How to Set Up Magento 2 Tax Exempt: Tax Exemption Configuration

Ready to simplify the tax process for your exempt customers? Magento 2 Tax Exempt helps businesses handle tax exemptions for exempt customers. It ensures compliance and improves the checkout process.

This tutorial will cover the tax exemption configuration for e-commerce customers.

Key Takeaways

-

What are the aspects of tax exempt in ecommerce?

-

Key features of the tax exclusion module that make tax management simple.

-

Easy steps for setting up tax exemptions for different groups.

-

Benefits of tax exclusion that improve ecommerce operations.

-

How to use a tax exclusion for backend setting.

-

5 common issues with solutions for tax exclusion.

What is Magento 2 Tax Exempt?

Magento 2 Tax Exempt lets bulk, non-profits, and government groups make tax-free purchases. It ensures tax-exempt customers do not pay sales tax at the checkout page.

Magento 2 tax-exempt is a feature that allows businesses to manage free transactions. It helps online stores automate their tax compliance processes. Customers can also set up end dates, often up to 180 days, to keep the document valid.

Key Features for Tax Exemption Magento 2

1. Automated Tax Exemption Application

The feature automatically applies tax exclusion during the payment process. It is for those customers who are in the correct tax category. For example, a wholesale buyer was purchasing free items. They will not see any sales tax when buying bulk items, as they have been pre-approved.

2. Customer Group and Tax Class Management

The backend can assign customers to different tax categories. It includes bulk or non-profit to apply the correct tax percentage. For example, non-profits get assigned a new tax class, so they do not need to pay sales tax when buying.

3. Tax Exemption Document Upload

Customers can upload their tax documents through their user account. For instance, a government agency can upload its tax exemption certificate. They can be in different formats to review.

4. Admin Approval and Management

After uploading, the admin can either authorize or reject the tax certificate. They make sure only eligible customers get free benefits. For example, the backend reviews and approves a bulk document. They allow them to buy exempt from tax in the future.

5. Expiration Date Handling

The system tracks when documents will expire and sends reminders. For instance, if a tax exclusion document is set to finish in 180 days. The system automatically sends an alert via email to both.

6. Compliance and Reporting

The Magento extension is used to manage and track customer tax exclusion. It is used to follow tax laws. The admin can generate reports showing all tax-exempt customers. It is with valid documents to ensure compliance.

