Best Ecommerce Services For Web Hosting Ecommerce Merchant Account

Are you looking for the right Web Hosting Ecommerce Merchant Account to grow your online business? Choosing the right service helps process payments securely and efficiently. Explores the key features of web hosting ecommerce merchant accounts. It will help you find the best ecommerce services that meet your needs.

This article will cover how to choose the right merchant account.

Key Takeaways

-

A Web Hosting Ecommerce Merchant Account is necessary for secure online payments.

-

eCommerce merchant accounts process transactions via payment gateways.

-

Key features include shopping carts, payment gateways, and software integrations.

-

The top providers are Stripe, PaymentCloud, CDGcommerce, Square, Dharma, and Helcim.

-

Each provider offers different features and pricing for various business needs.

-

Avoid mistakes like weak security, ignoring PCI compliance, and choosing incompatible services.

What Is An eCommerce Merchant Account?

An eCommerce merchant account is a specialized bank account. It allows online businesses to accept credit card payments. It works with a payment gateway to process transactions on an eCommerce site. This account is essential for small business owners. It enables them to sell products and services online.

Ecommerce platforms like Shopify and WooCommerce often integrate with merchant accounts. These platforms may offer built-in payment processing. They can also connect to third-party providers. When choosing an eCommerce merchant account, consider several factors. These include fees, security, and compatibility with your hosting provider.

Merchant service providers may offer additional features. These go beyond basic payment processing. They can include fraud protection, recurring billing, and multi-currency support. Evaluate these options carefully. Find the best fit for your business needs.

