Magento 2 3D Secure 2.0: Authentication And Braintree Integration

Are you looking for a way to secure your Magento store against online payment fraud? Magento 2 3D Secure feature adds an extra layer of protection during checkout.

This tutorial will cover how to configure and implement 3D Secure in Magento 2.

Key Takeaways

- Benefits of testing the setup in a sandbox environment with different payment methods.

- Implement and manage 3D Secure with ease in the Magento admin panel.

- Get access to various payment gateways and credit card schemes.

- Provide an additional layer of security for online transactions.

- Reduce chargebacks and fraud by authenticating cardholders.

- Support integration with multiple payment gateways like Braintree, Visa, and Mastercard.

- Reduce fraudulent transactions and chargebacks.

-

Implementation Of 3D Secure Options For Magento 2 Integration

-

13 Steps To Configure Secure Payment Option With 3D Secure Magento 2 Extension

-

Best Practices For Validating Payer Authentication Using 3D Secure

What Is 3D Secure 2?

Magento 2 3D Secure is a payment authentication protocol.

Subscribe Pro supports 3D Secure 2 (3DS2) as part of its M2 extension. It makes the configuration process simple. It is a protocol developed by EMVCo and backed by major card networks. It adds an extra layer of security to online transactions. For example, security for card-not-present (CNP) transactions. It prevents fraudulent activities. It ensures that the person making the payment is the actual cardholder.

The protocol uses XML messages over an SSL connection. It transmits cardholder authentication data securely. Different financial institutions offer their own versions of 3D Secure. For example:

- Verified by Visa

- Mastercard SecureCode

- American Express SafeKey

- J/Secure

Benefits Of 3D Secure 2.0 For Magento 2 Merchants

1. Frictionless Checkout Flow

3D Secure acceptance hosted checkout introduces a frictionless checkout flow. It performs risk-based authentication. It reduces the need for cardholder participation. Thus, it makes transactions smoother and more secure. For example, device information, transaction history, and behavioral patterns.

2. Non-Payment Authentication

3D Secure 2.0 allows for non-payment authentication. It enables cardholders to be authenticated even without making a purchase. It is helpful for adding credit cards to e-wallets.

3. Native Mobile Integration

3D Secure payment processor includes a mobile SDK component. Merchants can natively integrate the 3D Secure process into their mobile apps. Also, it enhances the mobile checkout experience.

4. Better Performance

3D Secure payment data improves end-to-end message processing. It leads to faster transactions and a more seamless customer experience. For example, JSON can be used instead of XML for data exchange. It allows for faster processing and reduced latency.

5. Prevention of Unauthenticated Payments

The 3D Secure checkout page provides protection against unauthorized payments. For example, even if card details are stolen or cloned. It verifies the cardholder's identity through additional authentication measures. The multi-factor authentication combines something the customer knows.

For example, password + mobile device + fingerprint. It makes it much more difficult for fraudsters to complete unauthorized transactions.

6. Reduced Fraud

By authenticating the cardholder, 3D Secure card data helps prevent unauthorized transactions. It reduces the risk of fraudulent activities.

7. Lower Chargeback Risk

Verified transactions are less likely to result in chargebacks. It protects your business from financial losses and reputational damage.

8. Lower Chargeback Risk

Verified transactions are less likely to result in chargebacks. It protects your business from financial losses and reputational damage.

9. Improved Customer Confidence

Customers feel more secure knowing their payments are protected. It leads to increased trust and loyalty.

10. Compliance

Understanding 3D Secure helps meet PSD2 and Strong Customer Authentication (SCA) requirements. In certain regions, it ensures regulatory compliance.

How Does Magento 2 3D Secure Authentication Work?

Visa originally developed 3D Secure to promote secure online transactions. Some examples of 3D Secure solutions include CardinalCommerce Consumer Authentication. It is a global leader in digital transaction security and a subsidiary of Visa.

It is recommended to use 3D Secure to:

- Ensure compliance with online payment regulations such as PSD2 SCA.

- Benefit from a liability shift, where the responsibility for fraudulent chargebacks moves from the merchant to the issuing bank. It is done once the transaction is authenticated through 3D Secure.

3D Secure 2.0 offers:

- Improved authentication methods

- Enhanced data sharing between merchants and issuers

- A smoother authentication flow

In Magento 2, 3D Secure works by adding an extra verification step during checkout. It requires the cardholder to provide a password or a code sent by the issuer.

It reduces the risk of fraud and ensures safe payment processing. For instance:

- When a customer makes a payment, they're redirected to a 3D Secure authentication page.

- The customer is then asked to verify their identity using a password or a one-time code sent to their phone.

- Once the customer is verified, the transaction is processed, and the payment is made.

The confirmation usually appears as a popup. The customers are redirected to the bank’s page or an iframe provided by the issuing bank. The popup or iframe includes a field. Here, the customer can enter an SMS code, password, or one-time token for verification.

Since the cardholder’s issuing bank supplies the popup or iframe, it ensures the cardholder’s identity is securely verified. 3D Secure verification is optimal for all online merchants. However, it can sometimes be bypassed. It can occur even if the cardholder has enabled 3D Secure for their account.

Comparison Between 3D Secure And PSD2

| Features | PSD2 (SCA) | 3D Secure |

|---|---|---|

| Authentication Requirements | Requires at least two factors: something the customer knows, has, or is. | Uses 3D Secure protocol for authentication. It can include multi-factor authentication. |

| Applicability | Applies to online payments in the EU (including the UK). It could extend to "non-EU" customers. | Applicable to both low-risk and high-risk transactions. It provides exemptions for low-value and recurring transactions. |

| Liability Shift | Shifts liability from merchants to issuers for fraudulent transactions. | Provides liability shift from merchants to issuers for covered transactions. |

| Implementation Timeline | - April 2019: Issuing banks encouraged to get "3DS 2.0" ready. - September 14, 2019: SCA goes into effect for European e-commerce transactions. - October 11, 2019: "3DS 2.0 Scheme mandate" for Europe goes into effect |

- 2020 and onward: 3DS 2.0 launches worldwide. |

| Exemptions | Exemptions for low-value transactions (below "€30"). They also include recurring transactions and trusted beneficiaries. | Includes exemptions similar to "PSD2". It offers additional considerations for merchant-initiated transactions and corporate payments. |

| Impact on Merchants | Merchants must update payment integrations to support "SCA". It can be regardless of location. | Merchants using 3D Secure must ensure compatibility with "3DS 2.0". It helps you to avoid declined payments. |

3D Secure Versions For Handling Payment Service

1. 3D Secure 2

The previous version redirects customers to a separate site. 3D Secure 2 allows the card issuer to authenticate the shopper directly within your app or payment form. The issuer can use methods to verify the shopper's identity, such as:

- Passive

- Biometric

- Two-factor authentication

2. 3D Secure 1

In this version, customers are redirected to the card issuer's site for authentication. Here, they provide additional information, such as a password or SMS verification code. This redirection process can sometimes result in lower conversion rates. It is due to technical issues or customers abandoning the authentication step.

