SagePay Magento 2: Payment Gateway And Security

Are you seeking a secure and efficient payment solution for your Magento 2 store? SagePay Magento 2 integrates seamlessly. It offers powerful payment gateways and security features. This system ensures safe transactions. It also protects customer data, enhancing trust and reliability.

This article will explain how to set up SagePay Magento 2. It will guide you through configuring the payment gateway.

Key Takeaways

-

What is SagePay Magento 2 Integration?

-

2 Types Of SagePay Integrations

-

Processing Payments with SagePay

-

Security and Compliance with SagePay Magento 2

What is SagePay Magento 2 Integration?

SagePay Magento 2 Integration is an extension. It connects Magento 2 e-commerce platforms with the Opayo payment gateway. Opayo was formerly known as SagePay.

SagePay integration allows store owners to accept online payments securely. It works through their Magento 2 websites. The extension supports various payment methods. These include credit cards and 3D Secure transactions. It offers both server and form integration options, enhancing the flexibility of the Magento 2 Opayo Payment system. It provides flexibility for different business needs. The integration is compatible with Magento 2 stores. It can be managed from the Magento 2 backend.

Opayo is a leading independent payment service provider. It ensures high security standards. The integration is PCI DSS Level 1 compliant. It offers a robust level of security for handling sensitive payment data.

The integration offers close collaboration with the Opayo team. It ensures seamless operations within the Magento 2 Sage Pay Integration. It ensures merchants can accept payments efficiently. It supports both Opayo Direct and PI integration methods. It caters to different business requirements.

2 Types Of SagePay Integrations

1. Magento 2 Form Payment

1. Lower PCI DSS compliance requirements for merchants:

-

This is because sensitive payment data is handled on SagePay's servers. It reduces the merchant's responsibility.

-

For example, merchants may only need to complete a shorter self-assessment questionnaire. They may not need to undergo a full PCI DSS audit.

2. SagePay handles the payment process:

-

It offloads the complexity of secure payment processing to SagePay's specialized systems.

-

It includes tokenization of card data. It also includes fraud checks.

-

Transaction routing is handled within the Magento 2 Opayo Payment framework.

3. Customizable payment page to match store branding:

-

Merchants can add their logo. They can adjust colors. They can modify the text to create a consistent brand experience.

-

It helps maintain customer trust during the payment process.

4. Supports various payment methods:

-

Beyond credit cards, this can include digital wallets. It can also include local payment methods.

-

Alternative payment options are supported. This flexibility can increase conversion rates by catering to customer preferences.

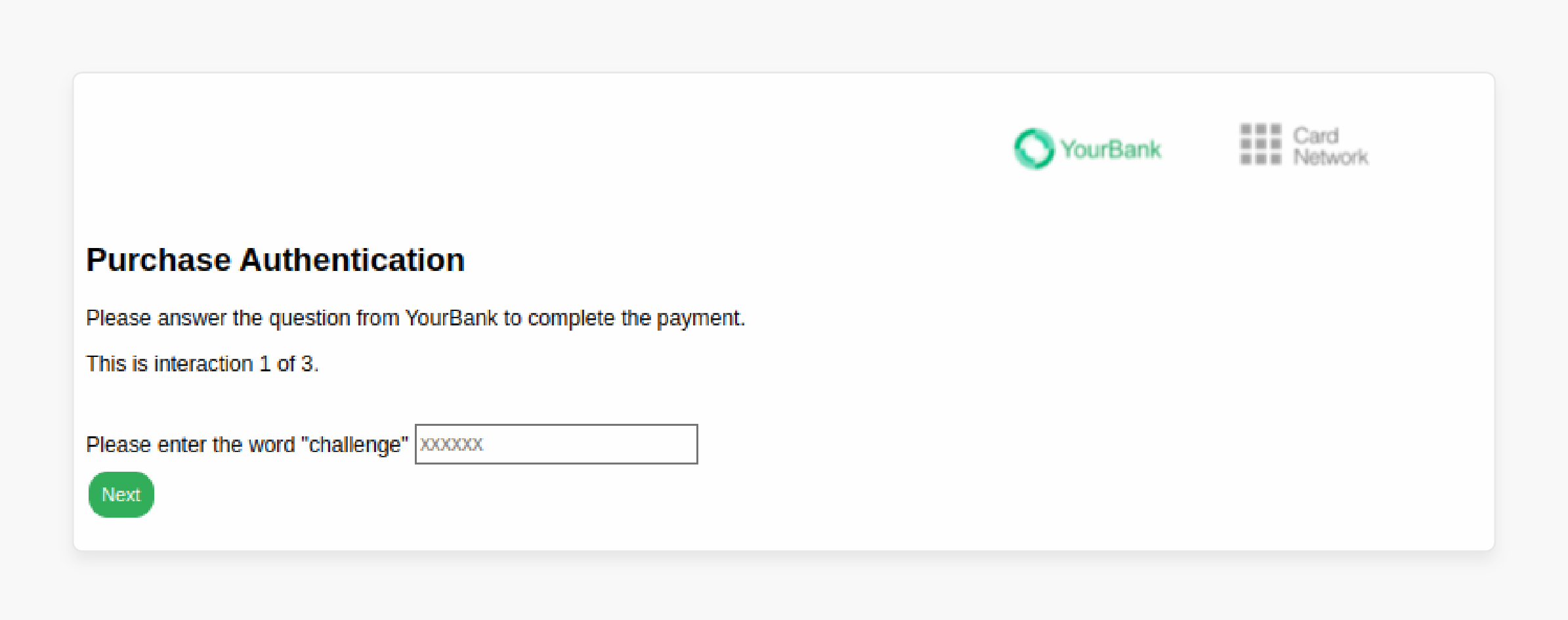

5. 3D Secure authentication available:

- It adds an extra layer of security for card payments. It potentially reduces fraud. It can shift liability away from the merchant.