3 Steps to Set Up Tax Exempt in Magento 2 for Specific Customer Groups

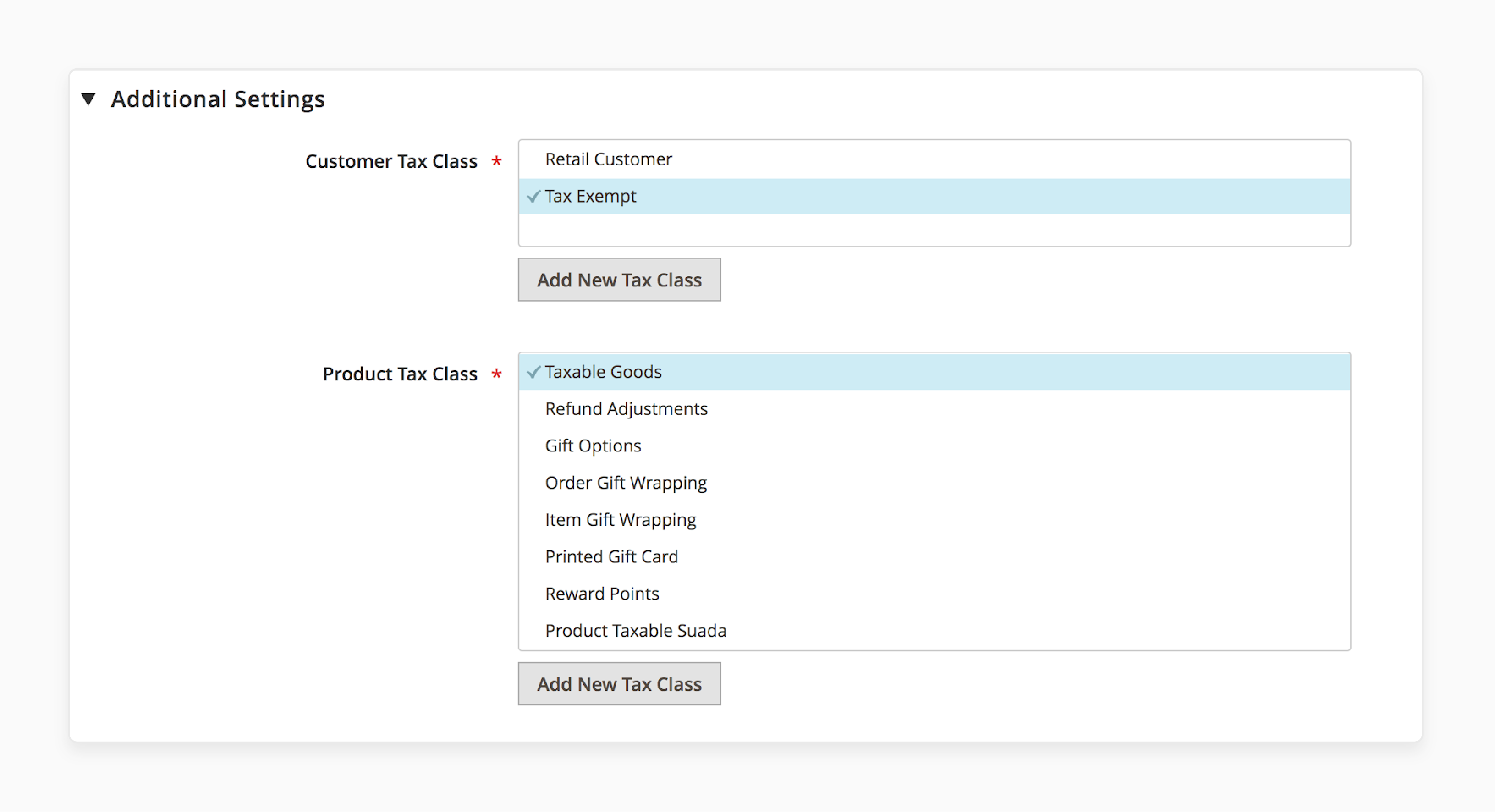

Step 1: Create the Tax Exempt Rule

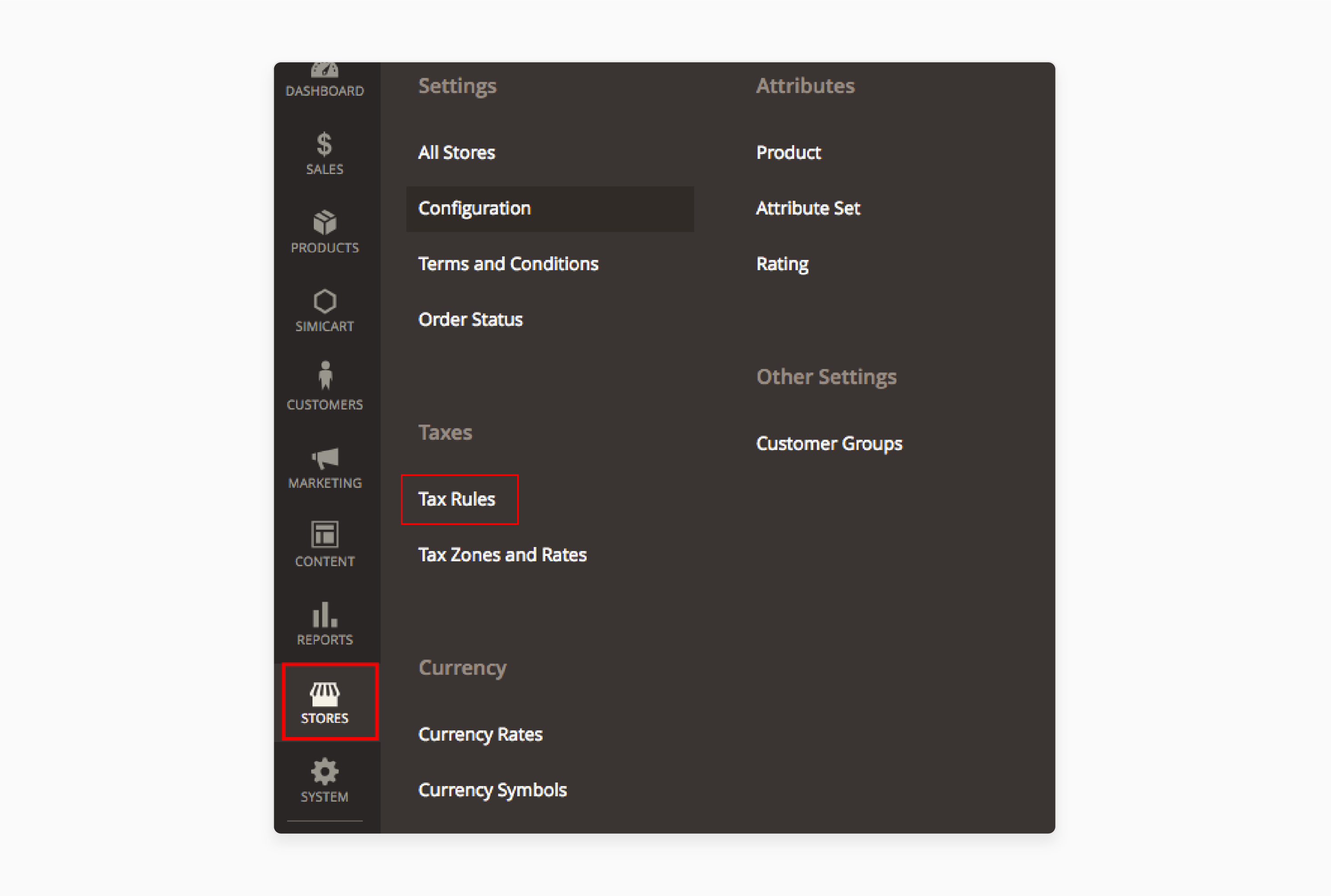

- Go to Stores > Taxes > Tax Rules.

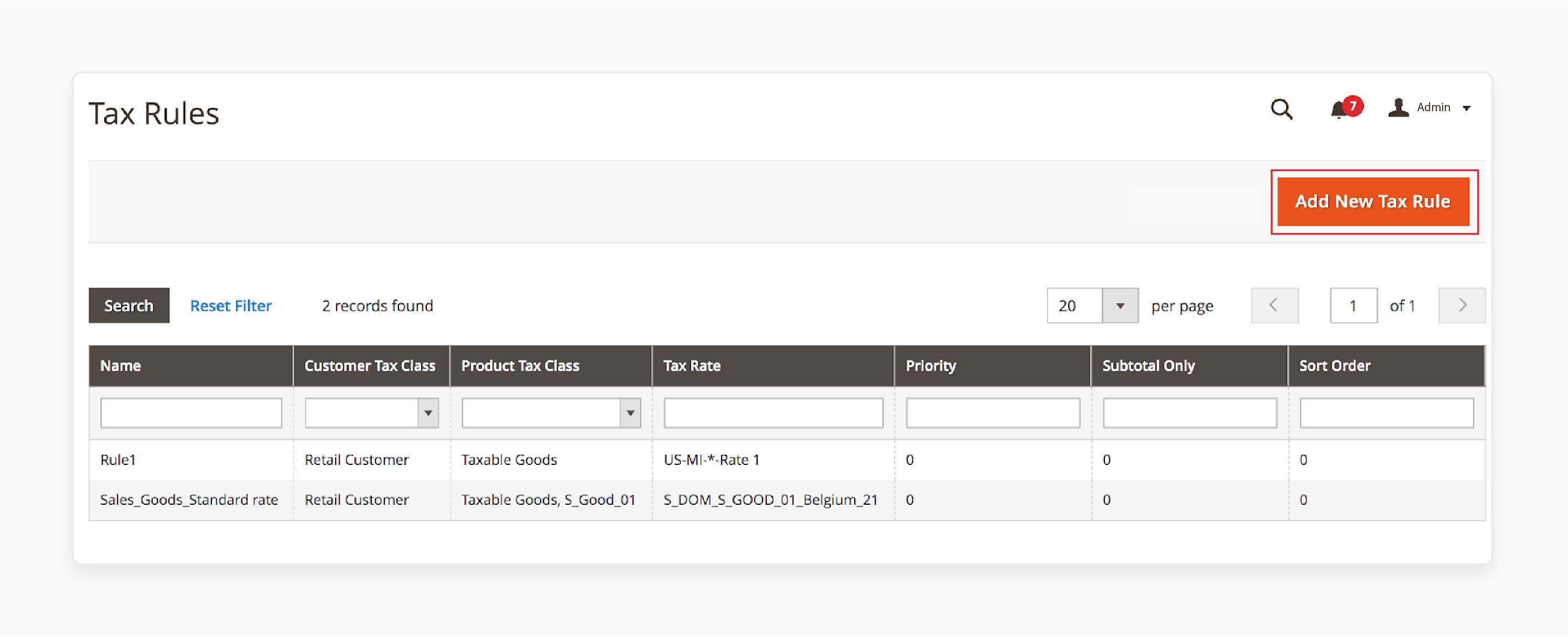

- Click Add New Tax Rule:

- Name the rule Tax Exempt.

