6 Steps to Configure Avatax Magento 2

Want to automate sales tax calculations for your Magento store? Avatax Magento 2 extensions integrate Avalara's tax automation platform with your store. It allows you to focus on your business while the extension handles tax calculations. This tutorial covers how to configure Avatax Magento and the top 3 extensions available.

Key Takeaways

-

Discover how Avatax Magento 2 extensions automate sales tax calculations and ensure compliance.

-

Learn the key benefits of using Magento Avatax including tax compliance and real-time updates.

-

Follow the step-by-step guide to configure Magento 2 AvaTax for your Magento store.

-

Explore the top 3 AvaTax Magento 2 extensions and their features.

What is Avatax Magento 2?

Avatax Magento 2 is a powerful extension that integrates the Avalara Avatax platform with Magento. It delivers instantaneous sales tax decisions based on precise geo-location.

It can calculate taxes for almost all countries in the world. You don’t need to create or rewrite tracking zones rates or tax rules. AvaTax updates data continuously ensuring accurate sales tax calculations in real time.

The extension also performs address validation and normalization. It looks for taxability determination and uses jurisdiction assignment technology for correct and valid tax calculation. The main purpose of the extension is to calculate tax with the Avalara Avatax Platform. All operations and requests are saved as logs in a table for admin review. Avatax Magento 2 is easy to install and configure for different stores.

Why Use Magento Avatax?

1. Comprehensive Tax Compliance

Avalara provides a wide range of tax compliance solutions. These include sales and use tax VAT and excise taxes. Magento Avatax ensures your business meets all tax regulations. It helps businesses of all sizes stay compliant. It reduces the risk of penalties and fines.

2. Automated Tax Calculations

Magento Avatax automates tax calculations for every transaction. It uses over 100,000 taxability rules and 11,000+ taxing jurisdictions. It ensures accurate tax rates are applied instantly. Automation saves time and reduces human error. Businesses can focus on other important tasks.

3. Real-Time Updates

Avalara AvaTax continuously updates tax rates and rules. The extension automatically calls out to AvaTax for the latest tax decisions. It ensures your tax calculations are always current. Real-time updates help you stay compliant with changing tax laws. You don’t need to update tax rates manually.

4. Address Validation and Standardization

Magento Avatax includes address validation and standardization features. It verifies standardizes and corrects addresses in North America. It improves the accuracy of tax calculations. Correct addresses reduce shipping errors and improve customer satisfaction. It also ensures compliance with tax regulations.

5. Integration with Avalara CertCapture

Avalara CertCapture allows you to track tax-exempt customers and documents. Magento Avatax integrates seamlessly with CertCapture. It makes managing tax exemptions easier. You can store and manage exemption certificates electronically. Integration simplifies compliance and reduces paperwork.