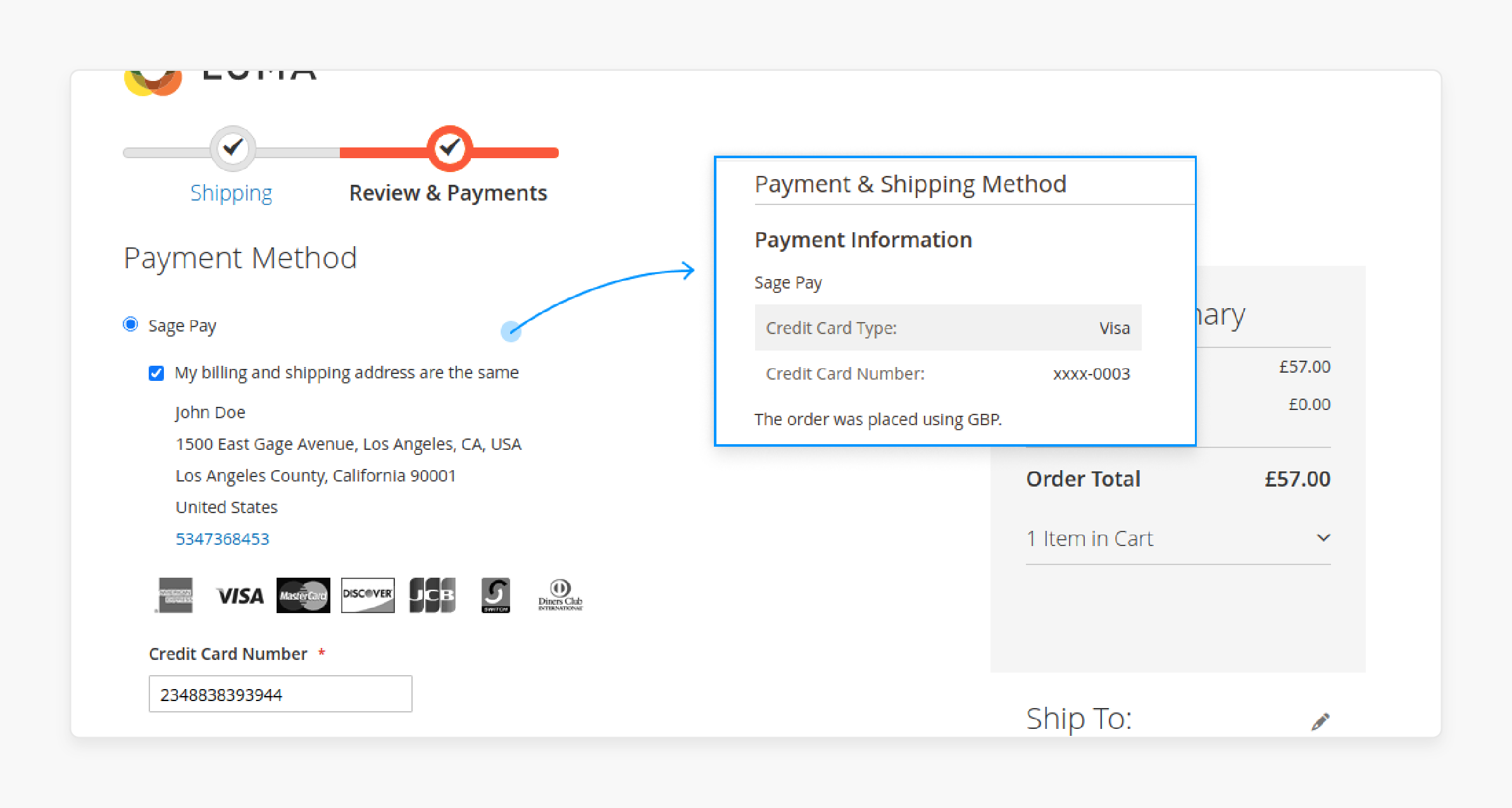

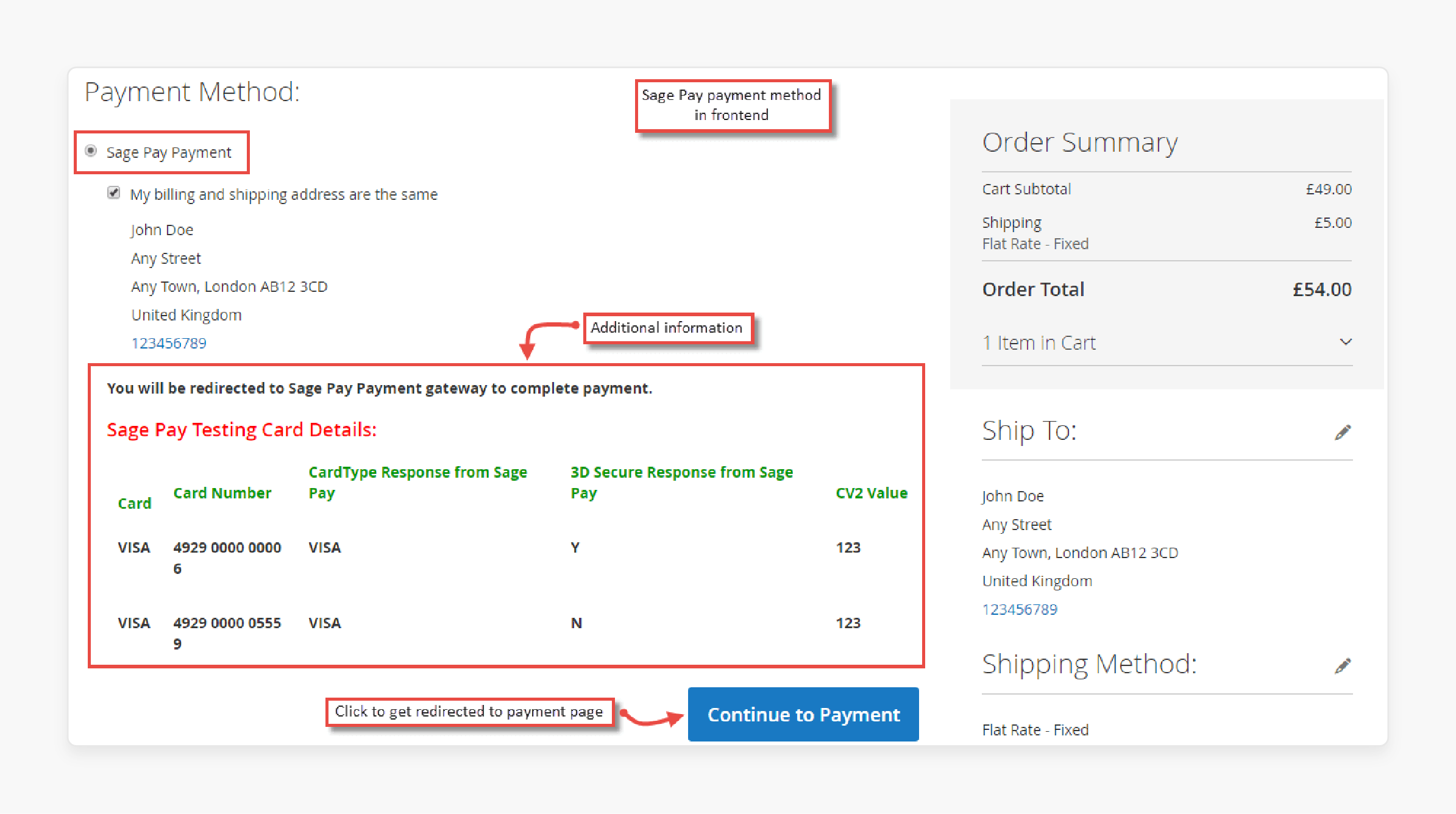

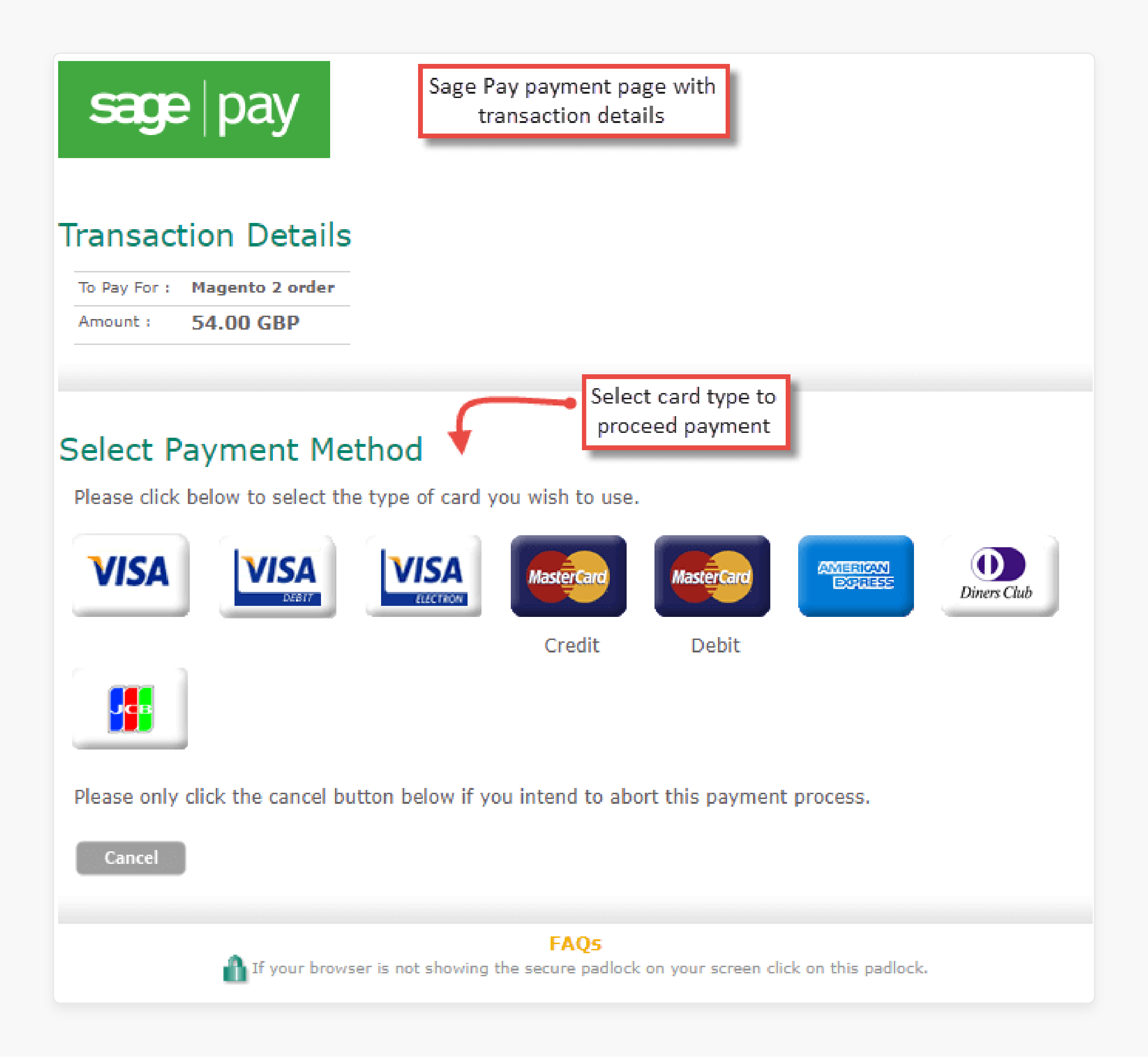

The checkout process involves multiple stages, including interactions with the Sage Pay Payment Gateway.

-

The customer selects SagePay at checkout.

-

Redirected to SagePay's secure payment page through the Magento 2 Sage Pay Integration.

-

Enters payment information

-

Returns to the Magento 2 store after completion.

This flow provides a clear separation between the store and payment processing. Such separation can reassure security-conscious customers.