3D Secure 1.0 vs. 3D Secure 2.0

| Features | 3D Secure 1.0 | 3D Secure 2.0 |

|---|---|---|

| Verification Flow | Standard verification flow requiring customer input. | Streamlined verification flow using contextual data. |

| Customer Authentication | Requires the customer to authenticate for every transaction. | Context-aware authentication reduces friction. |

| Risk Assessment | Less sophisticated risk assessment. | Advanced risk assessment based on contextual data. |

| Integration with Merchants | Basic integration with merchants’, requiring more technical input. | Enhanced integration options for merchants, allowing more straightforward implementation. |

| Response Handling | Responses often require merchants to handle them manually. | Improved response management through automated systems. |

| User Experience | Popup or iframe can disrupt the user experience. | Smoother user experience with fewer disruptions. |

| Support for Non-Payment Authentication | No support for non-payment authentication. | Supports non-payment authentication for adding cards to wallets. |

| Compatibility | Limited compatibility with newer systems | Fully compatible with version 1.0, ensuring continuity. |

| Transaction Risk Assessment | Manual risk assessment for every transaction. | "95%" of payment transactions are low-risk. It reduces the need for customer verification. |

| Fallback Mechanism | No fallback mechanism, resulting in failed transactions. | Automatically falls back to 3D Secure 1.0 when 2.0 is not supported. |

| Contextual Data Usage | Relies on customer input for verification. | Uses contextual data to make verification decisions. It reduces customer input. |

Implementation Of 3D Secure Options For Magento 2 Integration

Below are the following two options to integrate both 3D Secure versions with your API:

1. Redirect Authentication

It is the quickest way to support both 3D Secure 1 and 3D Secure 2. It will determine which version the card issuer supports. It will also provide a redirect URL with PSD2 SCA. It completes the authentication process, whether it's 3D Secure 1 or 3D Secure 2.

2. Native 3DS2 + Redirect 3DS1

Use our 3D Secure 2 helper functions for web and SDKs (iOS and Android). It handles 3D Secure 2 authentication within your site or app. If needed, the payment can also be routed to the 3D Secure 1 flow. For 3D Secure 1, handle the redirect in your client-side implementation. It offers a smoother shopping experience and future-proof payment authentication.

13 Steps To Configure Secure Payment Option With 3D Secure Magento 2 Extension

- Confirm that the required information has been sent to Subscribe Pro.

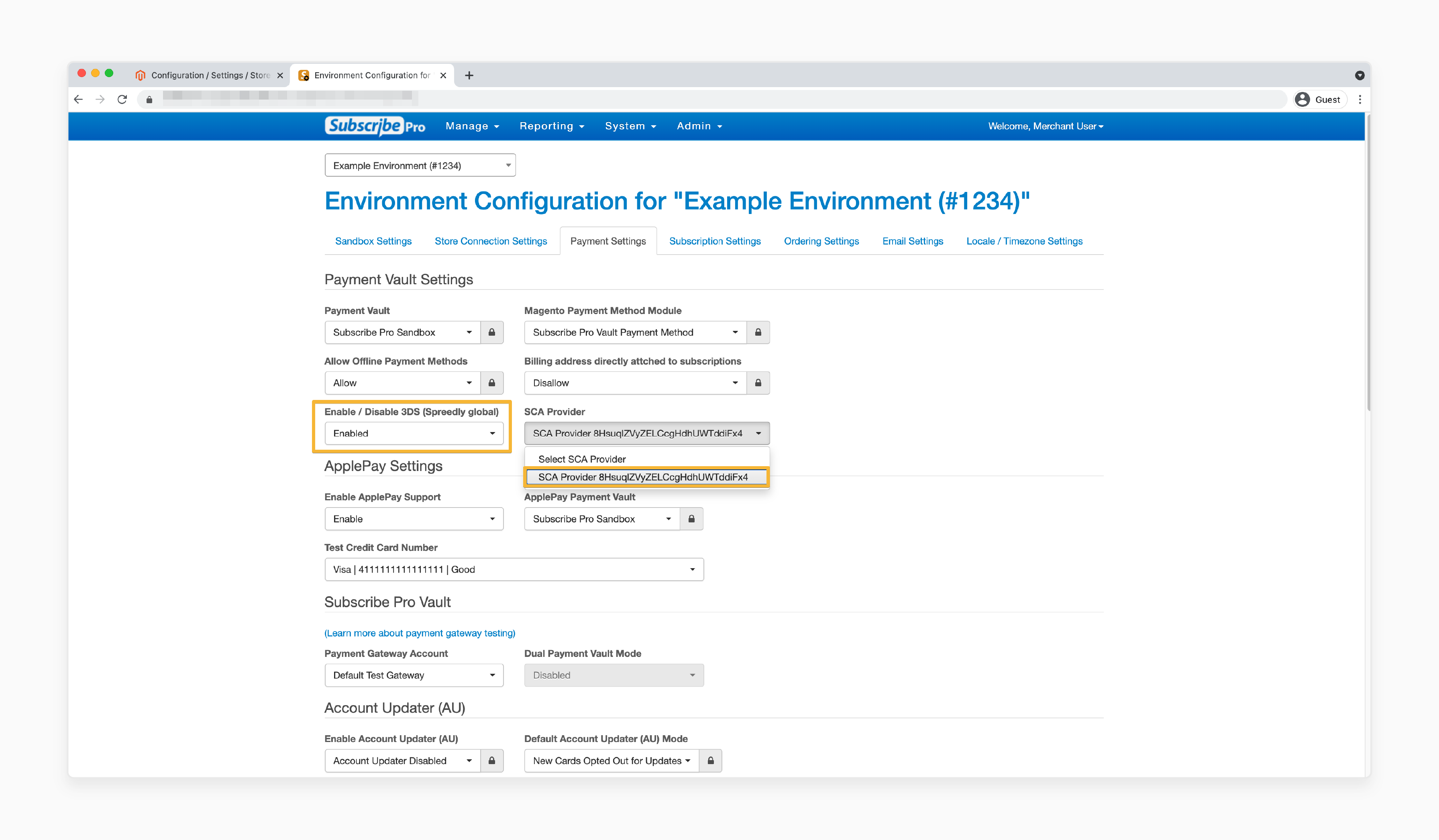

- Once this is done, create a new SCA Provider to continue the configuration process.=

