Boost Tax Compliance & Setup with Magento Tax Class ID

Are you tired of the tax setup hassle on your online store? With Magento Tax Class ID, you can simplify tax rules for products and customer groups, ensuring accuracy and compliance. This article covers how Magento Tax Class ID optimizes tax managed enhancing functionality and customer satisfaction.

Key Takeaways

-

Magento Tax Class ID ensures accurate tax calculations for products and customers.

-

Supports tax customization and compliance with adjustable rates and legal adherence.

-

Automation minimizes errors, streamlining calculations and compliance.

-

Enhances reporting and transparency, providing clear tax details at checkout.

-

Facilitates scalability, managing tax changes effectively as businesses grow.

What is Magento Tax Class ID?

Magento tax class ID is a unique identifier within the Magento platform. It assigns specific tax rules to products and customer groups.

Different products, like electronics and clothing, have distinct tax classes. Each class has an ID, which ensures the correct tax rate is applied during checkout. This system is essential for accurate tax calculations across various inventories.

Setting up a Tax class ID in Magento is essential for meeting local tax regulations. Administrators can create and assign unique IDs for each tax class via the Magento backend. This setup allows for precise tax control on every transaction. Magento uses the Tax Class ID to determine the correct tax rate when a customer purchases. This automation streamlines tax management, minimizes errors, and ensures correct tax charges for customers.

Role of Tax Class ID in Magento E-commerce

1. Accurate Tax Rate Application

Tax Class ID determines the tax rate for products and customer groups. Each item is taxed according to its classification. This system ensures adherence to regional tax laws. It automatically applies the correct tax rate at checkout. It prevents discrepancies and ensures compliance. Businesses don’t need to adjust tax rates manually. It keeps transactions smooth and hassle-free.

2. Customization of Tax Rules

The Tax Class ID enables customization within Magento. Businesses can set different tax rates for different products or services. This flexibility optimizes financial outcomes. It ensures precise tax management. Custom rules help meet the unique tax requirements of different locations. It also allows special tax setups for promotions and discounts.

3. Compliance with Local Regulations

Using Tax Class ID helps maintain compliance with Magento tax regulations. Magento allows the configuration of tax settings that meet legal requirements. It minimizes the risk of penalties due to improper tax collection. Accurate tax application reduces audit risks. It also helps businesses maintain a positive reputation.

4. Automation of Tax Calculations

Tax Class ID automates tax calculations. It reduces the workload on staff. It ensures that correct tax rates are applied at checkout. Automation helps prevent human errors. Tax updates can be applied instantly. It ensures ongoing compliance with tax law changes.

