Set Up Magento 2 Deposit Payment Solution in 8 Steps

Looking for flexible payment options for your Magento store?

Magento 2 deposit payment enables customers to make partial payments for their purchases. Store owners can offer installment plans and layaway options through this extension.

This article will explore how to setup deposit payment solutions for your Magento store.

Key Takeaways

-

Magento 2 deposit payment allows customers to pay in installments.

-

Merchants can set flexible deposit percentages for various products.

-

Automated reminders help keep customers informed about upcoming dues.

-

Multiple ecommerce payment gateways integrate seamlessly with the deposit system.

-

Regular payment reports help merchants track revenue and customer behavior.

How Does the Magento 2 Deposit Payment Work?

“Magento 2 deposit payment system splits the total order amount into multiple payments.”

Customers pay an initial deposit during checkout. The remaining balance gets divided into scheduled installments.

The extension automatically calculates payment schedules based on store settings. Store owners can customize deposit percentages and installment terms. Payment reminders notify customers about upcoming dues.

Main Features of Magento 2 Deposit Payment Extension

1. Payment Configuration

-

Magento 2 deposit payment settings allow custom percentage rules. Merchants can adjust deposit amounts from 10% to 50%.

-

The installment plan options fit different business models. You can set up weekly, monthly, or quarterly payments.

-

Payment schedules adapt to your store's needs. Merchants define due dates and grace periods.

-

Automated reminders keep customers informed about payments. The system sends notifications through email and SMS.

-

Multi-currency features support international transactions. Customers pay in their preferred currency.

2. Customer Management

-

Individual credit limits protect your business interests. Each customer receives a personalized spending cap.

-

Payment history shows all customer transactions. Records include deposits, installments, and completion dates.

-

Custom terms meet specific customer requirements. Different customer groups get unique payment plans.

-

Status updates flow automatically to customers. Buyers receive confirmation after each payment.

-

Plan modification tools handle payment adjustments. Customers can request changes within set guidelines.

3. Order Processing

-

Split payment calculations happen in real-time. The system divides total amounts into equal installments.

-

Partial refund systems protect both parties. Merchants can process returns on deposit orders.

-

Order status changes reflect payment progress. Each installment payment updates order status.

-

Payment verification runs automatic checks. The system confirms each transaction instantly.

-

Invoice generation follows your business rules. Documents update after each payment received.

4. Reporting Tools

-

Payment collection tracking shows all transaction statuses. Reports display daily, weekly, and monthly collections.

-

Due payment reports highlight upcoming collections. Merchants see expected revenue for planning.

-

Customer histories reveal payment patterns. Data helps predict future payment behavior.

-

Revenue forecasts use historical payment data. Predictions help with inventory and cash management.

-

Default analysis identifies payment risks. Reports show late payment patterns.

5. Integration Options

-

Multiple payment gateways expand customer choices. Popular options include PayPal, Stripe, and Square.

-

API connections link to business systems. Your accounting software receives payment data automatically.

-

Third-party accounting integration simplifies bookkeeping. Payment records sync with QuickBooks or Xero.

-

Email systems send branded payment notifications. Messages match your company's communication style.

-

SMS integration provides instant payment alerts. Customers receive text updates about payments.

Benefits of Magento 2 Deposit Payment Extension

| Benefit | Description | Example |

|---|---|---|

| Increased Sales | Flexible deposit payments attract budget-conscious customers. They can afford high-ticket items by paying in installments. | Amazon could see a 30% rise in sales of luxury electronics. Offering a deposit payment option can make this possible. |

| Improved Cash Flow | Merchants receive an upfront deposit, which improves cash flow. The remaining balance is collected in installments over time. | A company like Best Buy could improve cash flow by securing 20% deposits on big-ticket items. Televisions and refrigerators are prime examples. |

| Wider Customer Reach | Flexible payment options appeal to a broader audience. Customers who prefer paying over time are more likely to buy. | A brand like Zara could attract younger shoppers by offering partial payments. It would expand its customer base globally. |

| Reduced Cart Abandonment | Customers are less likely to abandon their carts with available flexible payment options. Deposit and installment options encourage them to complete purchases. | Walmart could reduce cart abandonment by 25%. It could happen after introducing split payment options for home appliances. |

| Lower Risk of Non-Payment | Collecting initial deposit reduces the risk of customers not completing the full payment. They are already financially committed to the purchase. | A company like Tiffany & Co. could reduce non-payments by using a Magento 2 partial payment extension. Requiring a 30% deposit on jewelry purchases would help secure payments. |

| Better Customer Loyalty | Offering flexible payment methods builds trust and loyalty among customers. It encourages repeat purchases and long-term relationships with the brand. | Nike could increase repeat business by offering flexi-plans for premium sneakers/sports gear. |