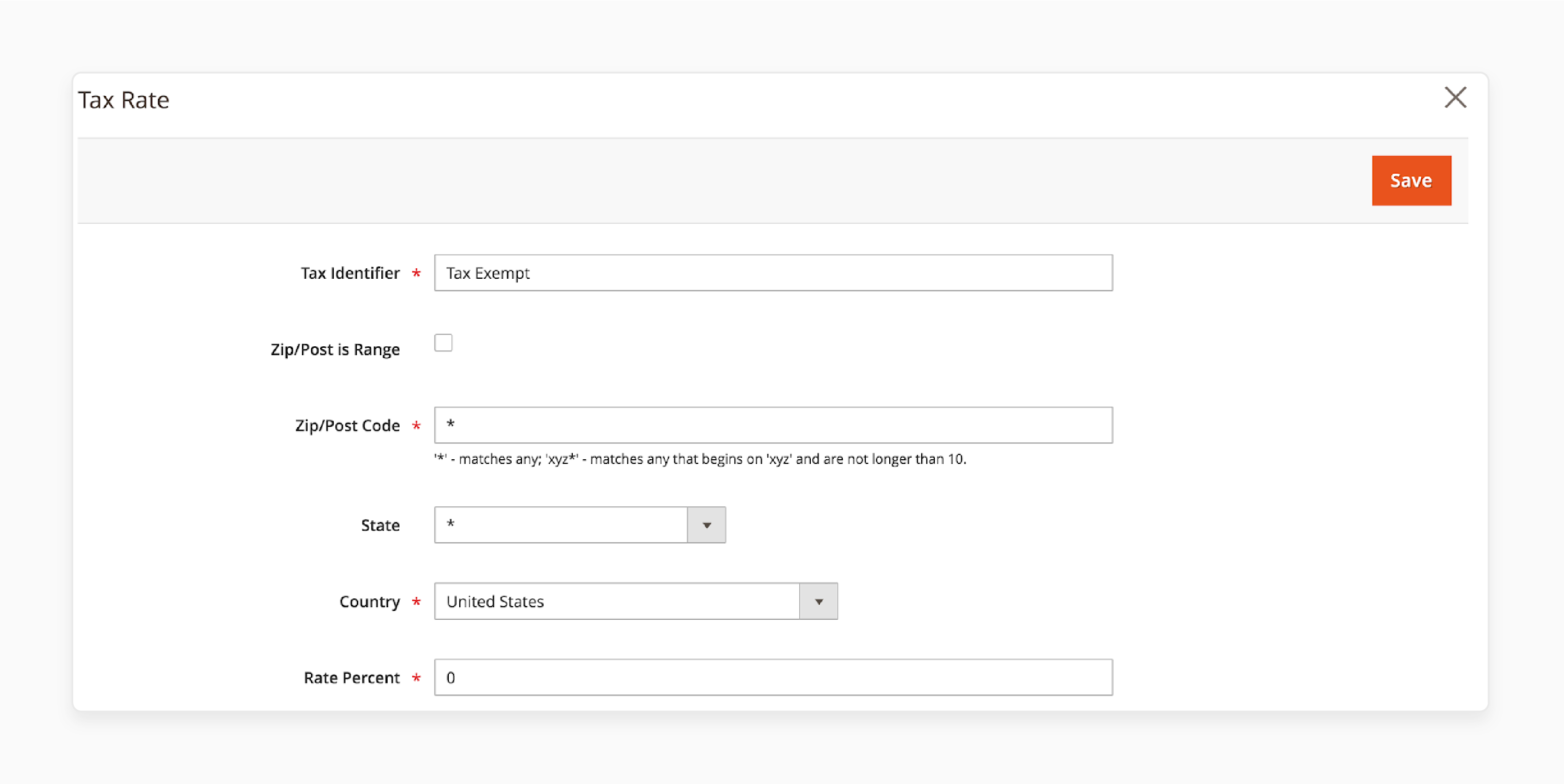

- Create a new Tax Rate:

-

Click Add New Tax Rate and save it.

-

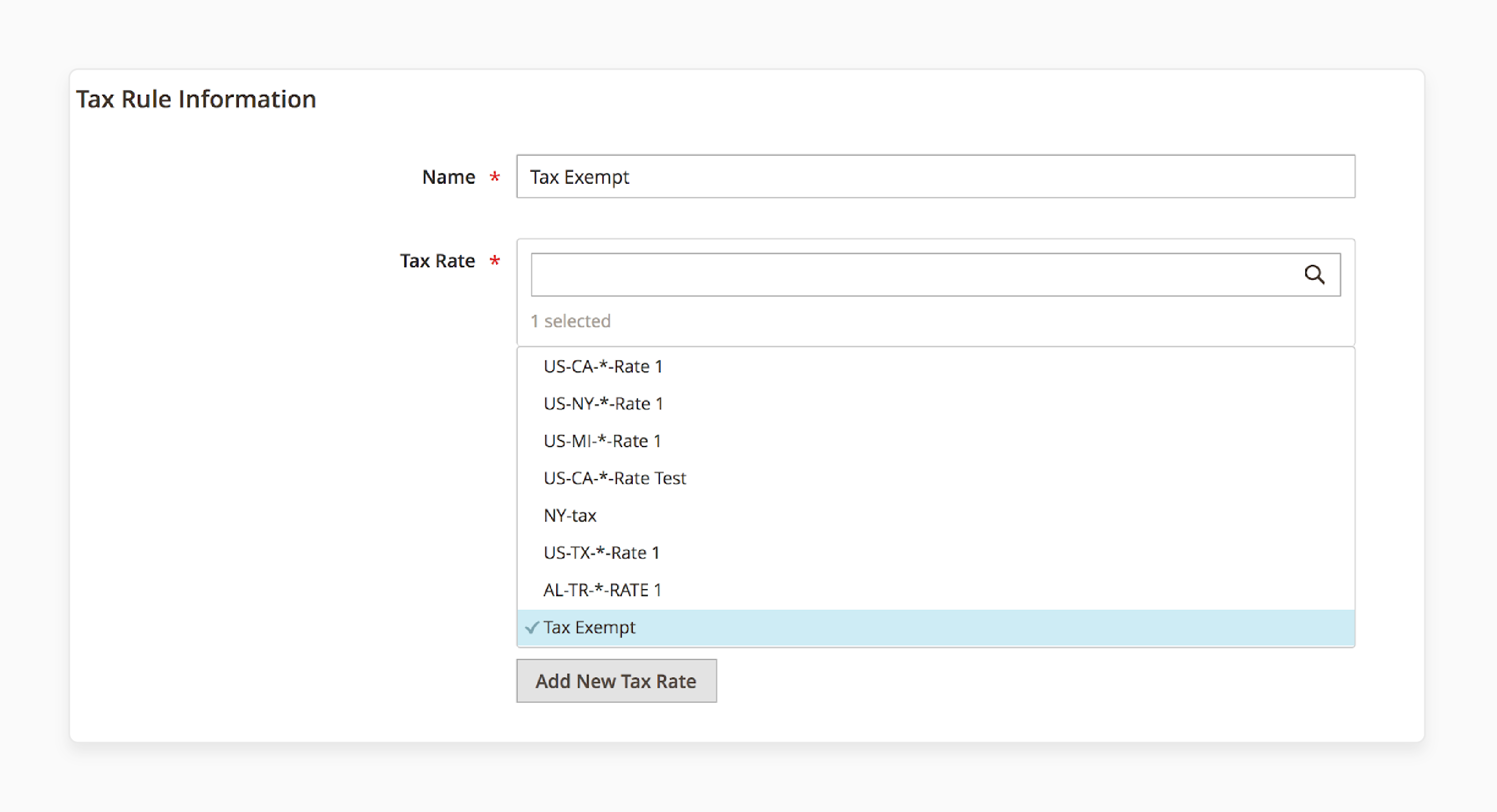

Select tax as Tax Exempt under Tax Rate.

- In Additional Settings:

-

You will need to create a new Customer Tax Class. Click Add New Tax Class.

-

Name it Tax Exempt, check the box, and select Tax Exempt under customer tax class.

