How to Add Magento Product Tax Class?

Struggling with managing taxes in your ecommerce store? Magento product tax class ensures accurate tax calculations by categorizing products for proper tax rates. It simplifies compliance and enhances the customer experience. This tutorial covers the importance, configuration, and troubleshooting tips for product tax classes in Magento.

Key Takeaways

-

Magento product tax class ensures accurate tax calculations by categorizing products.

-

Different tax classes include customer, product, and shipping categories in Magento 2.

-

You can add and configure tax classes using clear steps for efficient tax management.

-

Proper tax classes enhance compliance, automate processes, and reduce errors.

-

Troubleshooting tips help resolve common issues with tax classes in Magento 2.

What is Magento Product Tax Class?

A Magento Product Tax Class categorizes products for tax calculations. It ensures the correct tax rate applies to each product.

The tax class is assigned when a product is created. Magento uses this class to calculate taxes in the shopping cart. Businesses can create multiple product tax classes as needed. It helps in maintaining accurate tax compliance.

The product tax class works with customer and shipping tax classes. It ensures precise tax calculations for every transaction. Magento allows full customization of tax classes. This feature adapts to the specific needs of businesses. Proper tax class setup simplifies tax management. It also ensures a seamless shopping experience.

Types of Magento 2 Tax Classes

| Tax Class Type | Description |

|---|---|

| Customer Tax Class | Groups customers for specific tax purposes. Assigns a tax class to customer groups. Applies tax rates based on customer type. Commonly used for wholesale or retail categories. Ensures accurate tax compliance for customer groups. |

| Product Tax Class | Categorizes products for tax rate application. Assigned to each product during setup. Ensures taxes align with the product type. Supports multiple product tax classifications. Simplifies product-specific tax calculations. |

| Shipping Tax Class | Defines tax rates for Magento shipping charges. Linked to a specific tax category for shipping. Ensures taxes apply accurately to shipping costs. Supports regions with varying shipping tax rules. Improves compliance for shipping tax policies. |

How to Add Magento Product Tax Class?