Features For An eCommerce Merchant Account

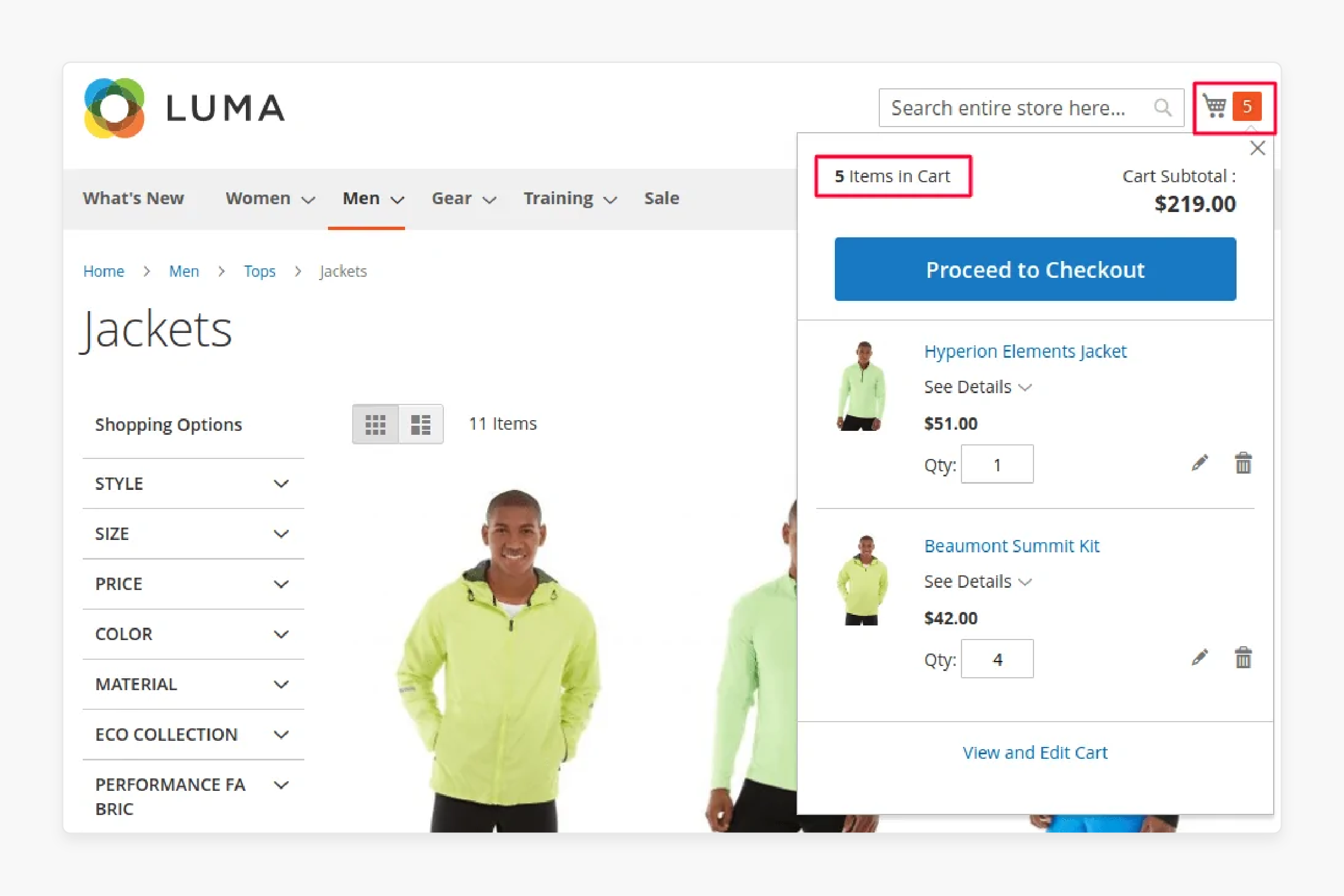

1. Online Shopping Carts

An online shopping cart is an important feature for eCommerce websites. It allows customers to select and store items for purchase. Many eCommerce hosting providers offer integrated shopping cart solutions. These carts can be customized to match your store's design. They often include features like inventory management. Discount codes are also common. Choose a cart that works well with your hosting plan. Ensure it's compatible with your payment gateway.

