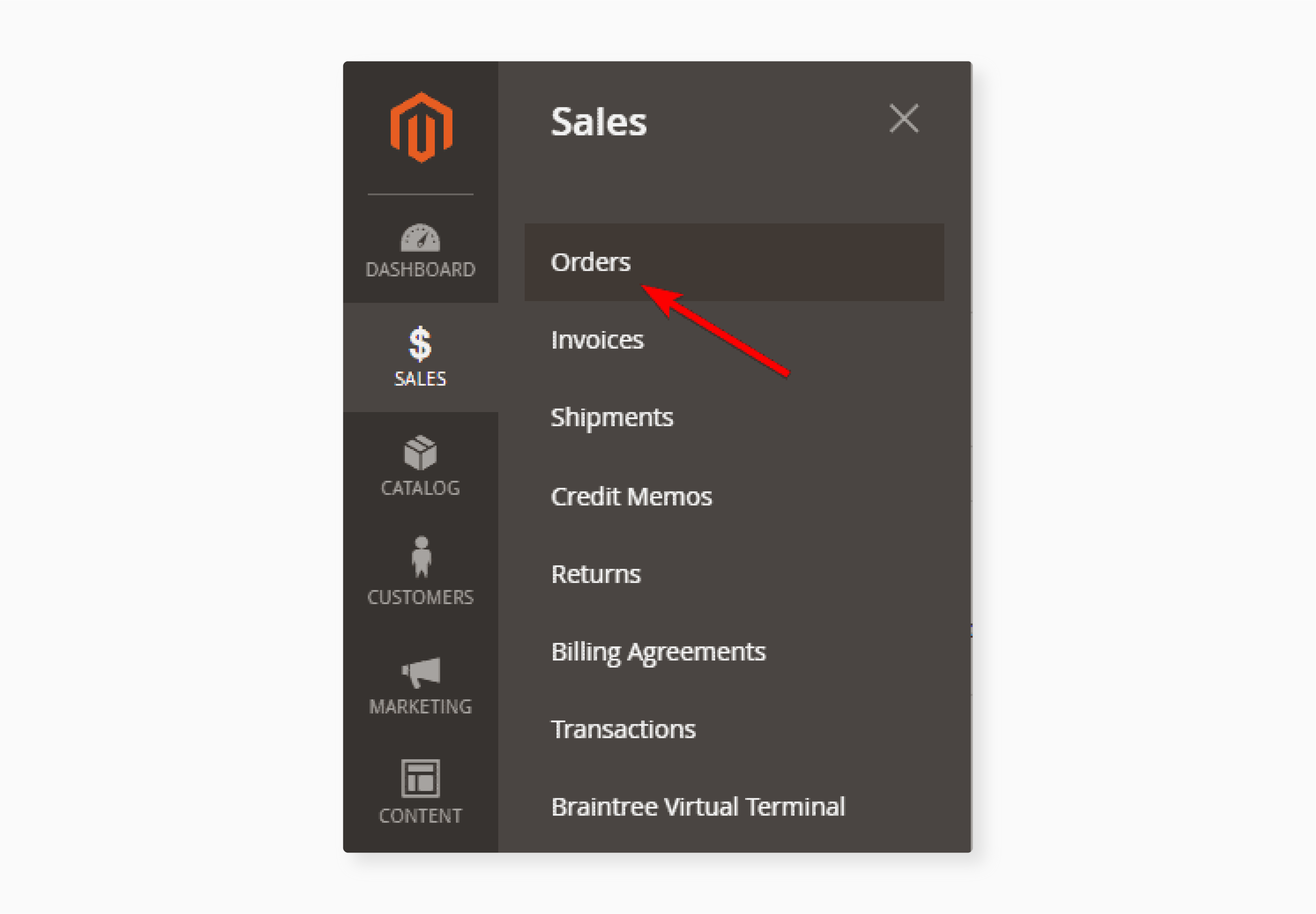

Verify Order Placement

To check if the order has been successfully placed, go to Sales > Orders in your Magento admin panel and confirm that the test order appears without issues.

Ensure Payment Transactions Work as Expected

-

Test Successful Transactions

You can make payments using valid test card details. Then, confirm that the order has been processed and the payment details have been recorded accurately.