5. Enhanced Reporting and Analytics

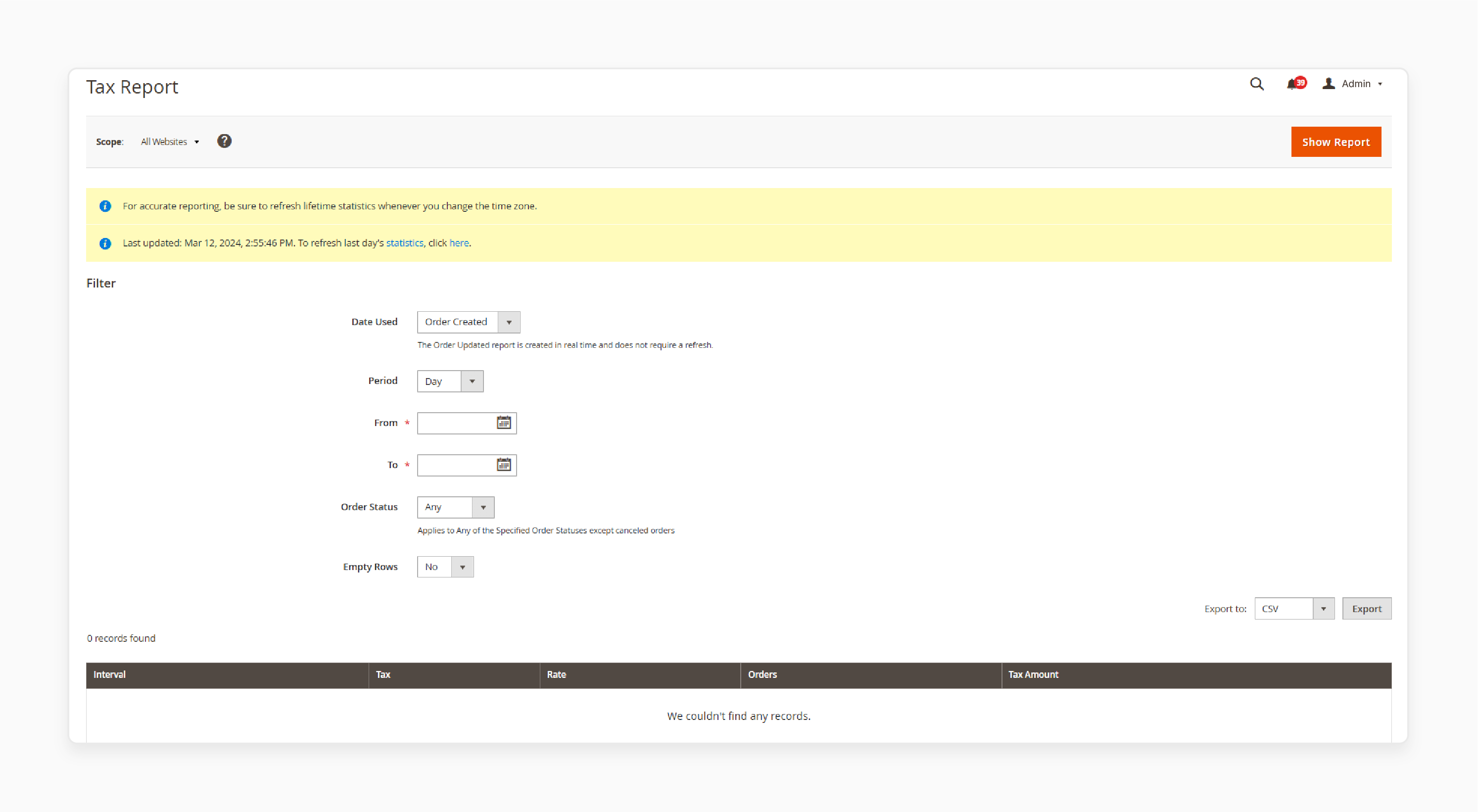

Tax Class ID is essential for reporting and analytics. It tracks tax collections by product category. This data is invaluable for financial analysis. It helps businesses understand their tax obligations. Reports help identify trends in tax payments. Businesses can use this data to improve financial planning.

6. Simplification of Product Catalog Management

Tax Class ID simplifies managing extensive product catalogs. It allows quick assignment of tax classes based on product type or customer group. It is essential for efficiently managing diverse inventories. Large stores benefit from easy tax categorization. It reduces confusion when applying tax settings.

7. Reduction in Tax-Related Errors

Using Tax Class ID reduces tax-related errors. It automates tax rate applications. Each product is correctly classified. It minimizes financial discrepancies and customer disputes. Fewer errors mean fewer refunds or corrections. It helps businesses avoid unnecessary tax liabilities.

Tips to Integrate Magento Tax Class ID with Your Store’s Workflow

| Tip | Explanation |

|---|---|

| 1. Define Clear Tax Categories | Classify products based on tax requirements. Assign each product to the correct Tax Class ID in Magento. It ensures accurate tax calculations. Proper classification prevents compliance issues. It also reduces manual tax adjustments. |

| 2. Assign Tax Classes to Customer Groups | Different customer groups may have different tax rates. Magento allows you to link Tax Class IDs to specific groups. It ensures that retail, wholesale, or tax-exempt customers are taxed correctly. It simplifies tax management for different buyer segments. Automated assignments reduce errors. |

| 3. Configure Tax Zones and Rules | Set up tax zones and rates in Magento's backend. Ensure each Tax Class ID is mapped to the correct location-based tax rule. It allows Magento to apply taxes based on the customer's location automatically. Keeping this updated prevents incorrect tax applications. |

| 4. Automate Tax Rate Updates | Tax rates change frequently due to local regulations. Use tax automation extensions or Magento's tax API to update rates automatically. It eliminates the need for manual tax adjustments. Keeping tax rates current ensures compliance. It also improves checkout accuracy. |

| 5. Test Tax Settings Before Going Live | Always test tax calculations before launching updates. Run test transactions with different products and customer groups. Check if the correct Tax Class ID is applied. Testing helps identify errors before customers experience issues. It ensures a smooth purchasing experience. |