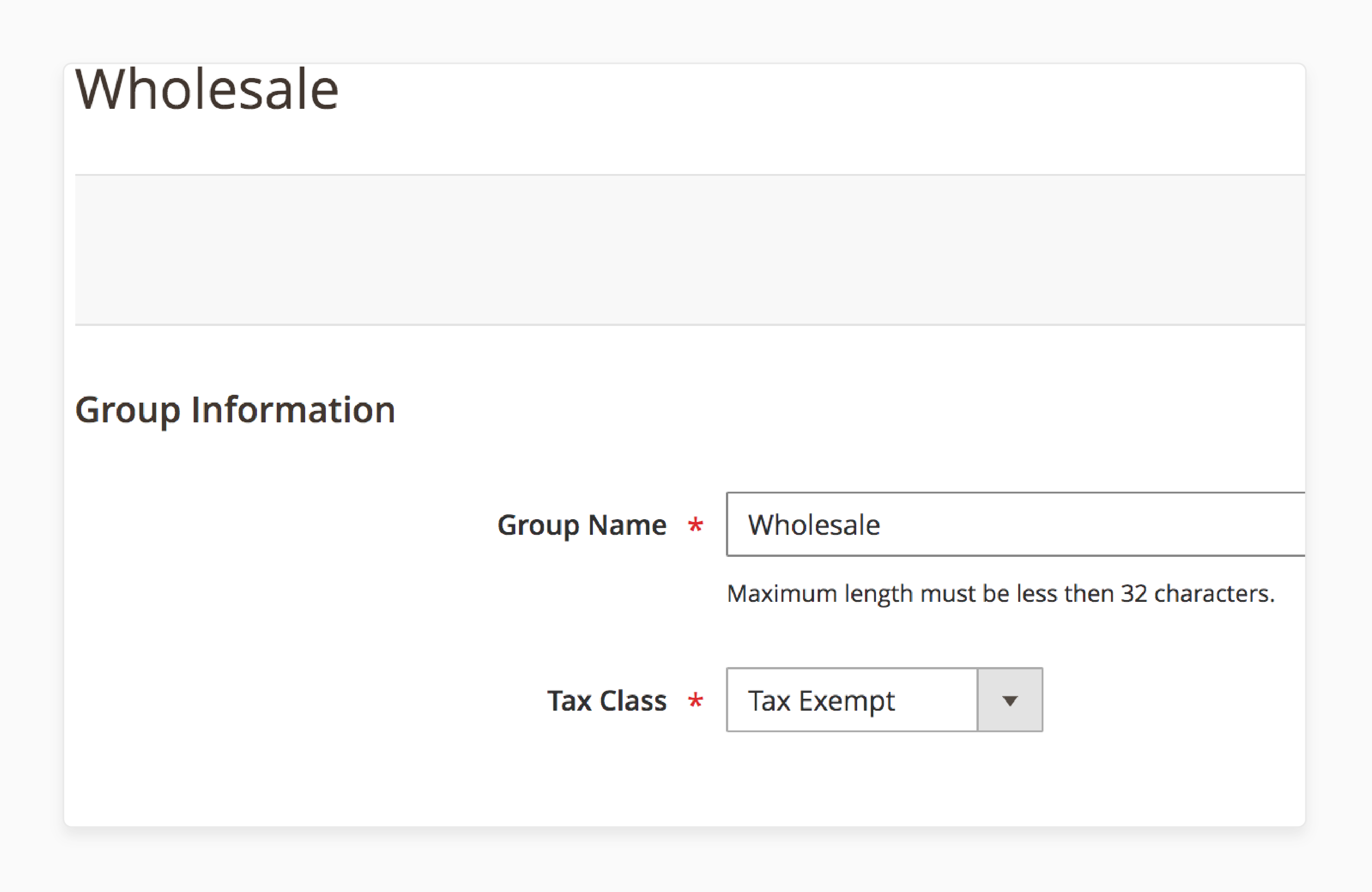

Step 2: Assign the New Customer Tax Class to a Specific Customer Group

-

After creating the rule, assign the Tax Exempt class to a specific customer group.

-

Go to Customers > Customer Groups.

-

Choose the "Wholesale" client group or any group you need.

-

Set the Tax Class to Tax Exempt for this group.

Step 3: Assign Customers to the Customer Group

-

Go to Customers > All Customers.

-

When creating a new customer or editing one:

-

Choose the bulk client group or the group with the tax exclusion.

-

This will apply the tax exclusion to that customer’s account.

-

Benefits of Magento Tax Exclusions for Ecommerce Stores

| Benefit | Details |

|---|---|

| Automated Tax Exclusion Management | Automates tax handling and reduces the need to calculate taxes for customers manually. |

| Improved Customer Experience | Qualifying customers, like bulk buyers. They enjoy a tax free payment process and would not have to pay taxes on items resold to an end-user. |

| Time and Resource Efficiency | Automates the process to reduce manual work. It also improves performance optimization operations. |

| Compliance with Tax Regulations | Ensures your store complies with tax regulations. It manages exclusion documents and applies the correct tax rates. |

| Scalability for Growth | As your business grows, the new Magento exclusion features scale with it. This also enable easier management through the plugin. |