-

Test Failed Transactions

Enter invalid card details (e.g., wrong CVV or expired date). Verify that the payment fails and that the customer receives an appropriate error message.

-

Check Hosted Payment Page Security

Ensure card data on the hosted payment page is encrypted. Look for HTTPS in the gateway URL and a padlock icon in the browser.

-

Verify Payment Details Processing

Go to Sales > Orders in your Magento admin panel. Open the test orders and confirm payment details are captured correctly.

4. Deployment to Live Environment

Final Checks Before Going Live

-

Review Magento Backend Settings

- Log in to your Magento admin panel. Go to Stores > Configuration > Sales > Payment Methods.

- Scroll to the CardSave payment gateway section. Verify all settings are correct.

-

Ensure CardSave Payment Gateway is Active

Confirm that the CardSave gateway is enabled in the same Payment Methods section. If it is inactive, toggle the Enabled option to "Yes."

-

Double-Check API Keys and Payment Options

Ensure the API credentials (pre-shared key) are entered accurately. Verify that supported card types and other payment options are correctly configured.

Go Live with CardSave on Your Store

-

Switch from Sandbox to Live Mode

Locate the Mode option in the CardSave payment gateway settings. Change it from Sandbox to Live, then save the configuration.

-

Inform Your Team

Notify your team about the new payment system. Provide training if necessary. Ensure everyone understands the process.

-

Monitor Transactions Closely

After going live, monitor transactions. Go to Sales > Orders in your Magento admin panel and check for issues in the initial days.

Troubleshooting Magento 2 CardSave: Common Issues and Fixes

1. Payment Gateway Not Appearing at Checkout

-

The CardSave payment gateway may not appear if it is disabled or improperly installed. Check the Magento backend settings to ensure the gateway is enabled and the extension is correctly installed.

-

Go to Stores > Configuration > Sales > Payment Methods to fix this. Enable the CardSave payment gateway. Then, verify that the extension is installed correctly by checking the module status in System > Web Setup Wizard > Component Manager.

2. API Credentials Not Working

-

Incorrect or outdated API credentials can prevent the payment gateway from functioning. It can happen if the pre-shared key or other details are entered incorrectly or have expired.

-

To resolve this, log in to your CardSave account. Verify the API credentials, including the pre-shared key. Update these details in Stores > Configuration > CardSave Settings. Save the configuration and test the payment process again.

3. Sandbox Mode Not Functioning

-

Sandbox mode may not work if it is not enabled or configured correctly. It prevents you from testing transactions using test card details provided by CardSave.

-

To fix this, go to Stores > Configuration > CardSave Settings. Enable Sandbox Mode. Use the test card details provided by CardSave to mimic transactions. Ensure the sandbox environment is functioning correctly before switching to live mode.

4. Payment Transactions Failing

-

Transactions may fail if customers enter invalid or expired card details. It can also occur due to incorrect configuration or issues with the payment gateway.

-

To troubleshoot, ensure customers enter valid card details. Test with different card types like Visa or MasterCard. Check the CardSave logs for error messages and verify the payment settings in the Magento backend.

5. Hosted Payment Page Not Loading

-

The hosted payment page may not load due to network issues or incorrect configuration. It can disrupt the checkout process and lead to cart abandonment.

-

To resolve this, check your internet connection. Verify the CardSave settings in Stores > Configuration. Ensure the hosted payment page URL is correct. If the issue persists, contact CardSave support for assistance.

6. Order Not Being Recorded in Magento

-

Orders may not be recorded if the payment success callback does not work. It can happen due to incorrect callback URL settings or server issues.

-

To fix this, go to Stores > Configuration > CardSave Settings. Verify the callback URL is correctly set. Test the payment process in sandbox mode to ensure orders are recorded properly in Sales > Orders.

7. Security Warnings on the Payment Page

-

Security warnings may appear if your site lacks an SSL certificate or has mixed content. It can make customers hesitant to complete their purchases.

-

To resolve this, ensure your site uses HTTPS. Check the browser console for mixed content warnings. If necessary, install a valid SSL certificate. It provides a secure and trustworthy payment process.

8. Delayed Payment Processing

-

Delayed payment processing can occur due to server latency or high traffic. It can frustrate customers and lead to abandoned carts.

-

To fix this, check your server's performance and uptime. Optimize your Magento eCommerce store for better speed. If the issue persists, contact CardSave support to investigate potential delays in their payment platform.