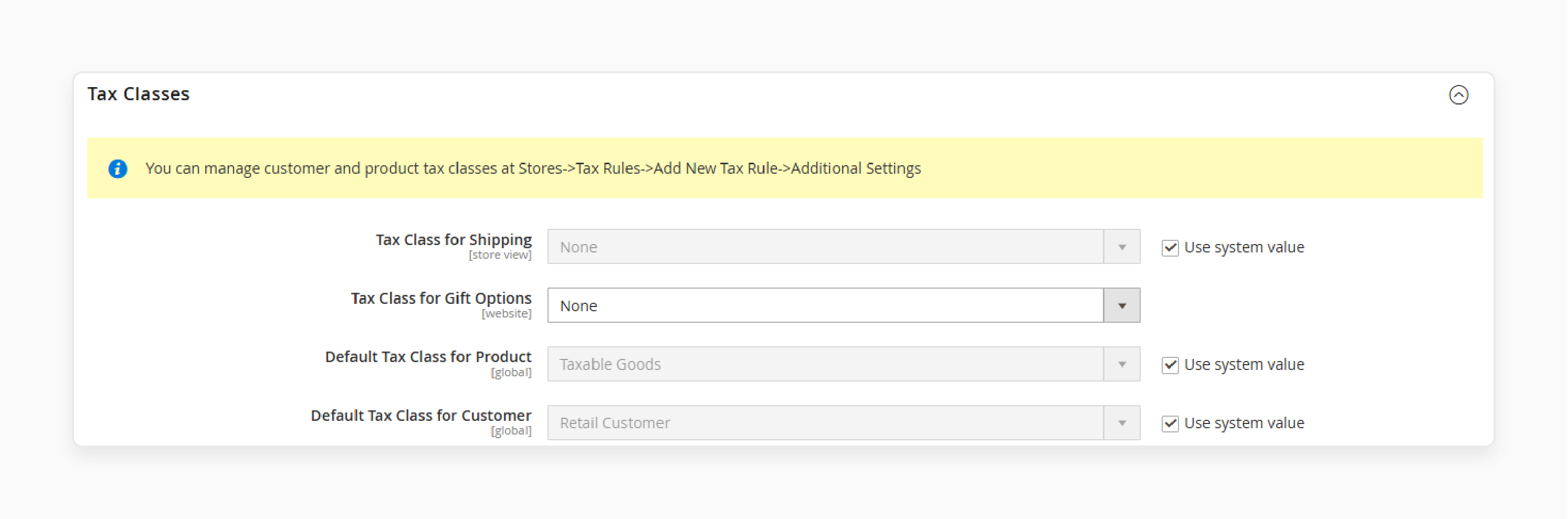

1. Configure Tax Classes

-

Navigate to Admin sidebar > Stores > Settings > Configuration.

-

Expand the Magento Sales option in the left panel.

-

Select the Tax option under Sales.

-

Expand the Tax Classes section to view the settings.

-

Configure the following fields:

-

Tax Class for Shipping

-

Tax Class for Gift Options

-

Default Tax Class for Product

-

Default Tax Class for Customer

-

-

After completing the configuration, click Save Config to apply the changes.