Comparing Top Magento 2 Deposit Payment Extensions

| Extension | Key Features | Compatibility | Pricing | Support |

|---|---|---|---|---|

| Meetanshi | - Offers partial payment and installments. - Provides down payment and layaway plans. - Supports EMI and custom payment schedules. - Allows admin to define credit limits. - Includes admin approval system for installment plans. | Magento 2.3.x, 2.4.x | $199 (starting) | 1-year support, lifetime updates |

| Amasty | - Allows deposit payments for any product. - Customizable installment schedules (daily, weekly, monthly). - Email notifications for payments. - Offers fixed and flexible layaway plans. - Manages partial payment orders with a separate admin grid. | Magento 2.x | Need specific quote | 1-year support, updates via Magento Marketplace |

| Milople | - Offers deposit payments and installment options. - Supports multiple payment methods. - Customizable down payment and installment schedules. - Admin control over installment frequency. - Revenue reports for partial payments. | Magento 2.x | $92 (starting) | 90-day support, lifetime updates |

Guide to Configure Magento 2 Deposit Payment Extension

Step 1: Install the Extension

-

Download the Magento 2 deposit payment extension from the official source.

-

Unzip the extension package. Copy the folder structure to your store directory.

-

Create the [Provider] directory in the app/code folder if it doesn’t exist.

-

The directory structure should be app/code/[Provider]/Depositpayment.

-

Run the following commands via SSH to activate the extension:

php bin/magento setup:upgrade

- After installation, flush the cache to apply the changes:

php bin/magento cache:clean

php bin/magento cache:flush

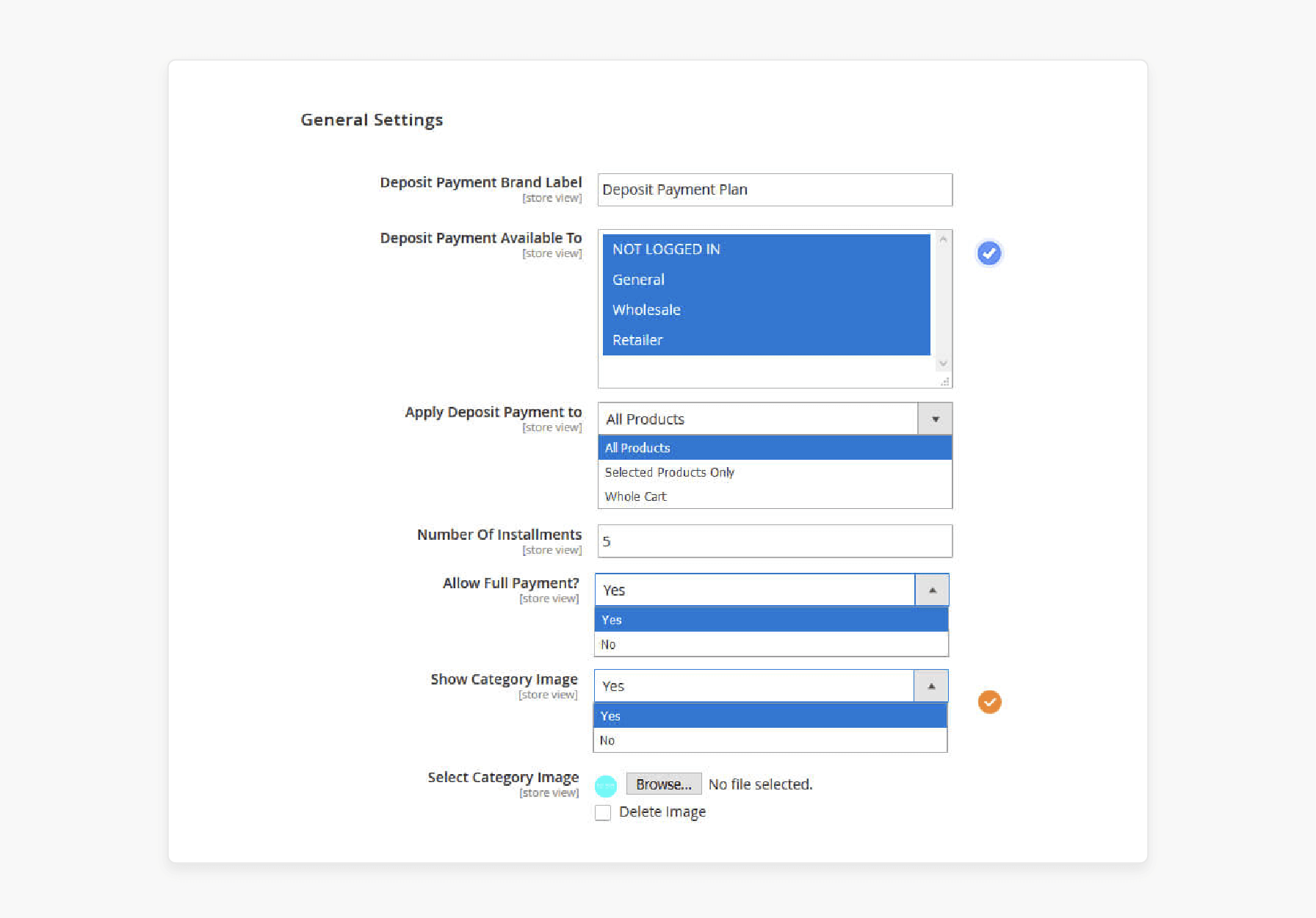

Step 2: Access the Configuration Settings

-

Log in to your Magento 2 admin panel.

-

Navigate to Stores > Configuration > [Provider] Deposit Payment. This will open the settings.

Step 3: Enable Deposit Payment

-

In the configuration panel, enable the deposit payment method.

-

Choose to apply it to specific customer groups or product groups.