2. Magento 2 Direct Payment

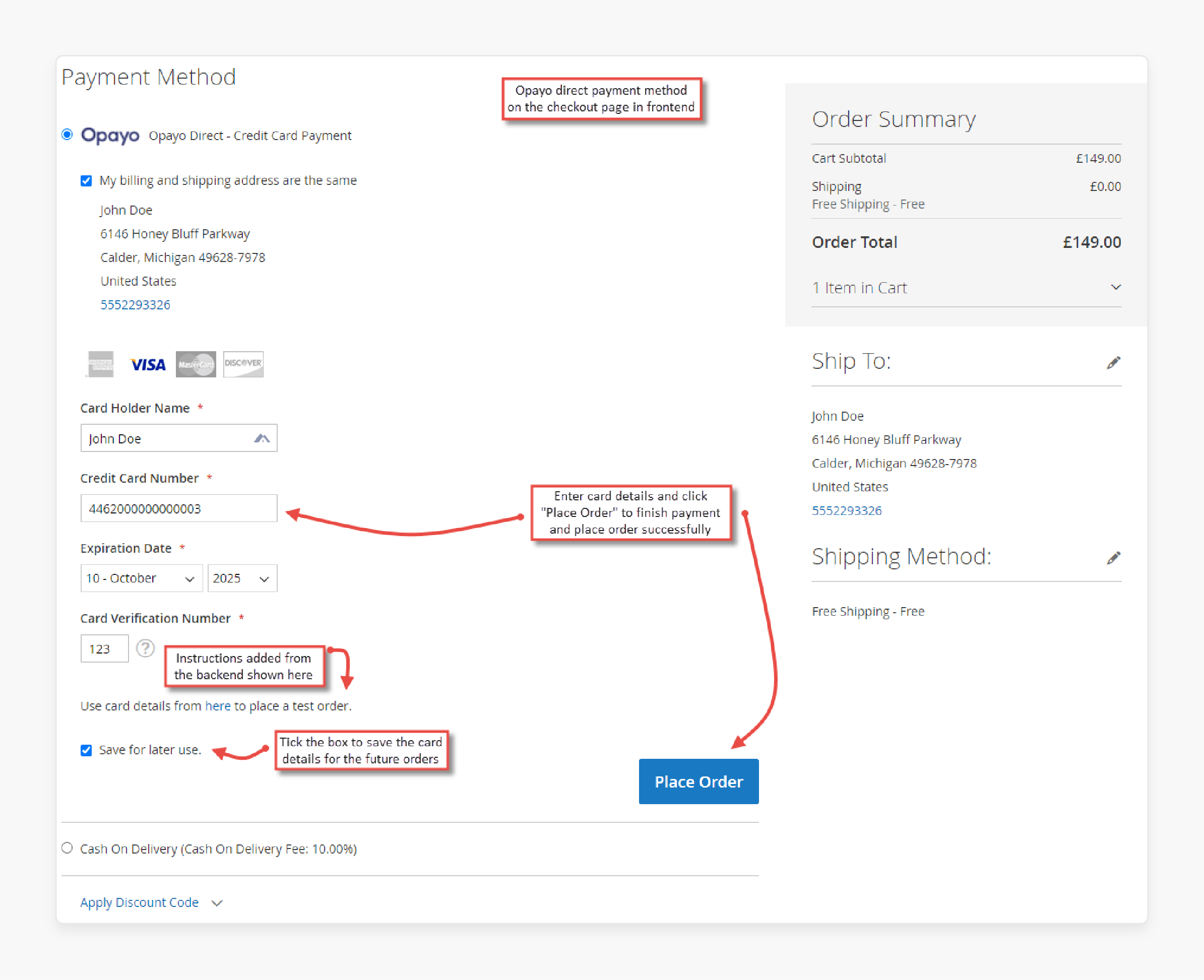

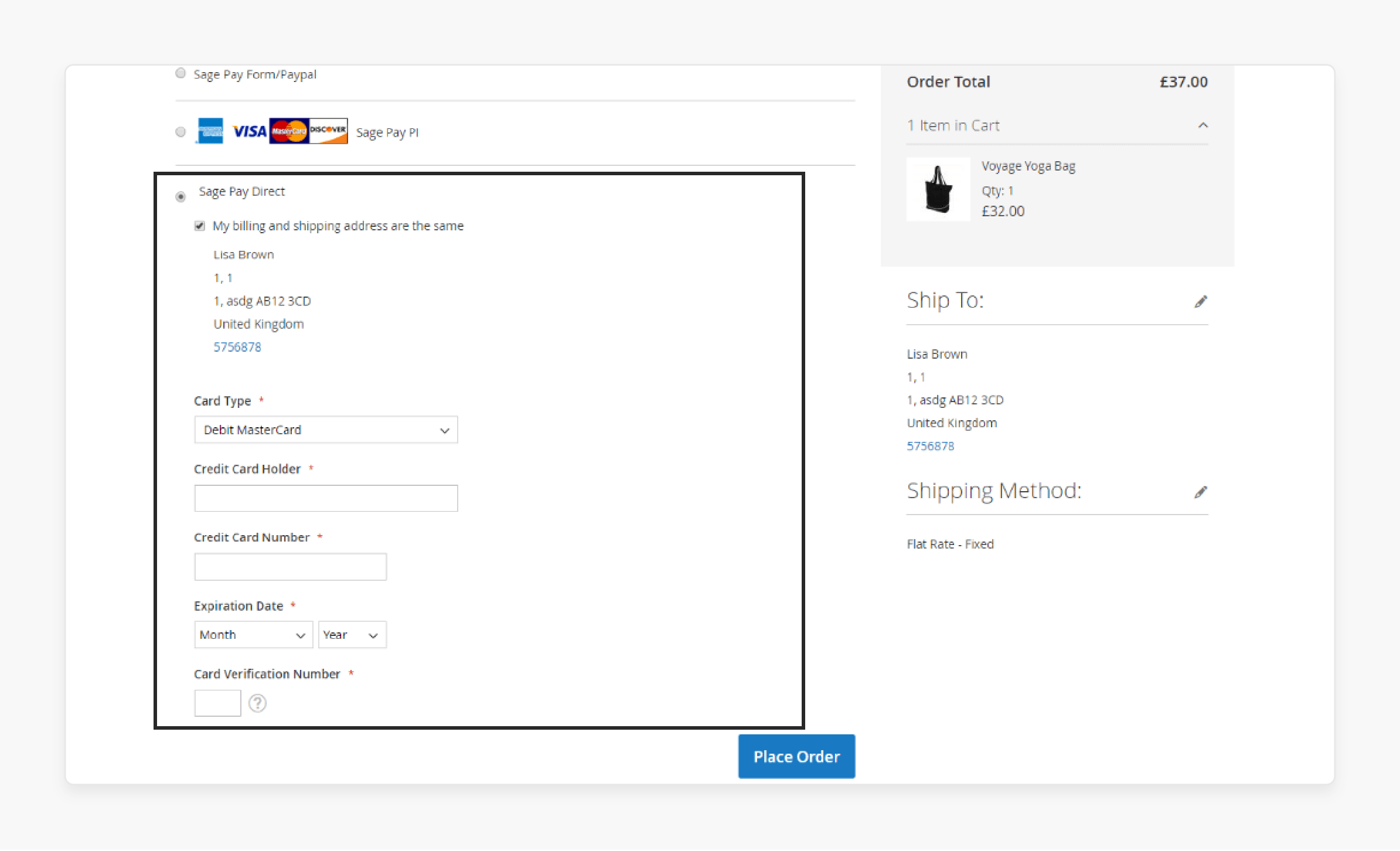

1. Seamless checkout experience:

Customers stay on the store's website throughout the process. It reduces potential drop-offs from redirects. It can lead to higher conversion rates, especially on mobile devices.

2. Higher PCI DSS compliance:

Higher PCI DSS compliance is required for Magento 2 Sage Pay Integration. Merchants need to ensure their entire system meets stringent security standards. It is necessary in the context of using Sage Pay with Magento 2. It often involves regular security scans. It also requires maintaining secure networks. Implementing strong access control measures is necessary.

3. More control over the payment process:

Merchants can customize the payment form. They can add specific validation rules. They can integrate payment data with their own systems more easily. It allows for features like saving card details for repeat purchases. It also enables implementing custom fraud checks.

4. Supports credit cards and other payment methods.

It is similar to Form Payment. However, it has additional capabilities. It allows for deeper integration of alternative payment methods into the store's interface.

5. 3D Secure authentication option available:

It is implemented directly in the checkout flow. It offers a more seamless user experience.

The checkout process involves:

-

The customer enters payment details on the store's checkout page.

-

Payment information is sent securely to SagePay.

-

The transaction is processed without leaving the store.

This streamlined process can reduce cart abandonment. It keeps customers engaged with the store. The engagement continues throughout the payment.

How to Process Payments with SagePay?

