Magento 2 Configure EU Tax: Key Concepts and Benefits

Want to ensure your Magento 2 store complies with EU tax regulations? The Magento 2 Configure EU Tax feature helps online merchants manage and adhere to EU tax rules efficiently.

In this article, we will explore the benefits and key concepts of Magento 2 configure EU tax.

Key Takeaways

-

Understand what Magento 2 Configure EU Tax is and its benefits.

-

Learn how to set up tax zones and rates for EU countries.

-

Discover the importance of accurate tax calculations and compliance.

-

Understand key concepts of Magento 2 Configure EU Tax for better tax management.

-

Find solutions to common tax configuration issues.

What is Magento 2 Configure EU Tax?

Magento 2 Configure EU Tax is a feature that enables online merchants to manage and comply with European Union tax regulations.

The functionality allows for the:

-

Setup of specific tax zones and rates for each EU country

-

Creation of tax classes for products and customers

-

Establishment of tax rules based on the customer’s location

-

VAT number validation for business customers

The proper configuration ensures:

-

Accurate tax calculations

-

Compliance with EU laws

-

Smooth shopping experience

The automated system reduces manual errors. It enhances the efficiency of tax management in your Magento 2 store.

Importance of Magento 2 Configure EU Tax

1. Legal Compliance

-

EU tax regulations require businesses to charge and remit VAT based on the customer's location.

-

Failure to comply with these regulations can result in significant legal consequences. It includes fines and penalties.

-

Configuration of EU tax helps businesses meet these legal requirements. It helps them avoid legal issues and maintain good standing with tax authorities.

