How to Configure the Affirm Magento 2 Extension

Does your ecommerce store lack flexible payment options? Affirm Magento 2 extension allows you to offer consumer-friendly payment plans to your customers.

In this tutorial, we will explain how to configure the Affirm Magento 2 extension.

Key Takeaways

- Affirm Magento 2 extension boosts sales with flexible payment options.

- Easy setup process for integrating Affirm into your Magento store.

- Marketing tools increase conversion rates and average order value.

- Best practices for maximizing Affirm's impact on your e-commerce site.

- Risk management features protect merchants from chargebacks and fraud.

What is the Affirm Magento 2 Extension?

Affirm is a payment integration tool. It allows merchants to offer Affirm's consumer-friendly payment plans to their customers. It modifies the payments page to accept Affirm as a payment type. It also processes authorizations, captures, and refunds through Magento. Some of its aspects are:

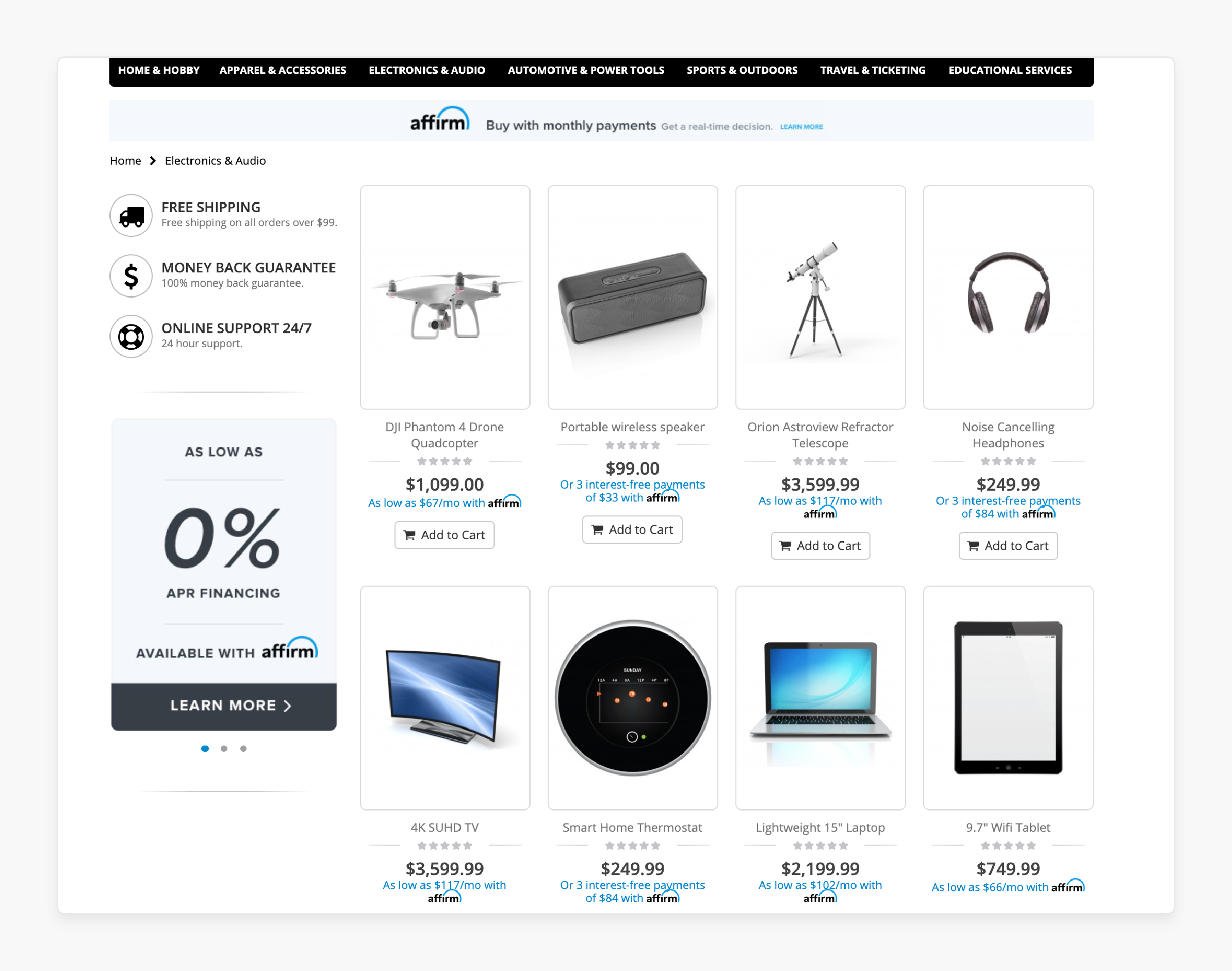

- Functionality: It provides marketing tools to calculate and display estimated installment payment amounts. It is based on product price or shopping cart total.

- Compatibility: It is compatible with Adobe Commerce (cloud and on-prem) and Magento Open Source versions 2.3 and 2.4.

- Integration: It requires a separate Affirm merchant account for financing and does not impact merchants' PCI compliance.

- Benefits: It helps merchants boost average order value. It also increases repeat transactions and taps into a premium network of high-intent shoppers.