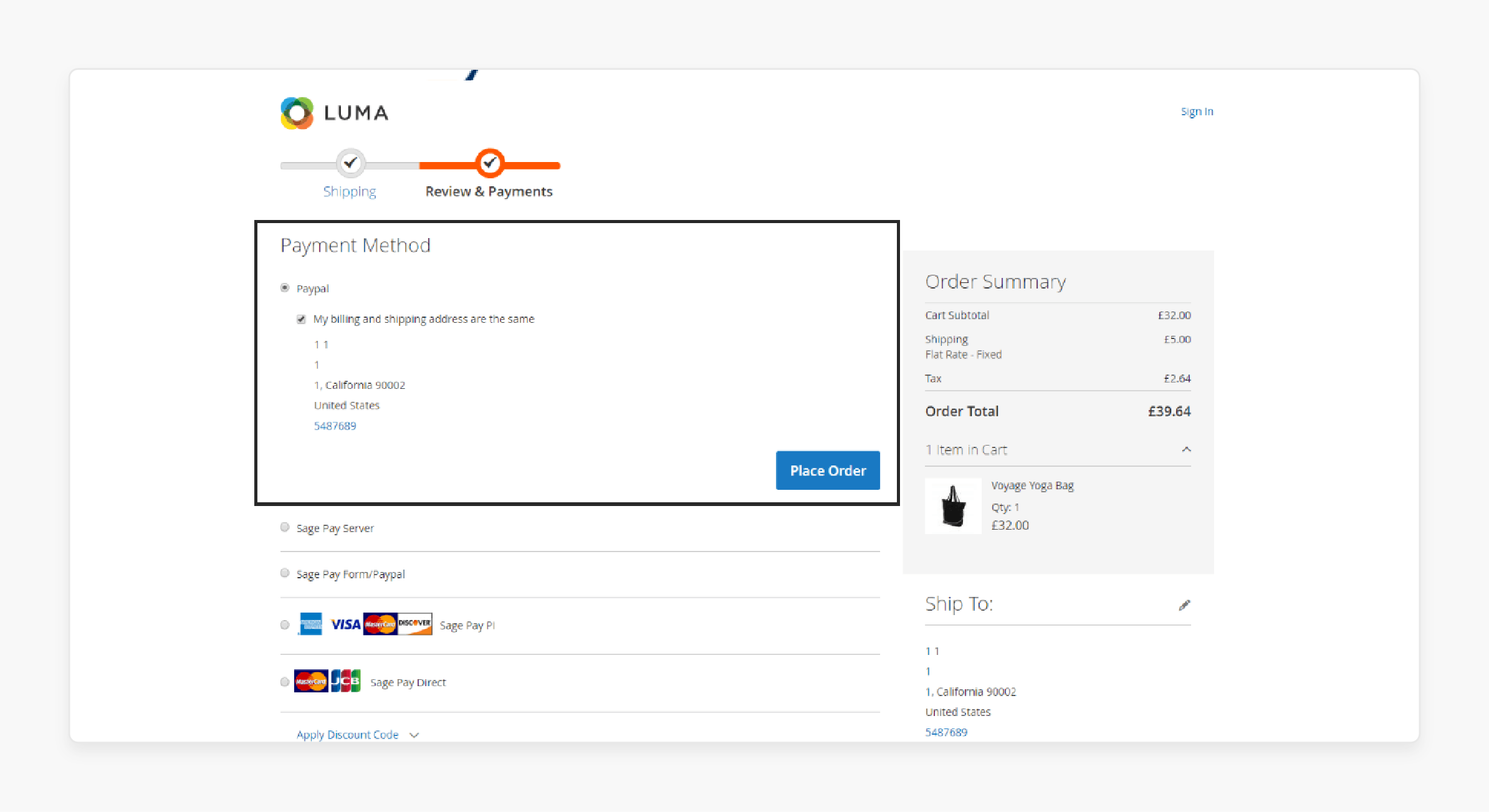

1. Customer Checkout:

-

The customer selects SagePay as a payment method through the Magento 2 Sage Pay Integration module.

-

This option appears alongside other enabled payment methods.

-

It allows customers to choose their preferred payment option.

-

Customers enter payment details on the checkout page or SagePay hosted form. This process is secured through the Magento 2 Sage Pay Integration.

-

The location depends on the integration type (Form or Direct).

-

Customers enter details directly on the store's checkout page. Or they are securely redirected to a SagePay-hosted page.

-

This flexibility allows merchants to balance user experience with security requirements.

2. Payment Processing:

-

Magento 2 sends transaction details to SagePay. It includes order amount, currency, and customer information. The data is encrypted during transmission to ensure security.

-

SagePay validates and processes the payment. It involves checking card details and available funds. It also applies fraud prevention measures.

-

SagePay's advanced systems can process thousands of transactions per second. It ensures quick response times. The system supports credit cards, PayPal, and other methods. It includes debit cards, digital wallets, and local payment methods.

-

Available methods depend on the merchant's location and account type. Supporting multiple payment methods can increase conversion rates. It caters to customer preferences.

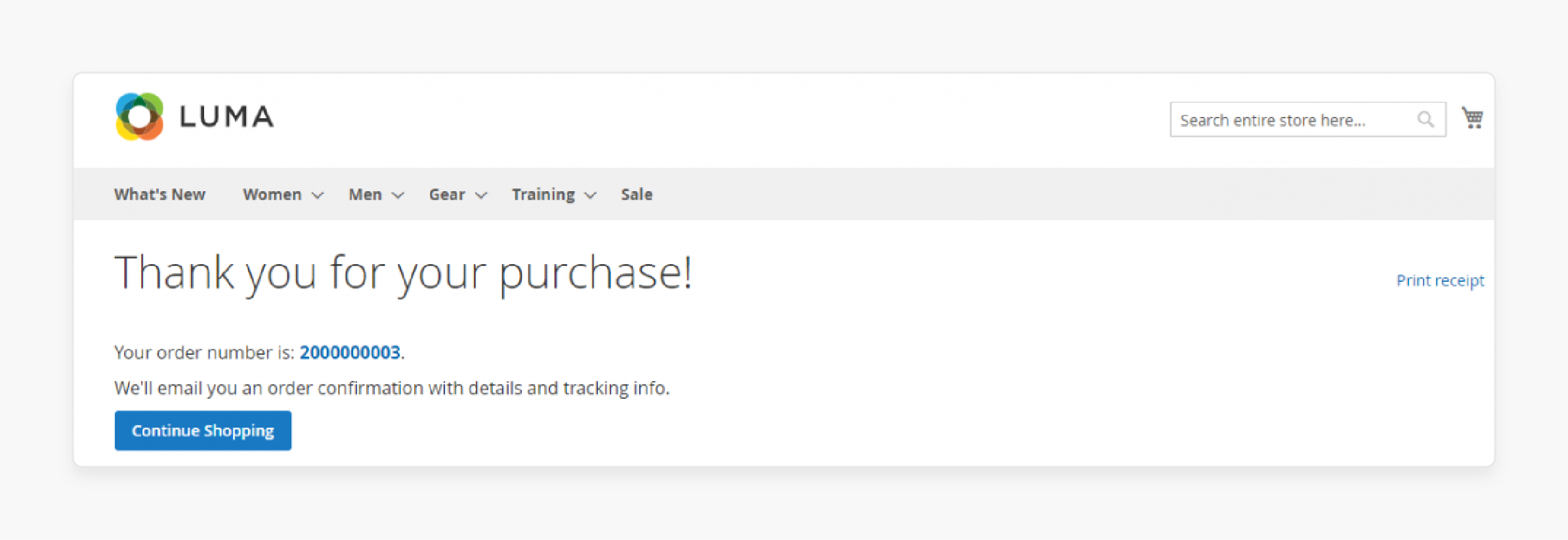

3. Transaction Confirmation:

-

SagePay returns transaction status to Magento 2. It includes approved, declined, or pending statuses. It also provides detailed response codes for troubleshooting if needed.

