Vertex Magento 2 Integration: Features and Benefits

Are you confused about how to handle taxes in your ecommerce store? The Vertex Magento 2 integration is a tax management solution. It helps to automate sales and uses tax compliance for businesses.

In this article, we will explain the features and benefits of Vertex for Magento 2 stores.

Key Takeaways

-

Discover how Vertex simplifies tax compliance across multiple jurisdictions for Magento 2 stores.

-

Learn about the automation of taxes and real-time tax rate updates with Vertex.

-

Understand how Vertex enhances the checkout process with accurate tax calculations.

-

Explore Vertex's global capabilities for handling international sales and tax compliance.

-

See how Vertex supports business growth and scalability by integrating with Magento 2.

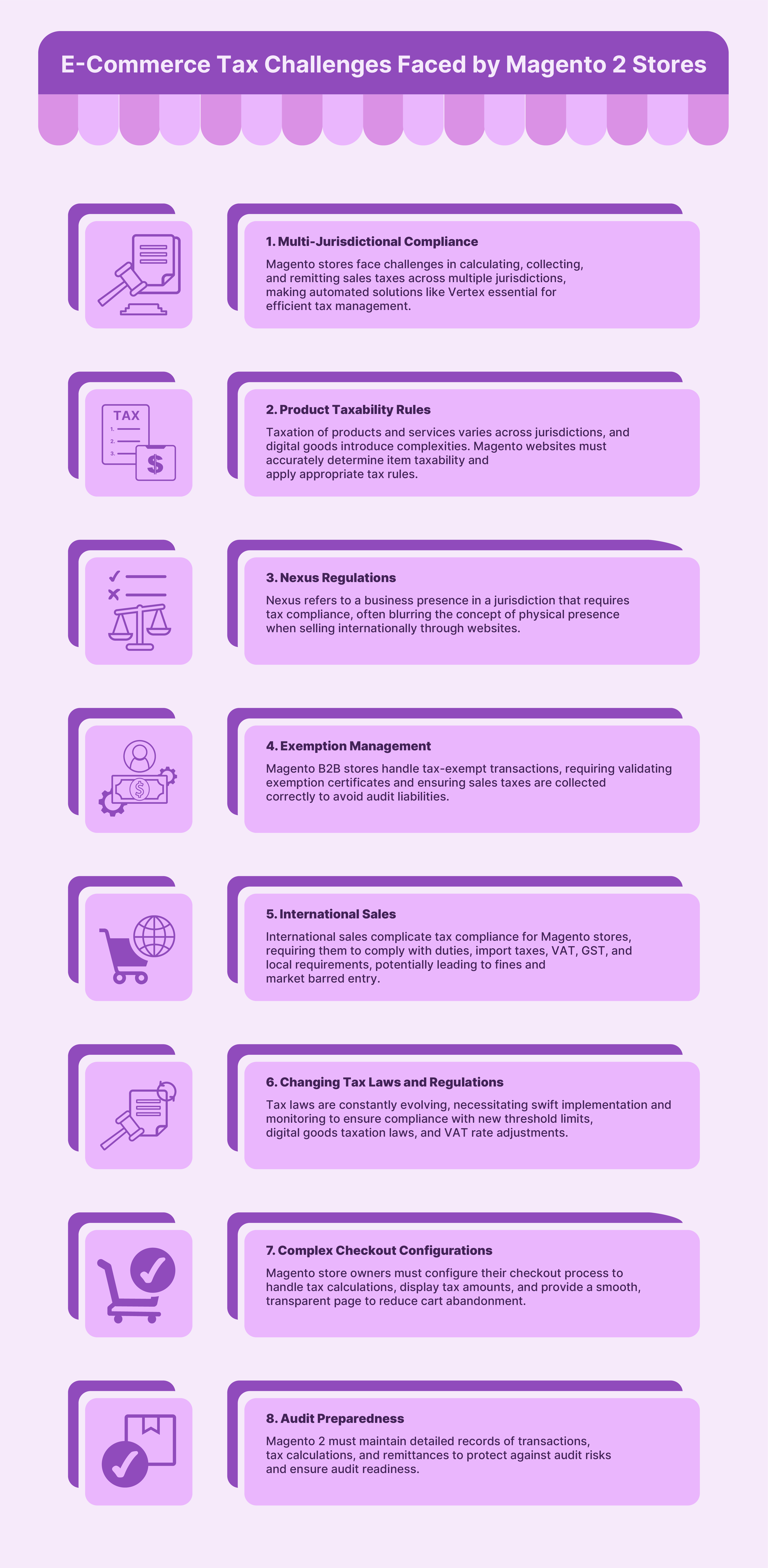

E-Commerce Tax Challenges Faced by Magento 2 Stores

1. Multi-Jurisdictional Compliance

-

Magento stores often sell to customers across multiple states and countries. Each jurisdiction can have different Magento 2 tax rules and regulations. For instance, in the United States, there are over 10,000 taxing jurisdictions, each with its own set of tax laws.

-

This variability requires Magento stores to calculate, collect, and remit sales taxes. It is a task that can be daunting without automated solutions like Vertex.

2. Product Taxability Rules

-

Different products and services are taxed differently based on various criteria. It can change between jurisdictions. For example, clothing might be tax-exempt in one state but taxable in another or up to a certain price point.

-

Digital goods and services also introduce complexities as they are new and taxed. Magento websites must be able to determine the taxability of each item sold. It should apply the correct tax rules.

3. Nexus Regulations

-

Nexus is a business presence in a state or jurisdiction enough to need the business to follow its tax laws. One major challenge is determining in which jurisdictions a business has tax obligations.

-

The concept of physical presence driving nexus gets blurred. It is when selling internationally through websites.

4. Exemption Management

-

Magento B2B companies often deal with tax-exempt transactions. It includes sales to nonprofit organizations or resellers.

-

Managing these exemptions correctly requires validating exemption certificates. It involves keeping them on file and ensuring that sales taxes are correctly collected. Failure to properly manage exemptions can lead to audit liabilities.

5. International Sales

-