Key Features of the Affirm Magento 2 Extension

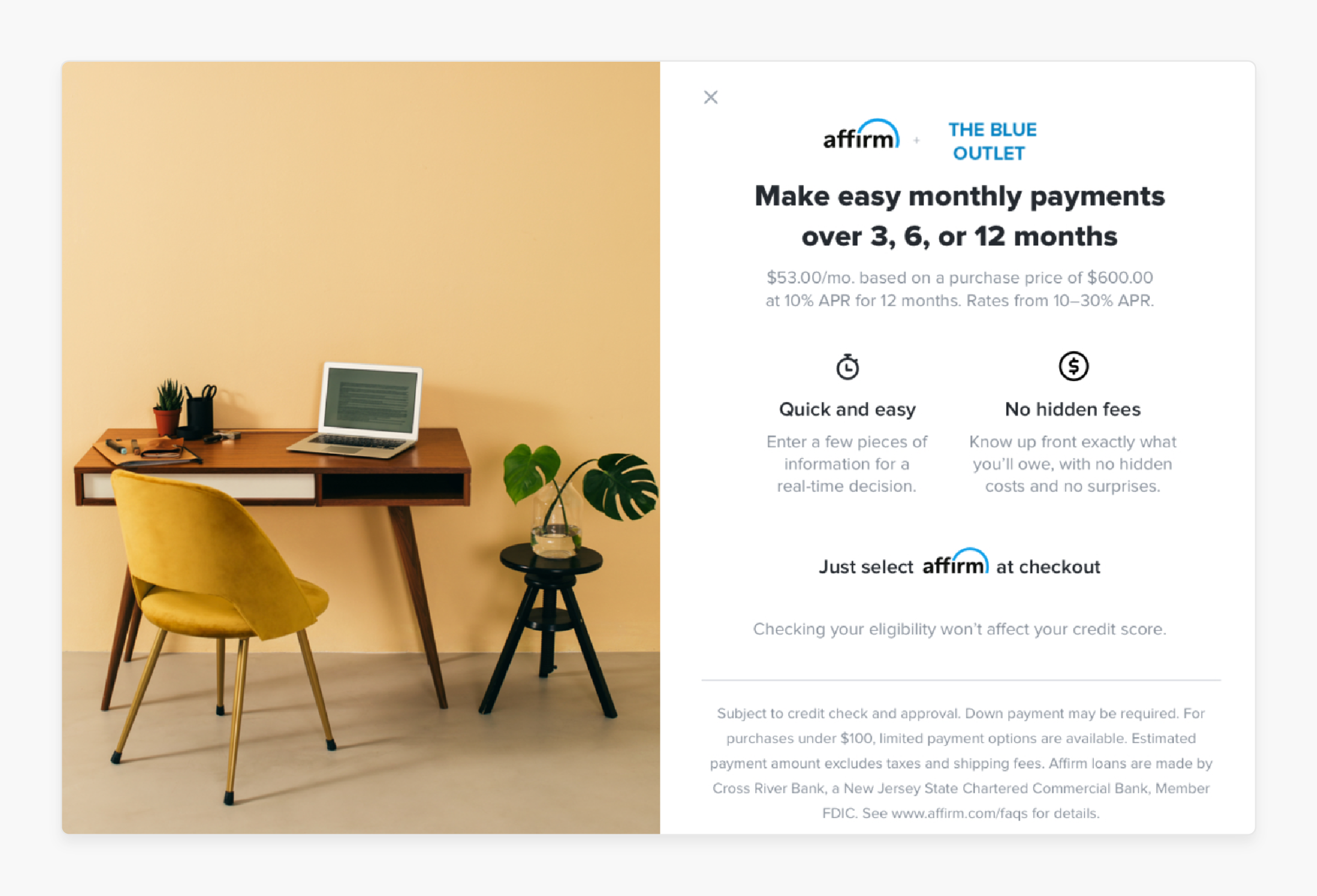

1. Flexible Payment Options

- The payment plans are designed to be transparent and customer-friendly. There are no hidden fees or unexpected charges. Shoppers know what they'll pay from the start. This clarity builds trust and encourages more confident buying decisions.

- Merchants can customize the payment options to suit their business needs. They can offer a range of payment terms, from 3 to 48 months. This flexibility helps attract a broader range of customers. It can also increase average order values as customers feel more comfortable making larger purchases.