| 6. Use Tax Reports for Accuracy | Magento provides detailed tax reports for analysis. Regularly review these reports to verify tax calculations. Ensure that different Tax Class IDs are applied correctly. It helps in tax filing and financial audits. Proper reporting prevents legal issues. |

| 7. Integrate with Accounting Software | Connect Magento with accounting tools like QuickBooks or Xero. This integration ensures tax data flows directly into financial records. It reduces manual data entry and errors. Automated syncing saves time and improves accuracy. |

| 8. Train Your Team on Tax Settings | Educate staff about Magento Tax Class IDs. Train them on assigning tax classes, updating tax settings, and troubleshooting issues. A well-trained team ensures tax rules are applied correctly. It prevents compliance issues and customer complaints. |

| 9. Monitor and Update Tax Rules Regularly | Review tax rules frequently to keep them current. Tax regulations may change, requiring updates to Tax Class IDs and rates. Regular monitoring prevents outdated settings from affecting your business. Staying proactive ensures smooth tax management. |

Benefits of Using Magento Tax Class ID

1. Reduced Errors in Tax Collection

Magento Tax Class ID assigns the correct tax rate to each product and customer group. This automation reduces manual errors in tax calculations. Incorrect tax applications can cause financial discrepancies. It may also lead to penalties. With proper tax class setup, businesses avoid overcharging or undercharging customers. Automated tax application improves accuracy and simplifies audits.

2. Faster Transaction Processing

Automated tax calculations speed up the Magento 2 checkout. Magento applies the correct Tax Class ID instantly. It removes the need for manual tax adjustments. Faster processing ensures quick order completion. It improves efficiency for businesses and customers. A smooth checkout leads to higher sales conversions.

3. Better Customer Experience at Checkout

Customers expect precise and accurate tax calculations. Magento’s Tax Class ID ensures pricing transparency. Customers can see correct tax breakdowns before making a purchase. It builds trust and prevents disputes. A hassle-free checkout encourages repeat purchases. Satisfied customers return more often.

4. Easier Tax Compliance

Magento configures tax settings based on local tax regulations. The Tax Class ID ensures correct tax rates are applied. It reduces compliance risks and prevents legal issues. Businesses can generate detailed tax reports for audits. Proper tax classification helps avoid penalties.

5. Simplified Multi-Store Tax Management

Managing taxes for multiple Magento stores can be difficult. Tax Class ID allows easy assignment of tax rules for each store. Different regions have unique tax rates. Magento applies them automatically. It keeps tax rules consistent across sales channels. A structured tax system reduces workload.

6. Improved Financial Reporting

A proper Tax Class ID setup helps track tax revenue accurately. Magento provides detailed tax reports for the product and customer groups. Businesses can use these reports to understand tax liabilities. Proper reporting makes audits easier. Well-organized tax data supports better financial decisions.

7. Scalability for Business Growth

As businesses grow, tax rules may change. New products, locations, or tax laws require updates. Magento Tax Class ID is scalable. It allows businesses to adjust tax rates easily. Its flexibility helps it adapt to changes in tax regulations. A structured tax system supports long-term business growth.