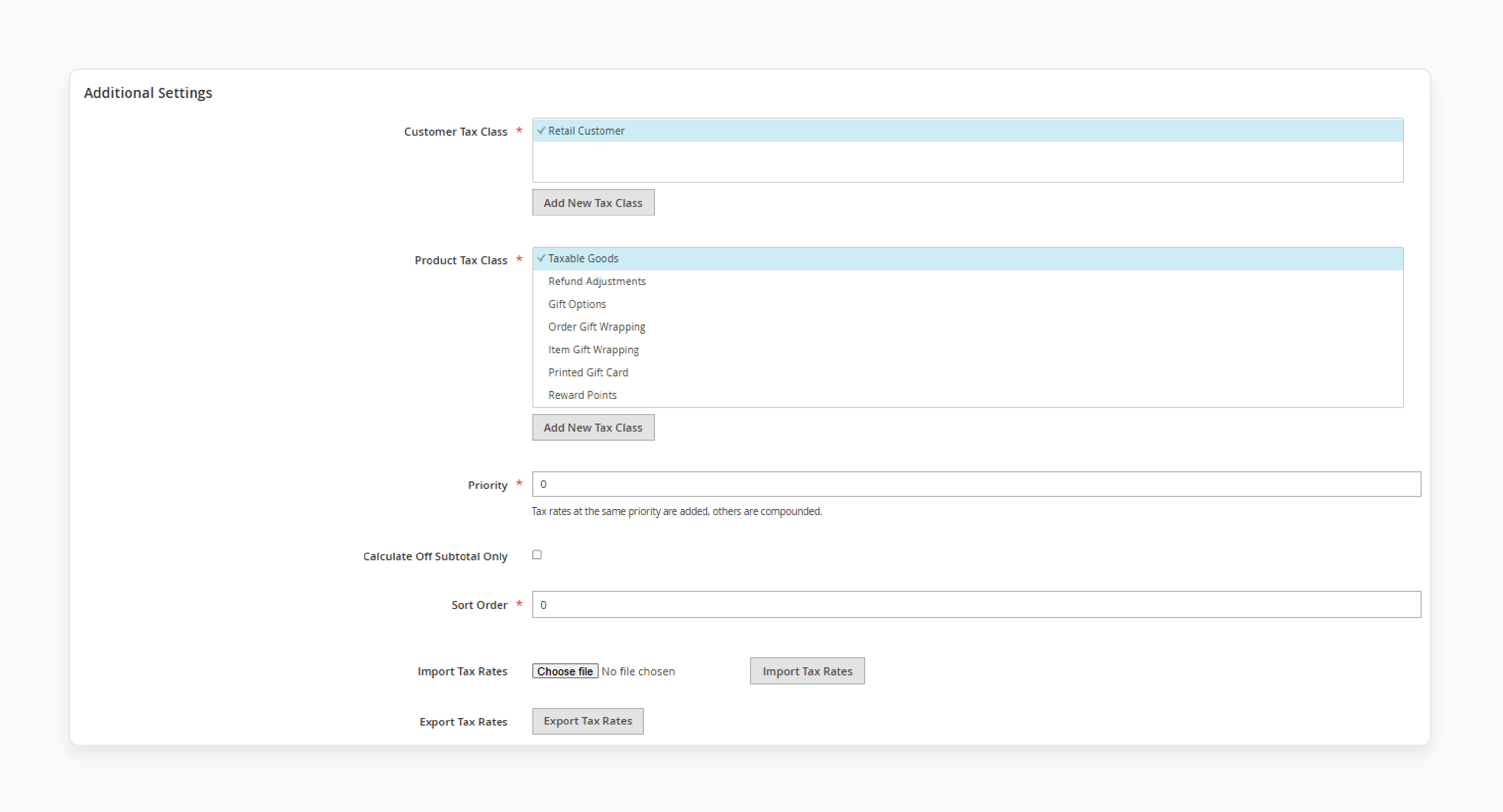

2. Add Tax Classes

-

Go to Admin sidebar > Stores > Taxes > Tax Rules.

-

Click on Add New Tax Rule to create a new rule.

-

Expand the Additional Settings section to find tax class options.

-

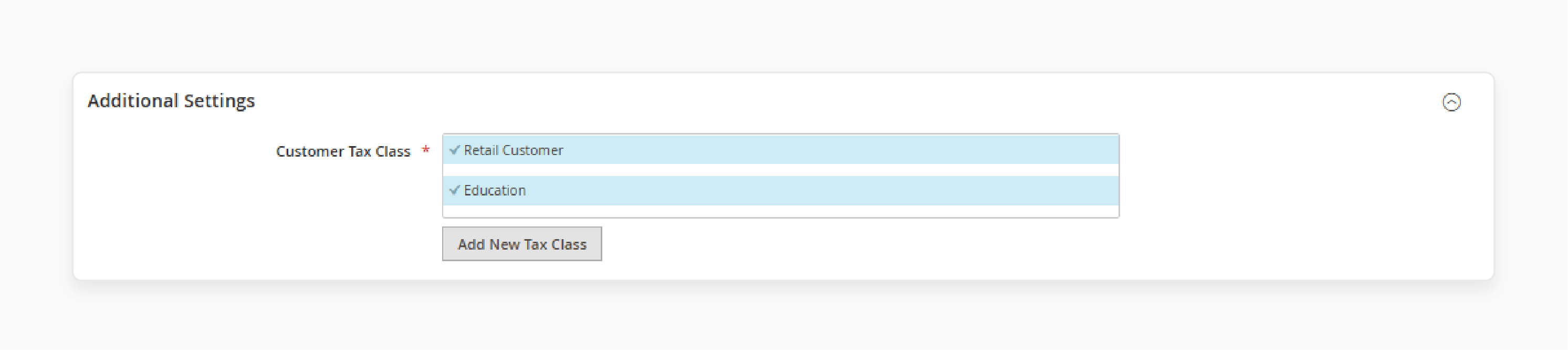

Under Customer Tax Class, click Add New Tax Class.

-

Enter the name of the new customer tax class and click the checkmark.