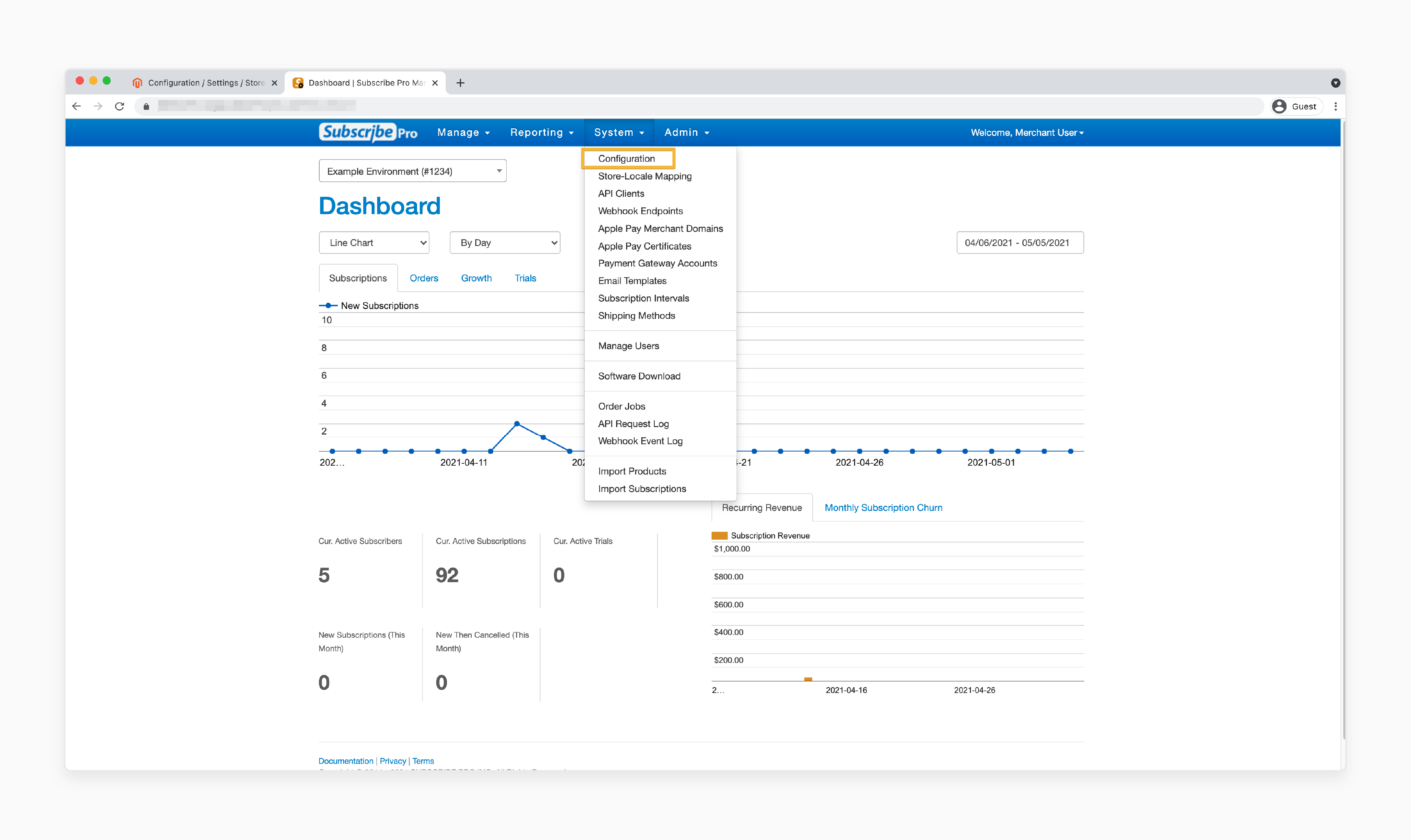

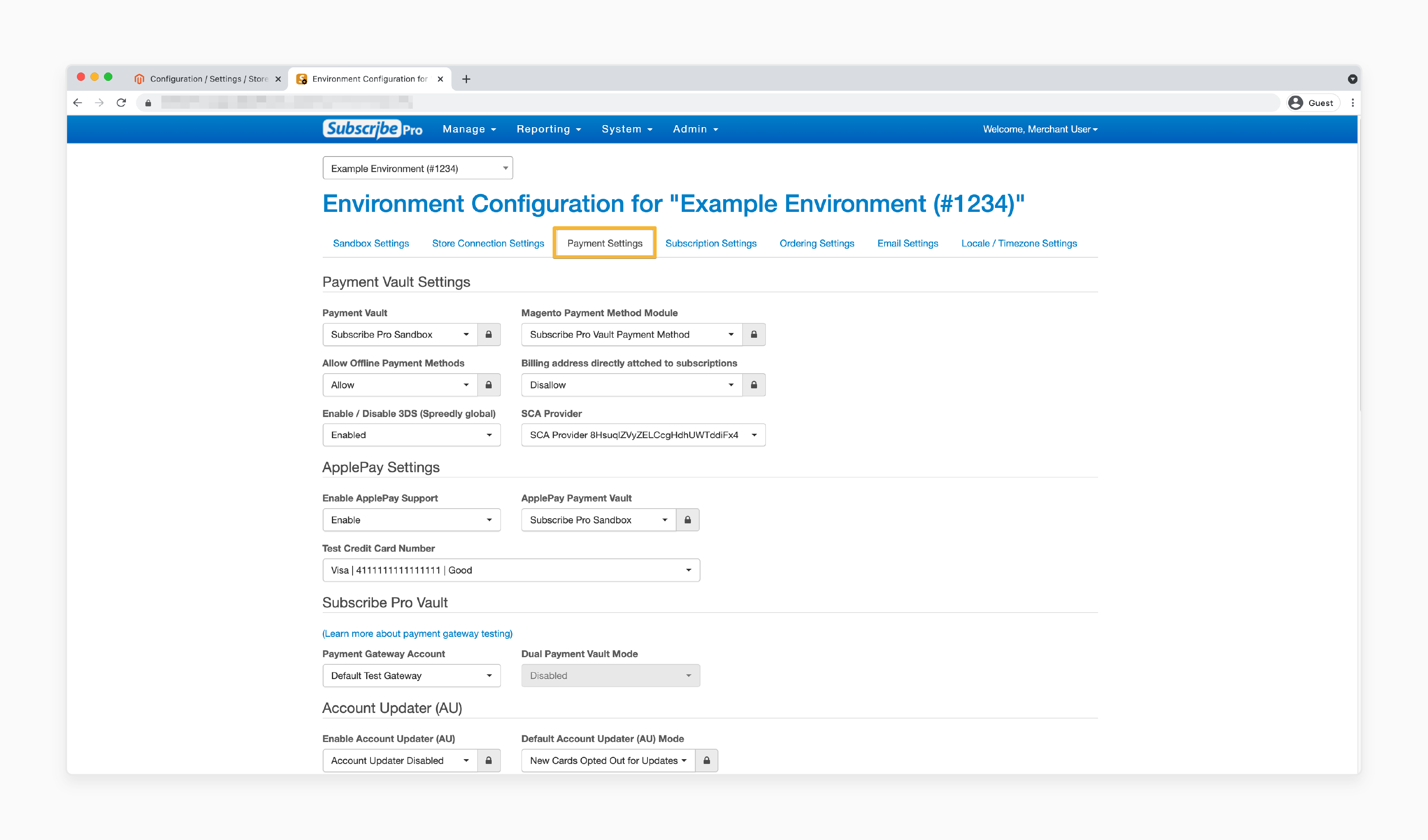

- Navigate to the 'Subscribe Pro Merchant App' under System > Configuration > Payment Settings.