How to Use TAX Exempt Extension for Back and Front End

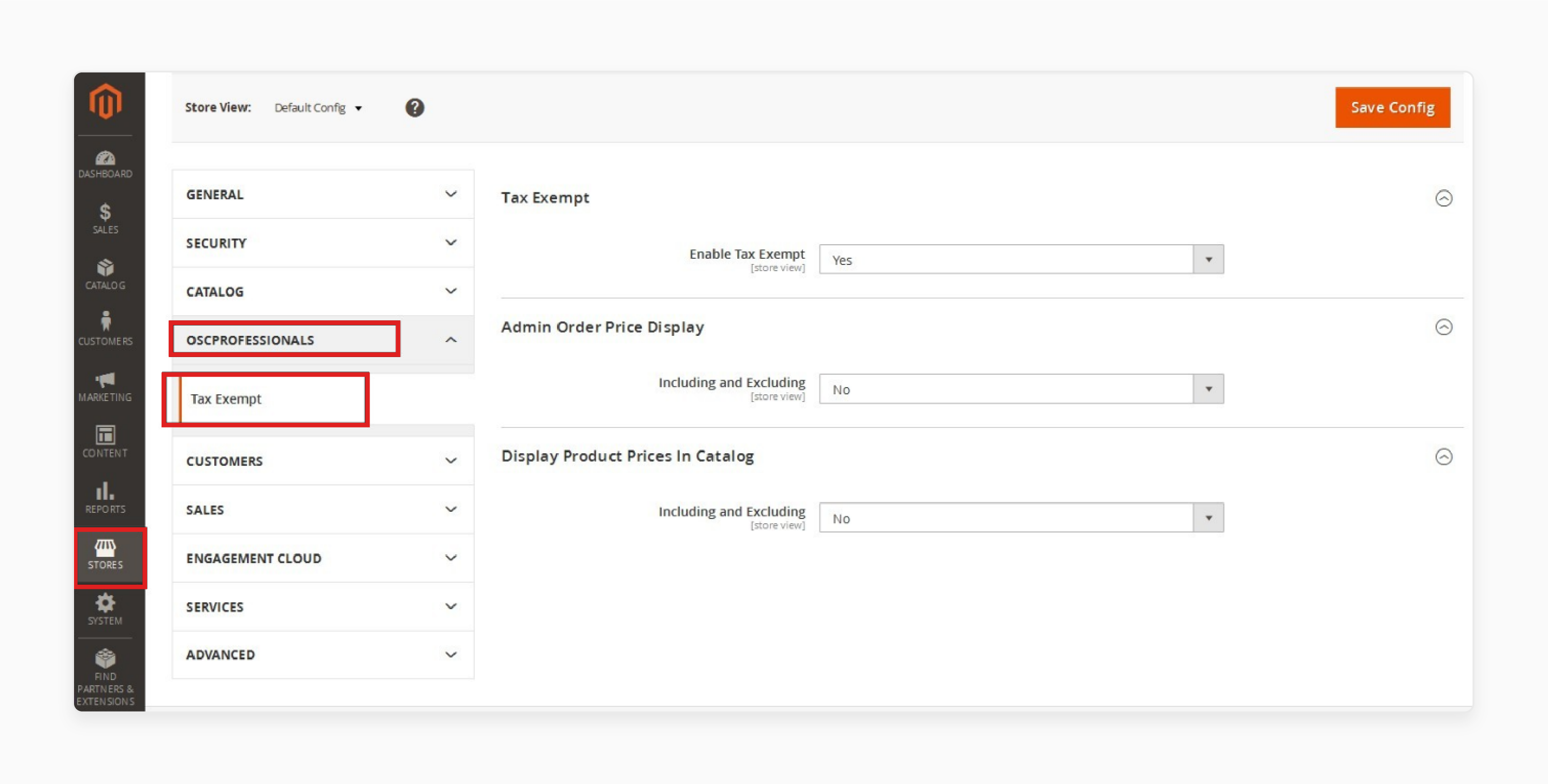

1. Backend Configuration for Tax Exempt Extension

Step 1: Login and Access the Tax Exempt Module

-

Go to Backend > Stores > Configuration > Platform Name > TAX Exempt.

-

Turn the module on or off in the configuration settings.

Step 2: Show Tax Exempt Declaration Form at Checkout

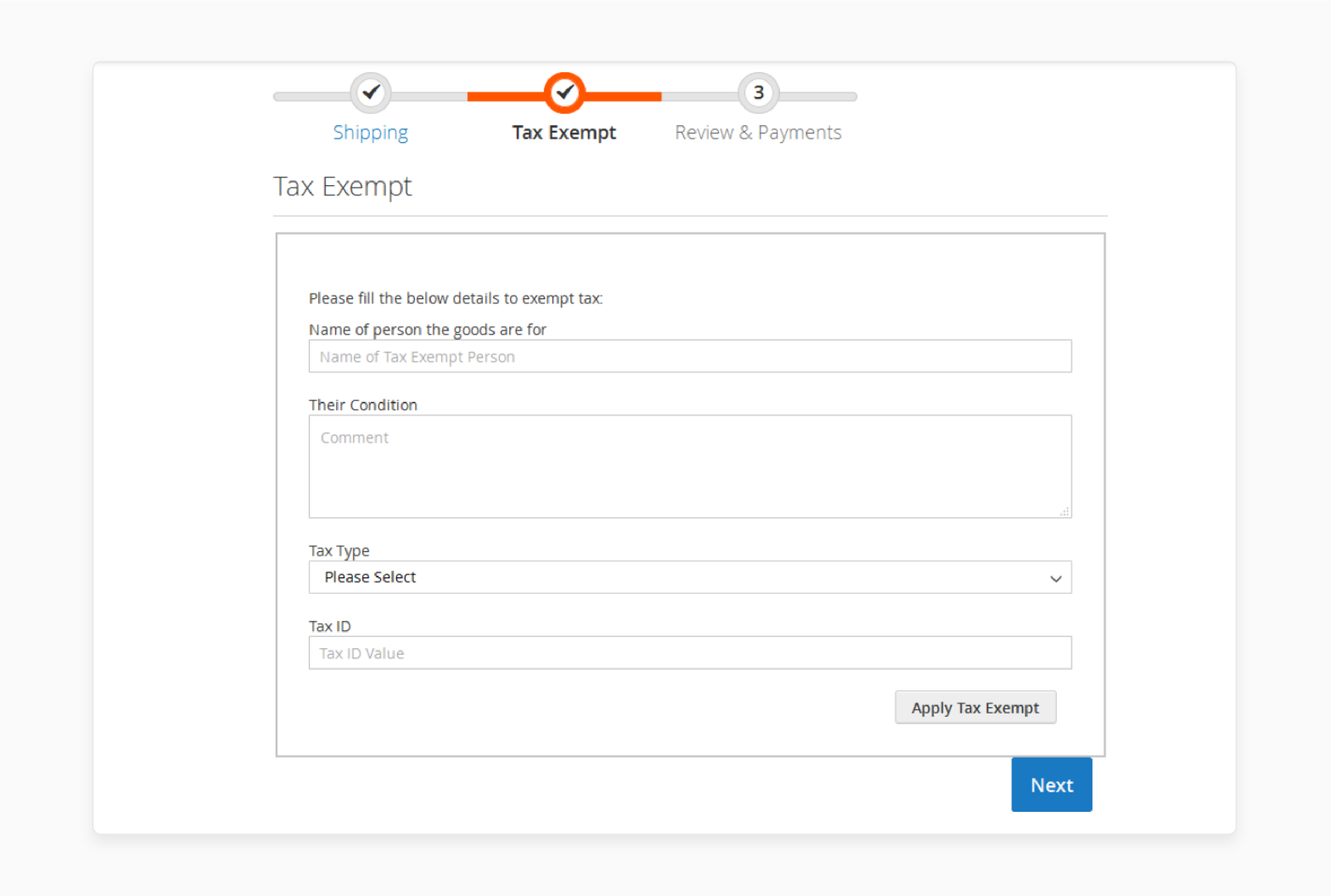

- When enabled, the Tax Exempt Declaration Form appears on the Checkout page. Customers can add their tax id value.

