How to Use Magento Get Tax Class ID?

Struggling to set up tax classes in Magento 2? Understanding Magento Get Tax Class ID is essential for accurate tax calculations. It links products, customers, and shipping to tax rules. This tutorial covers steps to get a Magento tax class ID for e-store tax management.

Key Takeaways

-

Magento Get Tax Class ID links products, customers, and shipping to tax rules. It ensures accurate tax calculations.

-

Tax Class IDs organize and simplify tax management. They group similar products or customers under one tax class.

-

They help follow regional tax laws. They also allow flexibility for custom tax setups and integrations.

-

Best practices include using descriptive names and auditing tax classes. It is also essential to leverage Magento's configuration settings.

-

Common issues with tax classes include missing IDs and dependency errors. Proper troubleshooting can resolve these problems.

What is Magento Tax Class ID?

A Magento Tax Class ID is unique identifier for tax class in Magento. Tax classes define the tax rules applied to specific products, customers, or shipping.

Each tax class linksto a tax rate. This rate determines the tax amount calculated during checkout. For instance, Retail Customers, Wholesale Customers, and Tax-Exempt Organizations are different tax classes. The classes ensure Magento applies correct tax as per customer and product details.

The Tax Class ID connects products or customers to the appropriate tax rules. Without it, Magento cannot calculate or apply taxes. This ID management occurs through Magento's APIs or the admin interface. It allows for efficient handling of tax logic. By using Tax Class IDs, businesses ensure tax calculations are accurate and compliant.

Why Use Magento Tax Class ID?

| Reason | Explanation |

|---|---|

| 1. Accurate Tax Calculation | The Tax Class ID ensures correct application of tax rates. It prevents overcharging or undercharging customers. Accurate tax calculations are critical. They maintain customer trust and ensure legal compliance. |

| 2. Simplified Tax Management | Tax Class IDs help organize tax rules. They group similar products or customers under one tax class. It reduces the complexity of managing many tax rates. It ensures tax rules are consistent across the store. |

| 3. Compliance with Tax Laws | Different regions have unique tax regulations. Tax Class IDs ensure compliance with these local rules. They automate tax calculations. It reduces errors and lowers the risk of penalties. |

| 4. Better Customer Experience | Customers see accurate tax amounts during checkout. It transparency builds trust. It avoids confusion about taxes. A seamless tax experience improves customer satisfaction. |

| 5. Flexibility for Customization | Developers can use Magento Tax Class IDs to create custom tax rules. These rules may include promotions or dynamic pricing. Tax Class IDs also support integrations with third-party tax services. It makes customization easier. |

| 6. Segmentation of Tax Rules | Tax Class IDs let you assign different rules to different groups. To illustrate, rates can be for retail, wholesale, or tax-exempt customers, to name a few. It ensures precise tax handling for all customer types. |

| 7. Scalability for Business Growth | As your business grows, you may need to handle more tax rules. Tax Class IDs make it easy to add and manage new classes. They ensure your tax setup scales with your business needs. |

| 8. Streamlined Reporting and Auditing | Tax Class IDs make tax reporting simple. They categorize transactions. It makes generating reports easier. Organized records help during tax audits and reviews. |

| 9. Integration with Other Magento Features | Tax Class IDs integrate with many Magento features. They work with shipping, invoices, and promotions. It ensures consistent tax application across the store. It improves efficiency. |

How to Use Magento Get Tax Class ID?

Follow the steps below to get the tax class ID in Magento using the provided code:

-

Inject the required dependencies.

-

Create a method

getTaxClassId($className)to fetch the tax class ID.