Fixing Common Problems with Magento Tax Class ID Setup

1. Tax Class ID Not Applying Correctly

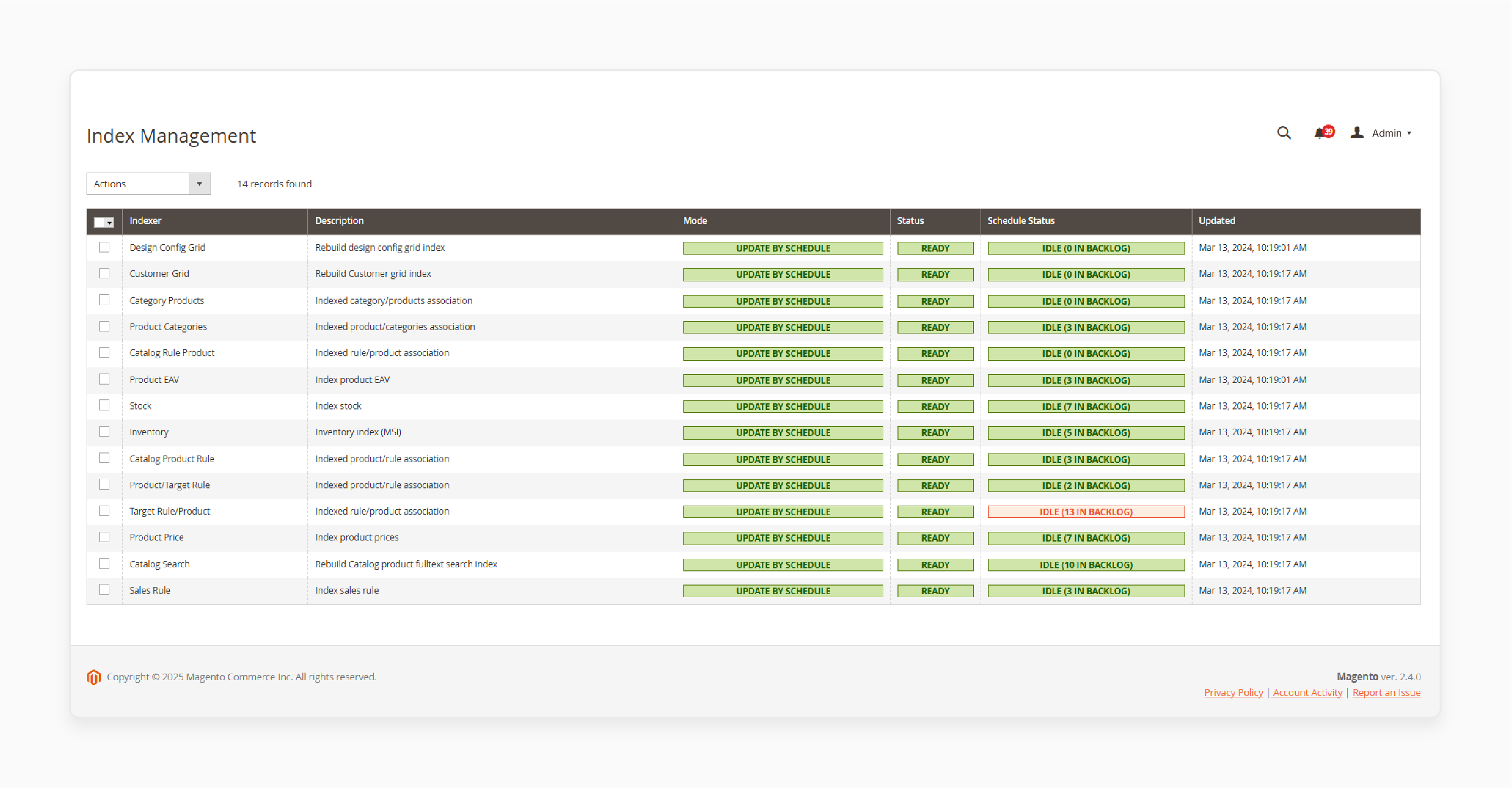

Tax Class ID may not apply to products or customers. It happens if tax settings are incorrect. Check the product tax class assignment in Magento. Ensure customer groups have the correct Tax Class ID. Refresh the cache and reindex Magento if the issue persists.