6 Steps to Configure Magento 2 AvaTax

-

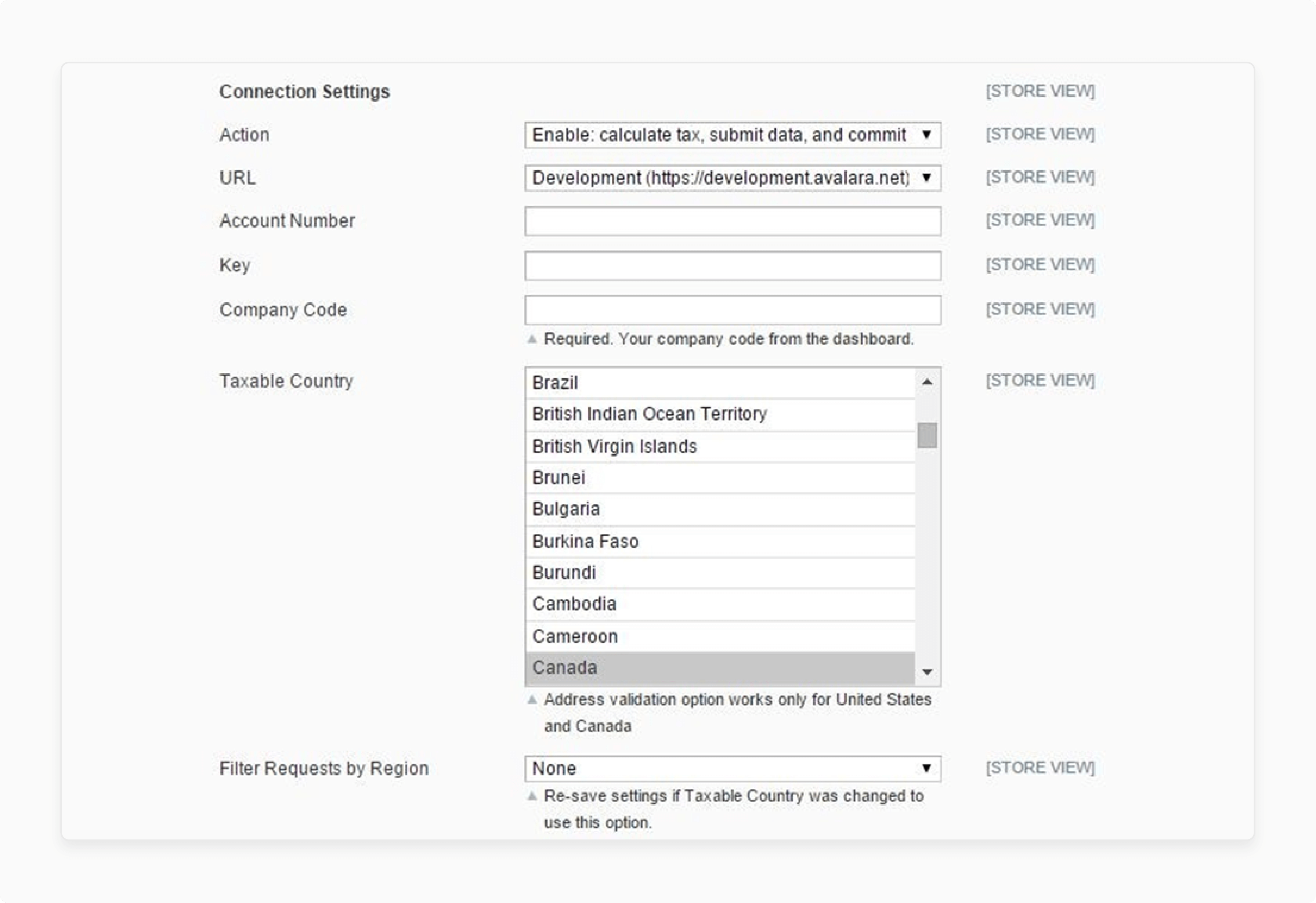

Go to Admin Panel > System > Configuration > Sales > Tax > Avatax: Connection Settings.

-

Enter valid credentials:

-

URL: Enter the URL of the Avalara Service for tax calculation and address validation/normalization.

-

Account Number: Enter the UUID issued by Avalara to identify your account.

-

Key: Enter the Authorization key to identify the person or system making the request.

-

Company Code: Enter the code that identifies your company profile/legal entity associated with Avatax operations.

-

-

Set Action under the Connection Setting block to enable or disable AvaTax:

-

Disable: Tax is calculated by default Magento; AvaTax is disabled.

-

Enable: calculate tax: Only tax for Orders is calculated by Avatax. Invoices and Credit Memos are not sent to Avalara.

-

Enable: calculate tax submit data: Tax is calculated for Orders; Invoices and Credit Memos are sent to Avalara as Uncommitted.

-

Enable: calculate tax submit data and commit: Tax is calculated for Orders; Invoices and Credit Memos are sent to Avalara as Committed.

-

-

Check Avatax Logs (Admin Panel > Sales > Tax > Avatax Logs) to verify connection status after making changes.

-

The success log indicates valid connection settings.

-

Error log indicates invalid connection parameters.

-

-

Configure Filter Requests by Region option if needed.

-

Set Detail Level to determine what detail is sent to Avalara:

-

Line: Uses calculated product tax rate from tax line.

-

Tax: Uses effective product rate collected for each product by jurisdiction.