2. Accurate Pricing

-

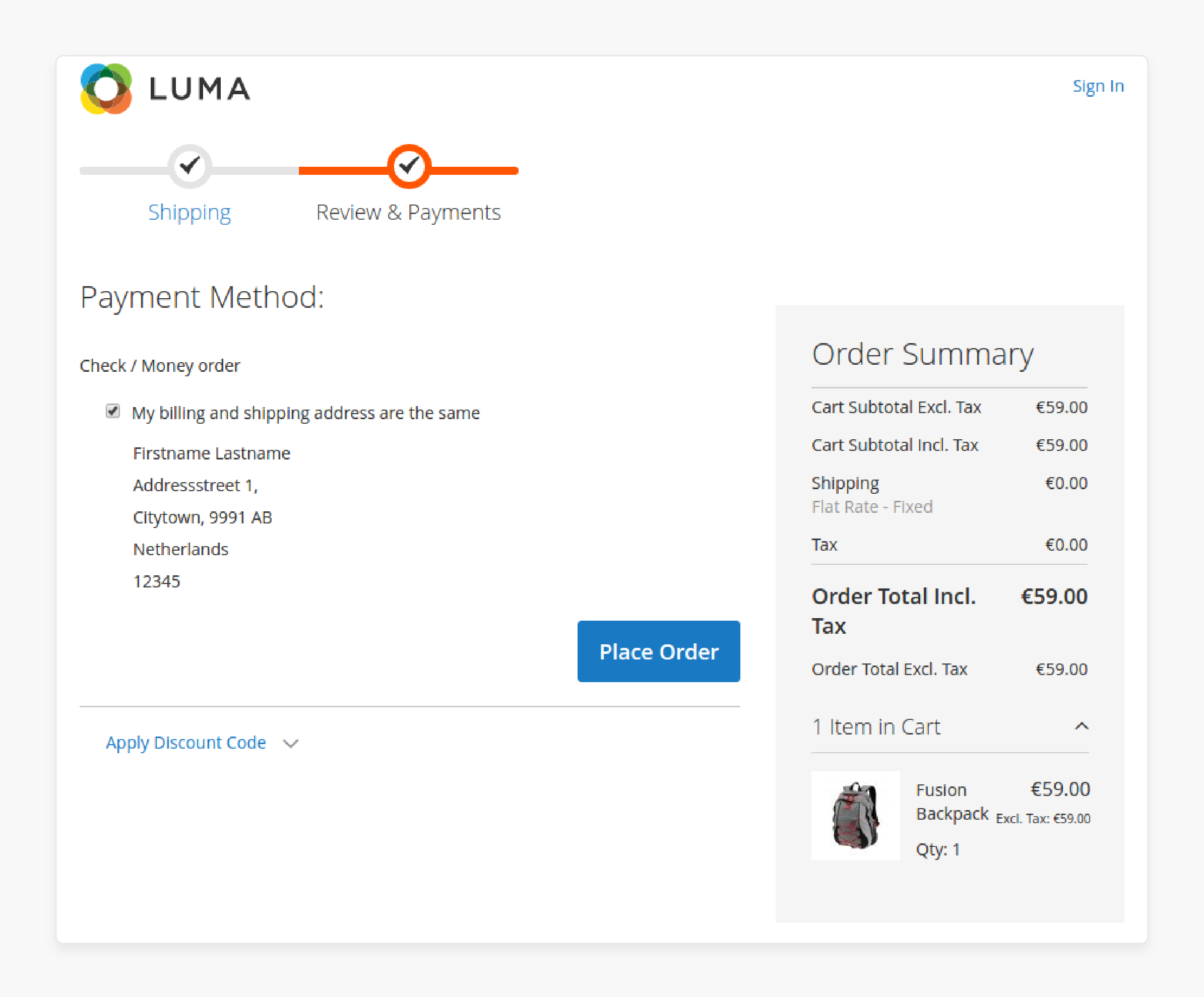

Customers in the EU expect to see the total price they will pay. It also includes taxes when shopping online.

-

Displaying prices that include VAT helps in setting clear expectations. It also helps avoid surprises at checkout.

-

Accurate pricing builds customer trust and can significantly reduce cart abandonment rates. It also helps in presenting a transparent and honest image of your business.

3. Enhanced Customer Experience

-

A transparent shopping experience enhances customer satisfaction and customer loyalty. It also increases repeat purchases.

-

When taxes are configured correctly, customers can see the applicable VAT on their purchases. It leads to a more informed and satisfying shopping experience.

4. Simplified Tax Management

-

Managing taxes can be complex and time-consuming for businesses selling to multiple EU countries with different VAT rates.

-

Magento 2 automates tax calculations based on the customer's location. It:

-

Reduces the risk of errors

-

Saves time

-

Ensures that the correct VAT rate is applied

-

Streamlines the checkout process

-

Reduces the admin burden on your business

5. Efficient Cross-Border Selling

-

Configuring taxes ensures that the correct VAT rate is applied based on the destination country.

-

It complies with EU regulations and helps maintain competitive pricing across different markets.

-

It also prevents potential issues with customs and tax authorities in different countries.