2. Incorrect Tax Rate Calculation

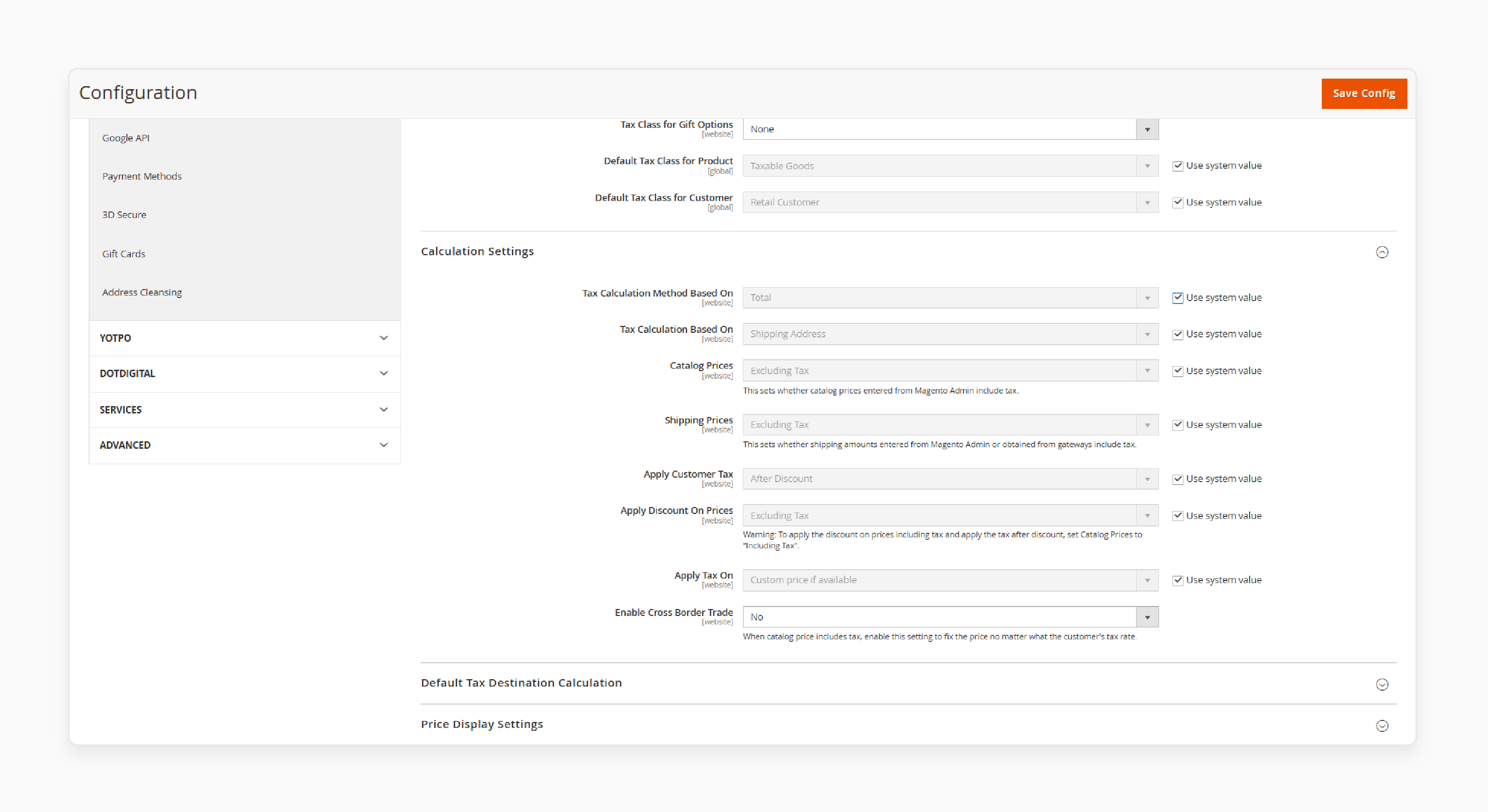

Wrong tax rates can cause checkout errors. Go to Tax Zones and Rates in Magento. Ensure tax rates match the customer's location. Check if tax rules are linked to the correct Tax Class ID. Update tax rates manually if needed.

3. Tax Exempt Customers Still Being Charged

Tax-exempt customers may still be charged tax. Check if the customer group is assigned a tax-exempt Tax Class ID. Ensure tax rules exclude these customers. Clear the cache if changes don’t take effect. Look for conflicting tax settings.

4. Tax Not Displaying at Checkout

If tax is missing at checkout, check Tax Calculation Settings. Ensure the right Tax Class ID is linked to products and customer groups. Verify tax display settings under Sales > Tax Configuration. Clear the cache to apply changes.

5. Tax Rules Not Updating After Changes

Magento may not apply new tax rules immediately. It is often due to caching or indexing issues. Reindex tax data under System > Index Management. Flush the cache to apply updates. Make sure the tax rule is active.

6. Conflict Between Multiple Tax Rules

Magento may apply the wrong tax rate if the rules overlap. Review all tax rules for duplicate conditions. Assign priority levels to avoid conflicts. Test calculations to ensure the correct rule applies.

7. Tax Not Appearing in Reports

Magento tax reports may miss data. Ensure all Tax Class IDs are correctly assigned. Check Reports > Taxes for reporting settings. Reindex Magento if tax records don’t appear.

8. Tax Rounding Errors in Final Price

Magento may round tax values incorrectly. Go to Stores > Configuration > Sales > Tax. Adjust the tax rounding method. Make sure the tax is calculated based on the correct display settings.