-

Magento 2 updates the order status based on the SagePay response. It triggers relevant processes like inventory updates. It also sends order confirmation emails.

-

This automation reduces manual work and potential errors.

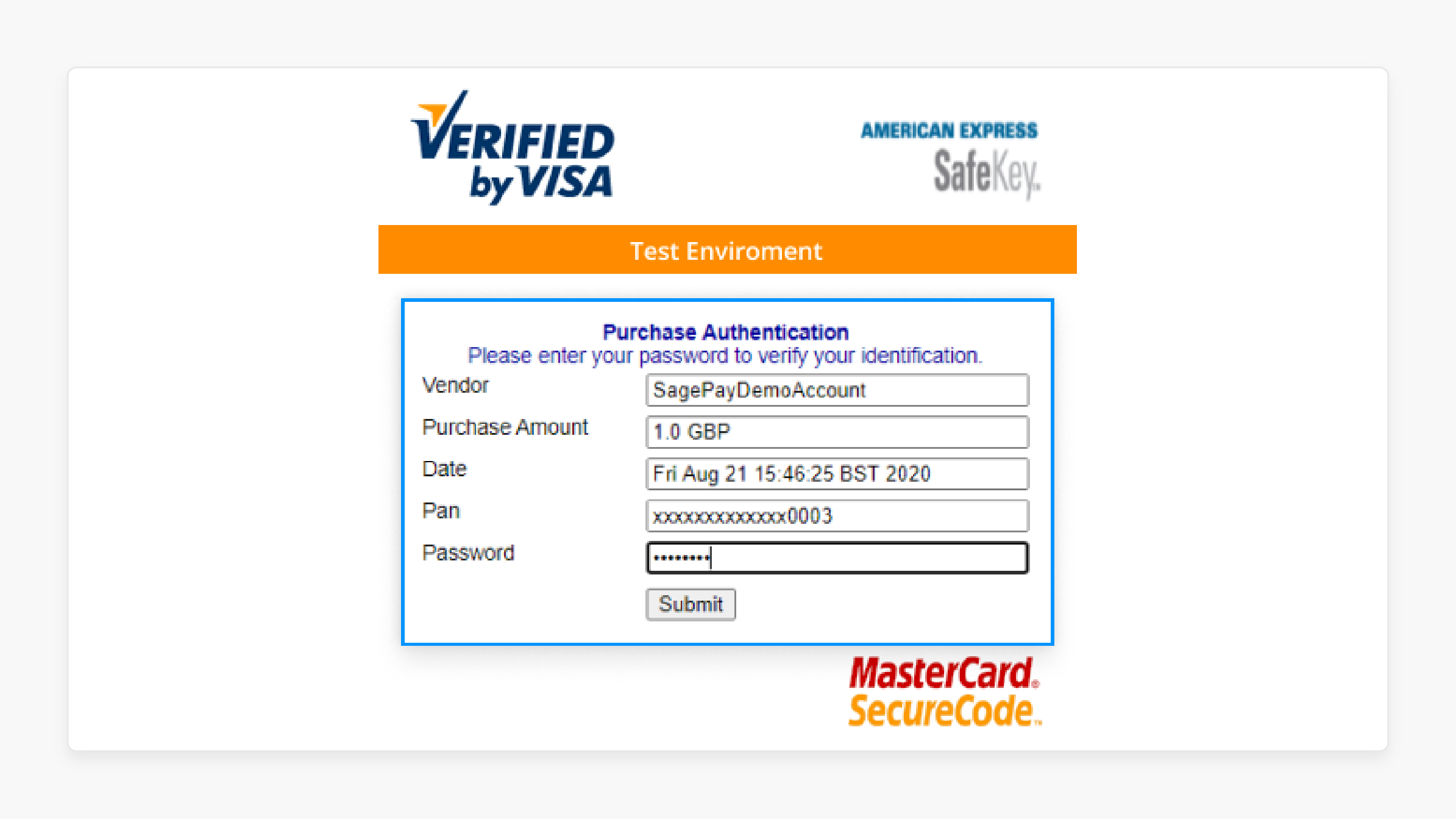

4. Security Measures:

-

3D Secure authentication is used for eligible transactions. It prompts customers to verify their identity with their card issuer. It reduces fraud risk. It potentially shifts liability away from the merchant.

-

PCI DSS compliance ensures secure payment handling. It means the entire payment process meets strict security standards. It protects sensitive customer data. It reduces the risk of data breaches.

5. Payment Types:

-

Authorize Only: Funds are reserved but not captured. It is useful for businesses that need to verify stock before charging. It's also helpful for those who customize orders before charging.

-

Authorize and Capture: Funds are immediately transferred. It is suitable for immediate digital goods delivery. It's also good when shipping products quickly.