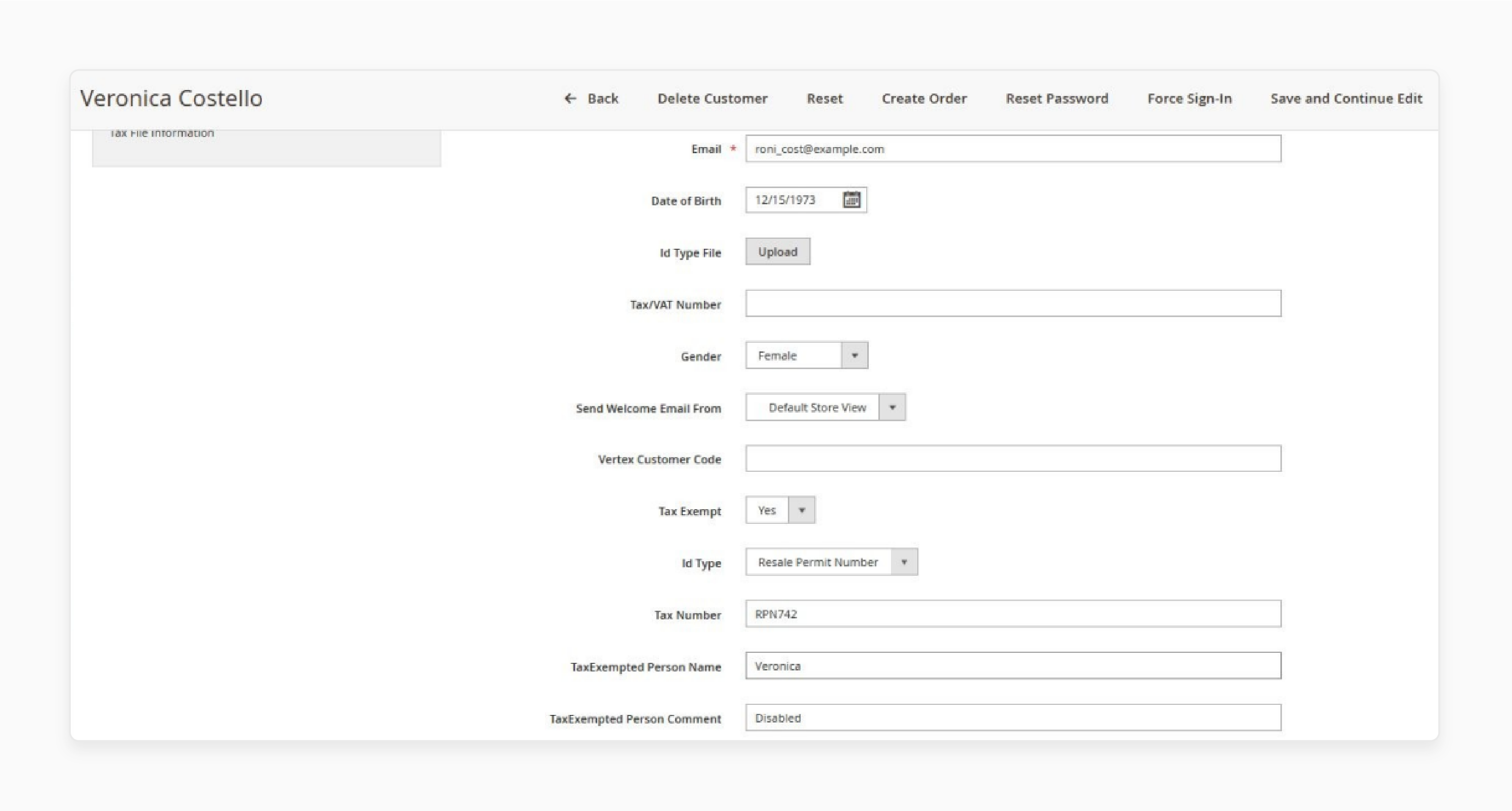

Step 3: Set Customer Tax Exempt Attribute

-

Go to Backend > Customers > All Customers > Add New Customer.

-

Select 'Yes' from the drop-down menu for the Customer Wise Tax Exempt Attribute.

2. Front-end Use of the Tax Exempt Extension

-

Tax Exemption for Guest Customers

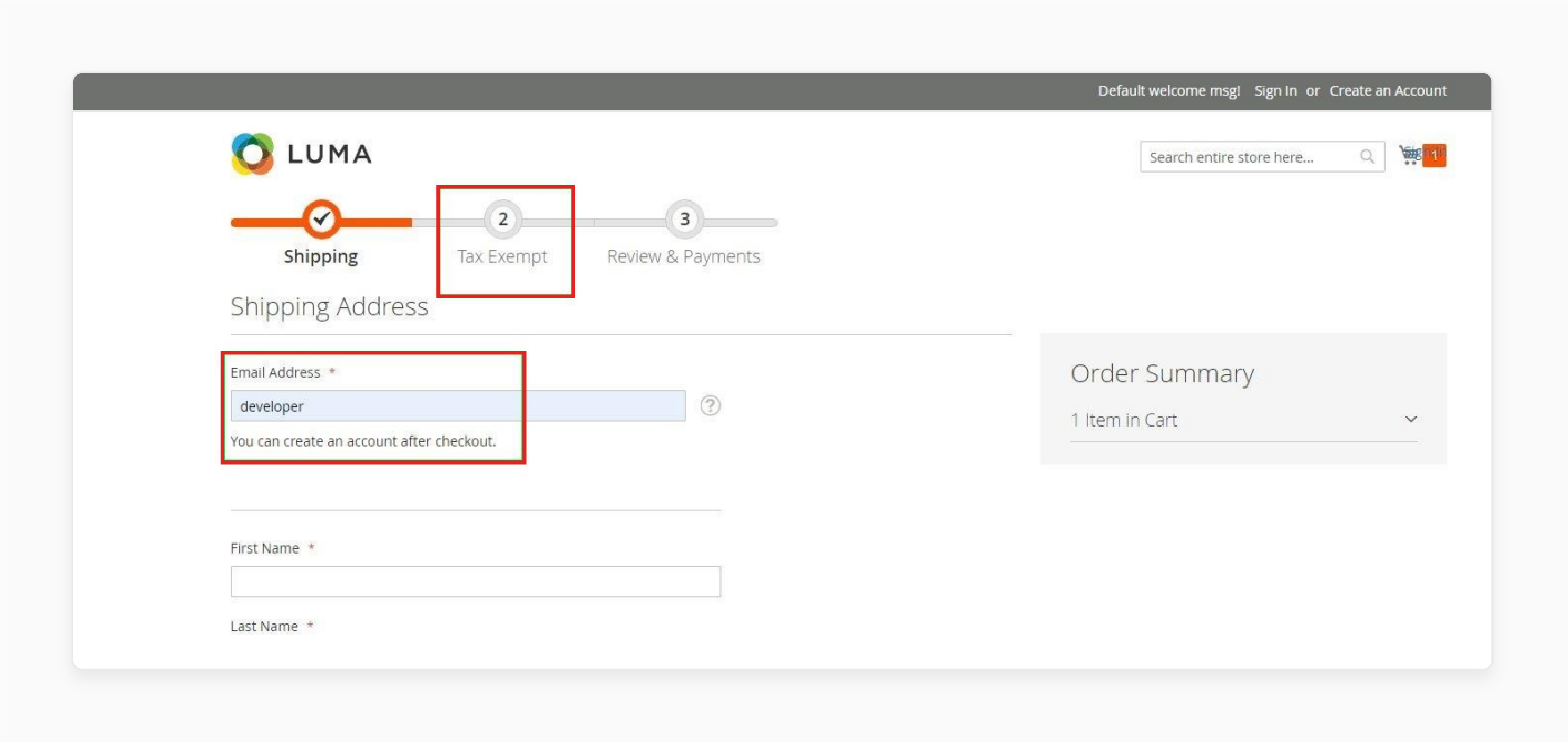

Step 1: Enable Tax Exempt for Guests

-

Set the Enable Tax Exempt option to 'Yes' in the backend.

-

The Tax Exempt tab will show on the Checkout screen. Guests can then select their tax ID type.

Step 2: Choose Tax Type and Enter Tax ID

-

Guests choose the Tax Type (Resale or IRS Number) from the menu.

-

After entering the Tax ID Value, they qualify to get the tax exclusion.

-

Complete the checkout tax-free.