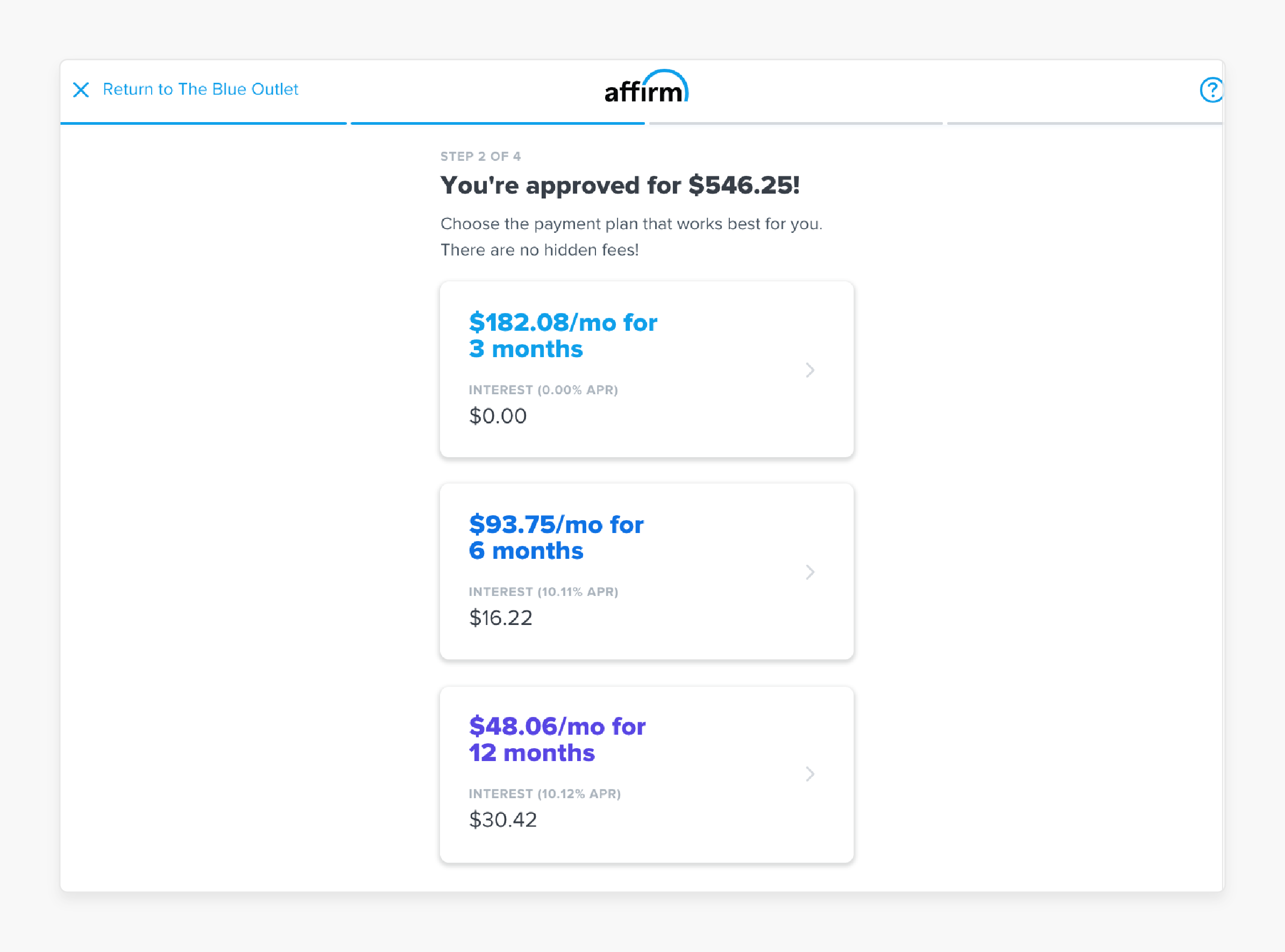

- At checkout, shoppers can quickly see their payment options and choose the plan that works best for them.

2. Risk Management

- When a consumer makes a purchase using Affirm, the merchant receives payment immediately. This upfront payment ensures that merchants have the funds they need to fulfill orders.

- Affirm takes on the risk of chargebacks. It can be a significant financial burden for merchants. It could also pose a Magento security issue for customers who might lose trust.

- Merchants can enjoy increased cash flow and reduced financial risk. This increased cash flow can be used to invest in business growth, improve operations, and enhance the customer experience.

3. Repeat Transactions

- Shoppers who have a positive experience with Affirm are likely to come back. They appreciate the flexibility and convenience.

- The extension makes budgeting more manageable for consumers. They can plan future purchases knowing they have access to flexible payment options. This long-term thinking often leads to more frequent shopping with the same merchant.

- Affirm's system can remember consumer information. It streamlines future purchases. Returning consumers enjoy a quicker, smoother checkout process.

- Merchants can use Affirm data to tailor promotions. They can offer special Affirm-based deals to past users. This targeted approach can effectively drive repeat business.

4. Payment Processing

-

When a customer selects Affirm, the extension handles the authorization process. It communicates with Affirm's servers to verify and approve the transaction. It happens quickly and securely in the background.

-

The Magento 2 extension also manages the capture of funds. Once an order is fulfilled, the transfer of money from Affirm is ensured to the merchant. This process is automated, reducing manual work for the merchant.

-

All these processes work within Magento's existing framework. Merchants can manage Affirm transactions alongside other payment types. This centralized approach simplifies bookkeeping and order management.