-

Top 3 AvaTax Magento 2 Extensions

1. Avalara AvaTax by Adobe Commerce Marketplace

| Details | Explanations |

|---|---|

| Extension Link | Avalara AvaTax by Adobe Commerce |

| Features | - Real-time tax calculations - Address validation - Geo-location-based tax rates - Automatic tax updates - Detailed tax reporting |

| Benefits | Avalara AvaTax offers real-time tax calculations, ensuring accurate tax rates for every transaction. The extension uses address validation to improve accuracy. Geo-location-based tax rates ensure compliance across different regions. Automatic tax updates keep your store compliant with the latest tax laws. Detailed tax reporting helps in managing and reviewing tax-related information effectively. |

| Price | Available upon request |

2. Avalara AvaTax Integration by Amasty

| Details | Explanations |

|---|---|

| Extension Link | Avalara AvaTax Integration by Amasty |

| Features | - Seamless integration with Avalara - Real-time tax calculations - Support for multiple tax scenarios - Address validation - Automatic tax updates |

| Benefits | The Amasty AvaTax Integration offers seamless integration with Avalara, making it easy to set up. It provides real-time tax calculations, ensuring accuracy for each transaction. The extension supports multiple tax scenarios, making it versatile for different business needs. Address validation improves accuracy, and automatic tax updates ensure compliance with the latest tax laws. This integration helps businesses manage taxes efficiently. |

| Price | N/A |

3. Multi Vendor Avalara Tax by Webkul

| Details | Explanations |

|---|---|

| Extension Link | Multi Vendor Avalara Tax by Webkul |

| Features | - Multi-vendor support - Avalara tax codes - Real-time tax calculations - Address validation - GraphQL support |

| Benefits | The Webkul Multi Vendor Avalara Tax extension supports multi-vendor environments, making it ideal for marketplaces. It uses Avalara tax codes for precise tax calculations. The extension provides real-time tax calculations and address validation to ensure accuracy. GraphQL support enhances the flexibility and performance of the extension. It helps marketplace admins and vendors manage tax compliance efficiently. |

| Price | $199 + $39.80 installation fee |

FAQs

1. How does AvaTax calculate sales tax during checkout?

AvaTax uses real-time geo-location to calculate sales tax during checkout. It ensures accurate tax rates based on the customer's location. The system applies over 100,000 tax rules across 11,000 jurisdictions. It guarantees compliance with current tax regulations.

2. Can AvaTax be integrated with any ecommerce platform?

Yes AvaTax can be integrated with various ecommerce platforms including Magento. The connector ensures seamless integration. It provides real-time tax calculations and automatic updates. This integration simplifies tax compliance for online stores.

3. What benefits does AvaTax offer for the shopping cart?

AvaTax provides accurate tax calculations for every item in the shopping cart. It ensures compliance with tax laws by updating rates in real time. Address validation reduces shipping errors. It enhances customer satisfaction and trust.

4. How does AvaTax ensure accurate tax calculation for multi-vendor environments?

AvaTax supports multi-vendor environments by using precise tax codes. It calculates taxes in real time for each vendor. It with dedicated Magento hosting ensures compliance and accurate tax distribution. Admins can manage and review tax data efficiently.

5. What features does the AvaTax connector provide for ecommerce businesses?

The AvaTax connector offers features like real-time tax calculations address validation and automatic tax updates. It integrates seamlessly with ecommerce platforms. The connector ensures compliance and simplifies tax management. Businesses can focus on growth while ensuring tax accuracy.

Summary

Avatax Magento 2 extensions are essential for any business looking to streamline tax compliance and improve accuracy. They offer numerous benefits including:

-

Automated Tax Calculations: Real-time tax calculations ensure accuracy.

-

Address Validation: Improves accuracy and reduces errors.

-

Multiple Tax Scenarios: Supports various tax scenarios and jurisdictions.

-

Seamless Integration: Integrates smoothly with Avalara's tax platform.

-

Reduced Risks: Minimizes the risk of errors and penalties.

Consider managed Magento hosting to integrate AvaTax easily and optimize tax compliance.