-

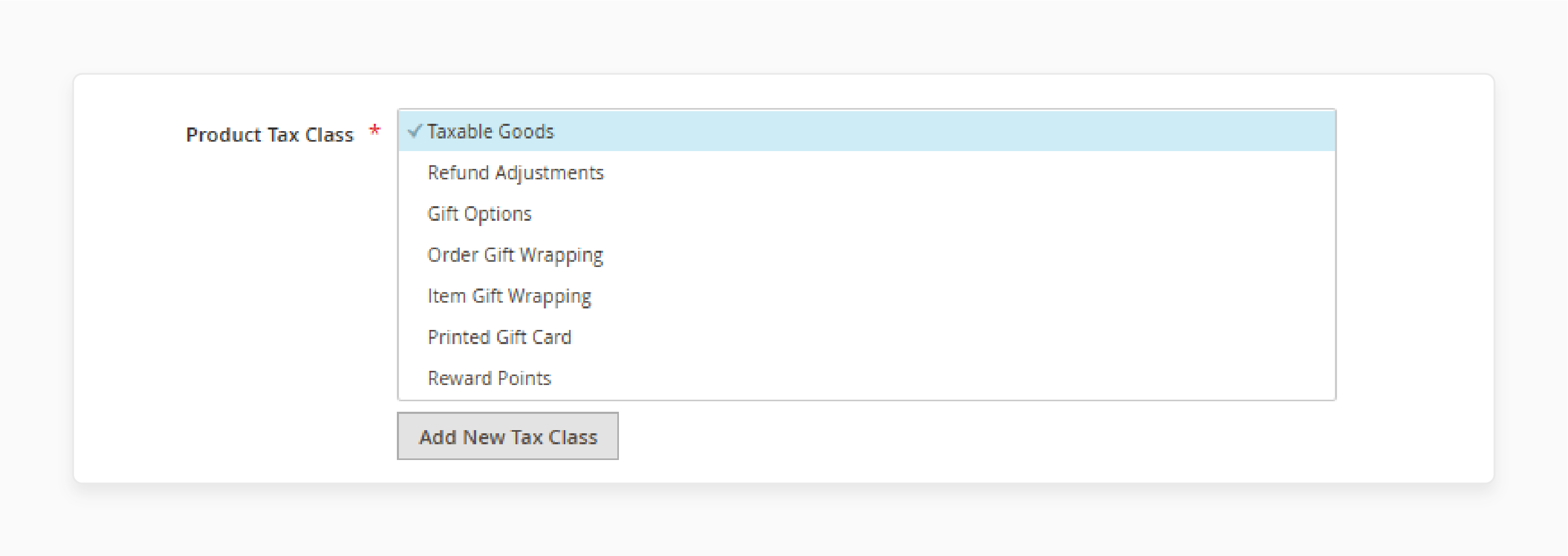

Under Product Tax Class, click Add New Tax Class.

- Enter the name of the new product tax class and click the checkmark.

3. Add a Product Tax Class

-

Navigate to Product Tax Class under Tax Rules settings.

-

Click Add New Tax Class to create a new class.

-

Enter a descriptive name for the product tax class in the text box.

-

Save the new tax class by clicking the checkmark.

-

Click Back to return to the Tax Rules grid and review the updates.

Importance of Magento Product Tax Class in E-commerce

1. Ensures Accurate Tax Calculation

A Magento Product Tax Class simplifies tax calculations. It assigns appropriate tax rates based on product Magento categories. It helps businesses comply with local and global tax laws. Accurate tax application avoids errors during checkout. It also builds customer trust with transparent pricing.

2. Enhances Tax Rule Customization

Product tax classes allow customization of tax rules. Businesses can define specific classes for various product types. This flexibility accommodates tax exemptions or special rates. It ensures compliance with complex tax policies. Customization helps in managing taxes efficiently.

3. Simplifies Checkout Processes

Assigning the correct product tax class reduces checkout errors. It applies the appropriate tax rate automatically. Customers see the correct tax amount during purchase. It improves their shopping experience. It also minimizes manual adjustments and errors.

4. Supports Multi-Regional Operations

Magento tax classes handle taxes for different regions. Businesses can assign classes for products sold globally. It adapts to varying tax rates and rules in different areas. It ensures compliance with international tax laws. It helps businesses expand their reach confidently.

5. Reduces Administrative Work

A product tax class automates tax calculations. It eliminates the need for manual tax computation. It reduces administrative workload for businesses. It also minimizes the risk of tax errors. Automation saves time and improves operational efficiency.

6. Facilitates Seamless Integration

Magento’s product tax class works with other tax settings. It integrates with customer and shipping tax classes. It ensures consistent tax calculations across the system. Seamless integration supports better tax management. It also helps maintain accurate financial records.

7. Boosts Compliance and Reporting

Using product tax classes ensures adherence to tax laws. It streamlines the process of preparing tax reports. Accurate tax records improve audit readiness. Businesses can avoid penalties for incorrect tax filings. It also boosts credibility with tax authorities.