Marketing Features Offered by Affirm for Magento 2 Merchants

| Tool | Description | Benefits |

|---|---|---|

| Promotional Messaging | Add Affirm promotional messaging at every phase of the shopping journey. | Increases conversion and average order value. |

| Banners and Logos | Use banners, logos, and buttons from the toolkit to market Affirm across all channels. | Amplifies conversion and raises awareness about pay-over-time options. |

| Product and Cart Page Messaging | Display estimated installment payment amounts on product and cart pages. | Informs customers about payment flexibility, encouraging purchases. |

| Email Programs | Leverage email programs to drive more awareness. It includes abandoned cart emails and promotional emails. | Converts browsers into buyers and lowers customer acquisition costs. |

| 0% APR Promotions | Promote interest-free offers on the homepage and in emails. | Extends spending power and encourages purchases. |

| Marketing Toolkit | Provides compliant, Affirm-approved messaging and templates for creating compelling content. | Simplifies marketing efforts and ensures accurate communication about payment plans. |

| Inline Checkout Messaging | Add Affirm messaging to the checkout process. | Reminds customers about payment methods at checkout. |

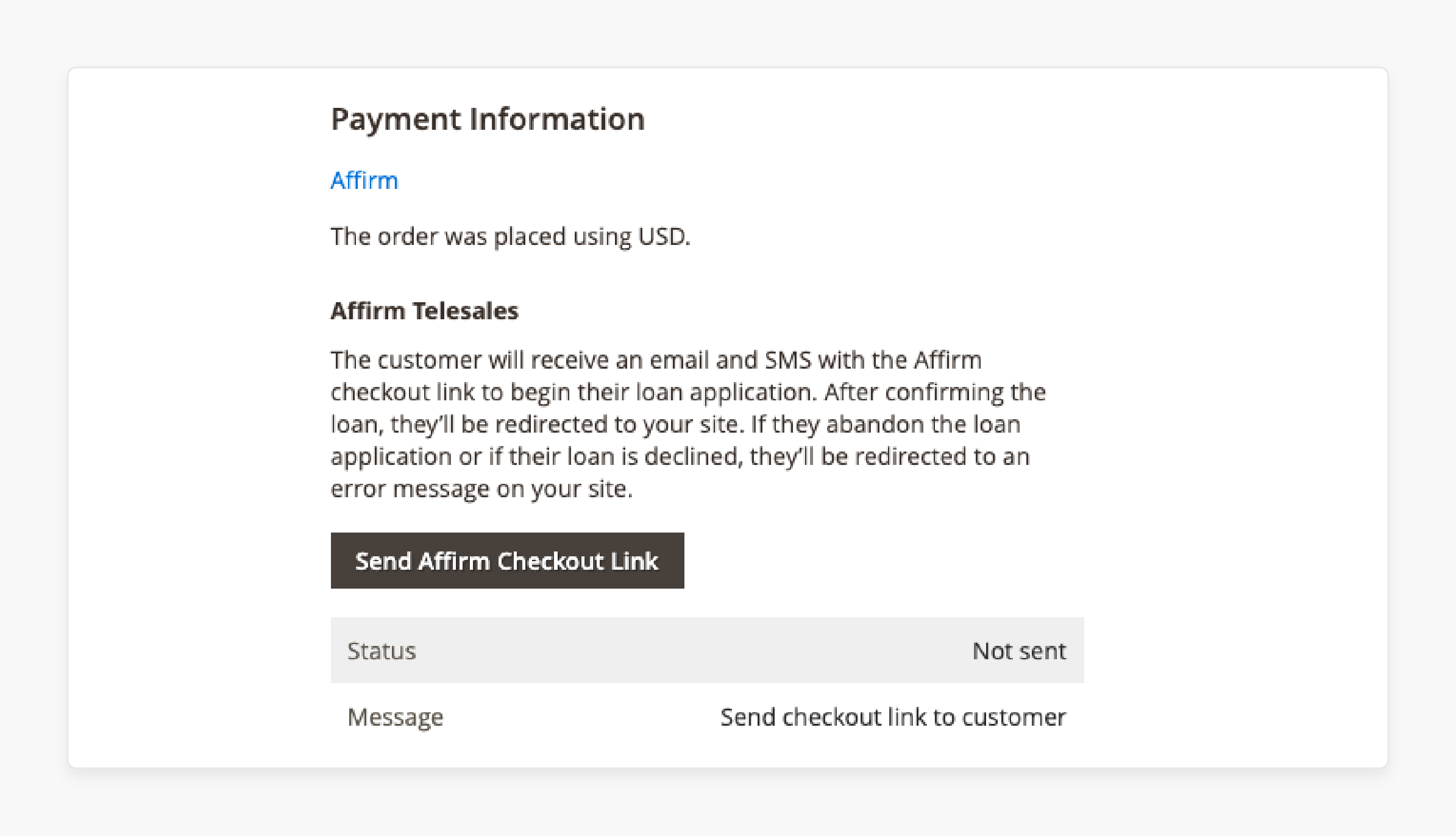

Steps to Configure Affirm Extension for Magento 2

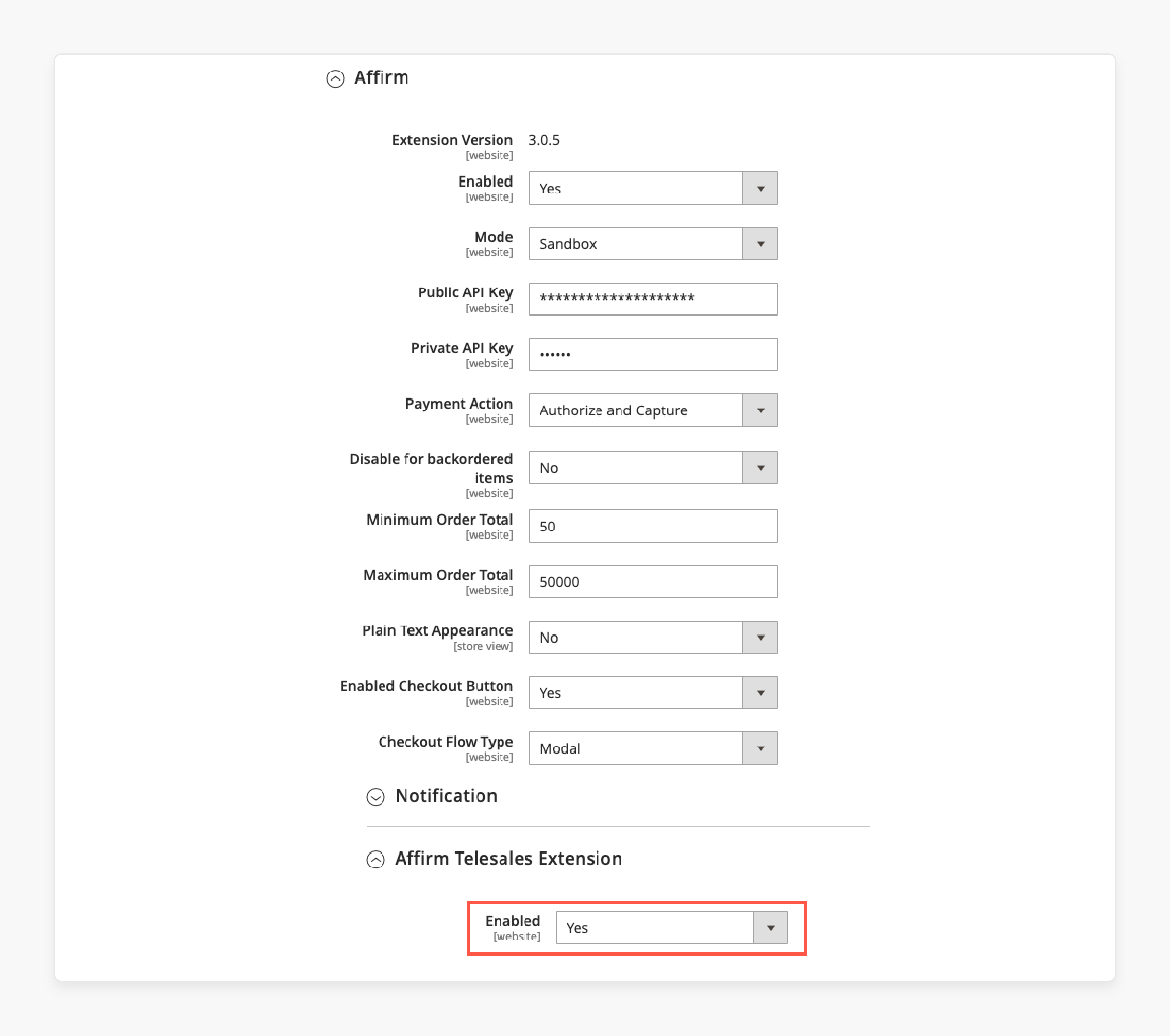

- Log in to the Magento admin panel after installing the Affirm extension.

- Go to Stores > Configuration > Sales > Payment modes > Affirm.

- Select Yes to enable the payment module.