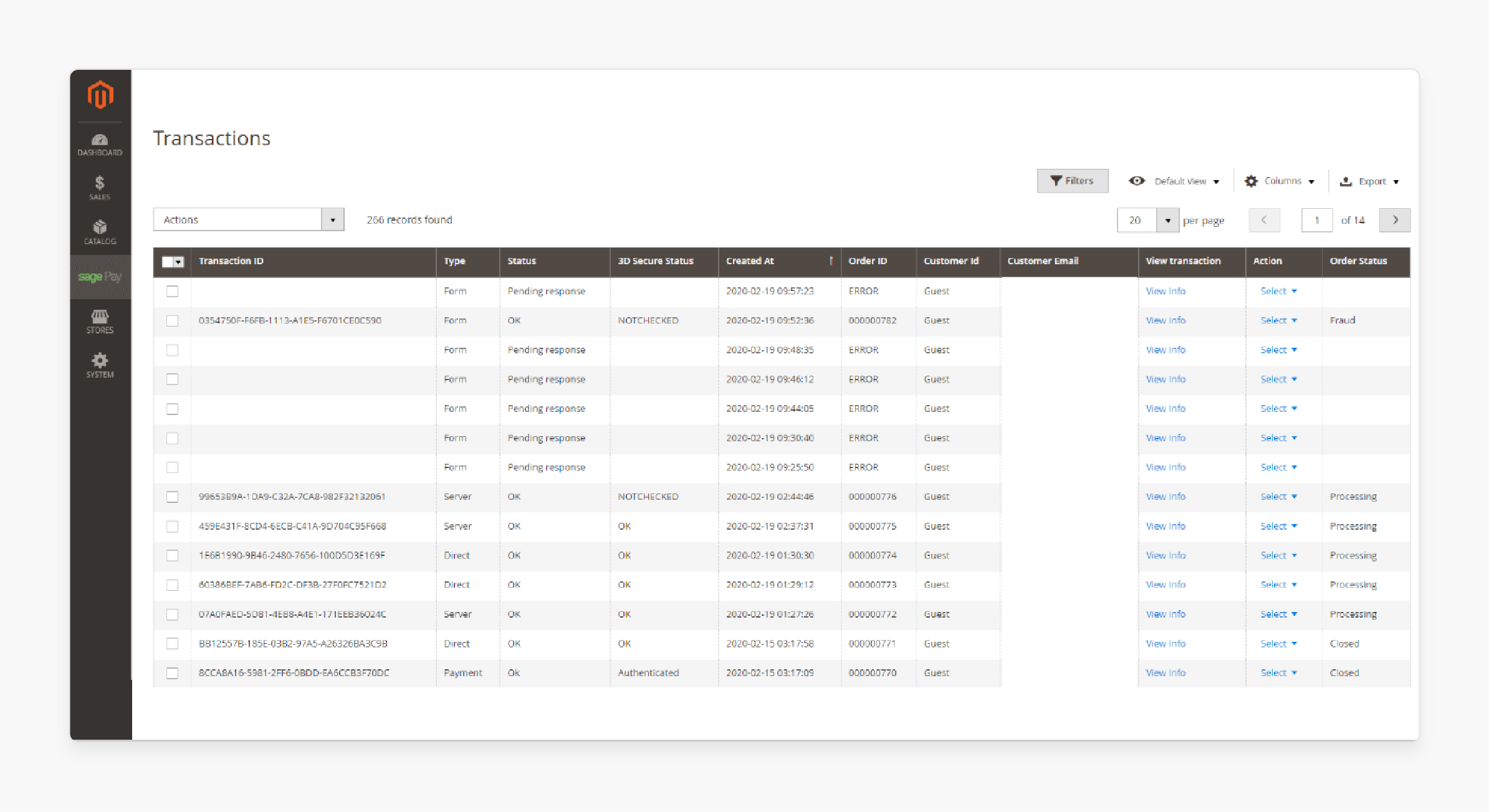

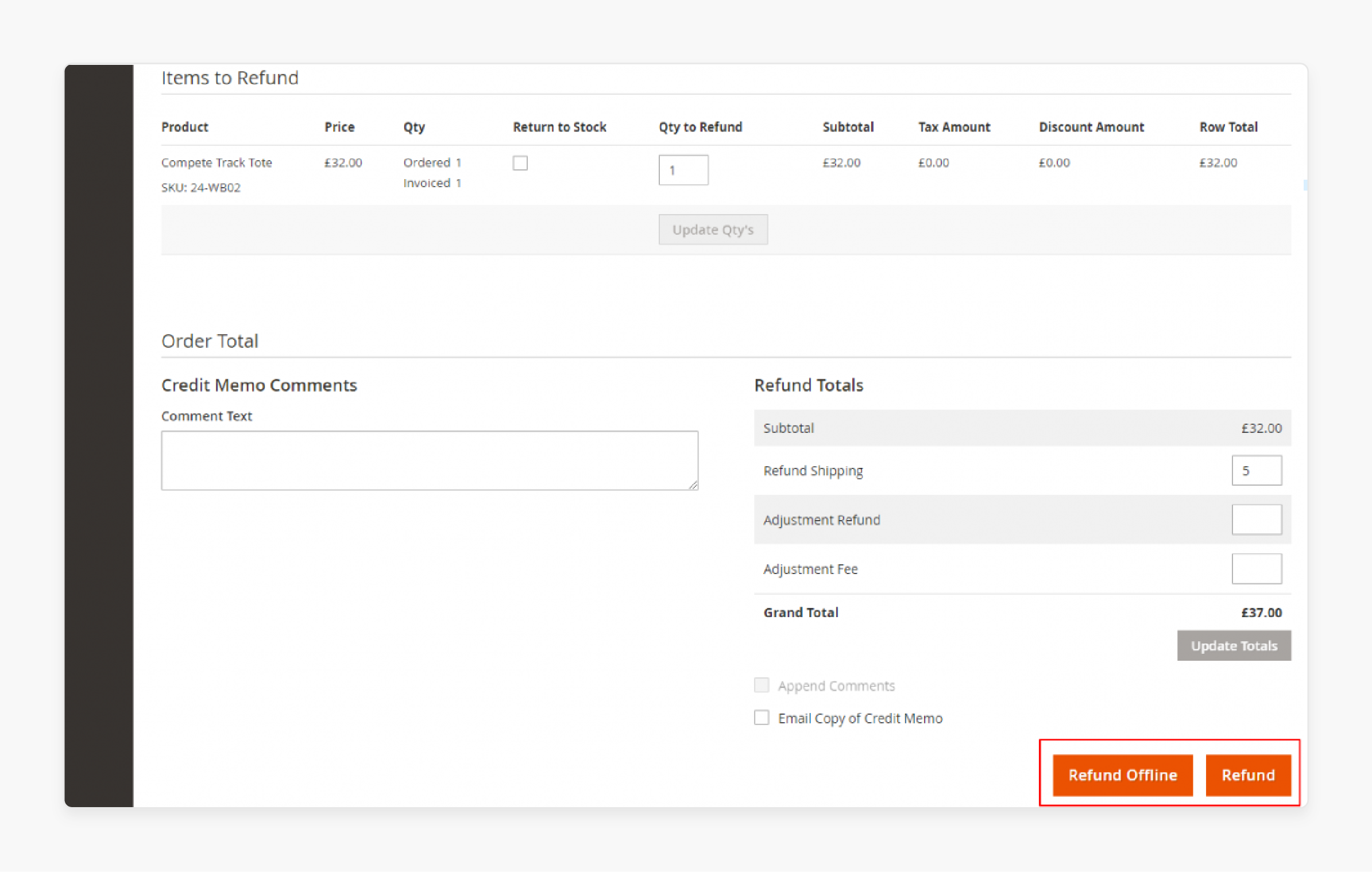

6. Backend Management:

-

Merchants can view transaction details in Magento 2 admin. They can see payment status, amounts, and other transaction details. It can be done without leaving their Magento interface.

-

Merchants can process refunds directly through SagePay integration. It streamlines the refund process within the Magento 2 Opayo Payment framework.

-

The Magento 2 Sage Pay Integration process includes automatic updates. It updates Magento orders. It also updates SagePay transactions. It ensures financial reconciliation.

7. Multi-currency Support:

-

The system can process payments in various currencies. It allows merchants to sell globally.