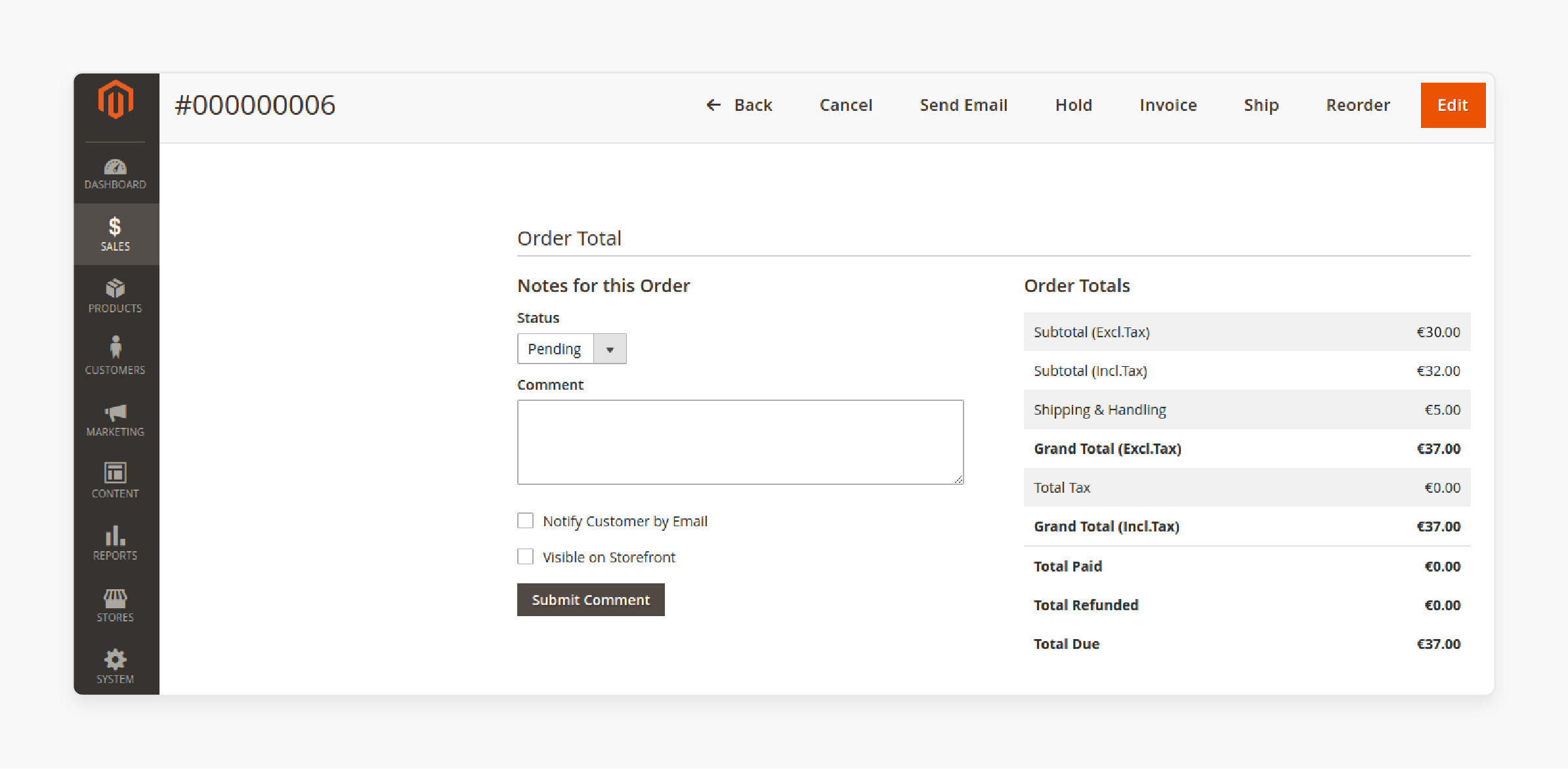

6. Reporting and Accounting

-

Accurate tax configuration in Magento 2 enhances financial reporting and accounting.

-

Magento 2 provides detailed tax reports that help in tracking tax collected and due. This makes it easier to prepare for tax filings and audits.

-

Proper tax reporting helps maintain accurate financial records and ensures that your business meets its tax obligations.

7. Avoidance of Penalties

-

Incorrect tax calculations and non-compliance with EU tax regulations can lead to severe penalties. These penalties can be costly and damaging to your business's reputation.

-

Configuring EU tax correctly helps businesses avoid these penalties. It helps ensure smooth operations without the risk of unexpected fines.

8. Competitive Advantage

-

Being compliant with EU tax regulations and accurate pricing can give your business a competitive edge.

-

Customers are more likely to trust and purchase from businesses that display transparent pricing.

-

It enhances your brand's reputation and makes your store more attractive to potential customers.