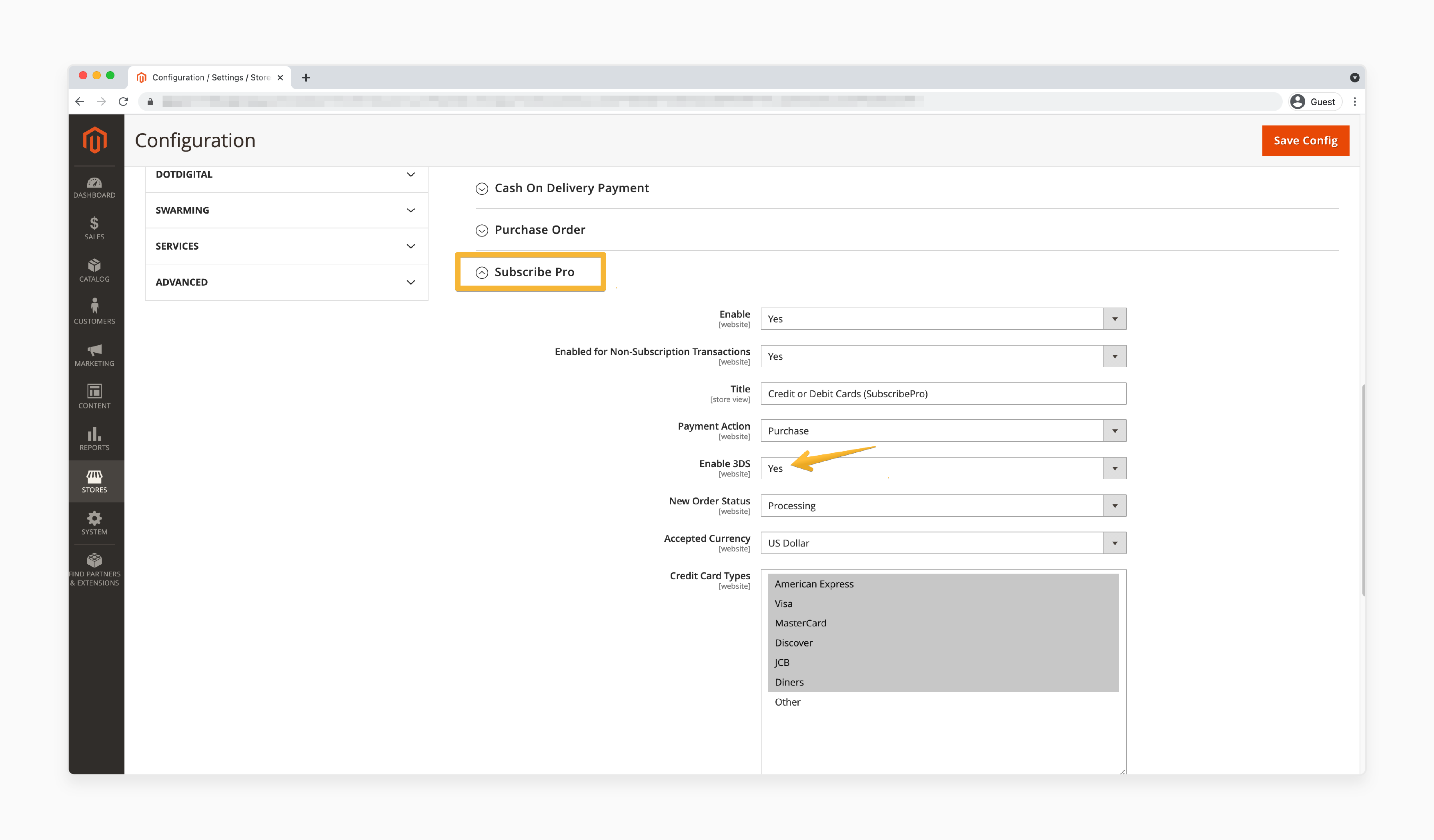

- Enable and configure '3D Secure (3DS)'.

- In the 'Merchant App', enable "3DS".

- Select the 'SCA Provider' that was created for your account.