<?php

namespace Vendor\Module\Plugin;

use Magento\Tax\Api\Data\TaxClassKeyInterface;

class PluginName

{

`private $taxClassManagementInterface;`

`private $taxClassKeyDataObjectFactory;`

`private $logger;`

`public function __construct(`

`\Magento\Tax\Api\TaxClassManagementInterface $taxClassManagementInterface,`

`\Magento\Tax\Api\Data\TaxClassKeyInterfaceFactory $taxClassKeyDataObjectFactory,`

`\Psr\Log\LoggerInterface $logger`

`) {`

`$this->taxClassManagementInterface = $taxClassManagementInterface;`

`$this->taxClassKeyDataObjectFactory = $taxClassKeyDataObjectFactory;`

`$this->logger = $logger;`

`}`

`public function getTaxClassId($className) {`

`$taxClassId = $this->taxClassManagementInterface->getTaxClassId(`

`$this->taxClassKeyDataObjectFactory->create()`

`->setType(TaxClassKeyInterface::TYPE_NAME)`

`->setValue($className)`

`);`

`return $taxClassId;`

`}`

}

Best Practices for Managing Tax Class IDs in Magento

1. Use Descriptive Names for Tax Classes

Choose clear and descriptive names for your tax classes. It makes it easier to identify their purpose. For example, use names like “Retail Customer” or “Tax-Exempt Organization.” Avoid generic names like “Class 1” as they can create confusion. Descriptive names help both developers and administrators manage taxes. They also improve clarity during audits and reporting.

2. Assign Correct Tax Classes to Products and Customers

Ensure products and customers are in the right tax classes. Incorrect assignments can lead to tax miscalculations. Verify that taxable and non-taxable items are set up. Assign the correct class to tax-exempt customers. Review your assignments to maintain accuracy.

3. Audit and Update Tax Classes

Tax rules and rates change over time. Audit your tax classes to ensure they follow current regulations. Update tax rates and class assignments as needed. Neglecting it can lead to compliance issues and penalties. Use Magento’s tools to streamline this process.

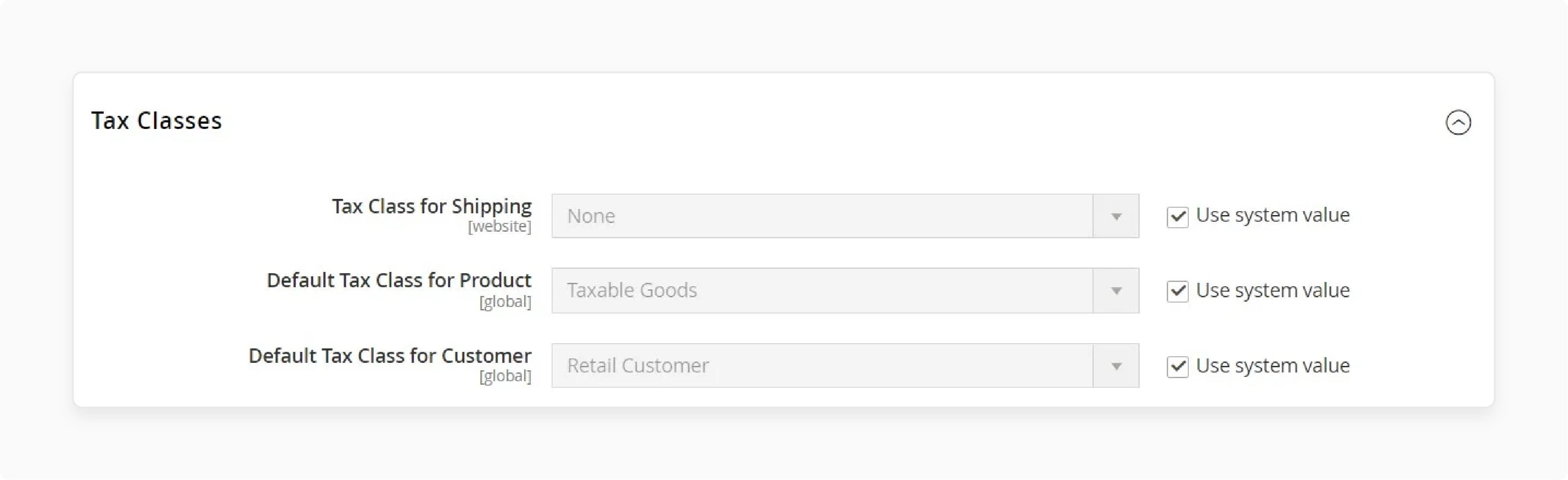

4. Leverage Magento's Tax Configuration Settings

Magento provides robust tax Magento configuration options. Use these to set up tax rules, rates, and zones. Combine these settings with your Tax Class IDs for precise tax management. It ensures taxes are consistent across regions and products. Always test changes in a staging environment before deploying them.