Key Concepts of Magento 2 Configure EU Tax

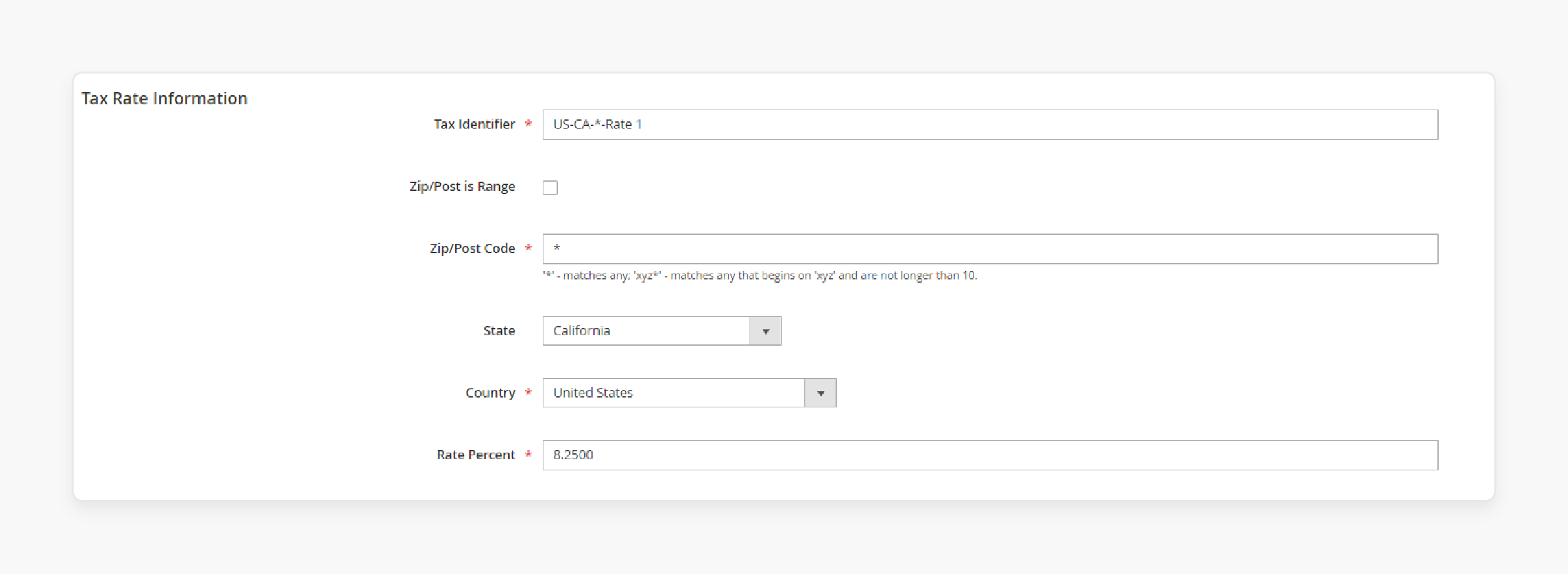

1. Tax Zones and Rates

-

Tax zones refer to geographical areas where specific tax rates apply. In the EU these zones typically correspond to different countries or regions within the EU.

-

Tax rates are the percentages applied to products and services sold within a specific tax zone. Each EU country has its VAT rates. It can vary depending on the type of goods or services sold.

-

Standard Rate: The default VAT rate applied to most goods and services.

-

Reduced Rate: A lower VAT rate for specific categories of goods and services. These include food and children's clothing.

-

Zero Rate: Some goods and services are exempt from VAT.

2. Tax Classes

-

Product Tax Classes: These are assigned to products to determine the applicable tax rate. You might have different tax classes for:

-

Standard goods

-

Reduced-rate goods

-

Zero-rated goods

-

-

Customer Tax Classes: These are assigned to customer groups based on their tax status. You might have different tax classes for:

-

Regular consumers

-

Businesses with VAT numbers (B2B)

-

Tax-exempt entities

-

-

Shipping Tax Classes: If your store charges tax on shipping, you need to assign a tax class to shipping.

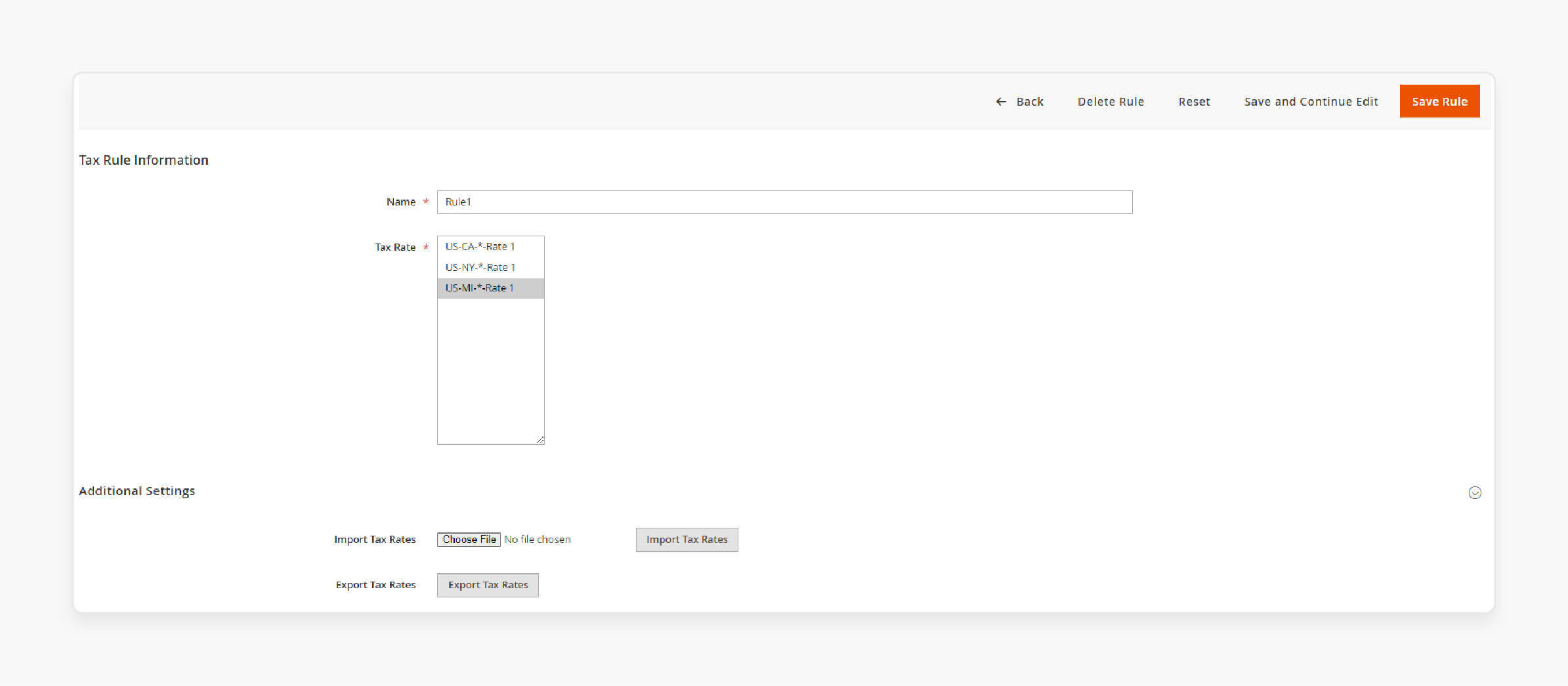

3. Tax Rules

- Tax rules combine tax rates and tax classes to determine how taxes are applied to transactions. A tax rule defines the conditions under which a specific tax rate applies to a product for a particular customer group.