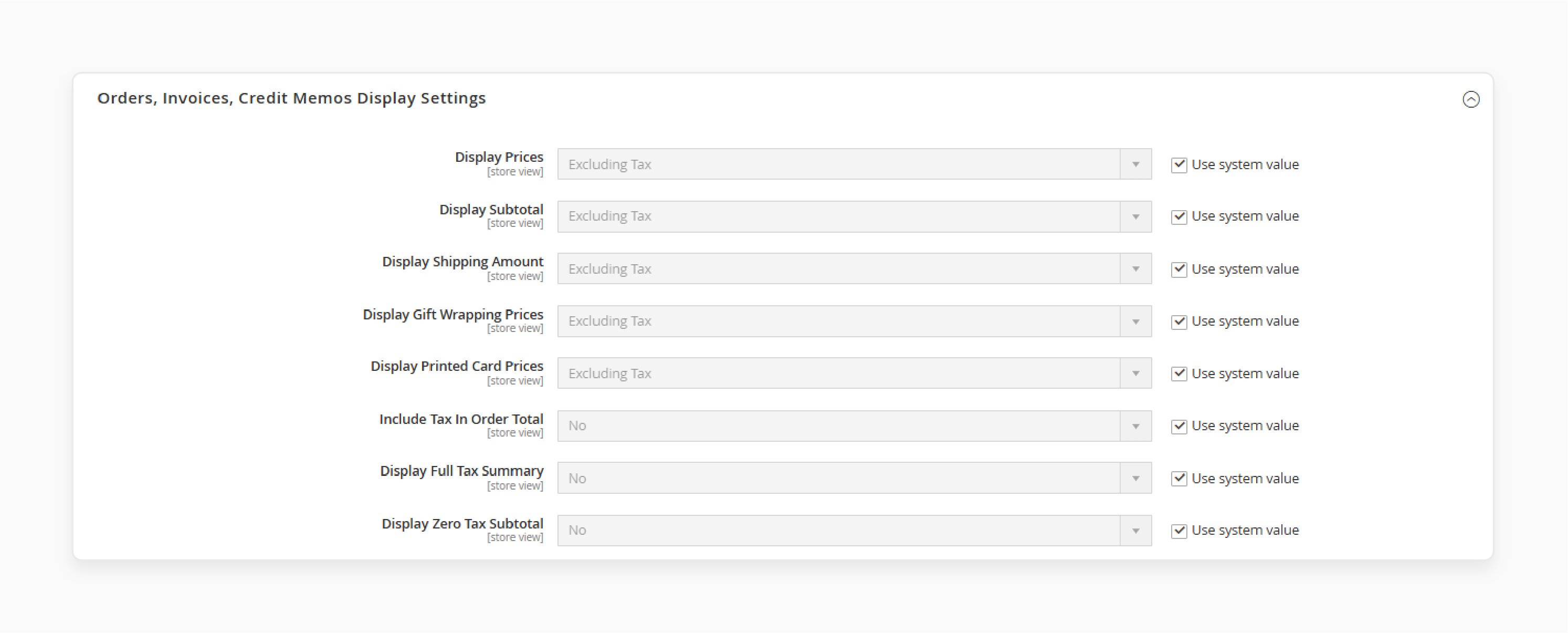

9. Tax Display Issues on Invoices and Credit Memos

Invoices and credit memos must show correct tax details. Check PDF invoice settings in Magento. Verify the Tax Class ID is linked properly. Regenerate invoices if needed. Clear the cache for updates.

Future Outlook of Tax Management in E-commerce

1. Upcoming Changes in Tax Regulations

| Change | Explanation |

|---|---|

| More Digital Taxation Policies | Governments are enforcing digital tax laws on online businesses. E-commerce stores must comply with new digital service tax rules. It affects cross-border transactions and online marketplaces. |

| Stricter Sales Tax Compliance | More regions require e-commerce stores to collect and report sales tax. Non-compliance can result in penalties. Businesses must stay updated on local tax laws. |

| VAT and GST Expansion | Many countries are expanding Value Added Tax (VAT) and Goods and Services Tax (GST) rules. E-commerce stores must register and apply the correct tax rates for international customers. |

| Real-Time Tax Reporting | Some countries are introducing real-time tax reporting. It requires businesses to submit tax data as transactions happen. Automation tools will be necessary for compliance. |

| Marketplace Tax Responsibilities | Online marketplaces may be required to collect and remit taxes on behalf of sellers. It shifts tax responsibility from sellers to platforms. E-commerce businesses must adapt to new rules. |