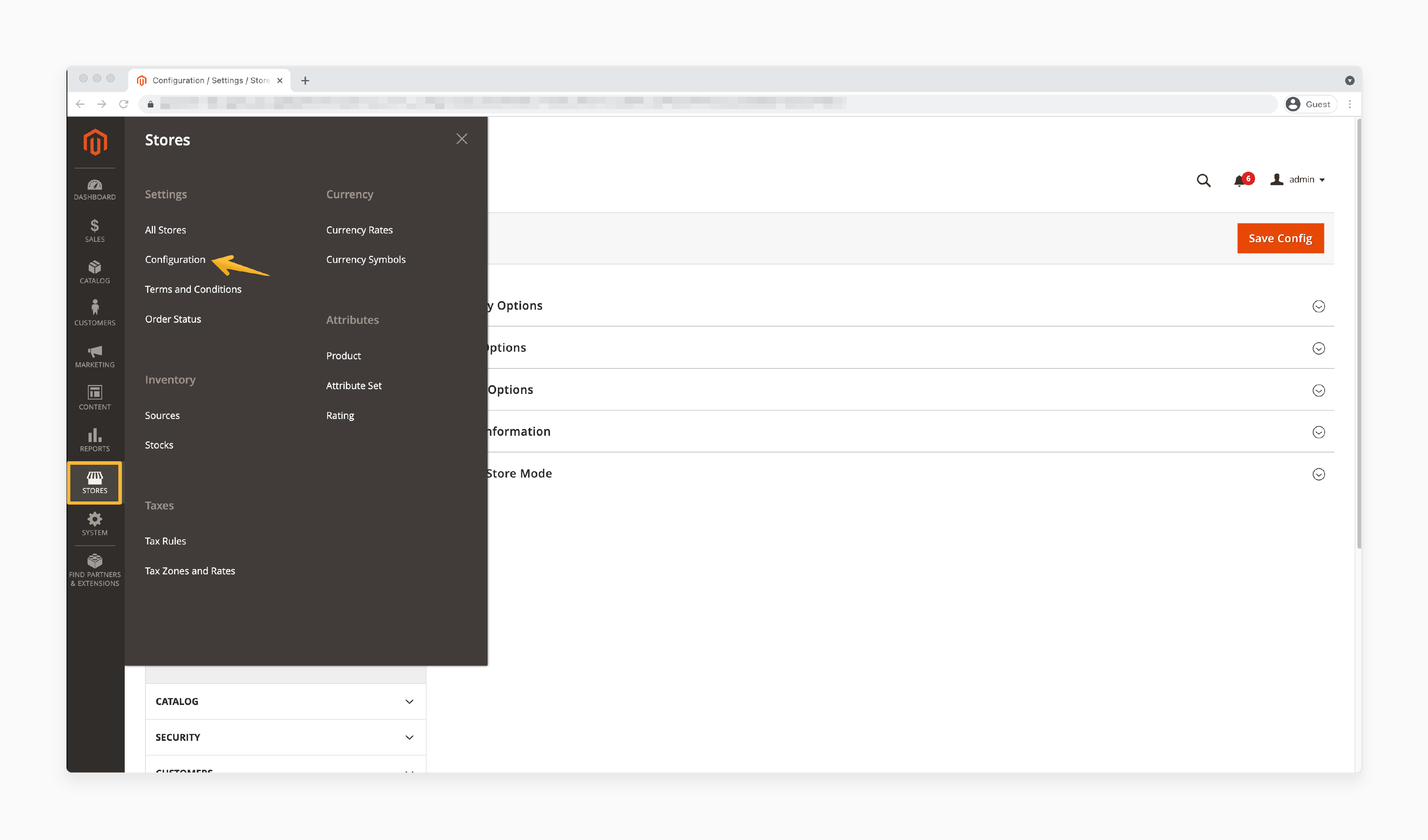

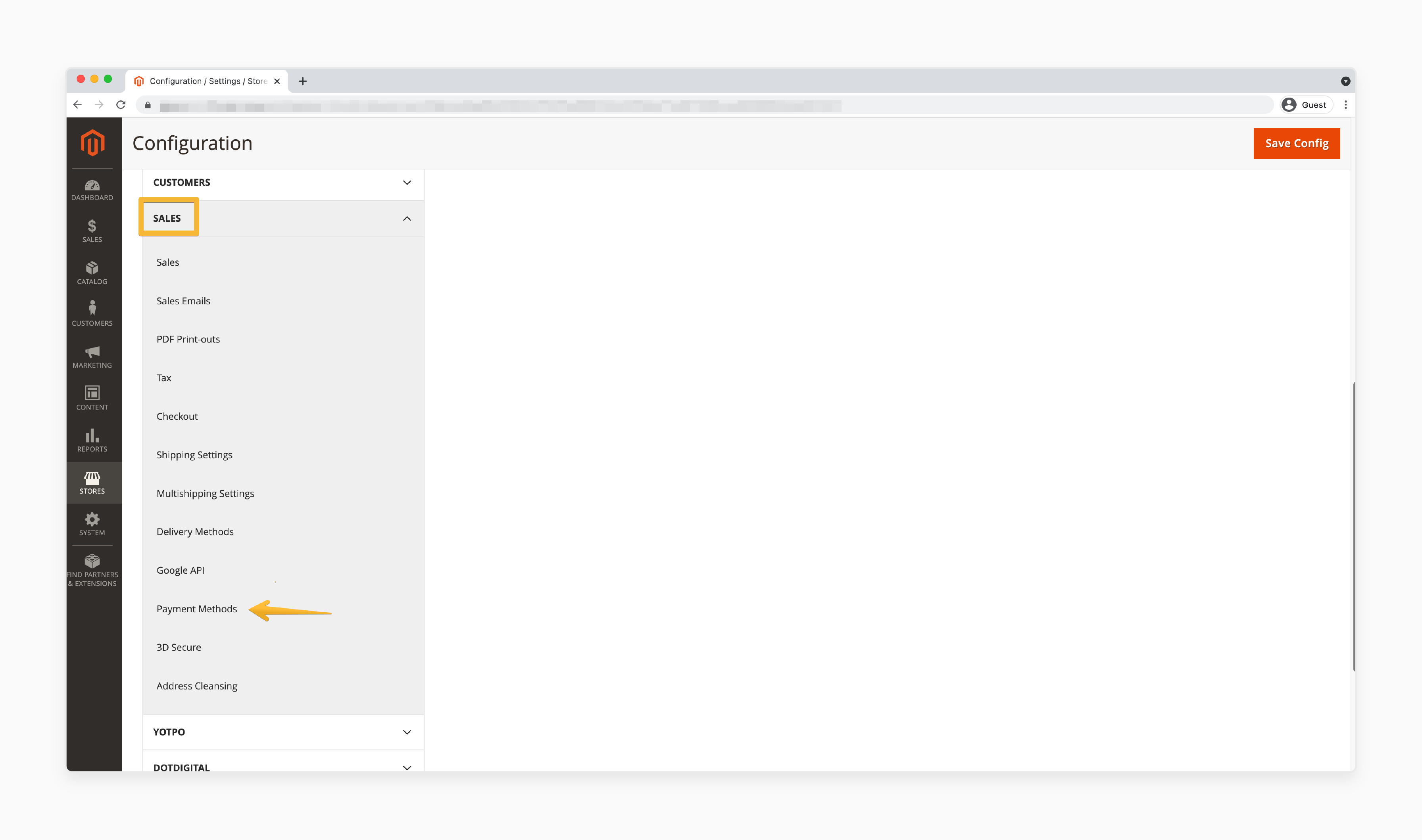

- Navigate to Stores > Configuration > Sales > Payment Methods > Subscribe Pro.