-

Condition: Criteria that must be met for the tax rule to apply.

-

Calculation: The method used to apply the tax rate.

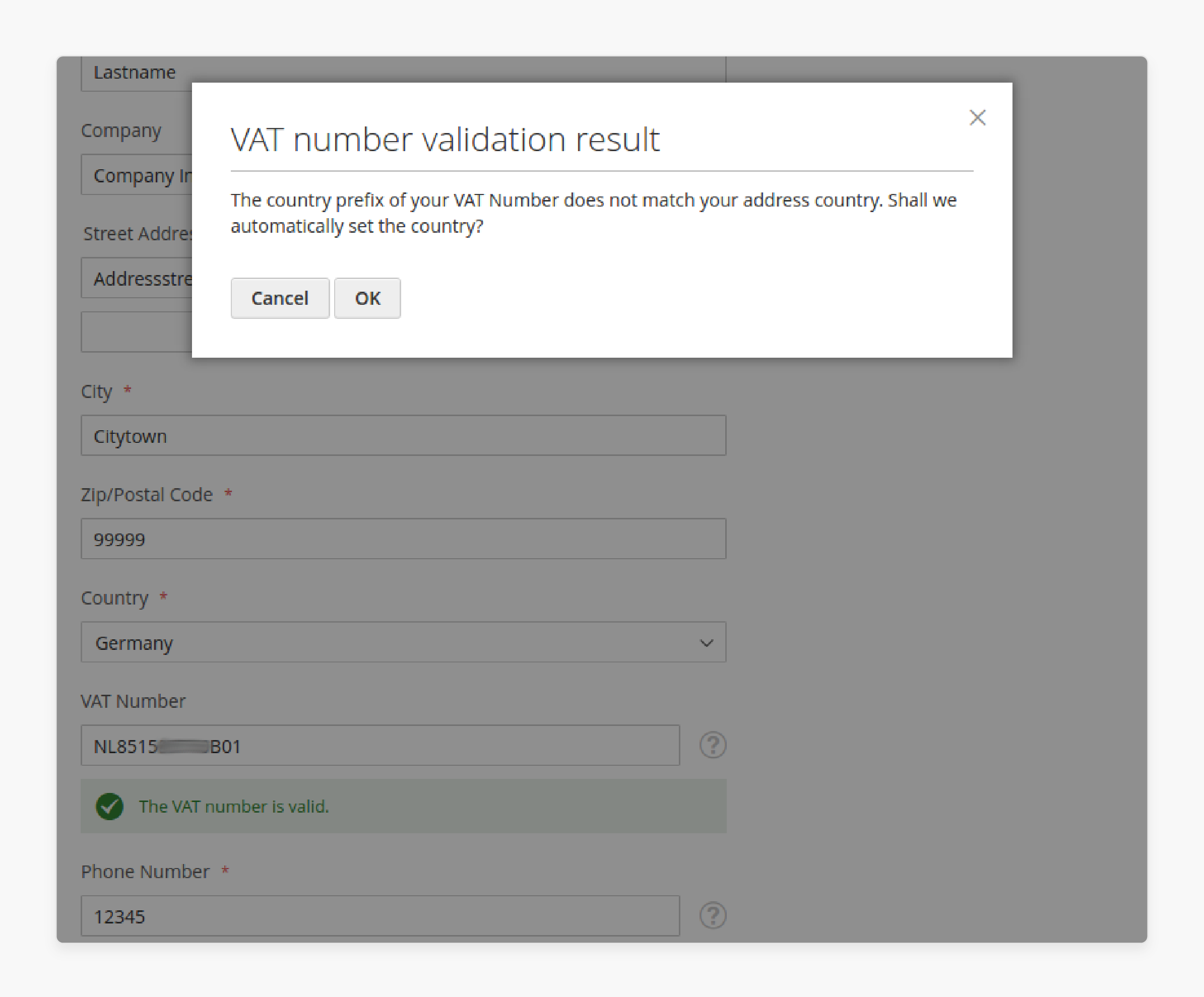

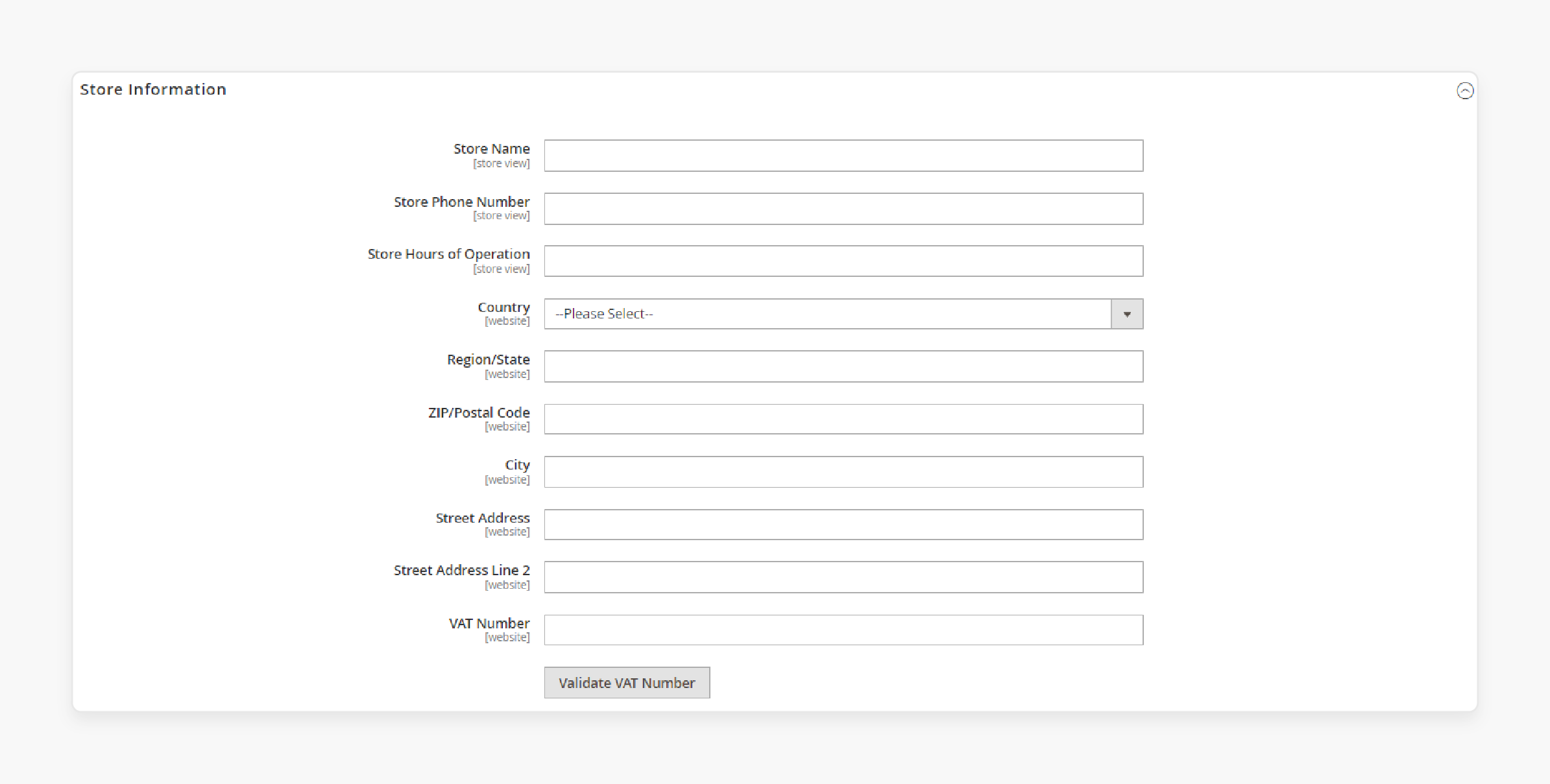

4. VAT Validation

-

For B2B transactions within the EU, businesses can validate VAT numbers provided by customers.

-

It ensures that VAT is correctly applied or exempted based on the customer's VAT registration status.

-

Magento 2 can automatically validate VAT IDs using the VIES provided by the European Commission.