9. Customer Data Not Saving

-

Customer data may not be saved if the stored payment option is not enabled. It prevents returning customers from using saved card details for faster checkout.

-

To resolve this, go to Stores > Configuration > CardSave Settings. Enable the Stored Payment option. Ensure customers consent to save their card details. Test the feature to confirm it works as expected.

10. Error Messages During Checkout

-

Error messages during checkout can result from extension conflicts or an outdated Magento version. It can disrupt the payment process and confuse customers.

-

To troubleshoot, update Magento and the CardSave extension to the latest version. Disable other payment extensions to check for conflicts. Review Magento logs in System > Logs for detailed error messages and address them accordingly.

What are the Alternatives to CardSave for Magento 2

1. Stripe

Stripe is a global payment gateway that supports multiple currencies. It offers advanced features such as subscription billing and supports Apple Pay and Google Pay. It is also developer-friendly and easily integrates with Magento 2.

2. PayPal

PayPal is one of the most widely used payment gateways. It supports instant payments and offers buyer protection. PayPal is ideal for businesses targeting international customers. It also supports One-Click Checkout for faster payments.

3. Authorize Net

Authorize.Net is a payment gateway with features like fraud detection and recurring billing. It is suitable for businesses in the US and Canada. It supports both card and bank payments.

Pros and Cons of CardSave vs Competitors

| Feature | CardSave | Stripe | PayPal | Authorize.Net |

|---|---|---|---|---|

| Global Reach | Limited to the UK | Global | Global | Primarily US and Canada |

| Fees | Competitive rates for UK businesses | Transparent pricing | Higher fees for international transactions | Moderate fees |

| Ease of Integration | Easy with Meetanshi's Magento 2 extension. (Meetanshi has developed Magento 2 CardSave Extension) | Easy with Magento 2 plugins | Easy with Magento 2 plugins | Requires additional setup |

| Security | Uses CardSave's hosted payment page for secure transactions | PCI-compliant with advanced fraud tools | Strong buyer protection | Advanced fraud detection |

| Customer Experience | Smooth checkout with stored payment options | Seamless with support for digital wallets | Trusted by customers worldwide | Reliable but less user-friendly |

When to Choose CardSave Over Other Options

-

UK-Based Businesses: CardSave is ideal for UK businesses due to its localized support and competitive rates.

-

Secure Transactions: If you want a safe and spam-free online payment process, CardSave's hosted payment page ensures security.

-

Stored Payment Options: CardSave allows customers to save card details for faster checkout, improving the user experience.

-

Small and Medium Businesses: CardSave is a cost-effective credit card processing service for small and medium businesses.

FAQs

1. How does CardSave work with Magento 2?

CardSave works with Magento 2 by using a Magento extension to process payments. Customers can enter the card details at checkout. With CardSave, merchants have complete control over the transactions through Magento 2.

2. Is CardSave suitable for small businesses?

Yes, CardSave is excellent for small businesses. It provides an online payment system with the UK's popular CardSave gateway. Customers have to add the card data details once. The payment facility with the UK's popular CardSave ensures fast and easy payments.

3. How secure is CardSave for Magento 2 payments?

CardSave ensures online payment security by not storing credit card data on Magento. Card details are taken and processed securely on the CardSave server. Businesses using the module for Magento 2 can offer safe and spam-free online transactions.

4. Can CardSave handle transactions out of the UK?

CardSave mainly supports UK transactions. But, it depends on the CardSave payment details and merchant agreements. Some businesses may need extra verification to accept global payments. Always check before using the CardSave payments extension.

5. What are the fees associated with using CardSave in Magento 2?

CardSave charges based on transaction type. Fees may include monthly costs and processing rates. Exact costs depend on business size and agreement. Always check CardSave's payment information for up-to-date pricing.

Summary

Magento 2 CardSave Payments simplifies payment processing for e-commerce stores. It enhances transaction security, improves user experience, and ensures smooth integration by:

-

Offering customizable checkout options for a branded payment experience.

-

Minimizing fraud risks with secure encryption and tokenization.

-

Supporting stored payment options for returning customers.

-

Allowing easy troubleshooting with sandbox testing and real-time verification.

-

Reducing manual workload by automating transaction management.

Boost your store's security and speed with managed Magento hosting.