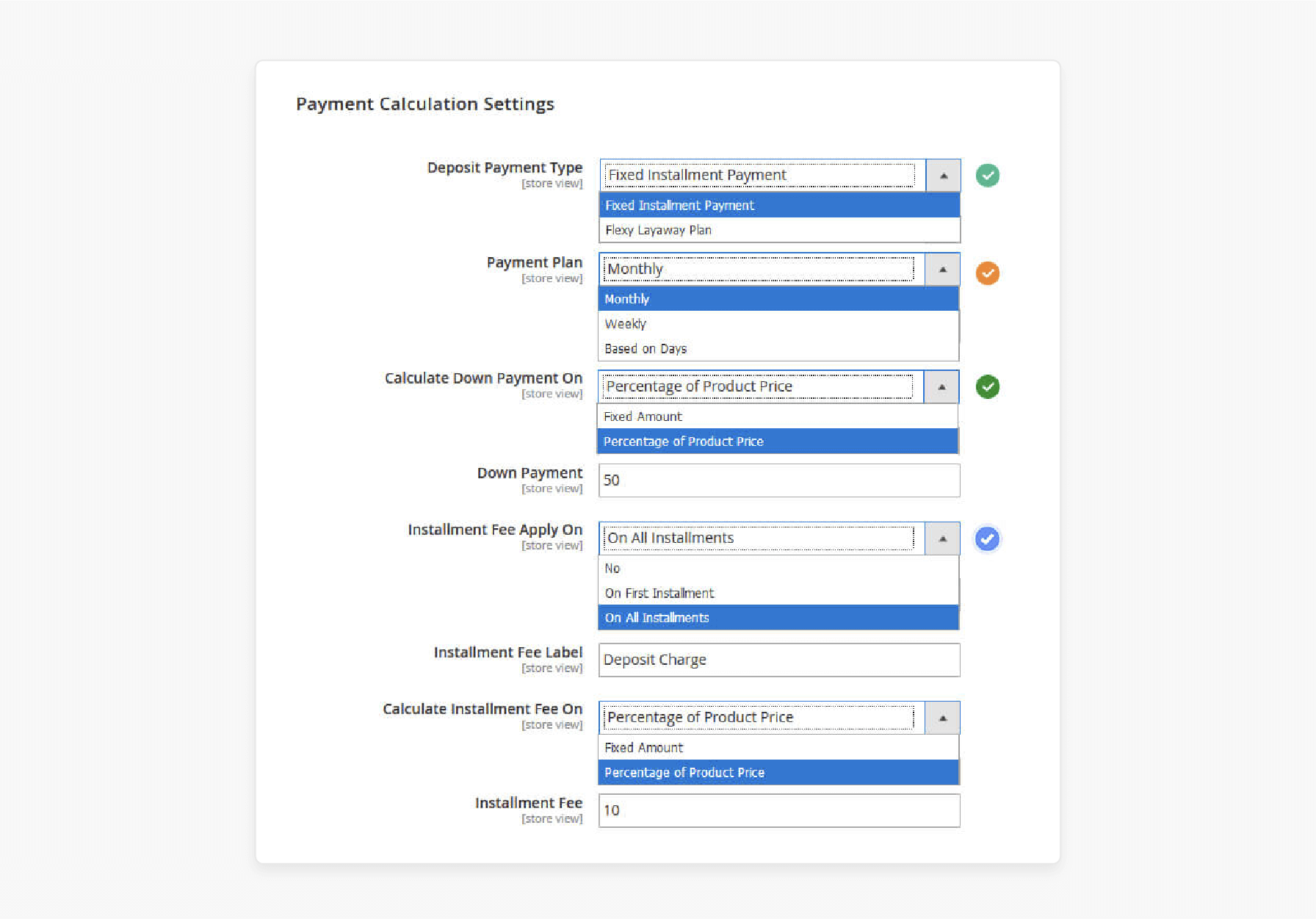

Step 4: Set Deposit Payment Plans

-

Define the number of installments for deposit payments.

-

Choose the payment type: Fixed Installment Plan or Flexi Layaway Plan.

-

Fixed Installment Plan requires a set number of installments.

-

Flexi Layaway Plan allows customers to choose how many installments to make.

-

-

Set payment intervals. These can be monthly, weekly, or daily.

Step 5: Configure Down Payment Settings

-

Define the down payment amount. You can set it as a fixed amount or a percentage of the total product price.

-

Configure the installment fee. Set it as either a fixed amount or a percentage of the product price.