8. In the Magento 2 admin panel, enable "3DS" for your site.

8. In the Magento 2 admin panel, enable "3DS" for your site.

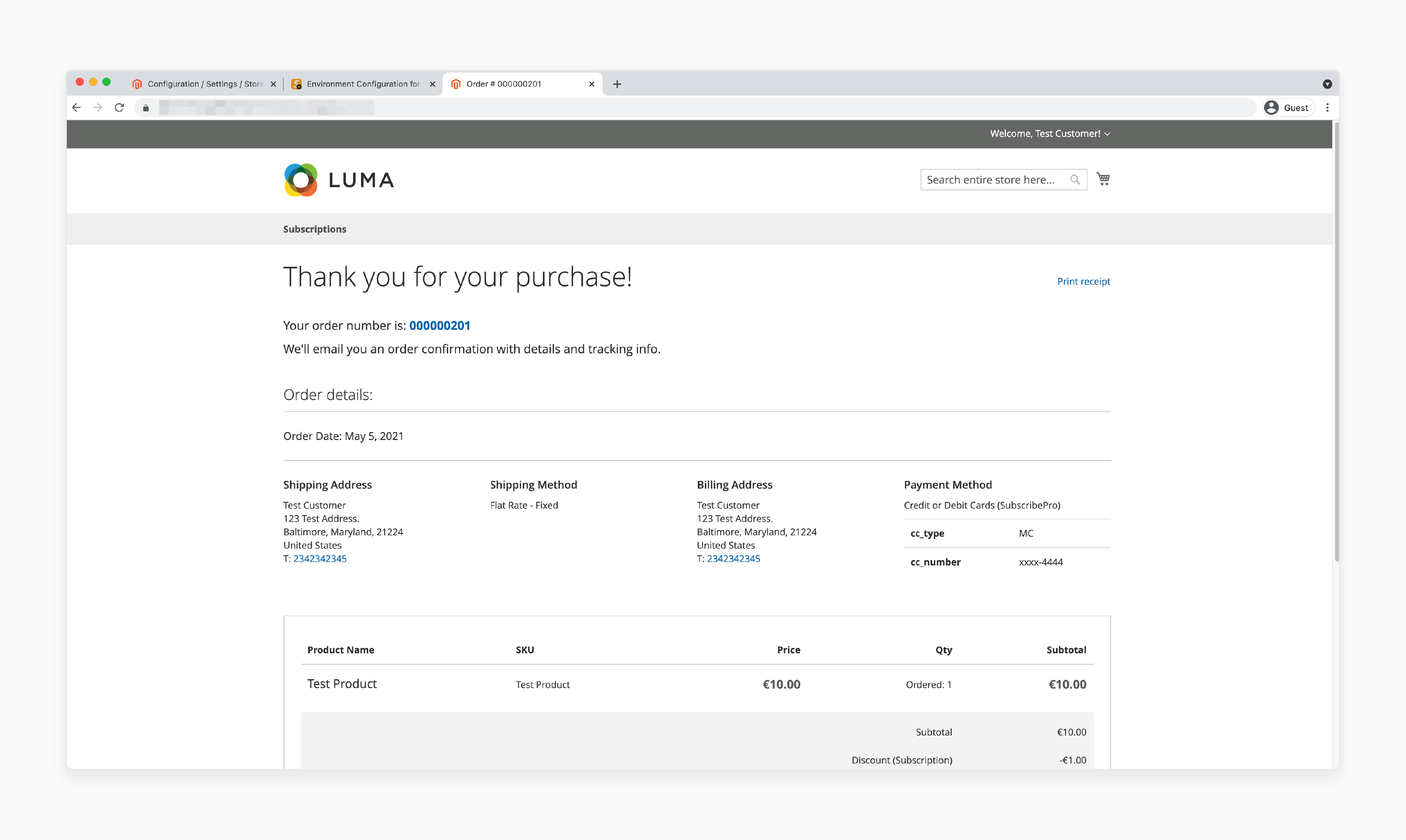

- Test it with a sample credit card.