- Select the Sandbox mode for initial testing.

- Enter the Public and Private API Keys.

- Choose the minimum and maximum order totals.

- Under Payment Action, choose Authorize and Capture.

- Test the module on Magento 2 by creating an order.

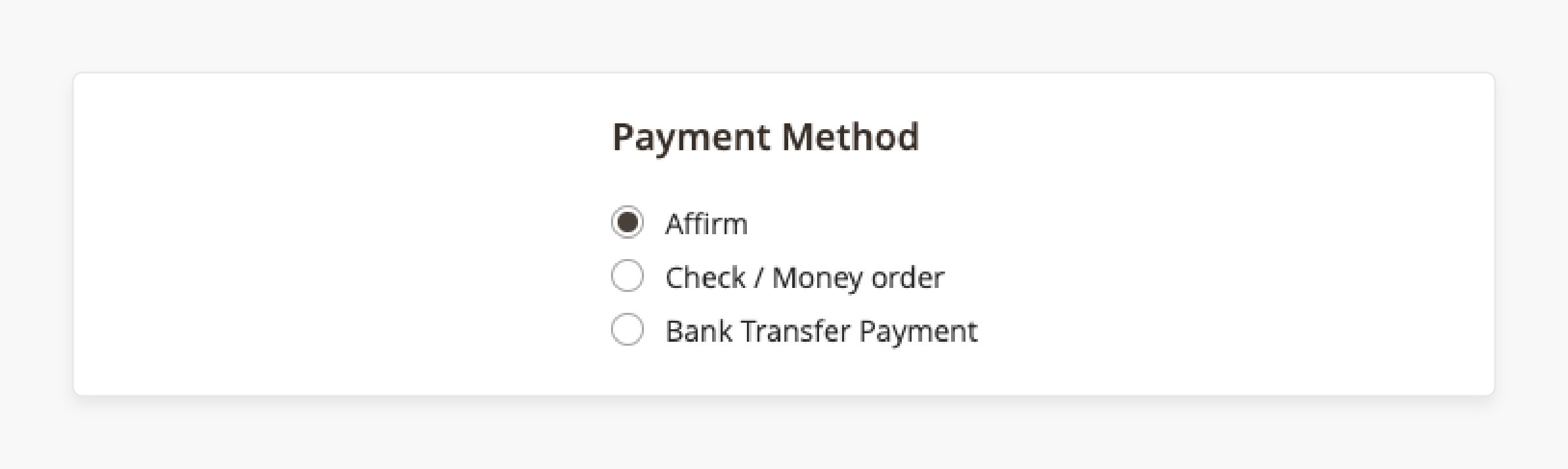

- Select Affirm on the payment page and checkout.

- Check your business email for the payment link to process the loan.

Best Practices for Using Affirm Payments with Magento 2

1. Integrate Affirm on Product and Cart Pages

- On product pages, Affirm messaging should be clearly visible. It can be displayed near the price or by the add-to-cart button. This placement catches the customer's eye at an important decision point. It may encourage them to consider items they might otherwise think are out of reach.