Selling internationally adds another layer of complexity to tax compliance. Magento stores must contend with duties, import taxes, VAT, GST, and other local compliance requirements.

-

Each country has its tax structure, and failure to comply can result in hefty fines and barred entry into those markets.

6. Changing Tax Laws and Regulations

-

Tax laws are constantly changing, and keeping up-to-date with the latest regulations is important. For instance, changes need to be closely monitored and quickly implemented to maintain compliance.

-

These changes include threshold limits, new digital goods taxation laws, or adjustments in VAT rates.

7. Complex Checkout Configurations

-

Magento store owners need to ensure that their checkout process is configured. It is to handle diverse tax calculations. This includes displaying tax amounts based on customer location and discounts before tax.

-

The complexity increases with the need to provide a smooth and transparent page to reduce cart abandonment.

8. Audit Preparedness

-

Lastly, the risk of Magento audits is a big concern. Magento 2 must have detailed records of all transactions, tax calculations, and remittances.

-

It is needed to defend against any discrepancies noted by tax authorities. Being audit-ready requires proper record-keeping and the ability to produce detailed transaction logs.

Features of Vertex for Magento 2

1. Automated Tax Calculations

-

Vertex automates the calculation of sales tax, VAT, and other taxes for transactions within Magento 2.

-

It dynamically applies accurate tax rates based on the customer’s location, the sold products, and prevailing tax rules and rates. This automation reduces the burden of manual calculations and decreases the risk of human errors.

2. Address Cleansing

-

Vertex includes address-cleansing functionalities. It ensures that addresses entered during the checkout process are accurate and standardized.

-

This feature is important for calculating correct tax rates. It also ensures that shipments reach customers without delays.

3. Exemption Certificate Management

-

The system provides efficient management of tax exemption certificates. Businesses can easily handle and validate customer exemptions during the checkout process.

-

It is necessary to make transactions with tax-exempt entities such as non-profit organizations. This feature helps maintain compliance and streamline the handling of exemptions.

4. Flexible Tax Calculation Configuration

-

Vertex offers flexible configurations that can be made to meet the unique tax numbers of different businesses.