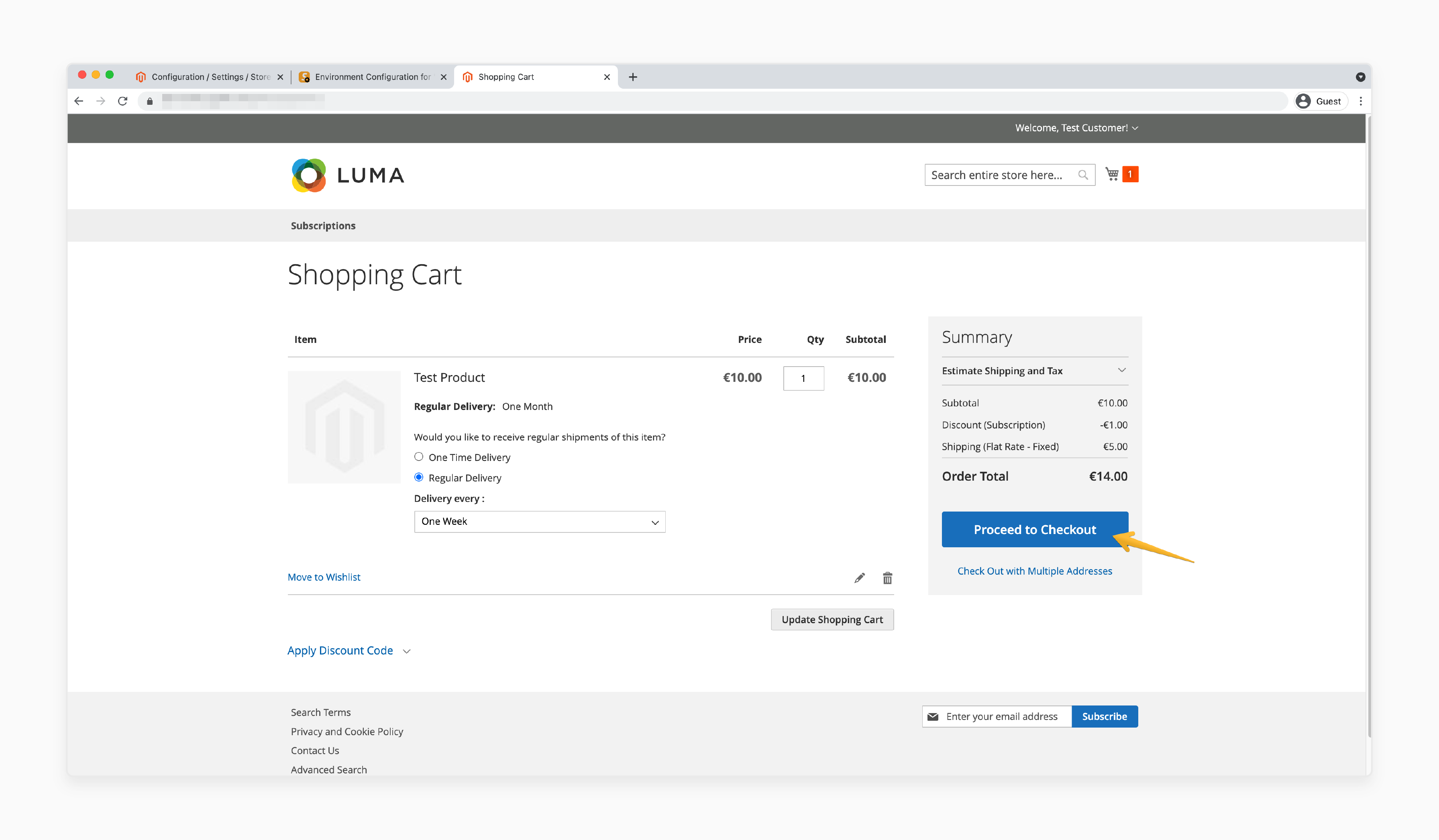

- Log in to your Magento 2 site as a customer, add a product to your cart, and proceed to checkout.

- During checkout, select a shipping address.

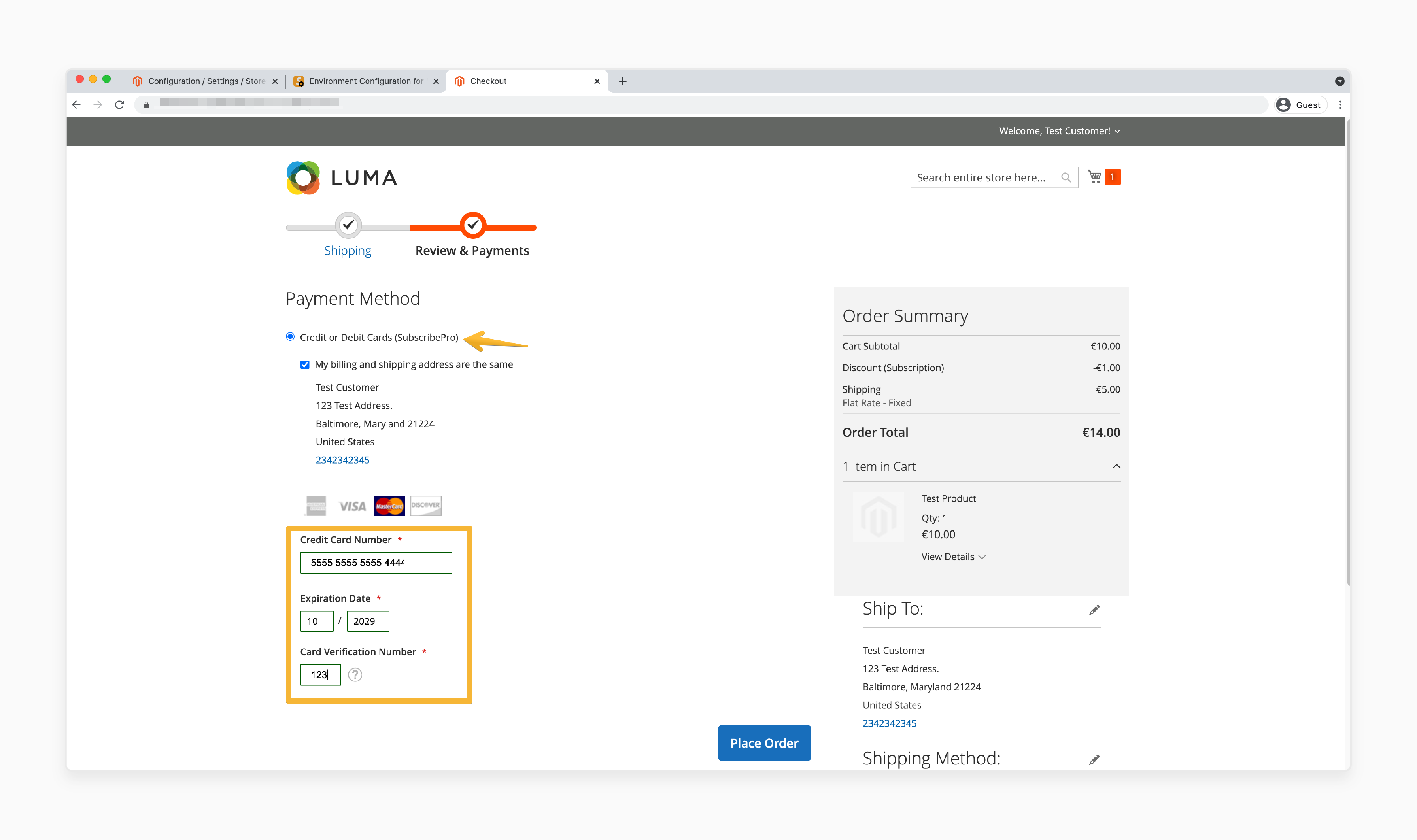

- Choose the 'Subscribe Pro' payment method, and use the following sample card:

- Card Number: 5555 5555 5555 4444

- CVV: 123

- Expiry Date: 10/2029

- Click on Place Order'.

Note: You should now see the 'Spreedly 3DS test iFrame' with a field to enter a verification code. Use the code "123456" for successful authentication. Any other code will generate an error message. Once the correct code is entered, you will be redirected to the checkout success page.