Troubleshooting Issues with Magento Product Tax Class

| Issue | Cause | Solution |

|---|---|---|

| Incorrect Tax Applied | Misconfigured product tax class settings. | Check the product settings for the assigned tax class. Verify the tax rules configuration. Fix any mismatched settings. Save changes. |

| Tax Not Displayed at Checkout | Missing or incorrect tax class assignment. | Assign the correct product tax class to products. Review tax rules for proper mapping. Test the checkout process. Update settings if needed. |

| Region-Specific Taxes Not Applied | Tax rules not set for specific regions. | Configure tax rules for each target region. Map them to the appropriate product tax class. Test for accuracy. Make adjustments as required. |

| Gift Options Not Taxed Properly | Gift option tax class not configured. | Set the Tax Class for Gift Options in settings. Go to Sales > Tax in the admin panel. Save the updated configuration. Test the changes. |

| Shipping Tax Errors | Shipping tax class missing or misconfigured. | Assign a specific Magento tax class for shipping. Configure it under Sales > Tax settings. Verify the setup. Save the changes. |

| New Tax Class Not Reflecting | Cache not refreshed after adding the class. | Refresh the Magento cache after updates. Reindex the store for changes to apply. Check if the new class is visible. Test it in the system. |

| Tax Calculation Inconsistencies | Conflicting or overlapping tax rules. | Review all tax rules for overlaps. Simplify rules to avoid conflicts. Test calculations on multiple products. Update the rules as needed. |

FAQs

1. What is Magento 2 tax configuration?

Magento 2 tax configuration determines how taxes apply to products and customers. You can set tax classes for shipping, products, and customers. Configure tax zones and rates under Stores > Taxes. Use it to calculate the appropriate tax for transactions.

2. How do tax rules in Magento work?

Magento 2 tax rules combine tax classes, zones, and rates. They apply different tax rules in Magento 2 based on customer and product class. Set up tax rules for regions, products, or customer groups. It, with dedicated Magento hosting, ensures accurate local tax compliance.

3. How do I set up different tax classes in Magento 2?

Go to Stores > Taxes > Tax Rules to add tax classes. Add new tax classes for customers or products under additional settings. Assign these classes while configuring Magento 2 store taxes. It helps handle extra tax requirements.

4. What is a tax zone and rate in Magento?

A tax zone and rate define local tax rules for regions. You can add a new tax rate under Stores > Taxes. Assign it to tax classes to calculate the appropriate tax. It supports compliance for multiple regions.

5. How do I calculate the appropriate tax for a product price?

Magento 2 calculates taxes based on product class and tax rules. Include tax or set tax-exclusive pricing in the settings. Select a tax calculation method under tax configuration. It ensures accurate product price calculations.

6. What is the default tax destination in Magento 2?

The default tax destination defines where taxes apply by default. It uses the customer's shipping or billing address. Set it under Stores > Taxes > Configuration. Magento calculates taxes based on this destination.

7. How do I handle a zero tax subtotal for products?

Assign a tax class with a zero rate for exempt products. Include it in the tax rules during setup. It ensures no extra tax is applied for those products. Verify it under the full tax summary to confirm compliance.

8. How do I add a new tax rate in Magento 2?

Go to Stores > Taxes > Tax Rules to add new tax rates. Define the rate based on the tax zone and product class. Set the tax according to regional requirements. Save the rate and assign it to appropriate tax rules.

Summary

Magento product tax class simplifies tax management and ensures compliance with regulations. It enhances your store's operations by automating tax calculations. Key benefits are:

-

Accurate Tax Calculations: Ensure correct taxes are applied to every transaction.

-

Customization Options: Tailor tax rules for products and customers.

-

Improved Checkout Process: Avoid errors and provide a smooth customer experience.

-

Multi-Regional Support: Manage local and international taxes efficiently.

-

Troubleshooting Solutions: Fix tax-related issues with actionable steps.

Consider Managed Magento Hosting for reliable and efficient tax management of Magento stores.