-

It supports product taxability rules, sourcing rules, and the tax on shipping and handling charges.

5. Real-time Tax Rates and Rules

-

Vertex maintains an up-to-date database of tax rates and rules. These are continually updated to reflect changes in tax legislation across various jurisdictions.

-

This real-time data ensures that businesses always apply the most current tax rates and follow the latest rules.

6. Detailed Reporting and Returns Filing

-

With Vertex, businesses can generate detailed tax reports. These are necessary for tax filing and compliance checks. These reports can be used to prepare and file tax returns more efficiently and with greater accuracy.

-

Vertex also supports electronic filing. It makes it easier to comply with tax authorities’ requirements.

7. Support for Multiple Countries and Regions

-

Vertex is designed to handle complex, multi-region tax scenarios. It supports tax calculations not just in the United States but in multiple countries around the world.

-

As tax laws change, Vertex automatically updates its tax rate and rule databases.

-

Vertex's system includes coverage of tax laws from over 130 countries and regions around the world.

-

It also adheres to local tax compliance laws and regulations.

8. Integration with Other Business Systems

-

Vertex can connect with other business systems, such as Magento ERP and CRM software. This broader integration capability allows for a smooth flow of data across business systems. It enhances the accuracy of tax calculations and the efficiency of business processes.

-

Vertex offers APIs that enable custom integrations with other business software, providing flexibility. This level of customization is beneficial for large, complex businesses requiring unique workflows.

9. Cloud-Based Solution

-

Vertex operates as a cloud-based solution. This means that it requires minimal installation and provides high availability and scalability. The cloud infrastructure allows Vertex to scale effortlessly with a business’s growth.

-

Updates and new features are rolled out automatically. It does so without requiring downtime or manual installation.

Benefits of Vertex in Magento 2 Stores

| Benefit | Description |

|---|---|

| Improved Tax Accuracy | - Reduces risk of over or undercharging tax - Ensures consistent tax treatment across all sales channels - Instills confidence in tax compliance |

| Streamlined Operations | - Eliminates manual tax research and rate updates - Frees up time and resources to focus on core business - Simplifies tax filing and remittance processes |

| Enhanced Customer Experience | - Provides transparency into tax calculations - Enables tax-inclusive pricing for clearer totals - Supports smooth one-page checkout with validated addresses |

| Scalability for Growth | - Handles tax calculations as transaction volumes increase - Supports expansion into new markets and jurisdictions - Integrates with other business systems beyond Magento |

FAQs

1. How does Vertex integrate with Magento to streamline tax compliance for my online store?

Vertex integration with Magento in the admin panel. It automates accurate sales and use tax calculations. It ensures compliance with the latest tax requirements across every transaction.

2. Can Vertex handle tax calculations for cross-border transactions in my Magento store?

Yes, Vertex supports cross-border transactions with accurate VAT tax. It is ideal for Adobe Commerce or Magento 2 users aiming to grow their business globally.

3. What features does Vertex provide to ensure accurate address validation in Magento?

Vertex includes an address validation API that standardizes addresses. It does so during checkout in Magento stores.

4. How does Vertex help Magento users with tax filings and returns?

Vertex automatically generates signature-ready PDF returns. It is for easy filing and eliminating manual compliance processes.

5. Where can I find resources or documentation for setting up Vertex on Magento 2.4.2?

Check Vertex Inc.’s official website or their GitHub repository for integration guides and updates. Use Magento’s admin dashboard for tax configuration and validation settings.

Summary

The Vertex Magento 2 integration is essential for international ecommerce businesses. In this article, we explained the tax challenges, features, and benefits of Vertex. Here is a quick recap:

-

Vertex manages varying tax rates and rules across more than 10,000 jurisdictions.

-

Streamlines complex processes by automating tax calculations, exemption management, and real-time updates.

-

Improves accuracy in taxes during checkout with validated addresses and transparent tax displays.

-

Facilitates compliance for international sales, including duties and VAT, which is essential.

-

Easily integrates with Magento 2, supporting business growth and expansion.

Optimize your store's performance with Vertex tax automation and managed Magento hosting.