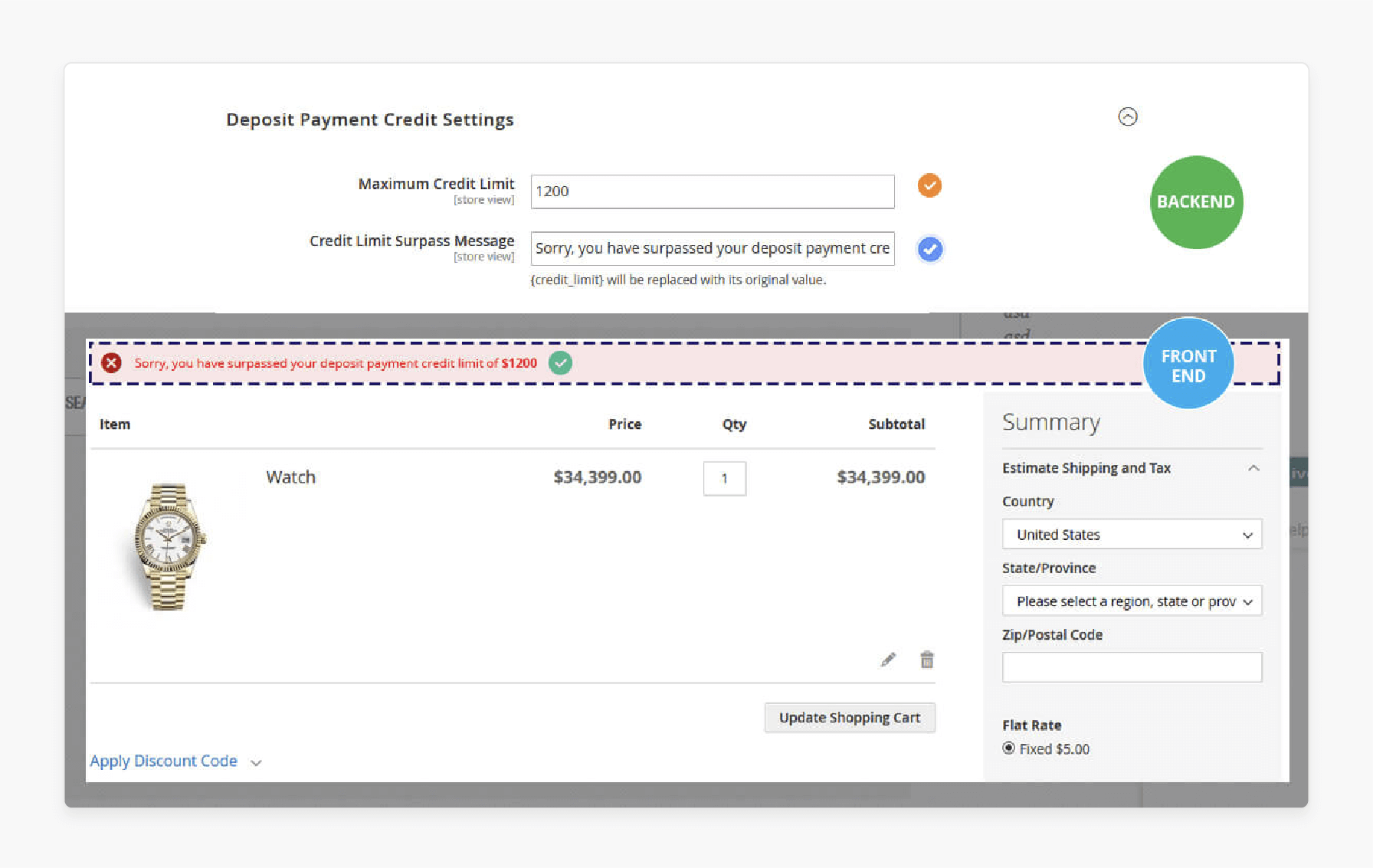

Step 6: Set Up Payment and Credit Limits

-

Set a maximum credit limit for customers using the deposit payment option.

-

Display a custom error message if the customer exceeds the credit limit.