5. Document Your Tax Class Setup

Maintain documentation of your tax classes, their purpose, and their usage. It is helpful for both current and future team members. It also simplifies troubleshooting and audits. Include details about assigned products, customers, and regions. Keep the documentation updated whenever changes occur.

6. Use Dependency Injection for Customizations

For custom tax logic, use Dependency Injection (DI) in your Magento code. DI ensures modular and maintainable customizations. Avoid hardcoding values related to tax classes. This practice improves code quality and makes updates easier. It also supports better scalability.

7. Test Changes in a Staging Environment

Always test tax class changes in a staging environment before applying them live. It ensures tax calculations work as expected. Test scenarios with different products, customer groups, and regions. Identify and fix any errors before deployment. Testing prevents issues that could disrupt customer transactions.

8. Check Customer Feedback

Pay attention to customer feedback about tax calculations during checkout. Errors in tax application can lead to customer dissatisfaction. Use feedback to identify and resolve tax class issues. This proactive approach enhances customer trust. It also ensures smoother shopping experiences.

9. Stay Updated on Tax Laws and Magento Updates

Keep up with changes in tax regulations. Tax laws can vary by region and are subject to updates. Stay informed to ensure compliance. Additionally, keep your Magento platform updated. Updates often include improvements to tax management features, enhancing accuracy and functionality.

Troubleshooting Issues with Magento Get Tax Class ID

| Issue | Explanation and Solution |

|---|---|

| 1. Tax Class ID Not Found | It occurs when the specified tax class name does not exist. Verify the tax class name in the Magento admin panel. Ensure it matches exactly, including capitalization. |

| 2. Incorrect Dependency Injection | If dependencies are not injected, the method may fail. Check for missing or incorrect dependencies. Use \Magento\Tax\Api\TaxClassManagementInterface and \Magento\Tax\Api\Data\TaxClassKeyInterfaceFactory. |

| 3. API Method Errors | The getTaxClassId() method may throw errors if the tax class key is not set. Ensure setType() and setValue() has right configuration. They should also have correct type (TYPE_NAME) and value (tax class name). |

| 4. Cache Issues | Magento's caching system may cause outdated data to persist. Clear the Magento cache using the command bin/magento cache:flush. Then test again to see updated results. |

| 5. Missing Permissions | API or user roles may not have permission to access tax class data. Verify that user or integration has correct permissions to manage tax settings. |

FAQs

1. What is a product tax class in Magento 2?

A product tax class defines the tax rate for specific products in Magento 2. It links products to tax rules for accurate tax calculations. Assign a product tax class during product setup in the catalog. Ensure it's correct to avoid tax errors during checkout.