-

Tax Exemption for Existing Customers

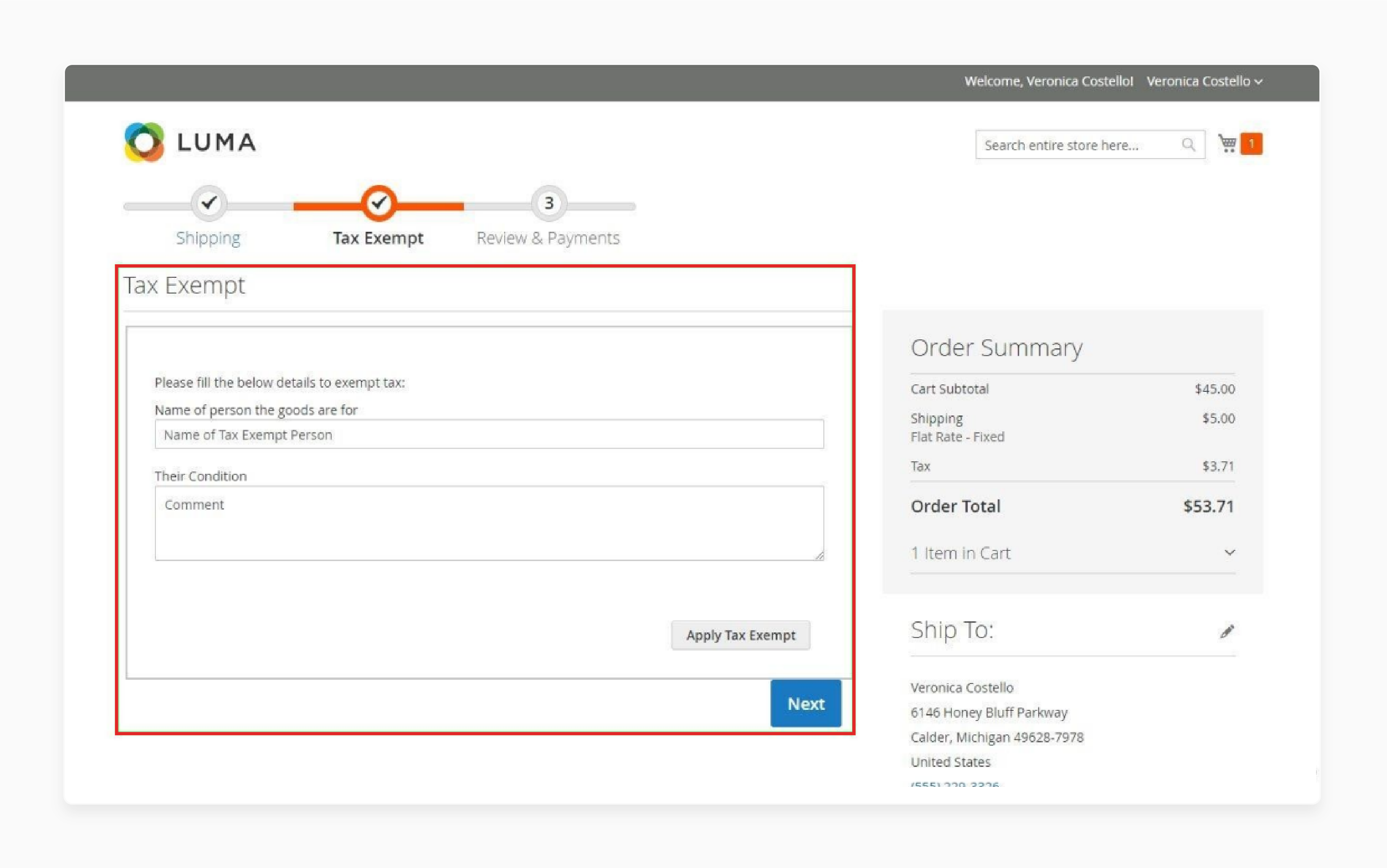

Step 1: Display Customer Information

- Existing customers will see their name and tax-exempt condition at checkout in their user account.

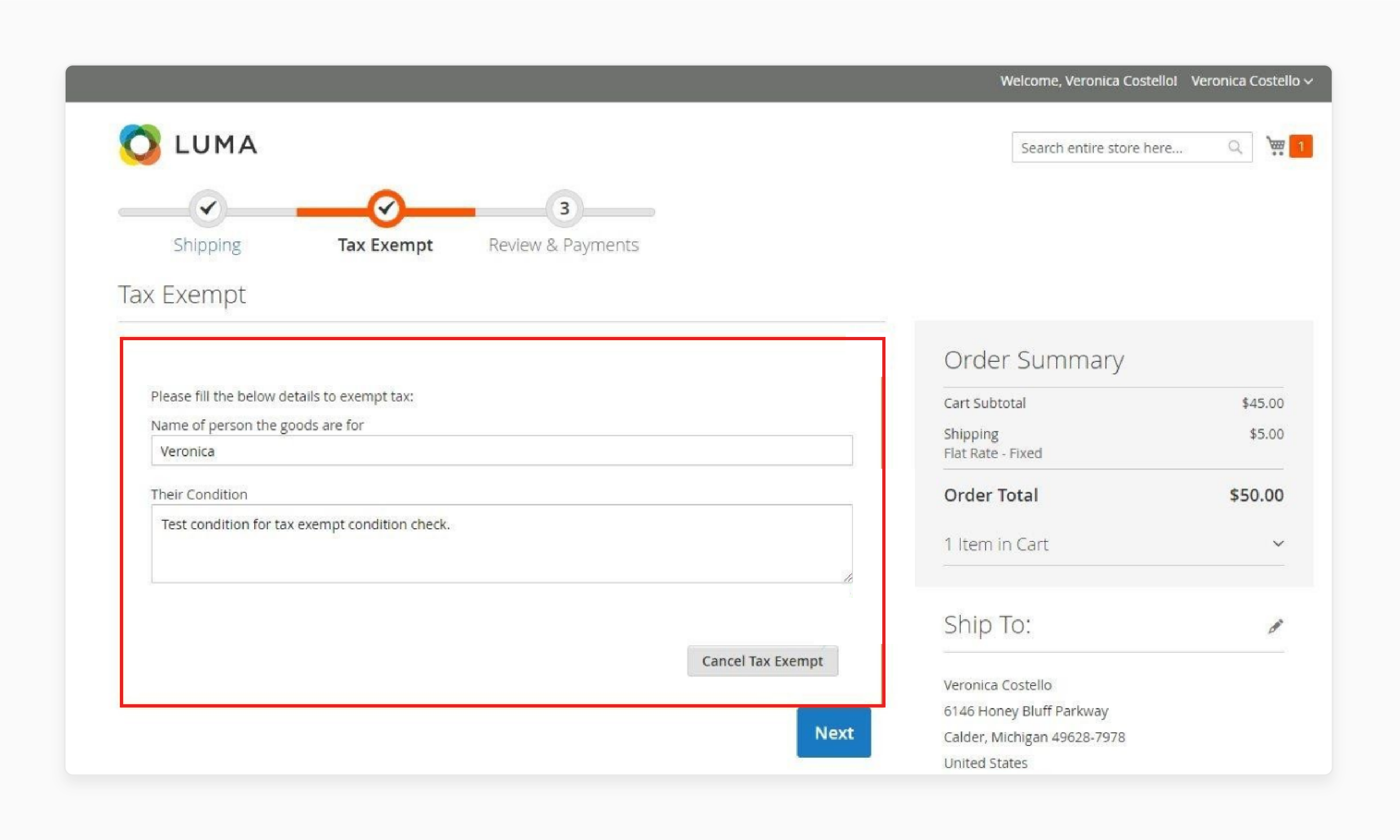

Step 2: Confirm Tax Exemption

-

After entering their details, customers can check out without paying tax once eligible.