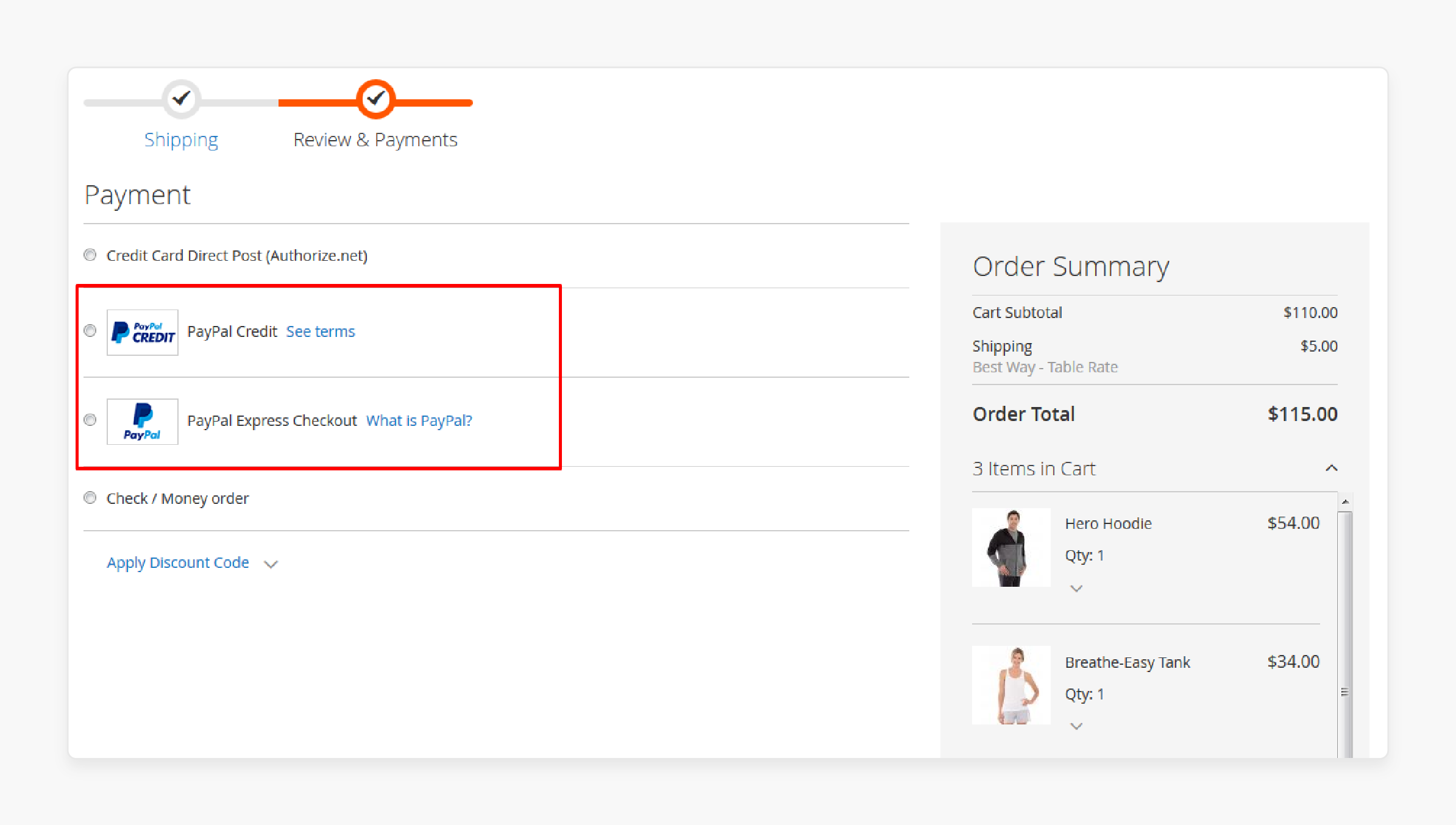

2. Payment Gateways

Payment gateways are essential for processing online payments. They securely transfer transaction data between the customer and the merchant. Many eCommerce hosting solutions offer built-in payment gateways. Some popular options include

-

PayPal

-

Square

Ensure your chosen gateway is PCI compliant. It protects customer data during transactions. Consider transaction fees when selecting a gateway. Also, review the supported payment methods.