Best Practices For Validating Payer Authentication Using 3D Secure

| Best Practices | Description |

|---|---|

| Clear Communication | - Inform customers about the 3D Secure process. - Reduce confusion and improve trust. |

| Mobile Optimization | - Ensure your checkout process works smoothly on mobile devices. - Prevent technical issues. |

| Regular Updates | - Keep your Magento 2 installation and payment modules up to date. - Ensure compatibility and security. |

| Monitor Performance | - Regularly review transaction data to assess the impact of 3D Secure. - Identify areas for improvement. |

| Provide Alternatives | - Offer alternative payment methods for customers who prefer not to use 3D Secure. - Ensure flexibility and customer satisfaction. |

| Security Measures | - Implement additional security measures, such as encryption and tokenization. - Protect sensitive customer data. |

| Future-Proofing | - Future-proof your e-commerce site. - Stay up to date with the latest 3D Secure protocols and regulatory requirements. |

| User Education | - Educate customers on the benefits and process of 3D Secure. - Increase adoption and reduce friction. |

| Technical Support | - Provide technical support for customers experiencing issues with 3D Secure. - Ensure a smooth and secure checkout process. |

| Compliance | - Ensure compliance with regulatory requirements, such as PSD2 and SCA. - Avoid fines and reputational damage. |

Pros And Cons Implementing API With 3D Secure

Pros of 3D Secure Payment Provider

1. Secures Online Payment Transactions

3D Secure provides an additional layer of authentication. It significantly reduces the risk of fraudulent transactions. It also protects merchants from financial losses. Also, it considers the reputational damage associated with fraud.

2. Liability Shift

The use of 3D Secure shifts the liability for fraudulent transactions. It moves from the merchant to the card issuer. Also, it provides additional financial protection for merchants.

For example, if a fraudulent transaction occurs on a 3D Secure-enabled card, the issuing bank, not the merchant, is responsible for the chargeback. It can result in significant cost savings for merchants. They mainly occur in high-risk industries.

3. Enhanced Customer Confidence

3D Secure reassures customers that their financial information is secure. It adds an extra layer of security. It leads to increased trust and potentially higher spending.

4. Compliance with Regulatory Requirements

3D Secure helps merchants comply with regulatory requirements. For example, the Payment Services Directive 2 (PSD2). It mandates stronger customer authentication for online payments in the European Economic Area.

Cons of 3D Secure Payment Provider

1. Customer Friction

The additional authentication step can cause friction in the customer's shopping experience. It potentially leads to abandoned baskets and reduced conversion rates.

2. Implementation Costs

Setting up and using 3D Secure may incur additional costs. It can be challenging for start-ups or businesses with "low budgets".

3. Lack of Consumer Understanding

In markets where 3D Secure is not mandated, cardholders may not be familiar with the protocol. It can deter them from completing transactions and cause cart abandonment.

Troubleshooting Common Payment Action Issues With 3D Secure

| Issue | Solution |

|---|---|

| 3D Secure Not Triggering for Low-Value Transactions | - Set a lower transaction threshold. - Ensure that all transactions trigger 3D Secure verification. |

| Customers Facing Issues During Checkout | - Ensure that the iframe for 3D Secure 2 is configured correctly. - Test different browsers and devices to confirm compatibility. |

| Payment Gateway Not Supporting 3D Secure | - Verify that your payment provider, such as Braintree or Stripe, supports 3D Secure 2.0. - If not, consider switching to a provider that offers full support. |

| Authentication Failures | - Verify that the customer's card is enrolled in 3D Secure. - Check if the billing address matches the card details. - Ensure the payment gateway is correctly configured. |

| Integration Problems | - Review your payment gateway's documentation. - Check for any conflicting Magento 2 extensions. - Consult with certified Magento developers if needed. |

| Incorrect 3D Secure Configuration | - Verify that 3D Secure is enabled in your Magento 2 settings. - Check that the 3D Secure API keys are correctly configured. - Test 3D Secure in a sandbox environment before going live. |

| Browser Compatibility Issues | - Test 3D Secure in different browsers to identify compatibility issues. - Ensure that the iframe for 3D Secure 2 is configured to work with various browsers. |

| Mobile Device Issues | - Test 3D Secure on different mobile devices to identify compatibility issues. - Ensure that the iframe for 3D Secure 2 is configured to work with various mobile devices. |

FAQs

1. How does 3D Secure in Magento 2 relate to PCI compliance when processing credit and debit cards?

3D Secure enhances transaction security. It doesn't replace PCI compliance requirements. Magento Marketplace offers PCI-compliant payment extensions. They support 3D Secure for both credit and debit cards. These extensions help merchants meet Magento security standards. They provide you with the added protection of 3D Secure authentication.

2. How does Adobe Commerce (formerly Magento) protect credit card details in ecommerce transactions?

Adobe Commerce implements 3D Secure. It does this without storing sensitive credit card details on the ecommerce server. Instead, it securely transmits encrypted card information to the payment gateway for authentication. This approach enhances security in online transactions. It keeps the ecommerce platform compliant with data protection regulations.

3. Can 3D Secure in Magento 2 protect credit card data when customers use local payment methods?

Yes, 3D Secure in Magento 2 can protect credit card data. You can do this even by using email payment links via email. The authentication process is triggered regardless of how the customer accesses the payment page. However, it's important to note that 3D Secure is used for online card transactions. It may not apply to all local payment methods.

4. How does 3D Secure affect merchants and payment processes when customers want to save their cards?

Customers can opt to save their card details in Magento. 3D Secure still protects merchants and payments. For the initial transaction, full 3D Secure authentication is required. For subsequent purchases using the saved card, you may apply a streamlined version of 3D Secure. It depends on the payment provider and the range of credit options offered. This approach balances security with convenience. It benefits both merchants and customers.

5. How does 3D Secure in Magento 2 balance global payment security with a seamless shopping experience?

Magento 2's implementation of 3D Secure supports global payment security. It maintains a seamless shopping experience. When customers save their cards for future use, the system securely stores tokenized card information. For subsequent purchases, 3D Secure may use risk-based authentication. It only prompts for complete verification when necessary. This approach ensures robust security for international transactions. It allows returning customers to enjoy a smoother checkout process in future shopping sessions.

Summary

Magento 2 3D Secure ensures a secure transaction process by verifying the cardholder’s identity. It helps:

- Reduce chargebacks and fraud.

- Enhances security in your store.

- Make online payments safer for both merchants and customers.

- Enhance payment security and reduce fraud risks.

- Improve customer trust and protect your business.

Consider Magento optimized server to ensure compliance with modern payment standards like PSD2 and SCA.