-

Place an Order from the Front-End

After filling out the tax exclusions form and confirming their status. Customers can place orders without tax for items that will be resold.

-

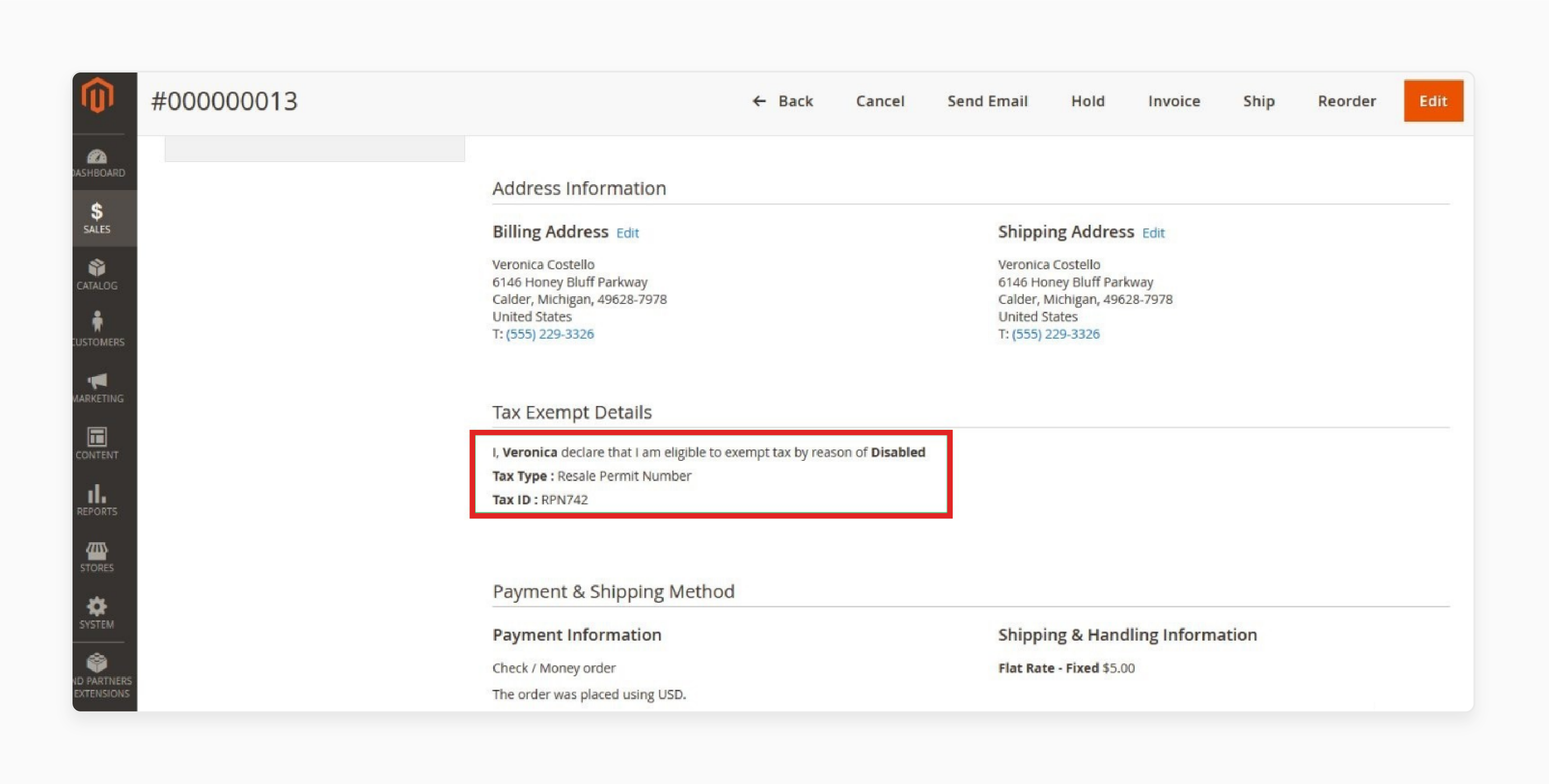

View Tax Exempt Orders in the Backend

-

The store owner can see the tax exclusion details on the Order View Page in the backend.

-

This helps the store owner track tax-exempt transactions and ensure compliance.

5 Common Issues with Magento Tax Exclusion and Solutions

| Issue | Solution |

|---|---|

| Incorrect Tax Free Application | Ensure the user account has the correct tax category in the backend. Automation makes sure customers receive all the tax exclusion benefits in the payment process. |

| Manual errors in handling Exclusion | Use tools to automate tax exclusion handling. This ensures customers receive all the tax exemption benefits without manual errors. |

| Expired or invalid Documents | Set up automatic reminders to alert both the administrator via email and customers before a document finishes. Tools help you need to receive alerts and keep records current. |

| Inconsistent tax regulations across locations | Use location-based tools to apply the correct tax rate. It can be based on the customer’s shipping address, ensuring compliance with local tax laws. |

| Missing or misconfigured tax category | Create a category for each group needing exclusion. It includes customers who choose the "wholesale" option. Link these classes to the tax exclusion extension to apply accurate tax regulations. |

FAQs

1. How do I apply the "wholesale" tax rule in Magento 2?

To apply the bulk tax regulations, create a specific tax rule in the backend. Then, assign this rule to customers in the bulk group. This allows them to check out without sales tax if they qualify for tax exclusion.

2. Can I offer free support for customers setting up tax exemptions?

You can offer support and free help during the setup of the tax exclusion. Many extensions include support features. They are highly recommended to help customers with any issues.

3. What can customers find in "my account" regarding tax exclusions?

In my account, customers can see their tax exemption status and any approved tax exclusion requests. This helps them easily track their eligibility for tax-exempt benefits.

4. What steps should tax-exempt customers follow to add items to their cart?

Tax-free customers should first verify their status in their customer account. When they add eligible items to their cart, the system will automatically apply the tax exclusion.

5. What file formats does the DCKAP tax exemption extension support for certificates?

The DCKAP tax exclusion extension supports documents in several formats. It includes jpeg, gif, txt, and ppt. This gives customers the option to upload their documents.

6. How can I ensure a SKU is tax-exempt in the shopping cart?

To make an SKU tax-exempt in the shopping cart. Assign it to the correct tax category linked to the tax exclusion extension. It is processed without tax when added to the cart.

Summary

Magento 2 Tax Exempt is a feature that simplifies tax management for eligible customers. It includes those customers who choose the "bulk" option or non-profits. Customers can quickly check their tax-exempt status by logging into my account or their customer account. Consider the following features:

-

Automated Tax Exemption Application: The system automatically applies tax exclusion at payment.

-

Customer Group and Tax Class Management: Includes customers who choose the wholesale option.

-

Tax Exemption Certificate Upload: Customers may submit their tax documents in my account.

-

Customizable Email Notifications: Alerts can be customized for users in their customer account.

Explore Magento hosting services to enhance your store’s efficiency and manage tax exemptions.