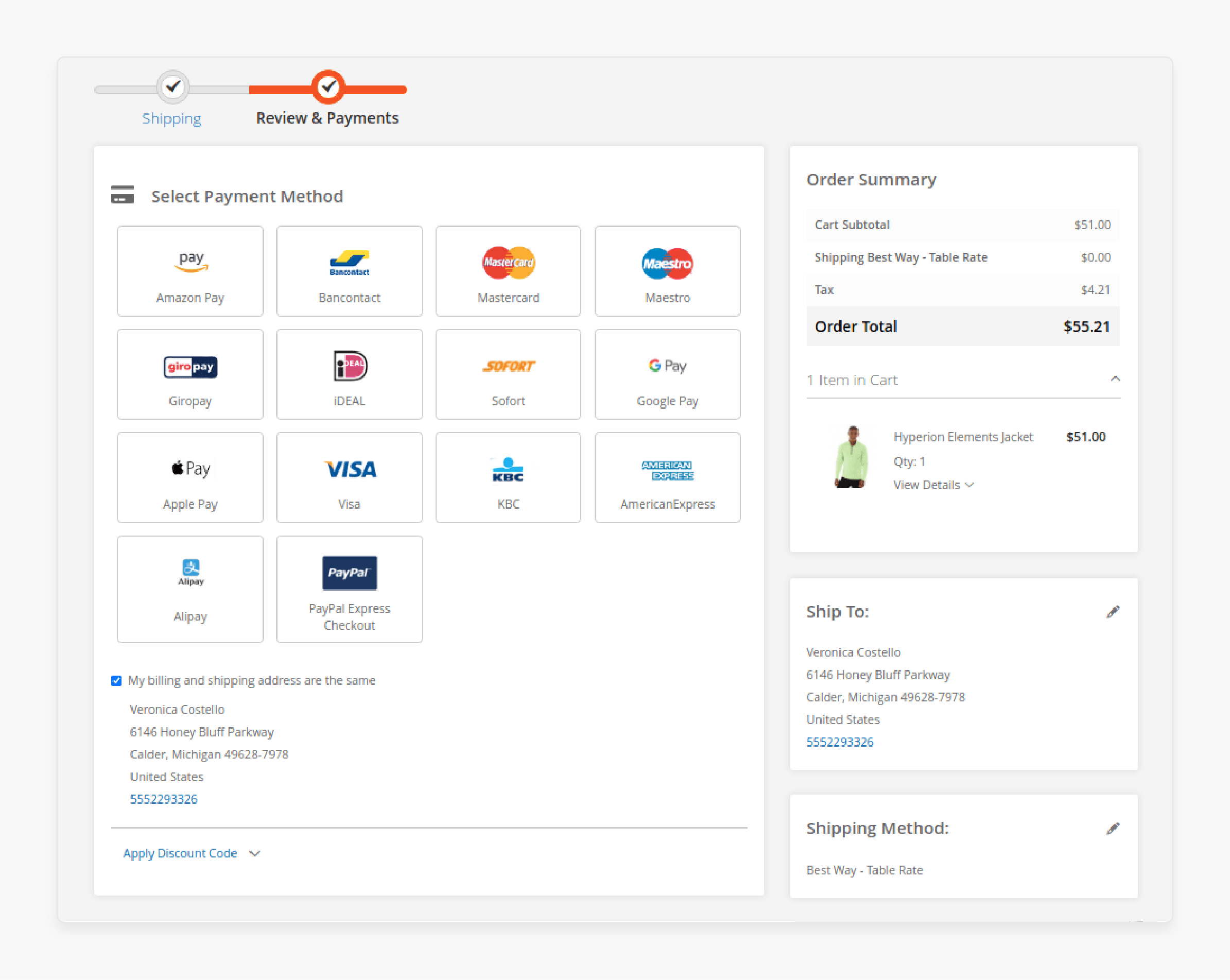

3. Support For Alternative Payment Methods

Offering alternative payment methods can increase sales. These may include

-

Digital wallets

-

Bank transfers

-

Buy-now-pay-later options

Many eCommerce platforms support various payment methods. Check if your hosting provider can integrate these options. Your shopping cart should also help them. Consider the preferences of your target market when choosing payment methods.

4. Software Integrations

Software integrations connect your eCommerce site with other business tools. These may include accounting software. Customer relationship management systems are another example. Inventory management tools can also be integrated. Many eCommerce hosting providers offer pre-built integrations. Ensure your chosen platform supports the integrations you need. It can streamline operations for your online business. It can also improve efficiency.