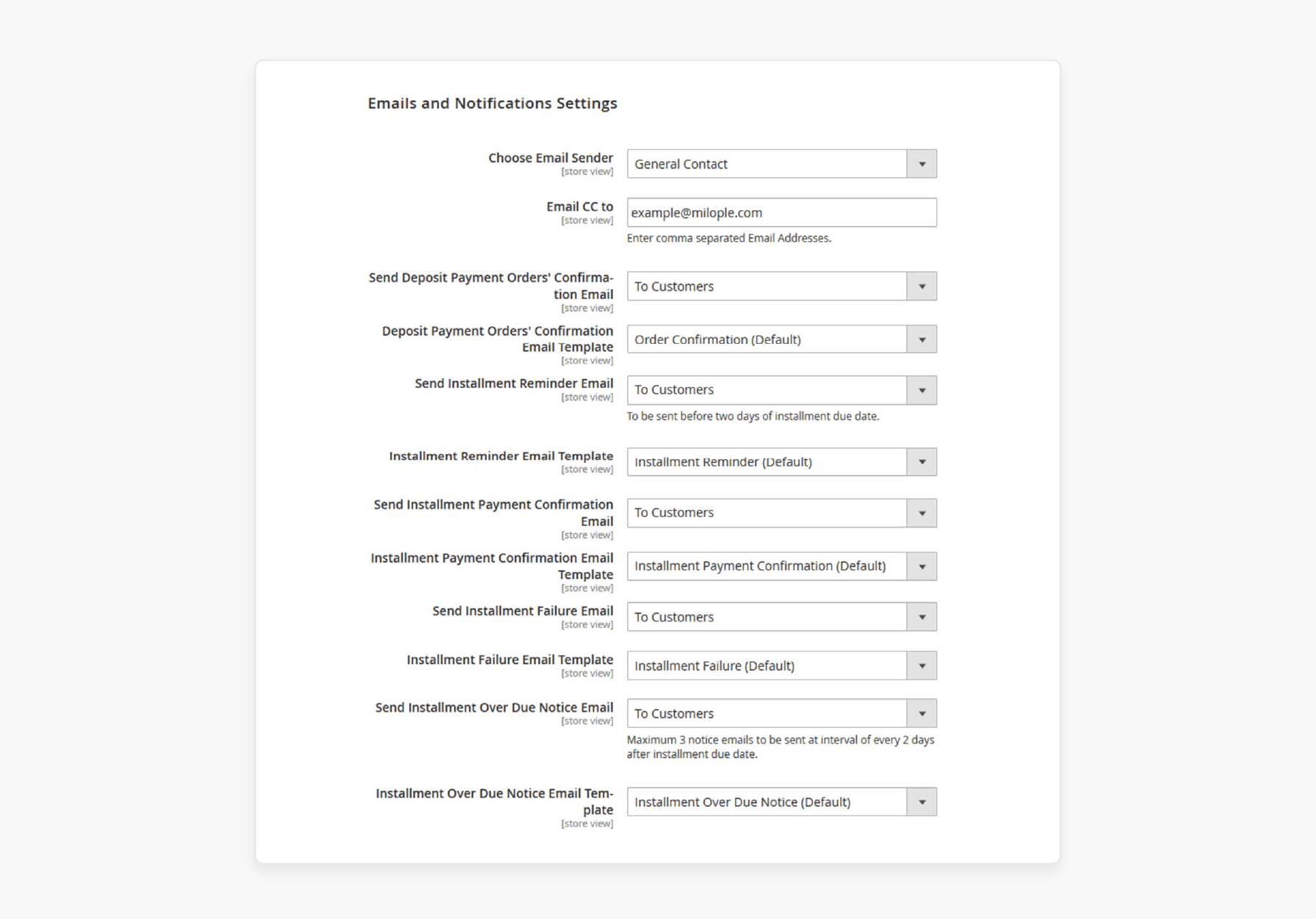

Step 7: Customize Email Notifications

-

Set up email notifications for customers regarding their installment payments.

-

Enable emails for events such as payment confirmation, installment reminders, and overdue notices.

Step 8: Finalize Configuration and Test

-

Save the configuration settings. Flush the cache to finalize all settings.

-

Test the deposit payment functionality. Place an order with installment payments enabled.

-

Verify that customers can view and pay their installments through their My Account section.

FAQs

1. How does the magento 2 partial payment extension work?

The extension allows customers to pay a deposit amount first. The remaining balance splits into installments. The magento 2 deposit payment system calculates payment schedules automatically. Merchants can set custom deposit percentages. The payment extension for magento 2 supports multiple payment gateways.

2. What payment options does magento 2 supports for deposits?

The magento 2 extension supports various payment methods. Customers can use credit card payment or EMI options. The partial payment module integrates with PayPal, Stripe, and other gateways. The system handles both fixed and flexible payment plans.

3. How can merchants configure the emi down payment calculation?

Merchants can set deposit percentages between 10-50%. The partial payment extension enables EMI with custom schedules. The magento 2 partial payment EMI system offers daily, weekly, or monthly options. Store owners can adjust payment terms per customer group.

4. Can customers place deposit payment orders for any product?

The deposit payment facility works for selected product categories. Merchants control which items qualify for partial payments. The magento 2 layaway extension lets you set minimum order values. Product-specific deposit rules help manage inventory better.

5. How does using magento 2 partial payment benefit store owners?

Store owners see improved cash flow through upfront deposits. The magento deposit payment system reduces cart abandonment. Regular installment payments create steady revenue streams. The extension provides detailed payment tracking reports.

6. What features help track partial payments?

The magento deposit payment order grid shows all payment statuses. Merchants can see the down payment amount for each order. The system tracks regularly scheduled installment payments. Automated reminders help maintain payment schedules.

7. How does the maximum partial payment credit limit work?

Merchants can set credit limits per customer group. The partial payment extension allows customized spending caps. The system prevents orders exceeding credit limits. Store owners can modify limits based on payment history.

Summary

Magento 2 deposit payment works through customizable percentage rules. Store owners can set deposit amounts between 10% to 50%, or 30% down payment on luxury items. Below mentioned are the article’s key highlights:

-

Multiple payment gateways expand customer payment choices. Popular platforms like PayPal/Stripe integrate directly with your store's deposit payment system.

-

Automated payment reminders keep transactions on schedule. The system sends email/SMS notifications to customers before installment due date.

-

Regular monitoring of payment reports reveals customer patterns. Understanding these patterns helps prevent payment defaults (improves collection rates).

-

Clear communication about payment terms prevents misunderstandings. Display all installment details and due dates during the checkout process.

-

Regular system updates maintain extension performance. Monthly maintenance checks help catch and fix any payment processing issues early.

Consider managed Magento hosting for worry-free deposit payment extension configuration