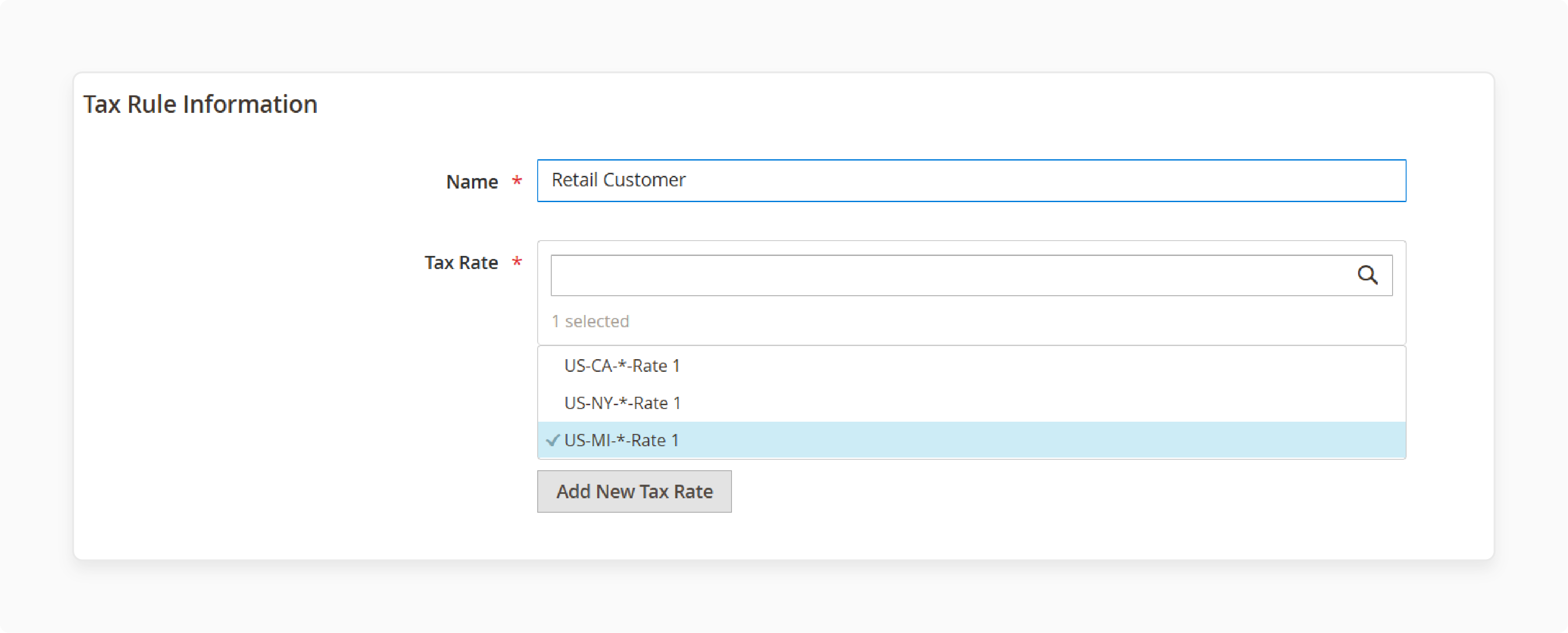

2. How do I set the default tax in Magento 2?

Set the default tax rate in the Magento admin under Stores > Tax Rules. Assign it to products or customer groups as needed. It ensures consistent tax application in the shopping cart. Test it with various billing and shipping addresses.

3. Can I assign a specific tax class for shipping?

Yes, Magento 2 allows setting a specific new tax class for shipping. Configure it under Stores > Configuration > Sales > Tax > Shipping Tax Class. This tax class applies to shipping charges based on shipping origin and destination. It, with dedicated Magento hosting ensures compliance with local tax laws.

4. What are customer tax classes in Magento 2?

Customer tax classes define the tax rates for different customer groups. Examples include retail, wholesale, and tax-exempt customers. Assign them under Customers > Customer Groups in the admin panel. They simplify billing by applying the correct tax rate.

5. How does Magento 2 handle tax based on the shipping address?

Magento calculates tax based on the shipping address if configured. Set this under Stores > Configuration > Sales > Tax > Calculation Settings. It ensures tax rates follow the customer’s location. Always verify shipping origin settings for accuracy.

6. What is the role of the product class in tax calculations?

The product class links products to tax rules in Magento 2. Each product in the catalog must have a valid product tax class. It ensures accurate tax calculations in the shopping cart. Incorrect classes can lead to tax discrepancies.

7. Can Magento 2 calculate taxes using the billing address?

Yes, you can configure Magento 2 to calculate tax based on the billing address. Set it under Stores > Configuration > Sales > Tax > Calculation Settings. It is helpful for businesses with billing-focused tax rules. Test scenarios to ensure accurate results.

Summary

Using Magento Get Tax Class ID is one of the integral factors of accurate tax management. Key benefits are:

-

Accurate Taxation: Applies correct tax rates to products, customers, and shipping.

-

Simplified Management: Makes tax rules easy to organize and scale.

-

Customer Satisfaction: Builds trust with clear tax calculations.

-

Customizations: Supports advanced and flexible tax setups.

Consider managed Magento hosting to manage tax setups of ecommerce stores.