Compare The Best eCommerce Merchant Services

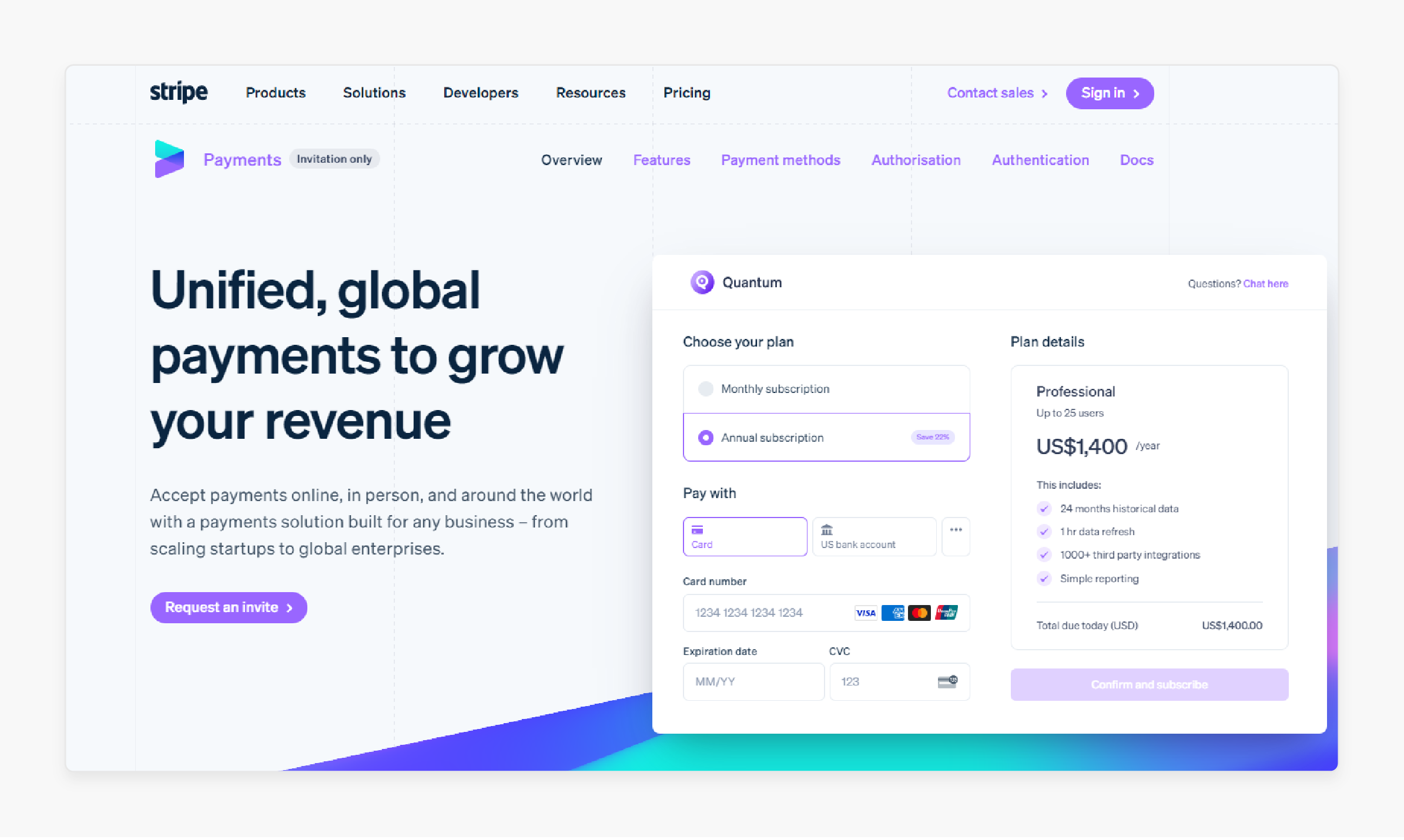

1. Stripe Payments

Stripe Payments supports a wide array of payment methods. These include

-

Credit cards

-

Digital wallets

-

Local payment options

Their fraud protection tools use machine learning algorithms. These detect and prevent fraudulent transactions in real time. Stripe's developer-friendly APIs allow for extensive customization. It enables tailoring of the payment process.

| Pros | Cons |

|---|---|

| • Stripe seamlessly integrates with numerous eCommerce platforms. | • Stripe's platform can be complex for non-technical users. |

| • This makes it easy to set up for most online businesses. | • Setting up and customizing fully may be challenging for some. |

| • Their pricing structure eliminates hidden fees. | • Some users report slow customer support responses. |

| • It allows businesses to predict costs accurately. | • It can be problematic for time-sensitive issues. |

| • Stripe excels in handling international transactions. | |

| • It supports over 135 currencies. | |

| • The service also offers local payment methods in various countries. |

Pricing:

Stripe charges 2.9% + $0.30 per transaction for online payments. They do not charge monthly fees for their standard service. This makes it accessible for businesses of all sizes.

2. PaymentCloud

PaymentCloud specializes in high-risk merchant accounts. They cater to industries that traditional processors often avoid. They offer virtual terminals for phone and mail orders. POS systems are available for in-person transactions. Their chargeback prevention tools protect merchants from financial losses. These tools specifically address losses due to disputed transactions.

| Pros | Cons |

|---|---|

| PaymentCloud works with businesses that other providers may reject. | PaymentCloud does not publicly disclose its pricing. |

| It includes industries like CBD, firearms, or adult entertainment. | This makes it difficult for businesses to compare costs. |

| They offer personalized customer support. | Companies must go through the application process to get pricing information. |

| Each client is assigned a dedicated account manager. | They may require more extended contracts compared to other providers. |

| PaymentCloud often negotiates rates for established businesses. | It could limit flexibility for businesses. |

| It can potentially lead to cost savings. |

Pricing:

PaymentCloud offers custom pricing based on business type and risk level. This tailored approach can benefit high-risk businesses. However, it may result in higher fees compared to low-risk industries.

3. CDGcommerce

CDGcommerce provides a free payment gateway and virtual terminal. It allows businesses to accept payments online and over the phone without additional costs. They include PCI compliance assistance for all merchants. It helps businesses meet essential security standards. The service offers month-to-month contracts. It provides flexibility for growing businesses.

| Pros | Cons |

|---|---|

| CDGcommerce stands out by not charging setup or annual fees. | CDGcommerce has limited international payment options. |

| It reduces upfront costs for new businesses. | It is a drawback for businesses with a global customer base. |

| They provide 24/7 customer support. | They may not be suitable for substantial businesses with complex needs. |

| It ensures help is available whenever issues arise. | Their services are more tailored to small and medium-sized enterprises. |

| The service integrates with many popular eCommerce platforms. | |

| This makes it easy to incorporate into existing setups. |

Pricing:

CDGcommerce offers interchange-plus pricing. It can be more cost-effective than flat-rate pricing for many businesses. Their monthly fee starts at $10. It is relatively low compared to many competitors.