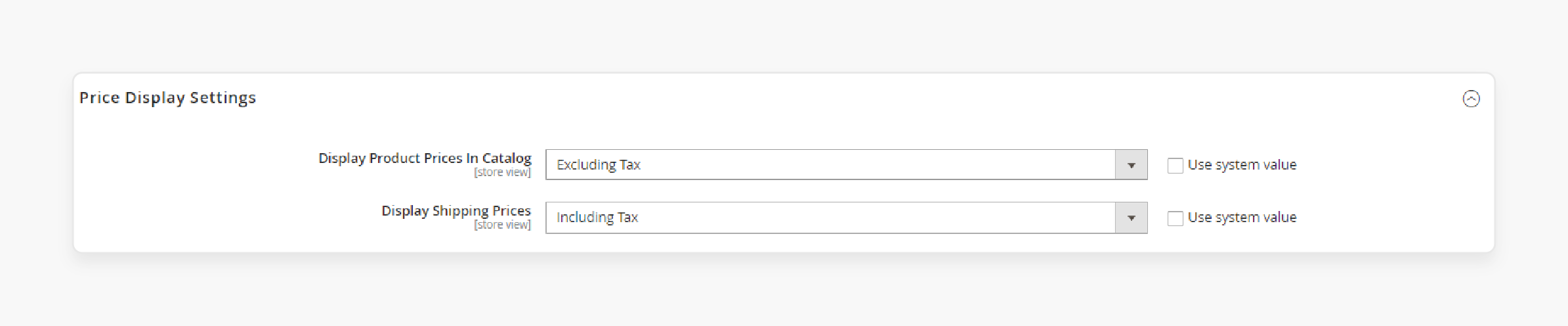

5. Display Settings

-

Inclusive or Exclusive Prices: You can choose to display product prices inclusive or exclusive of VAT.

-

Tax Display Settings: Control how taxes are displayed throughout the store, including:

-

Checkout

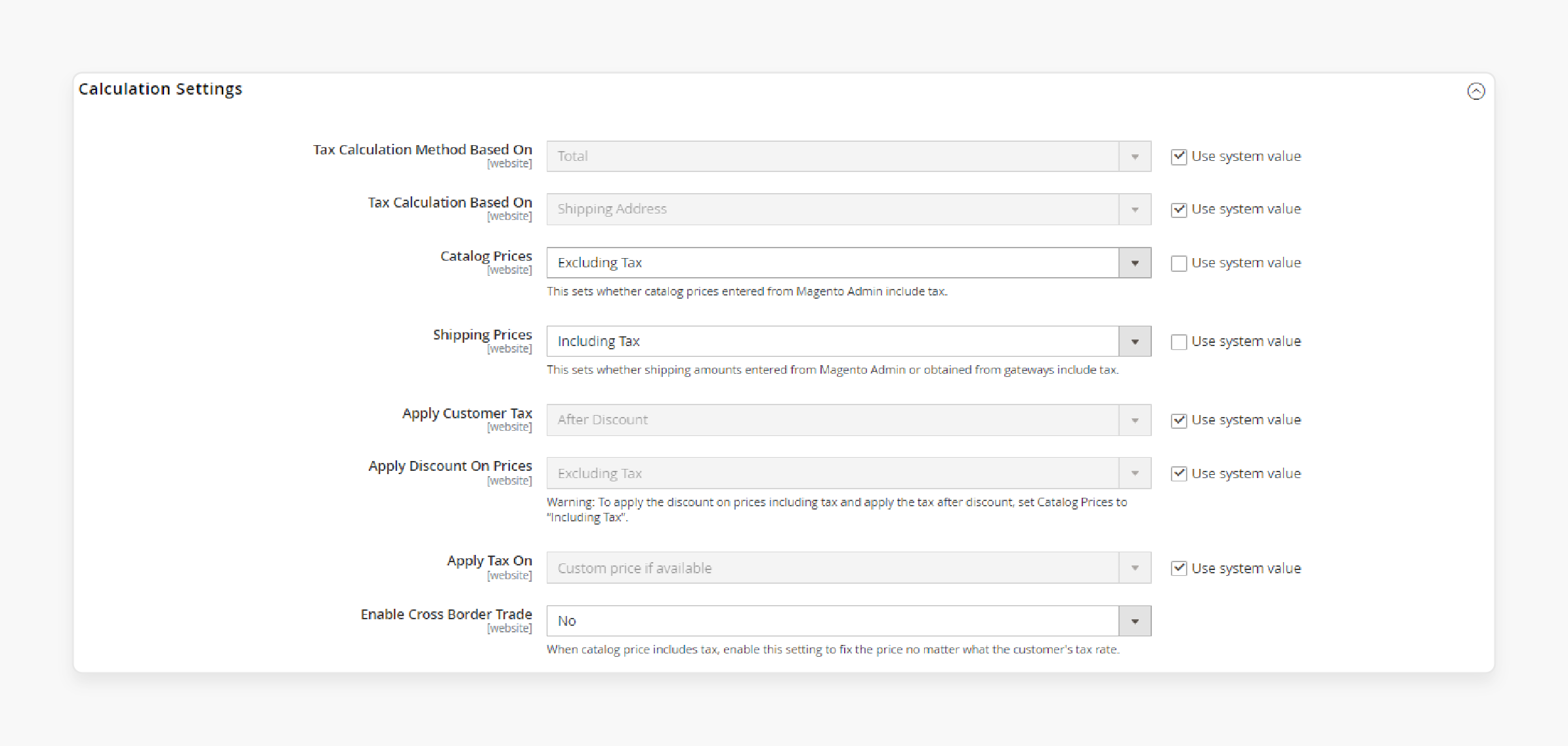

6. Cross-Border Trade

-

Destination-Based Tax: In cross-border trade, VAT is charged based on the destination country of the goods or services. It means that the tax rate applied depends on the customer's location.

-

One-Stop-Shop (OSS) Scheme: The OSS scheme allows businesses to report and pay VAT for all EU sales in a single country. Instead of registering for VAT in each country they sell to.

7. Tax Reporting and Compliance

-

Tax Reports: Magento 2 provides built-in tax reports that help track VAT collected and due. These reports prepare tax returns and ensure compliance with EU tax regulations.

-

Audit Trails: Keeping accurate records of all transactions, including tax calculations and validations helps in compliance and audit purposes. Magento 2 maintains detailed logs of tax-related activities.

Common Issues and Solutions of Magento 2 Configure EU Tax

1. Incorrect Tax Calculations

Issue: Tax calculations might be incorrect due to misconfigured tax rates or rules.

Solution:

- Verify Tax Zones and Rates: Ensure that you have correctly defined tax zones and rates for each EU country.

- Go to Stores > Tax Zones and Rates and check the configurations.

- Check Tax Rules: Ensure that the correct tax rates, rules, and classes are applied to each rule.

- Navigate to Stores > Tax Rules.

- Update Product Tax Classes: Make sure each product is assigned the correct tax class under Catalog > Products.

2. VAT Validation Issues

Issue: Customers' VAT IDs are not being validated correctly. It leads to incorrect tax applications for B2B transactions.

Solution:

-

Enable VAT Validation: Ensure VAT validation is enabled in Stores > Configuration > General > General > Store Information.

-

Check VIES Integration: Verify that the VIES service is operational. VIES service may experience downtime, causing validation failures.

3. Displaying Incorrect Prices

Issue: Prices displayed to customers may not include VAT or may show incorrect tax amounts.

Solution:

-

Configure Display Settings: Adjust your tax display settings in Stores > Configuration > Sales > Tax. Ensure that you are displaying prices inclusive of VAT where required.

-

Update Product Display Settings: Check individual product settings to ensure they are set to display the correct prices inclusive of VAT.

4. Cross-Border Tax Issues

Issue: Tax rates may not adjust correctly for cross-border sales within the EU.

Solution:

-

Enable Destination-Based Tax Calculation: Ensure that your tax settings are configured for destination-based calculations. It can be set in Stores > Configuration > Sales > Tax under the Calculation Settings.

-

OSS Scheme Configuration: If using the OSS scheme, ensure that it is correctly set up. It helps handle VAT reporting and payment for cross-border sales.

FAQs

1. How do I set up the default tax rate in Magento 2?

To set up the default tax rate in Magento 2. You should navigate to Stores > Tax Zones and Rates. Then click Add New Tax Rate, enter the rate details, and save.

2. What is the process to configure EU VAT in Magento 2?

To configure EU VAT in Magento 2. You should go to Stores > Configuration > Sales > Tax. Enable EU VAT validation and configure the settings according to your requirements.

3. What are the steps to configure EU tax in Magento 2?

The steps to configure EU tax in Magento 2 include setting up tax rates, creating tax rules, and enabling EU VAT validation. Access these options via Stores > Tax Zones and Rates and Stores > Configuration > Sales > Tax.

4. How can I add a new tax rule in Magento 2?

To add a new tax rule in Magento 2. You should go to Stores > Tax Rules and click Add New Tax Rule. Then, define the tax rule name, select applicable tax rates and customer tax classes, then save the new tax rule.

Summary

Magento 2 Configure EU Tax feature ensures accurate tax calculations, legal compliance, and a smooth shopping experience. The article explores several points, including:

-

Ensures businesses meet EU tax laws, avoiding fines and penalties.

-

Provides transparent pricing, improving customer satisfaction and loyalty.

-

Applies correct VAT rates based on destination country, maintaining competitive pricing.

-

Prevents costly penalties for incorrect tax calculations and non-compliance.

Want to ensure your Magento store complies with EU tax regulations? Consider managed Magento hosting solutions.