2. Technological Advances in Tax Software

| Technology | Impact on Tax Management |

|---|---|

| AI-Powered Tax Calculation | AI improves accuracy in tax calculations. It reduces errors and ensures real-time tax adjustments. Businesses can rely on AI to manage tax complexities. |

| Blockchain for Tax Compliance | Blockchain creates secure and transparent tax records. It helps prevent tax fraud and makes audits more efficient. Governments may adopt blockchain for tax tracking. |

| Automated Tax Filing | Modern tax software automates filing and reporting. Businesses save time and reduce compliance risks. It eliminates manual calculations. |

| Cloud-Based Tax Solutions | Cloud platforms allow real-time tax updates across multiple locations. It is useful for global e-commerce businesses. Cloud tax tools ensure compliance in multiple countries. |

| E-commerce Tax APIs | APIs connect e-commerce platforms with tax authorities. They provide instant tax rate updates and improve compliance. Many businesses use tax Magento APIs to simplify operations. |

3. Preparing Your Store for Future Tax Challenges

-

Monitor Tax Law Updates: Stay informed about upcoming tax regulations. Regularly check official tax authority websites.

-

Invest in Tax Automation: Use tax software to handle real-time tax calculations and compliance. Magento automation reduces human errors.

-

Optimize Tax Class Assignments: Ensure products and customer groups have correct Tax Class IDs. It helps apply the right tax rate.

-

Use AI and Data Analytics: AI-powered tools can analyze tax trends. They help predict future tax obligations and improve decision-making.

-

Prepare for International Compliance: If selling globally, register for VAT, GST, and digital service taxes where required. Keep up with international tax laws.

-

Consult Tax Experts: Work with tax professionals for complex tax structures. They help ensure compliance and avoid financial risks.

-

Test Your Tax Setup Regularly: Test transactions to verify tax accuracy. Fix any tax miscalculations before they impact customers.

FAQs

1. What is a customer tax class in Magento 2? How do I add a new one?

A customer tax class in Magento 2 categorizes customers for tax purposes. To add a new tax class, navigate to the Tax menu in your Magento 2 store backend. Select "Customer Tax Classes," then click "Add New Tax Class."

2. How can I configure tax rules for a Magento 2 store?

To configure Magento 2 tax rules, access the backend of your Magento 2 store. Go to "Taxes" under "Stores" and select "Tax Rules." Click "Add New Tax Rule," set the conditions, and link them to the appropriate tax rates and product classes.

3. What steps do I follow to set up a default tax in Magento 2 for products and shipping?

To set up a default tax, open the tax settings in your Magento 2 admin panel. Specify your default product class and the tax class for shipping. These settings ensure the correct tax is applied to product sales and shipping charges.

4. How do I add a new tax rate for B2B transactions in a Magento 2 store?

For B2B transactions, go to "Tax Zones and Rates" in the Magento 2 backend. Click "Add New Tax Rate," enter the tax details specific to business customers, and save the configuration.

5. How does Magento 2 calculate tax in the shopping cart for different addresses?

Magento 2 calculates tax based on the product class, customer class, and applicable tax rate. The tax is determined by the billing address or shipping address. It depends on what is set as the tax calculation basis in the tax configuration settings.

6. Can I specify a specific tax class for products in my online store? How?

Yes, you can assign a specific tax class to each product. Edit the product details in your Magento 2 store. Under the "Prices" tab, select the desired tax class from the "Tax Class" dropdown menu. Save your changes.

7. How do I ensure the shipping origin is considered in Magento 2 tax configuration?

To factor in the shipping origin for tax calculations, navigate to the "Stores" menu. Select "Configuration," then "Sales" and "Shipping Settings." Set the origin address to determine shipping and tax calculations. It, with dedicated Magento hosting, ensures compliance with local tax laws.

Summary

Understanding Magento Tax Class ID is essential for efficient tax management. Implementing it correctly ensures compliance and enhances store operations. Key benefits include:

-

Accurate Tax Application: Ensures correct tax calculations for various products and customer groups.

-

Efficient Tax Configuration: Streamlines the setup and adjustment of tax rules.

-

Compliance Assurance: Helps meet local regulations to avoid penalties.

-

Enhanced User Experience: Provides clear tax breakdowns at checkout, boosting customer trust.

-

Scalability Support: Makes managing tax settings easier as your business grows.

Consider managed Magento hosting for efficient tax management of Magento stores.