4. Square

Square is an all-in-one payment processing solution. It includes a free online store builder for small businesses. The service offers inventory management tools. These tools help businesses track stock levels. They work across both online and offline sales channels.

| Pros | Cons |

|---|---|

| • Square is renowned for its ease of setup and use. | • Square has higher transaction fees for keyed-in payments. |

| • This makes it accessible even for those with limited technical knowledge. | • It can be costly for businesses that frequently process phone orders. |

| • There are no monthly fees for their basic service. | • They offer limited customization options compared to some competitors. |

| • It reduces ongoing costs for small businesses. | • It is not suit businesses with specific branding needs. |

| • Square is suitable for both online and in-person sales. | • It also may not meet certain functionality requirements. |

| • It offers a unified solution for businesses. | |

| • It covers both physical and digital presences. |

Pricing:

Square charges 2.9% + $0.30 per online transaction. The rate for keyed-in transactions is higher. It is 3.5% + $0.15 for these transactions. It reflects the increased risk of card-not-present transactions.

5. Dharma Merchant Services:

Dharma Merchant Services offers next-day funding for transactions. It improves cash flow for businesses. They provide a virtual terminal for phone and mail orders. Mobile payment options are available for on-the-go transactions. The service integrates with major shopping carts. It facilitates easy setup for most eCommerce businesses.

| Pros | Cons |

|---|---|

| • Dharma is known for its transparent pricing. | • Dharma is only suitable for some low-volume merchants. |

| • They have no hidden fees or surcharges. | • Their pricing structure benefits businesses with higher transaction volumes. |

| • They do not require long-term contracts. | • They offer limited support for high-risk industries. |

| • It offers flexibility for businesses. | • It may exclude some types of businesses. |

| • The company is recognized for its excellent customer service. | |

| • They provide personalized support to merchants. |

Pricing:

Dharma uses interchange-plus pricing. It starts at 0.15% + $0.07 per transaction. They charge a $20 monthly fee. It is competitive for the level of service provided.

6. Helcim:

Helcim offers volume-based discounts. These automatically reduce rates as a business grows. They provide a free hosted payments page. It allows businesses to accept online payments without building an entire website. The service includes inventory management tools. These help businesses track stock levels.

| Pros | Cons |

|---|---|

| • Helcim does not charge monthly fees. | • Helcim is not ideal for low-volume businesses. |

| • It reduces ongoing costs for businesses. | • Their pricing structure benefits those with higher transaction volumes. |

| • They have a transparent pricing structure. | • They have limited integrations compared to larger providers. This may be a drawback for businesses. |

| • There are no hidden fees. | • It mainly affects those using less common eCommerce platforms. |

| • The service supports multiple currencies. | |

| • It facilitates international sales. | |

| • It also expands potential customer bases. |

Pricing:

Helcim uses interchange-plus pricing. It starts at 0.30% + $0.08 per transaction. Their rates decrease as transaction volume increases.

Common Mistakes to Avoid When Setting Up Web Hosting Ecommerce Merchant Account

1. Neglecting PCI Compliance:

Many new ecommerce businesses overlook PCI compliance. This standard is necessary for protecting customer data. Ensure your hosting provider is PCI compliant. It applies to shared hosting, VPS hosting, and cloud hosting options.

2. Ignoring SSL Certificates:

Failing to install an SSL certificate is a critical error. SSL encrypts data between the customer and your site. Many hosting providers offer free SSL certificates. Install these to secure your ecommerce store.

3. Weak Password Policies:

Using weak passwords for your hosting account and merchant services is risky. Implement strong password policies. It applies to all aspects of your ecommerce hosting plan.

4. Overlooking Regular Updates:

Failing to update your ecommerce platform and plugins is dangerous. Regular updates patch security vulnerabilities. Set up automatic updates if your hosting provider offers this feature.

5. Insufficient Backup Procedures:

Not having a strong backup strategy can be disastrous. Choose a hosting provider that offers regular backups. Implement your own backup procedures as well.

6. Choosing the Wrong Hosting Type:

Selecting an inappropriate hosting option can limit your ecommerce growth. Shared hosting may not suit high-traffic stores. Consider VPS or dedicated hosting for larger operations.

7. Incompatible Ecommerce Platforms:

Choosing an ecommerce platform incompatible with your hosting service causes problems. Ensure your chosen platform (like WooCommerce or Shopify) works with your hosting provider.

8. Payment Gateway Incompatibility:

Selecting a payment service provider can be challenging. Choose one compatible with your hosting or ecommerce platform. An incompatible provider creates issues. Verify compatibility before setting up your merchant account.