- Cart pages are another key location for Affirm messaging. Here, customers are reviewing their potential purchases. Seeing Affirm options at this stage can prevent cart abandonment. It reassures customers that their total purchase is manageable.

- The Affirm toolkit provides various integration assets. These elements should be used consistently across the site. They create a cohesive visual language around the Affirm option.

2. Leverage Email Programs

- Abandoned cart emails are a prime opportunity to highlight Affirm. When customers receive these reminders, they're often still interested in the product. Seeing Affirm as an option might be the push they need to complete the purchase.

- Follow-up emails after browsing sessions can also feature Affirm. These emails can remind customers of products they viewed. They can then emphasize how Affirm could make those items more attainable.

- Regular promotional emails keep the payment option top-of-mind for all subscribers. It can be particularly effective when promoting big-ticket items or sales events. Customers may be more likely to take advantage of deals when flexible payments are available.

- Short, informative sections in newsletters can explain how Affirm works. It builds familiarity and trust with the payment option. Over time, this can lead to increased usage and higher conversion rates.

3. Create Dedicated Landing Pages

- Dedicated pages allow for in-depth explanations of Affirm's benefits. Merchants can detail the flexibility of payment plans. They can highlight the transparency of fees and terms. This thorough information helps build trust with potential customers.

- The Affirm toolkit offers preapproved templates for these landing pages. These templates ensure compliance with Affirm's guidelines. The templates are optimized for clarity and conversion.

- Landing pages can include interactive elements to engage shoppers. For example, they might feature a payment calculator. This tool allows customers to estimate their monthly payments for different purchase amounts. It makes the concept of Affirm more tangible and personal.

4. Configure Payment Actions

- Store owners can update the setting to "Authorize and Capture." This option streamlines the payment process. When a customer completes a purchase, the funds are immediately authorized and captured. It means the transaction is fully processed at checkout.

- However, some merchants may prefer more control over the capture process. For these cases, Magento 2 offers the option to capture and release payments manually. It can be done through the Admin Panel.

- "Authorize and Capture" reduces manual work for merchants. There's no need to capture funds later manually. It can speed up order fulfillment and improve cash flow. It's particularly beneficial for merchants who ship orders quickly.

FAQ

1. How do I install the Affirm Magento extension?

To install the extension, use the Magento composer. Log in to your Magento admin panel. Go to Stores > Configuration > Sales > Payment modes > Affirm. Enable the payment module. Enter your API keys and configure settings like minimum/maximum order totals.

2. What are some of Affirm's features for Magento 2 merchants?

Affirm's features include flexible payment options, risk management, repeat transaction encouragement, and payment processing. It also offers marketing tools like promotional messaging, banners, and email program integration.

3. How can I offer Affirm as a payment option to my customers?

After configuring the extension, Affirm will appear as a payment option during checkout. You can also integrate Affirm messaging on product and cart pages. Admins can create dedicated landing pages and include them in email communications to inform customers.

4. What is the recommended Payment Action setting for the Affirm Magento extension?

The recommended setting is "Authorize and Capture." It streamlines the payment process by automatically capturing funds when a customer completes a purchase. It reduces manual work and speeds up order fulfillment and website performance.

5. Is the Affirm extension compatible with different versions of Magento?

Yes, the Affirm extension is compatible with Adobe Commerce (cloud and on-premises). It is also compatible with Magento Open Source versions 2.3 and 2.4. It integrates seamlessly with the Magento platform for efficient payment processing.

Summary

The Affirm Magento 2 extension is a quick payment mode for frequent and easy purchases. In this tutorial, we explored how to configure the extension after installation. Here is a quick recap:

- Affirm extension offers flexible payment plans for Magento stores.

- Key features include risk management and repeat transaction encouragement.

- The extension integrates seamlessly with Magento's existing payment framework.

- Best practices involve product page integration and email marketing.

- Configuration steps include API key entry and payment action setting.

Choose a suitable managed Magento hosting plan with Affirm’s payment modes to provide the best customer experience.