-

They can do so without managing multiple payment accounts.

-

SagePay handles the currency conversion. It ensures accurate, real-time exchange rates. It simplifies accounting for the merchant.

8. Recurring Payments:

-

Merchants can set up subscriptions and recurring billing. This feature enables the offering of subscription-based products or services. It potentially increases the customer's lifetime value.

-

Tokenization is used for secure repeat transactions.

-

Customer payment details are securely stored as tokens. It allows for easy repeat purchases. It avoids storing sensitive card data on the merchant's systems.

Security and Compliance with SagePay Magento 2

1. PCI DSS Compliance:

-

SagePay is PCI DSS Level 1 certified. It is the highest level of compliance. It requires annual on-site audits and network scans.

-

It ensures the highest level of payment data security. It involves maintaining a secure network. It requires protecting cardholder data. It includes implementing strong access control measures. Regular monitoring and testing of networks is necessary. Maintaining an information security policy is also required.

-

Reduces merchant's compliance burden. Merchants using SagePay may be eligible for reduced PCI DSS requirements. They only need to complete a shorter self-assessment questionnaire. It is instead of undergoing a full audit.

2. 3D Secure Authentication:

-

Supports 3D Secure for card payments: This includes both 3D Secure 1 and the newer 3D Secure 2. 3D Secure 2 offers a more seamless user experience.

-

Adds an extra layer of security: It requires cardholders to complete an additional verification step. This verification is done with their card issuer.

-

Helps prevent fraudulent transactions: It confirms the cardholder's identity. It reduces the risk of unauthorized transactions. It can lead to fewer chargebacks for merchants.

3. Tokenization:

-

Converts sensitive card data into unique tokens: Each token is a randomly generated string. It represents the card data. The token has no intrinsic value if intercepted.

-

Enhances security for recurring payments: Merchants can store tokens instead of actual card data. It allows for repeat transactions. Sensitive information is not handled directly.

-

Reduces risk of data breaches: Even if a token is compromised, it remains secure. The original card data can't be reconstructed from the token.

4. Encryption:

-

Uses strong encryption for data transmission. It involves TLS 1.2 or higher. It also uses strong cipher suites.

-

Protects information between Magento 2 and SagePay servers. It ensures data security during transmission. Even if data is intercepted, it remains unreadable to unauthorized parties. This security measure is an essential part of the Magento 2 Sage Pay Integration.

5. Fraud Prevention:

-

Implements advanced fraud screening tools: This may include address verification. It can also involve CVV checks. Machine learning algorithms may be used to detect unusual patterns.

-

Helps identify and prevent suspicious transactions: It flags potentially fraudulent transactions for review or rejection. It can significantly reduce a merchant's fraud losses.

6. Hosted Payment Pages:

-

Option for SagePay-hosted payment pages: This redirects customers to a secure page hosted by SagePay. Customers enter payment details on this page.

-

Shifts responsibility for data security to SagePay: This can reduce the merchant's PCI DSS scope. Sensitive card data never touches the merchant's servers.

7. Server Integration:

-

Offers secure server-to-server communication: This allows for direct communication between the merchant's server and SagePay. It keeps details from being exposed to the customer's browser.

-

Reduces exposure of sensitive data: Communication is kept on the server side. It minimizes points where data could be intercepted.

8. Magento 2 Security Features:

-

Integrates with Magento 2's built-in security measures: This includes features like:

-

Admin action logging

-

Secure password hashing

-

Enhances overall store security: It works within Magento 2's security framework. It ensures consistent security practices across the platform.

9. Regular Security Updates:

-

SagePay Magento 2 extension receives frequent updates. It ensures that the latest security patches and improvements are applied.

-

Addresses new security threats and vulnerabilities. Regular updates allow for quick responses to newly discovered security issues.

10. Compliance Certifications:

-

SagePay holds various security certifications. It may include ISO 27001 for information security management.

-

Ensures adherence to industry standards. These certifications provide independent verification. They demonstrate SagePay's commitment to security practices.

11. Secure Refund Processing:

-

Allows secure refunds through Magento 2 admin: This enables merchants to process refunds. They can do so without leaving their Magento interface.

-

Maintains transaction security for refunds: Refunds are processed through secure channels. These are the same channels used for original transactions.

12. Access Controls:

-

Supports role-based access controls in Magento 2: This allows merchants to set granular permissions for staff members.

-

Limits exposure to sensitive payment information: Restricting access to payment data reduces the risk of internal data breaches.

FAQs

1. What is SagePay Magento 2?

SagePay Magento 2 is a payment gateway and security extension for Magento 2. It allows users to process transactions on their Magento store securely. This extension leverages the Magento 2 Sage Pay Payment Gateway features.

2. What is Opayo, and how is it related to SagePay Magento 2?

Opayo is the new name for SagePay. Opayo is a payment service provider. It offers a payment gateway. The SagePay Magento 2 extension enables integration with Opayo. This integration allows for processing payments.

3. What are the key features of the SagePay Magento 2 extension?

The SagePay Magento 2 extension has several key features. These include secure transaction processing. It also offers 3D Secure authentication. The extension supports credit card payments. It provides backend management capabilities. Lastly, it ensures a seamless checkout experience.

4. Is the SagePay Magento 2 extension easy to integrate with a Magento store?

The SagePay Magento 2 extension offers simple integration options. These options allow for seamless setup with a Magento 2 store. Integration can be done through form integration or PI integration. This module simplifies the process within the Magento 2 Sage Pay Integration.

5. How does the SagePay Magento 2 extension ensure a high level of security for transactions?

The SagePay Magento 2 extension provides a secure payment gateway. It includes advanced security features. These features protect card details. They also ensure safe payment processing for customers.

6. Can I use Opayo Direct Integration with the SagePay Magento 2 extension?

The SagePay Magento 2 extension supports Opayo Direct Integration. It allows merchants to link their Opayo account directly with the extension. It enables streamlined payment processing.

7. What are the benefits of using the SagePay Magento 2 extension for payment integration?

The SagePay Magento 2 extension offers benefits for payment integration. These include enhanced security. It provides a seamless checkout experience. The extension supports various payment methods. It also enables efficient transaction processing.

Summary

SagePay Magento 2 integration enhances the security and efficiency of payment systems. This integration facilitates the use of various payment methods. These include credit cards and 3D Secure transactions. It offers both server and form integration options. These accommodate different business needs. Let's summarize the key points.

-

Two Integration Options: Choose between Form Payment and Direct Payment.

-

Comprehensive Setup Process: From installation to going live, configuring SagePay Magento 2 involves detailed steps.

-

Secure and Flexible Payment Processing: SagePay ensures transactions are secure.

-

Robust Security Measures: SagePay Magento 2 safeguards against fraud and protects sensitive data.

Explore managed Magento hosting services to enhance security with SagePay integration.