9. Inadequate Server Resources:

Underestimating your resource needs leads to slow loading times. Choose a hosting plan with sufficient bandwidth and storage. It is important for running an online business effectively.

10. Ignoring Geographic Considerations:

Not considering server locations can affect site speed. Choose a hosting provider with servers near your target audience. It improves load times and user experience.

Security Essentials for eCommerce Merchant Accounts

| Security Aspect | Description |

|---|---|

| Data Encryption | Use strong encryption for all customer data. This protects sensitive information during transactions. |

| Secure Hosting | Choose a hosting provider with robust security measures. Look for features like firewalls and malware scanning. |

| Regular Security Audits | Conduct frequent checks of your eCommerce site. This helps identify and fix potential vulnerabilities. |

| Access Control | Limit access to sensitive areas of your website. Only give permissions to trusted employees who need them. |

| Secure Checkout Process | Implement a secure checkout system. This builds customer trust and protects their payment information. |

| Security Updates | Keep your eCommerce platform and plugins up-to-date. This helps patch known security issues. |

| Customer Education | Inform your customers about safe online shopping practices. This can include tips on creating strong passwords. |

| Fraud Detection | Use tools to spot and prevent fraudulent transactions. This protects both your business and your customers. |

FAQs

1. What is an ecommerce merchant account?

An ecommerce merchant account is a type of bank account. It allows businesses to accept credit cards and other electronic payments online. This account is essential for handling transactions on your ecommerce site. It enables you to process payments securely and efficiently.

2. What are the benefits of using a dedicated ecommerce hosting service?

Using a dedicated ecommerce hosting service provides several benefits. These include enhanced security and support for higher traffic volumes. These services are designed to accommodate the specific needs of an ecommerce business. They ensure a smooth and reliable shopping experience for customers.

3. How do I choose the best ecommerce hosting provider for my online store?

To choose the best ecommerce hosting provider, consider several factors. These include reliability, security features, scalability, customer support, and additional ecommerce features. Look for built-in payment processing as an example of helpful features. Seek providers that offer a good hosting plan tailored to your business needs. Also, consider those with a reputation for excellent service.

4. What should I look for in a payment gateway for my ecommerce store?

When choosing a payment gateway, consider several factors. These include transaction fees and security measures. Several factors are important. These include ease of integration with your ecommerce platform. Support for multiple payment methods is also important. It should consist of credit card payments. Additionally, ensure that the payment gateway is PCI compliant.

5. How does a merchant account differ from a payment service provider?

A merchant account is a specialized type of bank account. It allows businesses to accept credit card payments directly. In contrast, a payment service provider (PSP) acts as an intermediary between merchants and banks. PSPs handle the payment process without the need for a dedicated merchant account. PSPs often offer additional services such as fraud protection and simplified pricing models.

6. What are the advantages of using Shopify and WooCommerce to build an e-commerce website?

Shopify and WooCommerce are popular ecommerce platforms. They offer powerful features for building and managing an online store. Shopify is a hosted solution. It is known for its ease of use, integrated payment processing, and comprehensive support. WooCommerce is a plugin for WordPress hosting. It offers greater flexibility and customization options. WooCommerce is ideal for business owners who want more control over their ecommerce site.

7. What are some hosting options suitable for small business ecommerce websites?

Suitable hosting options for small business ecommerce websites include shared hosting, VPS hosting, and cloud hosting. Shared hosting is affordable and ideal for smaller stores. VPS hosting offers more resources and better performance. Cloud hosting provides scalability and reliability. It is a good hosting solution for growing businesses. Choose the best option based on your specific business needs and traffic expectations.

Summary

Web Hosting Ecommerce Merchant Accounts are essential for processing online payments securely. These accounts allow eCommerce businesses to accept credit card payments. They also integrate with payment gateways to facilitate smooth transactions. To ensure seamless payment processing and support business growth, consider the following:

-

Merchant accounts are necessary for secure online payment processing. They enable businesses to accept credit card payments.

-

Key features to prioritize include shopping carts and payment gateways. Support for alternative payment methods and software integrations is also essential.

-

Top providers offer tailored solutions to meet various business needs. These include Stripe, PaymentCloud, CDGcommerce, Square, Dharma, and Helcim.

-

Avoid common mistakes. Don't neglect PCI compliance. Don't ignore SSL certificates. Don't use weak passwords.

-

Ensure your hosting provider offers strong features. These should include security and scalability.

Explore managed Magento hosting options to improve performance with merchant accounts.